Attributes

Author(s): @crabman , @TheDoc , @mess and others [private]

Parameter: RelaysToTokensMultiplier

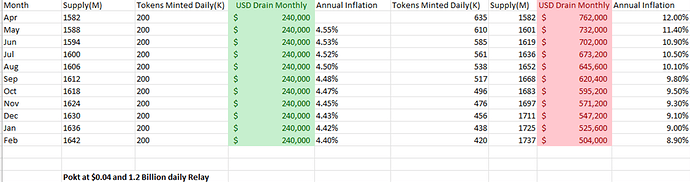

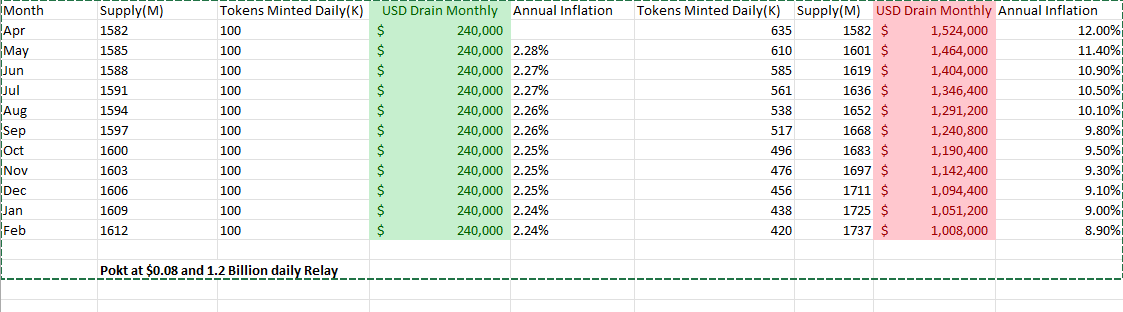

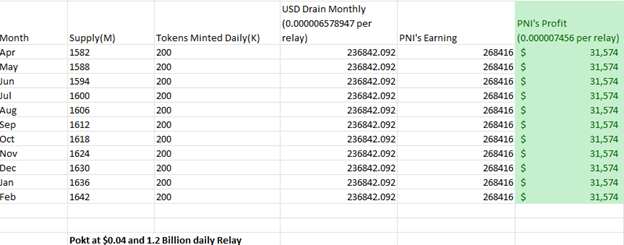

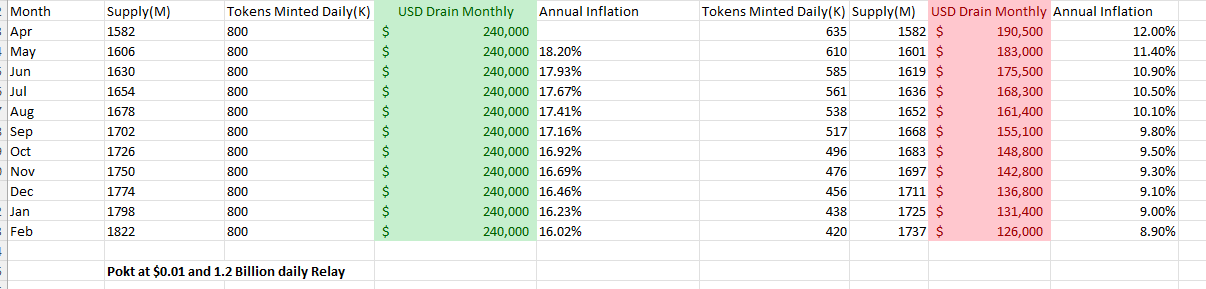

Current Value: Variable set by the SER Proposal https://forum.pokt.network/t/pup-30-sustainable-emission-reduction-ser/3937. Currently approximately causes 10-12% inflation or 700k-762k USD per month

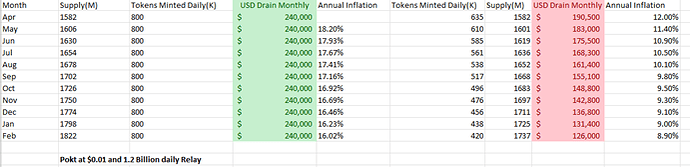

New Value: Variable, decouples inflation from being supply based to relay based. Pokt token are minted proportional to the index price of a relay in USD and the current price of pokt. As of today, this would cause an effective inflation of 4.55% or 240k USD per month.

We also introduce a new parameter that can be modified to keep this proposal adaptable to changing circumstances.

