Attributes:

Author(s): @msa6867 , @cryptocorn, @caesar

Parameter: RelaysToTokensMultiplier

Current Value: variable so as to maintain Target Daily Emission = 690k $POKT/day starting Jan 1, 2023 and beyond. (At projected Jan 1 supply of ~1.50B $POKT, this corresponding to an effective inflation rate of 16.8% for 2023, 14.4% for 2024, 12.6% in 2025, etc.)

New Value: variable so as to maintain Target Daily Emission = 690k $POKT/day during January and February 2023 and decreasing by 4.05% monthly thereafter for 12 months starting March 1, 2023 terminating at 420k $POKT per day starting February 1, 2024 and thereafter. (At projected Jan 1 supply of ~1.501B $POKT, this corresponding to an effective inflation rate of 14.0% for 2023, 9.0% for 2024, 8.2% in 2025, etc.)

Summary:

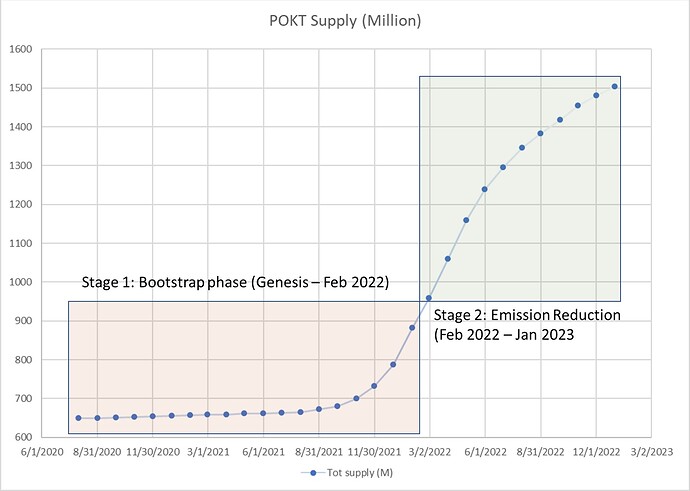

Since the start of WAGMI in February of last year, RTTM has been aggressively reduced from 10000 in February 2022 to 574 on January 1, 2023. Corresponding, average servicer rewards per 15k staked have reduced from the hundreds of POKT per day to high single digits today. The reductions have been effective in reducing the rate of growth of POKT supply as shown in Figure 1, but have come at a cost to node runners in terms of being able to innovate fast enough to remain profitable.

Figure 1 – Historical record of POKT Supply (Million), Genesis through Present

There have been several sentiments expressed on how to proceed once PUP-22 reaches the end of its reduction cycle on Jan 1, 2023. The main sentiments expressed are as follows:

- Node runners need a break from further emission following 10 months of aggressive reduction

- Less aggressive emission reduction measures are needed going forward: the rate of recent reward reductions is outstripping the rate at which node runners can innovate to reduce costs, threatening the ability of node runners (especially small node runners) to continue their nodes

- Node runners need predictability of rewards: monthly reductions over the last 10 months have varied between 0 and 24% and the WAGMI and FREN proposals only cover about 5 months at a time, making it hard to know what rewards to expect in the future

- Inflation/daily emissions is still too high and needs to be reduced further

- Having a tokenomics with infinite max supply hurts Pocket Network in terms of appealing to a larger investor base; defining POKT tokenomics to have a finite max supply is beneficial in terms of market appeal and attracting investors.

Continuing with further aggressive reductions in the vain of WAGMI and FREN is incompatible with the first two sentiments expressed above, while doing nothing is incompatible with the last two. Both these courses of action are incompatible with the middle sentiment above of wanting predictability of what the near-to-medium-term future holds.

On the other hand, bringing the era of aggressive emission reduction to a close while continuing for 12 months with a moderate, predictable monthly reduction going forward provides a good balance to all of the above-expressed sentiments. This proposal puts in place a monthly reduction in target daily emission of 4.05%, reducing target daily emission from 690k today to 420k by February 1, 2024, as shown in Table 1. This will allow us to immediately change the narrative of inflation to 12.6% as of March 1, dropping to single-digit inflation by September of this year.

