**Update: **

Spreadsheet used to generate the graphs is at following location:

Attributes:

Author(s): @msa6867

Parameter: RelaysToTokensMultiplier

Current Value: variable so as to maintain Target Daily Emission = 690k $POKT/day starting Jan 1, 2023 and beyond. (At projected Jan 1 supply of ~1.50B $POKT, this corresponding to an effective inflation rate of 16.8% for 2023, 14.4% for 2024, 12.6% in 2025, etc.)

New Value: variable so as to maintain Target Daily Emission = 690k $POKT/day starting Jan 1, 2023 and decreasing by ~1.4% monthly thereafter with total supply asymptoting to a maximum value of 3.0B POKT. (At projected Jan 1 supply of ~1.50B $POKT, this corresponding to an effective inflation rate of 15.5% for 2023, 11.3% for 2024, 8.6% in 2025, etc.)

Summary:

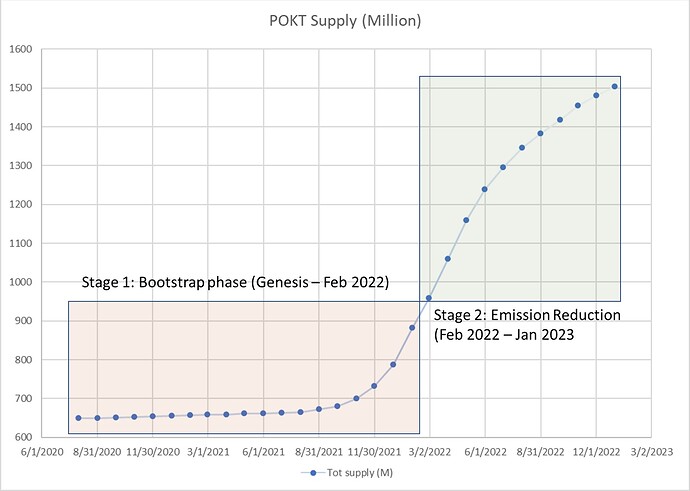

Since the start of WAGMI in February of this year, RTTM has been aggressively reduced from 10000 in February to 730 today and a projected 640 to 650 come January 1. Corresponding, average servicer rewards per 15k staked have reduced from the hundreds of POKT per day to mid-teens today. The reductions have been effective in reducing the rate of growth of POKT supply as shown in Figure 1, but have come at a cost to node runners in terms of being able to innovate fast enough to remain profitable.

Figure 1 – Historical record of POKT Supply (Million), Genesis through Present

There have been several sentiments expressed on how to proceed once PUP-22 reaches the end of its reduction cycle on Jan 1, 2023. The main sentiments expressed are as follows:

- Node runners need a break from further emission following 10 months of aggressive reduction

- Less aggressive emission reduction measures are needed going forward: the rate of recent reward reductions is outstripping the rate at which node runners can innovate to reduce costs, threatening the ability of node runners (especially small node runners) to continue their nodes

- Node runners need predictability of rewards: monthly reductions over the last 10 months have varied between 0 and 24% and the WAGMI and FREN proposals only cover about 5 months at a time, making it hard to know what rewards to expect in the future

- Inflation/daily emissions is still too high and needs to be reduced further

- Having a tokenomics with infinite max supply hurts Pocket Network in terms of appealing to a larger investor base; defining POKT tokenomics to have a finite max supply is beneficial in terms of market appeal and attracting investors.

Continuing with further aggressive reductions in the vain of WAGMI and FREN is incompatible with the first two sentiments expressed above, while doing nothing is incompatible with the last two. Both these courses of action are incompatible with the middle sentiment above of wanting predictability of what the future holds.

On the other hand, bringing the era of aggressive emission reduction to a close while continuing indefinitely with a very gentle, predictable monthly reduction going forward provides a good balance to all of the above-expressed sentiments. This proposal puts in place a modest monthly reduction in target daily emission of approximately 1.4%, and defines a methodology for PNF to accomplish this monthly adjustment in such a way as to cause the max theoretical POKT supply to be 3.0B POKT, independent of monthly variations between actual vs target emission levels.

Abstract:

This proposal provides for a gentle ~1.4% per month step down of target average daily emission PNF uses to set RelaysToTokensMultiplier (RTTM). The methodology to implement this reduction is such that the max theoretical POKT supply will be 3.0B POKT independent of relay growth or other factors that may cause systemic over-minting. In addition, it gracefully and stably accommodates any App burn that may potentially be executed in the future.