RelayPricingIndex: Monthly price for an average daily relay.

Initial value:

RelayPricingIndex: 0.0002 per relay [ daily for 30 days or 30 relays ]

Calculated using Infura Pricing based on the Growth Plan (https://www.infura.io/pricing)

$1000/5m = 0.0002 per relay

Summary:

Although all our previous inflation measures, including SER reduced inflation, they were detached from the ground realities. As a result, inflation remained high, and the protocol does not appear to be in any position to absorb even half of the minted POKT. Not even towards the end of the SER cycle where we expect inflation to be the lowest (based on current pricing).

We believe this can be detrimental to the price of the token and will discourage entry of new buyers or those who simply want to hold the token for the upside.

Please note this is intended to be a temporary inflation mechanism. When V1 comes about we should restart some sort of bootstrap to attract node operators again because at that point we will have the necessary ingredients to increase our relays, especially the paid ones.

Abstract

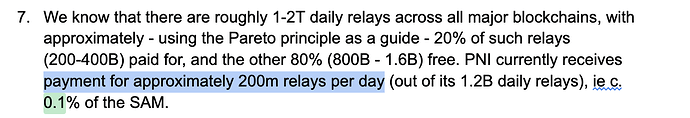

To balance out inflation caused by SER, at the time of writing this proposal we need sales of 762k USD every month. Using RelayPricingIndex based on Infura, this would mean we have to scale our relays to 762k/0.0002 = 3.81 billion paid relays daily

This is a stretch for the following reasons:

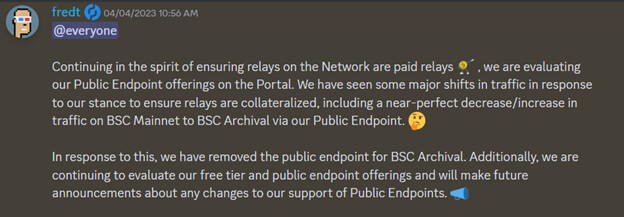

Data Integrity: At this time, we have no data integrity built into the network. We do, however, check for the viability of chains behind the nodes at the cherry picker level by making sure their block height is current. We will not get customers who build critical dApps or trading tools to use our service let alone pay for it.

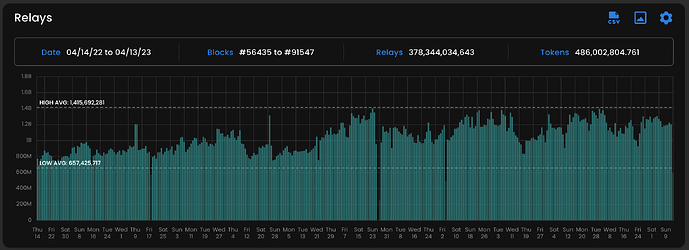

Exhibit A

Architectural limitations: We cannot go beyond 3B relays without tweaks which are still being worked on. No hard deadlines have been given. We believe we need to scale to atleast 5B relays including free relays to realize 3.81 billion paid relays.

Exhibit B:

Challenge for our Sales Department

Selling ~4B relays is a very challenging task even if we somehow work the above two.

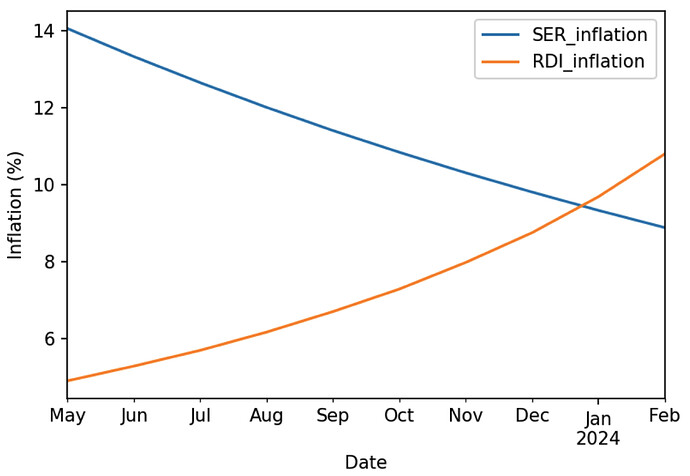

Exhibit C

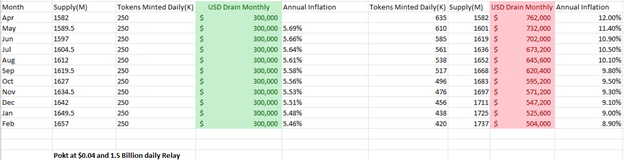

SER gives a Moving Target to our sales Team.

