Update on 13 September

TL;DR

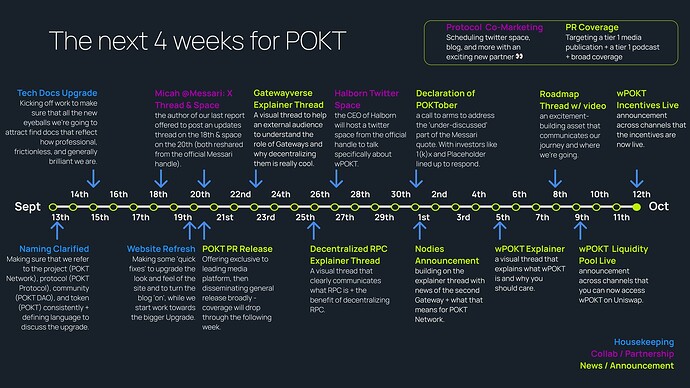

wPOKT will be ready to launch ahead of schedule.

But we’re pushing it back by 2 weeks.

New dates for your calendars are:

- 4th Oct (Bridge live)

- 9th Oct (Uniswap pool live)

- 12th Oct (Incentives live)

See full post here

Update on 4 September

-

We are now on the final stretch before launch!

-

Halborn audits of the smart contracts and back-end have been completed and all remedial actions have been taken. The reports are to be released by Halborn in the coming weeks

-

The main bridge site and the wPOKT token will launch on Wednesday 20 September, which will allow POKT holders to lock up their POKT holdings and mint wPOKT

-

The Uniswap v2 wPOKT/ETH pool will launch on Monday 25 September (more details on that to follow in the liquidity thread)

-

DAO-sponsored incentives for the Uniswap pool will commence on Thursday 28 September. The gap between the launch of the Uniswap pool and the start of the incentives is to allow people enough time to add liquidity to the Uniswap pool so that they are eligible for the incentives as soon as they start.

Update on 7 August

-

All initial wPOKT development sprints have been completed.

-

A contract has been signed with Halborn to start the audit of the wPOKT bridge and smart contracts by 21st of August.

-

Subject to final testing and QA, as well as alignment around the launch plan with all relevant launch partners, we are targeting Monday 18th of September for the official launch date of the wPOKT liquidity pool and the accompanying incentives (separate post to come later this week on this). The bridge app itself will likely launch at least a week before this date, to enable live testing and for anyone to mint wPOKT to ahead of the liquidity pool launch.

-

the wPOKT budget has committed to spending $100,000 out of its $150,000 ERA budget allocation to date, with additional reserves of $25,000 made to cover all Ethereum gas and infrastructure costs related to the actual launch of the bridge. A full breakdown of actual spending will be provided at the end of the project, and any excess funds will be returned to the DAO’s treasury.

-

here is the code for the wPOKT back-end system: GitHub - dan13ram/wpokt-validator - note that PNF will manage and control all of these “validators” on behalf of the DAO as part of the initial launch of this MVP.

-

here is the wPOKT smart contracts repo - GitHub - St4rgarden/wpokt at audit

validators for testing purposes. -

Feel free to explore and test it: https://wpokt-demo.vercel.app/

-

The demo app’s code is available here: GitHub - dan13ram/wpokt-monitor

-

Please note that the demo was built mainly to test the backend and the core bridging process.

-

Since SendWallet does not support POKT testnet, RaidGuild just added a sample pocket CLI command to the UI for sending POKT tokens to the vault and left it as such.

-

In the final mainnet bridge UI, Metamask and SendWallet (as well as any other suitable POKT wallets with a browser integration) will be supported for the best possible UX for all users.

-

Please explore the links, test the bridge, and share any feedback!

Update on 20 July 2023

- Updated all timelines in line with the latest progress and delays

- Added a new spec doc documenting the updates to the approach for the back-end (in particular), as well as the design and front-end. See here for reference

- Added a new deliverable and spec doc for a wPOKT Uniswap LP staking/farming strategy. See here for reference

TLDR:

- Timelines are pushed back by 3 weeks, meaning if everything goes according to plan with the audit, we can hit a late August launch. However, being conservative, by the end of September (ie end of Q3) is a very reasonable target even if we hit some more last-minute snags

- We have moved away from using Copper on both Ethereum and Pocket due to a lack of a testnet environment, blockers on progress, and technical factors meaning that gas costs were an issue

- Mints on Ethereum will be signed by M/N wpokt signer nodes (as per the specs), and end-users will also pay the gas required

- Burns / Invalid Mints on Pocket Network will be signed by N/N wpokt signer nodes

- All private keys used as part of the signer nodes for the bridge will be managed by Google secret manager, which has built-in redundancy with rotation policies to ensure that the keys are stored in multiple data centres so that they are safe even if one of them goes down, and deployed to the signer nodes securely

- PNF will manage all the signers for this initial version, with the plan to open up and decentralise with each subsequent iteration

- Raid Guild will complete the work for the wPOKT Uniswap LP staking strategy in parallel with the rest of the work

- PNF will share a proposal for a wPOKT Uniswap LP liquidity strategy to the forum for consideration in the course of w/c 7 August (if not before)

wPOKT

We have held off on a formal update until now due to the desire to make sure we had firm timelines before getting anyone too excited. You can now start to get excited ![]()

This project builds on our overarching objective at PNF to accelerate the DAO’s impact, which includes helping to steward the growth - and value - of the Pocket ecosystem.

More specifically, one of PNF’s stated Big Hairy Audacious Goals for Pocket is for POKT to have the institutional financial rails expected of a blue-chip token. The volatility and lack of market depth of POKT act as a genuine barrier to entry to new entrants to the ecosystem. And for Pocket’s economy to win, the lifeblood of the economy, POKT, should be as freely accessible as possible for new node runners, gateways, applications, and DAO contributors.

Purpose, objectives, and operating principles

We want to develop a “wrapped” version of POKT, “wPOKT,” that can represent the value of native POKT 1:1 and benefit from the smart contract features and tools available within the Ethereum ecosystem.

Our aim with wPOKT is twofold:

- Enable the interoperability of Pocket Network with best-in-class DeFi and DAO tooling and infrastructure

- Improve liquidity and access to POKT

Achieving these objectives has the potential to unlock financial legos, such as streaming payments, DAO budgeting, and other integrations that will help the DAO to scale and onboard new contributors. Additionally, wPOKT as a programmatic primitive can be the foundation for more sophisticated Pocket products in the future.

In building wPOKT, we are keen to adhere to the following principles:

- Never let perfect be the enemy of good. This initial version of wPOKT is an MVP: it is more important to ship a working version of wPOKT and its accompanying bridge in the coming months than it is to ship a “perfect” - perhaps “trustless” - version in a year’s time.

- Keep things simple and reduce all unnecessary overhead. The UX should be incredibly straightforward and easy to use as PNF doesn’t have the bandwidth to process refund requests and act as 24/7 customer support for wPOKT.

- User safety is paramount. We must minimise the scope for user mistakes and never sacrifice safety in the desire to ship quickly.

- We cannot slow down any other ecosystem priorities to deliver wPOKT. Consequently, wPOKT cannot include any features that would require a protocol upgrade prior to v1, eg to enable threshold multisig functionality for Pocket’s blockchain (which will be included in v1).

Implementation plan

Success metrics

The north star metric for this project is 2% depth (the amount that can be purchased/sold within 2% of the spot price). As of 19 June 2023, the amount that can be purchased within this range on the largest market for POKT(measured by 24h volume) is $1.9k (albeit the liquidity on Kucoin is much better with a 2% depth of $11k).

For wPOKT to be successful, it is necessary for people to easily be able to buy - and sell wPOKT - and then use that wPOKT as they need, including bridging it over to the Pocket Network blockchain to stake as a node runner, or directly as an application/gateway (post v1).

Technical specifications

- Design spec

- Front-end spec

- Smart contracts spec

- Back-end spec

- New spec doc documenting the updates to the approach for the back-end (in particular), as well as the design and front-end. See here

- Spec doc for a wPOKT Uniswap LP staking strategy that enables the DAO to provide liquidity incentives for those providing liquidity to wPOKT Uniswap pool. See here

Budget

This is an indicative “do not exceed” budget. Final numbers and costs are subject to change.

For clarity, any excess or unutilised funds from the Era Budget will be returned to the DAO Treasury at the end of the Era or at the close of wPOKT (whichever comes first), and any remaining funds from the Era allocation will be returned to the DAO treasury at the end of each cycle.

| Deliverable | Responsibility | Projected cost ($) |

|---|---|---|

| Scope out project and deliver draft technical spec across design, front-end, smart contracts and back-end | Raid Guild | 6,400 |

| Deliver technical build of wPOKT as against the agreed specifications, including all necessary design, front-end, smart contracts and back-end components | Raid Guild | 42,200 |

| Legal advice and drafting of terms of service for wPOKT front-end | Fox Williams (law firm) | 11,400 |

| Audit of wPOKT | Audit firm | 50,000 |

| Infrastructure costs (gas costs to launch smart contracts on Ethereum, and additional costs for custodying wPOKT funds) | PNF, Copper | 25,000 |

| TBC: Front-end to enable DAO sponsored liquidity provisioning for the wPOKT/ETH pair on Uniswap | Raid Guild | 15,000 |

| wPOKT min liquidity (50/50 POKT and ETH) | PNF and DAO | 75,000 |

Operational budget = $150,000 (max)

Minimum liquidity budget (excluding additional DAO incentives) = $75,000 (max)

Stakeholders, roles and responsibilities

| Stakeholder | Role and Responsibilities |

|---|---|

| PNF | Steward the project by setting the objectives, maintaining oversight over all contributors and ensuring that the project is delivered in the most efficient and safe manner. |

| Raid Guild | Lead technical developer for the project. Build out and integrate together the design, front-end, smart contracts, and back-end. |

| Halborn | Audit the final product from the Raid Guild team to uncover any bugs and opine on the overall safety and viability of the project. |

| DAO voters | Approve the wPOKT budget of $150k included within the new ERA proposal once it goes to a vote, and approve any additional wPOKT liquidity incentives if it goes to a vote too |

| Community members | Provide input and comment on the spec as it is released, and support the project once launched by using the bridge and/or providing liquidity to the wPOKT/ETH pair on Ethereum |

| PNF’s PR firm | Connect PNF to the right contacts to ensure that wPOKT gets awareness with its target audience |

Deliverables, stakeholders and timeline

| Deliverable | Stakeholder | Timeline |

|---|---|---|

| Align on objectives and approach for the wPOKT project | PNF | By end of April 2023 - Done |

| Onboard technical lead to build wPOKT | PNF | By mid May 2023 - Done |

| Share technical deliverables and roadmap, along with budget for all technical work | Raid Guild | By end of May 2023 - Done |

| Provide visual design prototype | Raid Guild | By start of June 2023 - Done |

| Finalise legal advice and documentation connected with wPOKT, including terms of use | PNF and law firm | By end of June 2023 - Done |

| FRONT END: UI Components, SMART CONTRACT: wPokt Contract and Minter contract | Raid Guild | By 28 July 2023 - Done |

| BACK END: Mint Flow | Raid Guild | By 28 July 2023 - Done |

| Front-end, smart contracts and final full build of wPOKT LP staking system | Raid Guild | By 4 August 2023 - Done |

| Finalise liquidity strategy for wPOKT to present to the DAO | PNF | By 11 August 2023 - Done |

| Finalise marketing and PR plan for launch | PNF and PR Firm | By 11 August 2023 - Done |

| Finalise wPOKT audit | Audit firm | Due by end of August 2023 - Done |

| Integrate any changes following audit report | Raid Guild | By 8 September 2023 - Done |

| DAO approval of initial liquidity incentives for wPOKT | PNF, DAO voters | By end of August 2023 - Done |

| Launch wPOKT, the bridge, and any DAO-approved liquidity incentives | PNF, Raid Guild, DAO | Bridge to launch on Wednesday 20 September, Uniswap liquidity pool to launch on Monday 25th September, and DAO-sponsored incentives to commence on Thursday 28th September |

Conclusion and next steps

We will use this thread to make continual updates as we achieve more milestones and more information and questions comes to light about the final approach to the relevant social, economic and technical components relating to the project.

We encourage all community members to join us in bringing this project to fruition, so please feel free to reach out or just comment if you feel you have a valuable contribution to make. We will also announce one or two Pocket Open Priorities (POPs) in relation to wPOKT in the coming weeks, so watch this space.

Thank you.

PNF