Pausing any further reductions after the 12 months of reduction is meant to motivate the DAO to take follow-on action that incorporates per-region, per-chain RTTM control that is expected to be available in V1 as well as to develop a comprehensive strategy related to the relationship between emission and app burn. If V1, app burn, or other factors leading to a better more comprehensive emission plan are available prior to the 18 months, the DAO may supersede this emission schedule by voting in a replacement emission scheme.

Table 1: Target Daily Emission Schedule

| month of SER | month | target daily | projected end | Inflation forecast |

|---|---|---|---|---|

| reduction | emission (K) | supply (M) | (= Mi+12/Mi - 1) | |

| Dec-22 | 1,501 | |||

| Jan-23 | 690 | 1,522 | 14.0% | |

| Feb-23 | 690 | 1,543 | 13.3% | |

| 1 | Mar-23 | 662 | 1,563 | 12.6% |

| 2 | Apr-23 | 635 | 1,582 | 12.0% |

| 3 | May-23 | 610 | 1,601 | 11.4% |

| 4 | Jun-23 | 585 | 1,619 | 10.9% |

| 5 | Jul-23 | 561 | 1,636 | 10.5% |

| 6 | Aug-23 | 538 | 1,652 | 10.1% |

| 7 | Sep-23 | 517 | 1,668 | 9.8% |

| 8 | Oct-23 | 496 | 1,683 | 9.5% |

| 9 | Nov-23 | 476 | 1,697 | 9.3% |

| 10 | Dec-23 | 456 | 1,711 | 9.1% |

| 11 | Jan-24 | 438 | 1,725 | 9.0% |

| 12 | Feb-24 | 420 | 1,737 | 8.9% |

Abstract:

This proposal provides for a moderate ~4% per month step down of target average daily emission that PNF uses to set RelaysToTokensMultiplier (RTTM). The exact schedule to be used by PNF is shown in Table 1.

The Pocket Network Foundation (PNF) will continue to calculate the RelayToTokenMultiplier (RTTM) by dividing the target daily emission rate (denominated in uPOKT) by the Trailing 7 Day Average Relays. Poktscan shall be used as the source of truth for relay counts for the measured periods. As per PUP-29, RTTM updates take place once per week; updates to target daily emission rate will reflect starting with the first regular weekly update following the first of each month.

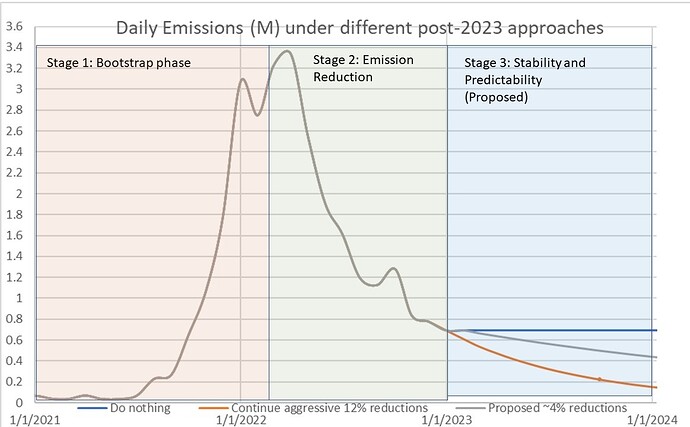

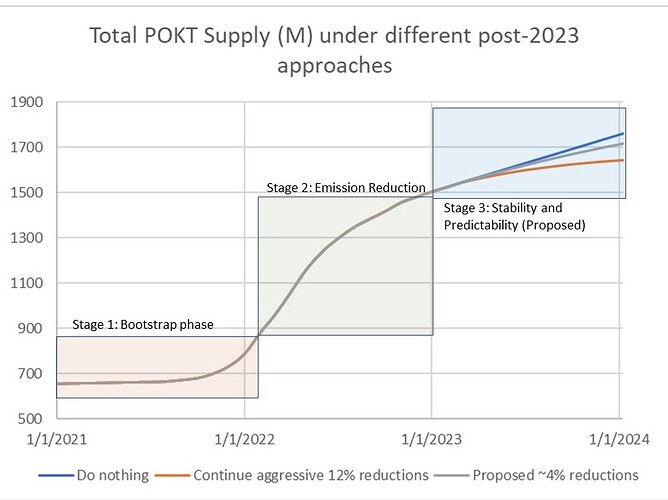

This proposal is a middle ground between taking no further action after the last January 1 (keeping target daily emission at 690k) and continued aggressive reduction in emissions as seen in Figures 2 and 3.