At the price of $0.04 USD per POKT, we need 762k USD sales monthly. What if price doubles or triples?

Note: Gateways costs are not included.

Motivation

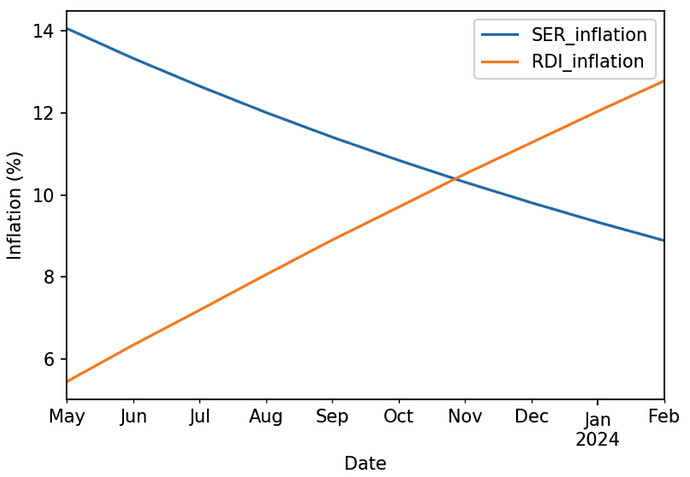

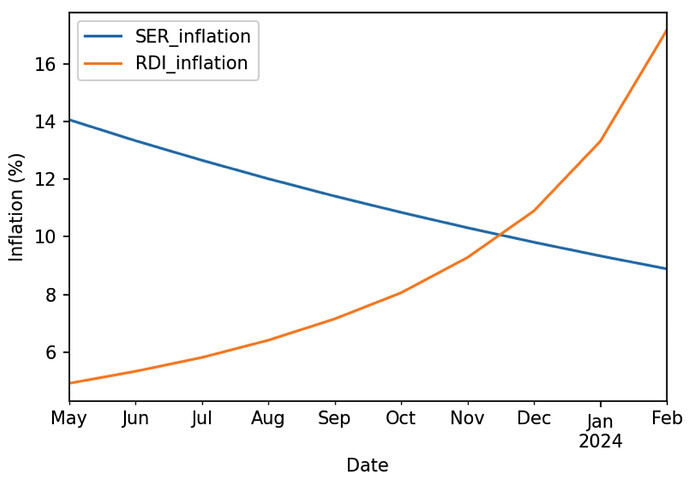

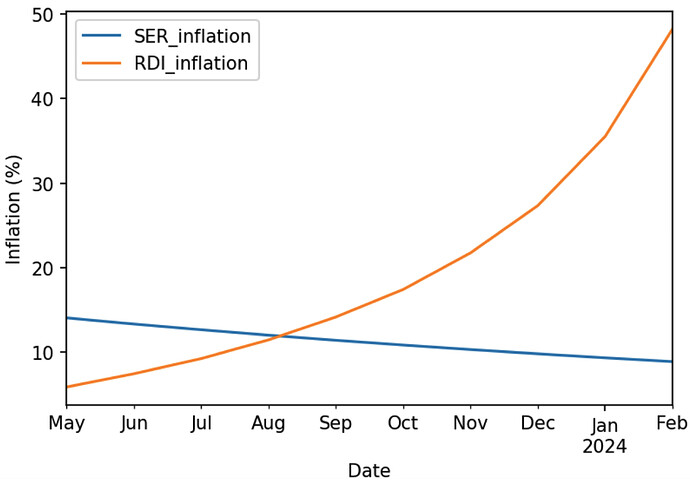

This proposal Vs SER.

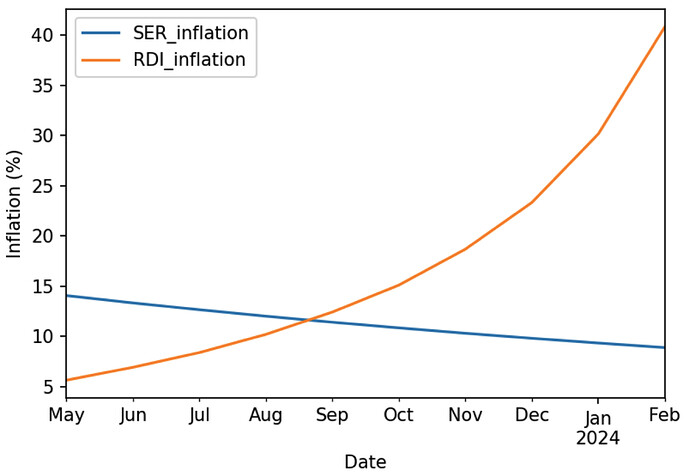

- Above shows the difficulty of getting our sales to the levels required by SER. Also shows inflation is not really going down fast enough.