In particular, starting in 2023, target daily emission would be set to:

(1) Target daily emission = 690k POKT * (3-X)/(3-x0)

where X is the current POKT supply (in billions) and X0 is the POKT supply (in billions) as of January 1, 2023.

For example, if on January 1, 2023 the POKT supply was 1.504B and the result of 690k daily mint during the month of January caused POKT supply to be 1.525B on February 1, 2023, then the target daily emission for the month of February would be set to 690k * (3-1.525)/(3-1.504) = 680k. If February emissions then resulted in a total supply of 1.544B on March 1, then target daily emission for the month of March would be set to 690k * (3-1.544)/(3-1.504) = 671.5k. The result is an approximate 1.4% reduction in target daily emissions month over month. The corresponding change to average servicer rewards, month over month, would be less than 0.2 POKT per day per 15k stake during the first half of 2023 and would be even less thereafter. This provides stability and predictability to node runners while maintaining desirable emission reductions over the longer term.

The Pocket Network Foundation (PNF) will continue to calculate the RelayToTokenMultiplier (RTTM) by dividing the target daily emission rate (denominated in uPOKT) by the Trailing 7 Day Average Relays. Poktscan shall be used as the source of truth for relay counts for the measured periods. As per PUP-29, RTTM updates take place once per week; updates to target daily emission rate will reflect starting with the first regular weekly update following the first of each month.

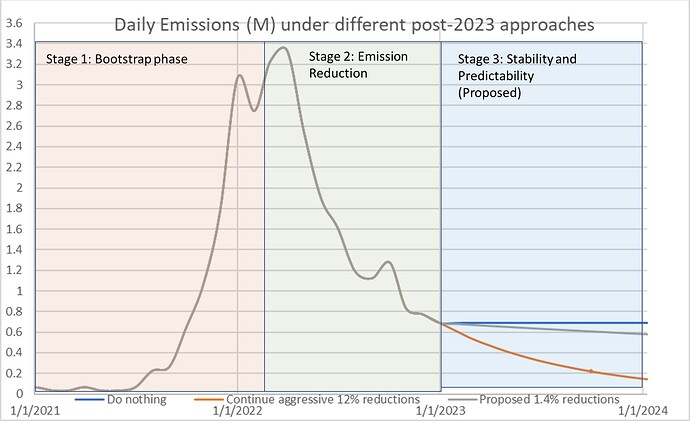

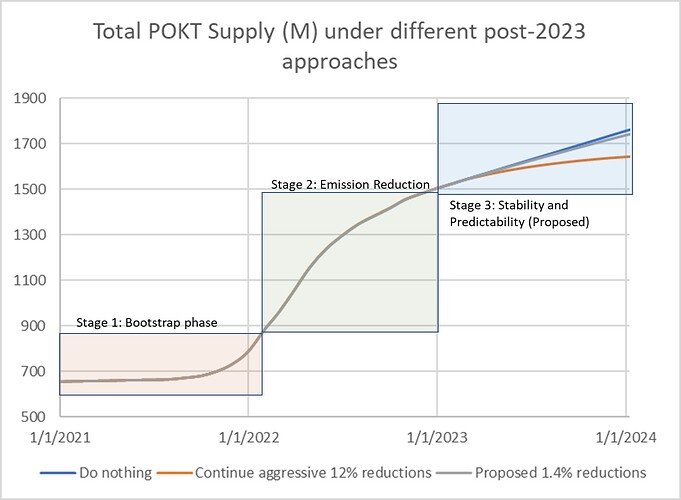

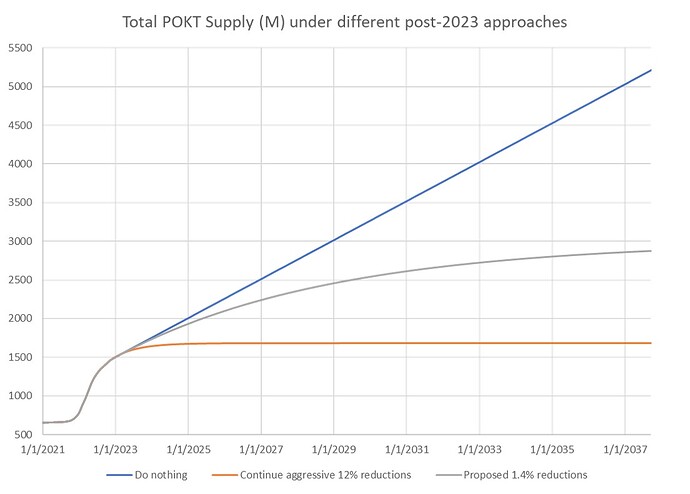

This proposal is a middle ground between taking no further action after January 1 (keeping target daily emission at 690k) and continued aggressive reduction in emissions. In practice, it is closer to the “do nothing” approach in the short term, as seen in Figures 2 and 3, while providing a well-behaved asymptote to 3.0B total supply over the long term, as seen in Figure 4.

