Update on 13 September

TL;DR

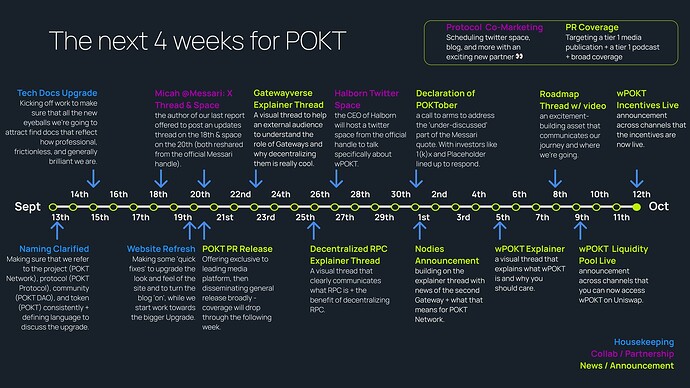

wPOKT will be ready to launch ahead of schedule.

But we’re pushing it back by 2 weeks.

New dates for your calendars are:

- 4th Oct (Bridge live)

- 9th Oct (Uniswap pool live)

- 12th Oct (Incentives live)

See full post here

Update on 4 September

-

The DAO passed this proposal on Friday 25 August, meaning that 6,144,393 POKT was approved (based on the USD/POKT price of $0.03255 at the time it passed), which will be split 50/50 between wPOKT and ETH as the starting liquidity in the pool.

- An additional $75k in wPOKT from the ERA budget will be added to a smart contract to distribute to all liquidity providers for providing liquidity to the wPOKT/ETH pool on Uniswap.

-

The main bridge site and the wPOKT token will launch on Wednesday 20 September, which will allow POKT holders to lock up their POKT holdings and mint wPOKT

-

The Uniswap v2 wPOKT/ETH pool will launch on Monday 25 September

-

DAO-sponsored incentives for the Uniswap pool will commence on Thursday 28 September. The gap between the launch of the Uniswap pool and the start of the incentives is to allow people enough time to add liquidity to the Uniswap pool so that they are eligible for the incentives as soon as they start.

-

FAQs will be shared in the coming weeks to explain more about 1) how to use the wPOKT bridge, and 2) how you can participate in the Uniswap wPOKT/ETH pool and earn more wPOKT for doing so

-

If you have any questions about how you can get involved, please ask them in this thread or please free to DM me on telegram too

Attributes

Author(s): PNF, on behalf of the Pocket Network community with advice from @freddiefarmer

Recipient(s): Uniswap v2 wPOKT/ETH liquidity pool and the accompanying DAO-sponsored wPOKT incentives contract for LPs in the liquidity pool. (To be executed by PNF on behalf of the DAO)

Asking Amount: $200k in POKT (calculated as of the date this proposal passes)

Summary

With the initial development sprints for wPOKT now finished - see update here - we can now focus on the liquidity strategy for wPOKT. (More information on the launch plan, including in relation to marketing, will be shared separately in the coming weeks).

This post outlines our plan to maximise the liquidity depth for wPOKT, given the constraints on the size of the DAO’s current treasury.

TLDR:

- Use the $200,000 (split 50/50 between ETH and wPOKT) from the DAO as per this proposal as starting liquidity in the proposed Uniswap v2 wPOKT/ETH pool

- Use the $75,000 in wPOKT (2.6m POKT as of today) already approved from the ERA program as additional incentives for all liquidity providers participating in the liquidity pool, which will pay out weekly over a 90-day period

- Target a range for the 2% liquidity depth of $15-25k.

- This incentives program will be reviewed before the end of the 90-day period to analyse its success and to propose, if deemed necessary, a follow on incentives program.

Motivation & Rationale

The volatility and lack of market depth for POKT act as a genuine barrier to entry to new entrants to the Pocket Network ecosystem. And for Pocket’s economy to win, the lifeblood of the economy, POKT, should be freely accessible to new node runners, gateways, applications, and DAO contributors.

Consequently, for wPOKT to be successful, it is necessary for people to easily buy and sell wPOKT and then use that wPOKT as they need, including bridging it over to the Pocket Network blockchain to stake as a node runner, validator or directly as an application/gateway (post v1).