- Doubling the price, doubles the sales number while this proposal keeps it the same.

- This proposal helps price recovery by keeping the USD value of pokt emitted the same while decreasing inflation.

Additional benefits of this proposal:

Makes POKT token desirable to hold:

Today because of high inflation, unless you stake your pokt, your token will be inflated away. This is one of the reasons why our order books have such bad liquidity. It does not help that we also have a less than ideal staking mechanism.

Gives power back to the node operators who own their hardware:

We should be encouraging node operators to use their spare hardware (eg. home servers) or invest in buying hardware to run nodes and chains. We have so far been enriching cloud providers. Node Operators who own their hardware can operate chains at a much lower cost and will not mind the low inflation.

Moreover, since they know inflation is low, they will not be inclined to stake with a node operator to get “full rewards”. They will be happy to get some rewards running the top 2-3 chains on their home server.

Saves us inflation for when we are at the top of the game

This proposal will save us about 95m tokens which could potentially be used to bootstrap v1.

Specification

RelayPricingIndex: 0.0002 per relay [ daily for 30 days or 30 relays ]

Average Daily Relay: 1.2B (Current)

Using above, set RelaysToTokensMultiplier to target an emission rate, In the example above that will be 200k tokens daily.

We hope that the sales team can generate revenue close to that number and buy pokt off the market to balance out the inflation.

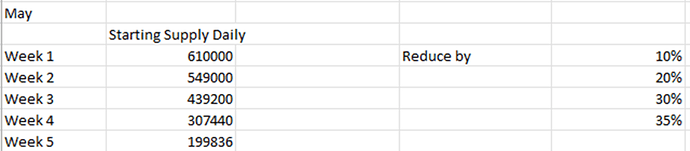

Start of this proposal, inflation must be cut drastically to get to levels provided by this proposal. It can be cut in one month in the following way:

Dissenting Opinions

Node Operators will not have enough time to adjust:

Node operators will get one week before the beginning of the new month to reduce their operations. A month following that week will have decreasing inflation. Commercial node operators also have a “treasury” which they can use to navigate for the time being.

Node Operators can also reduce the number of chains or regions they serve to reduce their expenses.

Node Operators unstaking will be bad for the network:

This is game theory, if half of nodes unstake the rewards will increase for the other half.

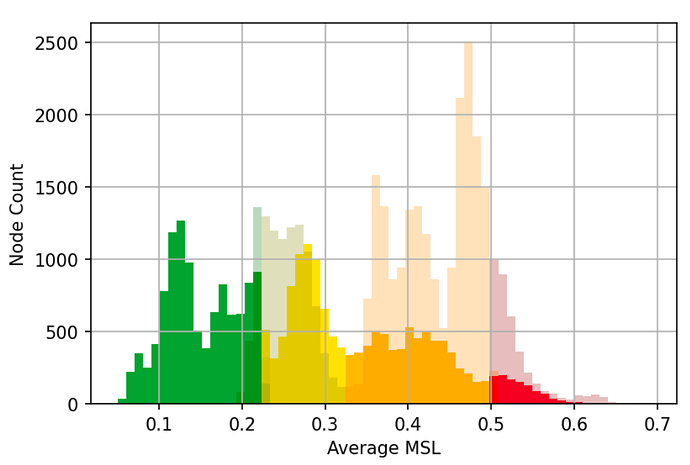

We are also still massively over-provisioned. This is actually good for the network. This forum post by poktblade is an interesting read.

We also have a very strong Altruist network to carry the load if required but it’s unlikely we will get to that. We have 20k nodes staked, network can easily run on half of that.

Unstaked users will dump their tokens.

Low inflation should ideally encourage them to hold the tokens, besides many node providers are now offering 0, negative or very tiny yields. This along with high inflation is eroding the value of staked pokt tokens. Surprisingly, the pokt tokens are still staked to those providers so we have no reason to believe tokens will be dumped.

Copyright

Copyright and related rights waived via CC0.