Figure 2 - Average Daily Emissions (Million) Genesis-Present plus projection into the future under various pot-FREN conditions (blue = no action. grey = this proposal, orange = continued aggressive reductions)

Figure 3 - Total POKT Supply (Million) Genesis-Present plus projection into the future under various post-FREN conditions (blue = no action. grey = this proposal, orange = continued aggressive reductions)

Figure 4 - Total POKT Supply (Million). Long term projection under various pot-FREN conditions (blue = no action. grey = this proposal, orange = continued aggressive reductions)

Under the terms of this proposal approximately 233M, 197M and 166M $POKT would be added to the supply during 2023, 2024 and 2025, respectively (assuming that no App burn is implemented before then), resulting in single-digit inflation by 2025.

Motivation:

The Bootstrapping phase, from approximately June 2020 through February 2022, was designed to encourage user adoption of the Pocket Network. Following this, aggressive emission reduction measures were taken from February through December 2022, to reduce annual inflation from triple digits to mid-teen levels. Going forward, it is desirable neither to maintain high inflation nor to continue highly aggressive inflation reduction measures; a middle ground is needed. This proposal seeks to provide that middle ground.

Any predicable, continued reduction to emission averages, no matter how small, has, as a natural consequence, the tendency to asymptote to some corresponding maximum supply. Being able to define a maximum supply is desirable in terms of public relations and attracting new investors to POKT who, whether right or wrong, will not consider a token for investment if it has an undefined or infinite maximum supply. While it was not the primary goal of the WAGMI and FREN proposals to define a maximum POKT supply, the current trajectory of POKT growth under WAGMI/FREN is already toward a maximum supply; any continued reduction, no matter how small, will naturally trace out to a maximum.

Table 1 shows the theoretical maximum supply and the period to inflation halving that result from various levels of month over month reductions to target daily emissions starting in February 2023. 1.4% monthly reductions (corresponding to a max supply of 3.0B) was chosen as a middle-of-the-road value for this proposal; other values in the sub-2% range can be considered as well. For example, if the community felt the even smaller 1% month-over-month reduction was preferable, the target daily emission could correspondingly be set instead to 690k POKT * (3.6 - X)/(3.6 - x0). Or if the more aggressive 2% month-over-month reduction was desired, the target daily emission would correspondingly be set instead to 690k POKT * (2.56 - X)/(2.56 - x0).

The last column of Table 1 lists other cryptocurrencies with emission reduction schema that fall approximately into each row of the table. As seen, a number of projects adopt a tokenomics that incorporates the equivalent of a month emission reduction close to 1.4%. Many of these trace their history to emulating bitcoin’s emission-halving scheme which takes place approximately every 4 years. This column can be more fully populated as reviewers suggest new tokens to add to the table. Emission halving in the two-to-four year time frame creates an approximate balance between decreasing rewards and decreasing operational and capital expenditures needed to generate those rewards in keeping with Moore’s law and its approximate equivalents as applied to processing, memory and storage.

Table 1 – Max POKT Supply as a natural consequence of small, stable monthly emission reductions.

| monthly emission | Corresponding | Corresponding Period | Other projects w/ |

| reduction | max POKT | to reduce emissions | similar long-term |

| (percent) | supply (Billion) | by half (Years) | emission reductions |

| 0.2% | 12.00 | 28.8 | |

| 0.4% | 6.80 | 14.5 | IRON |

| 0.6% | 5.00 | 9.6 | |

| 0.8% | 4.14 | 7.0 | |

| 1.0% | 3.60 | 5.7 | SOL, AVAX |

| 1.2% | 3.25 | 4.8 | |

| 1.4% | 3.00 | 4.1 | BTC, ADA, LTC, BEAM |

| 1.6% | 2.81 | 3.6 | |

| 1.8% | 2.67 | 3.2 | |

| 2.0% | 2.56 | 2.9 | |

| 2.2% | 2.46 | 2.6 | |

| 2.4% | 2.38 | 2.3 | |

| 2.6% | 2.31 | 2.1 | |

| 2.8% | 2.25 | 2.0 | |

| 3.0% | 2.20 | 1.9 | |

| 3.2% | 2.16 | 1.8 | |

| 3.4% | 2.12 | 1.7 | |

| 3.6% | 2.09 | 1.6 | |

| 3.8% | 2.06 | 1.5 | |

| 4.0% | 2.03 | 1.4 | |

| 4.2% | 2.00 | 1.3 |

Rationale:

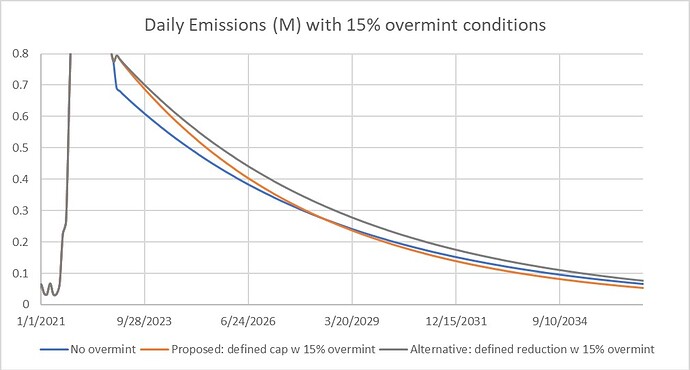

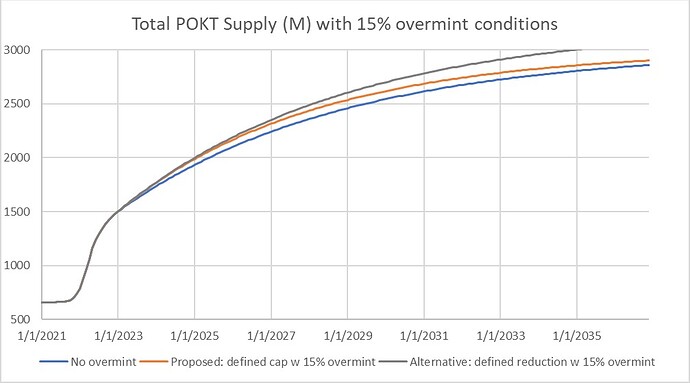

With regard to the methodology used to accomplish the monthly reductions, two methods are possible. One method focuses on column 1 of Table 1 and applies a fixed percentage reduction each month to the target daily emission. The second method focuses on column 2 of Table 1 and applies a variable reduction each month based on actual net supply growth during the previous month. The latter approach is more stable in terms of accommodating emission fluctuations that happen in practice. In particular, the proposed methodology self-corrects systemic over-mint or under-mint conditions, while the alternative approach causes such deltas to accumulate over time, as seen in Figures 5 and 6. For this reason, the second methodology is chosen as the basis of this proposal.

Figure 5 – Projected Average Daily Emissions (Million) with Systemic 15% overmint such as occurs during periods of rapid growth of relays (blue = no overmint. orange = this proposal with 15% overmint, grey = alternative defined-reduction method with 15% overmint)

Figure 6 – Projected POKT Supply (Million) with Systemic 15% overmint such as occurs during periods of rapid growth of relays (blue = no overmint. orange = this proposal with 15% overmint, grey = alternative defined-reduction method with 15% overmint)