Note that we generally refer to the Annual Percentage Rate (APR) in this proposal as opposed to the Annual Percentage Yield (APY), as the APR can be seen as the base rate of return. APY is the effective yield and takes compounding interest into account, and can be boosted by trading volume and price appreciation, as described in further detail in the Mechanism design & Implementation section below.

Success metrics

-

PNF’s north star metric for wPOKT - and liquidity for POKT in general - is 2% depth (the amount that can be purchased/sold within 2% of the spot price).

-

As of 10 August 2023, the amount that can be purchased within this range on Gate, the largest reputable market for POKT (measured by 24h volume), is $1.3k, with the 2% depth on Kucoin at $7k.

-

We want to target a range of liquidity (post the impact of the DAO’s incentives) for the 2% depth in the Uniswap wPOKT/ETH pool of between $15k and $25k. This is based on the assumption that 15%+ APR is sufficient to incentivise liquidity providers to provide liquidity for the wPOKT/ETH pair, notwithstanding the historically high volatility of POKT and the fact that POKT is still a relatively unknown token with a recent history of very negative price action.

Mechanism design & Implementation:

- Raid Guild has already been paid $10,100 from the ERA budget to create the LP staking smart contract (based on the SNX staking contract) and to design and build the front-end. See here for the initial version of the front-end, and see here for the spec.

- The ERA budget also includes a line item of $75,000 to fund some of the overall liquidity budget for wPOKT.

The effective APY received by liquidity providers (LPs) for providing wPOKT/ETH into the liquidity pool and staking it in the wPOKT LP staking strategy will vary depending on the:

- “Loss-versus-rebalancing” (LVR) cost, which is the running cost for LPs based on the maximum arbitrage profits available and assumes an infinitely liquid reference market. This is a function of volatility alone, but our efforts to offset any of it depends on the amount and type of trading volume, i.e. whether or not this pool will become a “primary” venue for trading wPOKT/POKT. The more important the pool becomes, the less LPs need to be compensated for providing liquidity (you can see the calculations for LVR in the Uniswap LP projections spreadsheet),

- total amount staked in the staking contract - additional stake will reduce the yield, which is the reason why we propose that the DAO does not stake its initial liquidity into the staking contract, to keep the yield higher for new liquidity providers (at least initially),

- total trading volume - a 0.3% fee is taken from every transaction and added back into the liquidity pool, which will boost yield (APY) for all LPs, and

- price of wPOKT, as increases to the price of wPOKT will increase the real rate of return for LPs by boosting the value of the incentives pool.

Building the on the information above, this proposal asks the DAO for an additional $200,000 in POKT so that we can provide the following:

- $200,000 (split 50/50 between ETH and wPOKT) as starting liquidity in the Uniswap v2 wPOKT/ETH pool, and

- $75,000 in wPOKT (2.6m POKT as of today) as additional incentives for all liquidity providers participating in the liquidity pool, which will pay out weekly over a 90-day period.

We propose that this DAO-sponsored LP incentives strategy for wPOKT will run for 90 days from launch, with rewards accruing block by block. Coming up to the end of the 90-day period, we will share our findings with the DAO about the strategy’s success and/or whether or not we propose to extend the strategy and, if so, on what basis. For example, we will consider whether it will make sense for the next incentives scheme to run on Uniswap v3 on Ethereum or to incentivise liquidity on new chains such as Arbitrum, Optimism, or Polygon.

While the initial APR of wPOKT received by liquidity providers (LPs) will start very high to attract liquidity, this will come down to a steadier level - most likely around c. 20% - as more people stake in the contract. Using the Uniswap LP projections spreadsheet, we can approximate that $200,000 in initial starting liquidity will provide an average execution price of c.$2k at a price level 2% higher or lower than the market price attributable to such liquidity levels. However, with the liquidity incentives we propose, we believe we can target a range for the 2% liquidity depth in the pool of between $15-25k. Such a liquidity range should provide a reasonable baseline for people looking to enter and/or exit the Pocket Network ecosystem via wPOKT.