Figure 2 - Average Daily Emissions (Million) Genesis-Present plus projection into the future under various pot-FREN conditions (blue = no action. grey = this proposal, orange = continued aggressive reductions)

Figure 3 - Total POKT Supply (Million) Genesis-Present plus projection into the future under various post-FREN conditions (blue = no action. grey = this proposal, orange = continued aggressive reductions)

Under the terms of this proposal approximately 168M $POKT would be added to the supply during the last 10 months of 2023 (in addition to the 42M added during January and February) and approximately 154M $POKT would be added to the supply in 2024, resulting in single-digit inflation by September of this year.

Motivation:

The Bootstrapping phase, from approximately June 2020 through February 2022, was designed to encourage user adoption of the Pocket Network. Following this, aggressive emission reduction measures were taken from February through January 2023, to reduce annual inflation from triple digits to mid-teen levels. Going forward, it is desirable neither to maintain high inflation nor to continue highly aggressive inflation reduction measures; a middle ground is needed. This proposal seeks to provide that middle ground.

Continued moderate, predictable reduction to emission averages results in stabilizing the POKT supply and combatting the false narrative that Pocket has uncontrolled inflation and indefinite supply. Under the terms of this proposal, Pocket Network will be able to claim single digit inflation within six months of the effective start date. This is desirable in terms of public relations and attracting new investors to POKT who, whether right or wrong, have bought into a narrative concerning Pocket Network inflation that is stuck in the past.

Rationale:

In pre-proposal discussions and debates, alternate methodologies to implement moderate continued reductions were explored. The record of those discussions and methodology can be found at this link:

It was determined to continue with defined monthly reductions rather than defined Maximum Supply in order to avoid prematurely creating a narrative centered around Pocket having a “Maximum Supply” since there are too many unknowns regarding the best emission practices under V1 and the turn on of app burn. For similar reason it was determined to limit the number of monthly reductions to twelve months in order to force the DAO to revisit emission strategies – and especially demand-centric strategies, once V1 mainnet turns on and once app burn is immanent. In addition to the above link, discussion regarding the desirability in the future of a demand-centric approach to emission can be found at this research thread:

Monthly reductions of ~4% was chose over the original 1.4% suggested in the pre-proposal in order to drive the narrative of single-digit inflation by the end of the year and strike a better balance between continuing to put pressure on node runners to continue innovating and not being so aggressive as to loose key talent from the ecosystem by driving out node runners.

Dissenting Opinions:

“This approach is not aggressive enough. What is needed is an immediate cut in emissions by half or two-thirds in order to cause node runners to capitulate resulting in reducing node count to only that needed to service current and near-term forecasted relays.”

As noted above, this proposal if implemented, does not preclude a more aggressive approach to be proposed to supersede this one, if such an approach can be justified and accepted by the community. That being said, the drawback to a more aggressive approach is that in the process of driving out current node runners via capitulation, the ecosystem will loose more in lost talent and lost innovation than it will gain by reducing the node count.

“This approach is too aggressive. Node runners are already stretched to the break-even point; Emission targets should not be changed during this season. “

The reductions are modest enough that those node runners who are willing to continue to innovate should stay profitable. Driving the narrative of single-digit inflation is important for the program and may reflect in POKT/USD price as investors gain confidence that Pocket Network has its inflation issue under control. While such reflection cannot be guaranteed, any price stabilization that does materialize would more than offset any negative effect rom reductions.

“A methodology should be defined that guarantees a Max Supply. This is needed to help drive the Pocket Network inflation narrative.”

This was considered and heavily debated during the pre-proposal phase. Ultimately it was decided that it is premature to claim or advertise a max supply, as there are too many unknowns regarding what the best emission practices will be post-V1. That being said, the approach taken herein is consistent with asymptoting to a maximum supply. Were 4% monthly reductions to be renewed indefinitely at the end of twelve months, Pocket supply would asymptote to approximately 2.0B.

Copyright

Copyright and related rights waived via CC0.