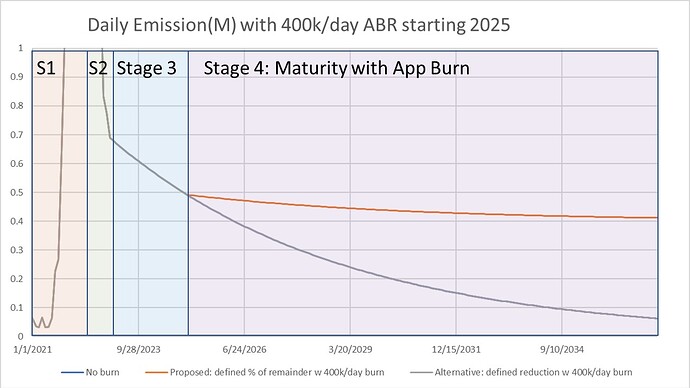

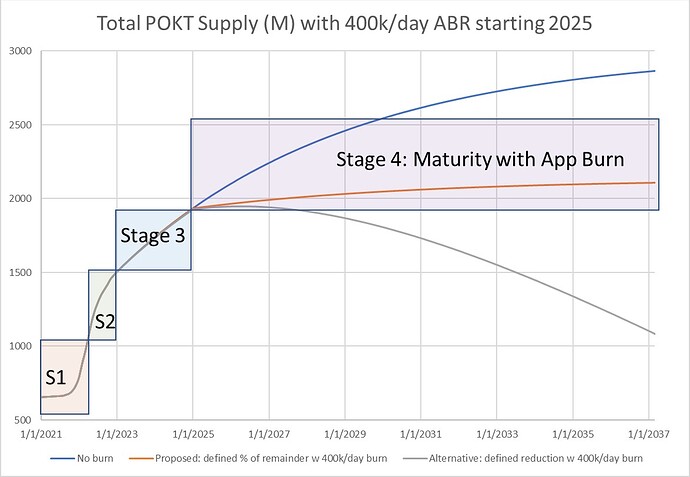

In addition, the proposed methodology causes a potentially more sustainable response to any App burn that may be implemented in the future. The proposed methodology results in an eventual equalization between app burn rate and daily emission rate leading to a stable token supply, while the alternative methodology can become significantly deflationary, as shown in figures 7 and 8. This is of lesser importance, since further instructions on how to accommodate app burn can be provided to the DAO via a follow on proposal if and when app burn is implemented in the future.

Note: this proposal itself is agnostic as to whether App burn will be implemented in the future or not. Figures 7 and 8 are neither an endorsement of nor prediction that App burn will turn on in 2025; it is simply a hypothetical exercise to show responsiveness of emissions under the terms of this proposal should App burn be turned on at a later date.

Figure 7 – Projected Average Daily Emissions (Million) with hypothetical 400k/day burn starting in 2025 (blue = no burn. orange = this proposal with burn, grey = alternative defined-reduction method with burn)

Figure 8 – Projected POKT Supply (Million) with hypothetical 400k/day burn starting in 2025 (blue = no burn. orange = this proposal with burn, grey = alternative defined-reduction method with burn)

Range of Parameter Space for Consideration:

The proposal as currently worded offers a “line in the sand” of 1.4% monthly reduction (corresponding to 3.0B max supply, per Table 1). That being said, a wide range of acceptable values exists, and the authors recommend for consideration anything between 0.6% and 2.0%. Anything above this range may be too aggressive in rate of reduction and anything below this range corresponds to a theoretical max supply that is so high as to not carry any positive weight for public relation purposes.

The proposal also offers January 1 as a “line in the sand” for when to baseline the denominator in equation 1 (with the first reduction to target daily emission occurring one month later). That being said, the baseline could be set to a wide range of acceptable dates, allowing for an extended period of time at 690k target daily emissions before initiating the regime of small reductions. For example, equation (1) above could be rewritten as:

“Starting in April 2023, target daily emission would be set to:

(1) Target daily emission = 690k POKT * (3-X)/(3-x0)

where X is the current POKT supply (in billions) and X0 is the POKT supply (in billions) as of April 1, 2023.”

This would cause target daily emissions to be set to 690k for the months of January, February, March and April 2023, with the first reduction occurring in May 2023. Note that Table 1, as currently populated, applies to a January 1 baseline. If April 1 was baselined instead, the table would adjust slightly. For example, the max supply of 3.0B would correspond to a monthly reduction of approximately 1.47% instead of 1.40% due to the approximate 63M POKT supply growth over the extra three months.

The author recommends Jan 1 to June 1, 2023 as being an acceptable range to consider to baseline the “X0” supply (with the first reduction occurring one month after baselining). Defining the go-forward plan now - even if it includes a static period at 690k POKT emitted per day - is superior to deferring the discussion for some months down the road due to (1) giving node runners predictability of what to expect reward levels to be in the future and (2) allowing Pocket Network to immediately control the tokenomics narrative in the marketplace.

Dissenting Opinion - Demand-Side Alternative Approach to Inflation

The above proposal assumes a continuation of the supply-side approach to inflation that has characterized Pocket Network since inception – bringing it to its next logical phase of reduced rate of supply growth with asymptote to a maximum supply. An alternative demand-side approach to inflation has been outlined by @srndptme (Vitality | Linen Wallet). In this alternative framework, inflation is an adjustable knob that is set to grow or shrink the supply-side infrastructure (e.g., POKT nodes, app chain nodes, etc) to match current and near-term projected demand and for now would be set to a drastically lower value than current setting.

[NB: In the following discussion, the term “supply” will be used synonymously and interchangeably with the term “infrastructure” and refers to the actual network infrastructure in place to service RPC demand. This is not to be confused with how the term is used in the body of the proposal in which it refers to a quantity of POKT tokens, whether as a theoretical maximum, a current number of tokens minted since genesis, an amount of tokens currently in circulation, or any other measure of units of POKT.]