We expect this liquidity will come from existing Pocket community members and new professional (and unprofessional!) liquidity providers interested in earning wPOKT for their support for the liquidity pool.

Deliverables and Budget

- DAO to approve $200k in POKT (6.95m POKT as of today, 10 August 2023) - calculated as of the date this proposal passes - to fund the initial liquidity in the Uniswap pool and the additional LP staking incentives pool - by 31 August - Done

- PNF to launch wPOKT bridge on 20 September - ongoing

- PNF to convert $100k of the POKT received from the DAO as part of this proposal to stables via an OTC trade and then to ETH via an exchange purchase - ongoing

- PNF to launch Uniswap pool and seed with agreed starting liquidity (currently proposed as $200,000 split 50/50 in wPOKT/ETH) on 25 September - ongoing

- PNF to launch wPOKT LP staking strategy front-end and seed smart contract with agreed amount of DAO incentives (currently proposed as $75,000 in wPOKT) on 28 September - ongoing

- PNF to share an updated liquidity strategy with the DAO at least 2 weeks before the end of the initial strategy - by the middle of November - to be done

Dissenting Opinions

The proposed APR/APY for the wPOKT LP strategy will disincentivise too many node runners and validators

With c.872m POKT tokens staked in the protocol as either node runners or validators, the wPOKT pool simply cannot absorb this much capital, so it’s not a fair comparison.

The total monthly incentives pool for node runners and validators is c.4.8m POKT (c.$135k) after you exclude the DAO’s 10% cut. And runs perennially with an APR of c.10% (the APY will increase up and down based on the prevailing price of POKT and the amount of POKT staked). On the other hand, the wPOKT incentives pool is capped at $75k (c.2.6m POKT) and will run for only 3 months.

The scale of both incentive schemes - in terms of the respective quantum and time - is very different. While we do not expect a material number of node runners to stop running infrastructure to become a liquidity provider instead, we do expect the additional utility for POKT/wPOKT provided by this strategy to result in many holders of POKT who may not already be staking their tokens - or were already planning to unstake due to lower returns at current levels of relays - to participate in this strategy and support liquidity for the project.

Said another way, we view this strategy as a net benefit for all holders of POKT/wPOKT, as it gives more utility to POKT and provides more opportunities for holders to earn from doing work that the community cares about.

We should increase the starting liquidity / incentives pool to something much higher

We agree that the current liquidity levels for POKT are completely unacceptable for a project with the ambition and importance of Pocket Network. The 2% depth for POKT/wPOKT is something we want to massively improve over the coming 5-6 months, with the ultimate target being a 2% liquidity depth of closer to $100k, which will require a tier 1 CEX.

However, we need to start by getting liquidity for wPOKT to a reasonable baseline. And we need to do so within the constraints of our available budget.

The size of the current DAO Treasury is 87m POKT (c.$2.61m), with 40.89m POKT ($1.22m) available after the ERA budget is fully allocated. This proposal asks for an additional c.6.95m POKT at current prices, which amounts to c.17% of the remaining DAO Treasury. PNF is executing this proposal on behalf of the DAO, meaning that at least 10% of this sum (at current prices) is returnable to the DAO’s treasury at any time. If the DAO decides to pull any liquidity at a later date, it will still remain as the DAO’s assets and not PNF’s. Only the $75k of proposed DAO incentives to LPs is non-refundable.

Given the information and resources we have, and the analysis we have undergone, we believe that the amount asked for in this proposal is appropriate given the 2% liquidity depth range - between $12.5-25k - we are targeting and the available budget.

Next steps / Implementation

We welcome questions, feedback and discussion on the proposal from the whole community!

To help aid the discussion, we plan to invite Freddie Farmer, who has been acting as a third-party expert adviser to PNF on this strategy, to join the community call next week. More details will be provided soon.

Once we have received sufficient feedback from the community on this proposal over the course of the next 7 days (or more if needed) and ironed out any material issues that may arise, we will put this proposal up for a vote.

Thank you

PNF

Additional Information / FAQ

Please see here for a (very early) working draft of the FAQ

Copyright

Copyright and related rights waived via CC0.