The objections raised by @srndptme to the above proposal (and by extension to the original definition of RTTM being fixed to 10000, to WAGMI and FREN proposals in the past and to any other alternative supply-side approach to inflation in the future) are as follows:

- There is no scientific basis for the approach outlined or for the values chosen. Inflation should be based on scientific rationale, not be arbitrary.

- The defined approach gives too much care to what node-runners desire (e.g., “Node runners need a break from further emission.”) Node runners are not the clients of the system. DApps are. Catering to the vote of node runners creates supply-side bloat that may seem for a while to profit node runners but ultimately leads to price collapse in which everyone looses

- Pocket Network is currently way over-provisioned on the supply side given current and near-term projected demand. To be competitive with centralized RPC service providers, supply utilization should be close to ~60%. While utilization is an elusive number to calculate for Pocket Network, it is safe to say that, in the aggregate, supply utilization is well less than 10%. This means that Pocket Network could shed 80% of its current supply-side infrastructure and still be able to service current demand with no degradation to QoS. Inflation should be cut so as to cause a deleveraging of supply down to only that which is needed to service the near-term demand. That may mean inflation of ~5%. Only the most efficient node providers survive, and investors will regain confidence that Pocket can be competitive in the marketplace.

Inflation, according to @srndptme, should be set dynamically according to the following rule set:

- Define metrics by which you can assess right-matching between supply and demand (ideally this would include methods to measure infrastructure utilization as well as QoS metrics)

- Define metric targets which would indicate the right amount of infrastructure is in place to handle current and projected demand (e.g., 60% utilization).

- Ascertain current and projected demand over next 3-6 months (e.g., using P95 relays per block or per session would take demand spikes into account)

- Ascertain deltas between the current/projected metric values and the target metric values

- Adjust inflation so as to close gap between current and target metric values. For example, if current supply utilization is grossly under the target utilization, then make a drastic cut to inflation to drive out supply (i.e., all but the most efficient node providers), bringing up the utilization of the remaining supply back toward the target.

- Repeat last 3 steps in a continuous loop, lowering or raising inflation rate so as to incentivize supply to be subtracted from or added to the network to meet projected demand.

The DeFi lending protocol Compound (COMP) is an example of a project that follows the above procedure of using an inflation knob to right-size supply (funds available to lend) to demand (funds desired to be borrowed).

Applying this methodology to Pocket Network is hugely more complex than applying it to Compound and perhaps cannot be effectively accomplished at all. First, supply, in the case of Pocket Network, is not liquid capital as in the case of Compound, but is highly illiquid, coming in the way of hardware requiring large capital expenditures that cannot easily be shed and service contracts that cannot be cancelled on a whim.

Second, supply, in the case of Pocket Network, is not global as in the case of Compound, but granular. The Pocket network may be overprovisioned in some regions and on some chains but under-provisioned in other regions and/or chains. Ideally, Pocket would have the ability to specify inflation (i.e., relay to token multiplier) on a per-region, per-chain basis, but that ability does not and will not exist in V0 and is not currently on the roadmap to exist in V1 (though a good case can be made that it should be added to the V1 roadmap).

Further research is need to see if the above challenges to a demand-side approach to inflation can be overcome and if so what set of metrics could be defined to ensure right-sizing the supply side to the projected demand.

@srndptme has argued that no DAO action should be taken in consideration of post-FREN emission strategy until this research is complete. The author of this proposal counters that while the above research is of high importance, it does not follow that this proposal or other counter proposal should not be considered in the meantime. This research may take months to conduct and there is no guarantee that it will yield a satisfactory strategy. It would be imprudent to leave the entire community directionless as to a planned course of action following the last FREN update on January 1 simply because a better and more drastic course of action may be defined in the future.

For example, if the community were to vote to pass this proposal in its current form (1.4% monthly emission reduction corresponding to a POKT cap of 3.0B POKT), the resulting narrative of max POKT = 3.0B can immediately replace the current narrative of max POKT = infinite in the marketplace. Then if research proves that making a drastic cut to inflation such as to force out a sizeable percentage of the supply-side infrastructure is needed for the health and long-term viability of the project, that can be separately voted on and enacted without doing injustice to the 3.0B max POKT narrative, since the result of such drastic cut in emission would be a POKT cap even less than 3.0B.

Dissenting Opinions - Other: