@Vitality has placed his thoughts in a Google doc. Please see his comments here

I like and support this proposal!

I’ve evolved my thinking on SER- I think it will be a useful addition to the tokenomics and narrative, and I’d be in favour of voting on it and implementing now, not q2 as I earlier suggested.

It would be helpful if, before submitting the proposal, the pre-proposal text is updated to reflect the suggestions.

My main concern is that this proposal will set a MaxSupply, but that is not correctly highlighted. The reader must understand this in the first paragraph. Also the disclosure of the calculations will be really interesting for the community.

I will update the pre-proposal to incorporate the suggestions. Some suggestions are conflicting so I need to figure out the balance. I will spell out that it does result in asymptote to a MaxSupply in the opening paragraph. However, I do not want to overemphasize this. I will also add link to the spreadsheet used to generate the graphs and tables.

I disagree with this statement. Many investors just like to hold their tokens and/or happy with a low APR delegating their tokens to someone else. What really drives investors away is a constant dilution of the market share of their tokens and uncertainty of max supply. Ideally, we want investors to do NOTHING with their tokens but just buy and hold. Pocket is very expensive to run and we want to stop encouraging people to run their own 3-4 nodes because that makes the network over provisioned and expensive. In my eyes, two things are very important in this regard, one we need to create easy ways of staking (TPOKT for example) but something decentralized, and second this proposal which encourages people to just buy and hold.

Removing horizitionally scaled servicers along with adding delegation would make staking much more straight forward, similar to cosmo’s delegation, redelegation.

Hi @msa6867 and @Cryptocorn,

Seems like you are leaning towards creating a proposal to get SER approved sooner than later.

And looks like working towards “max supply” or at least taking advantage of the narrative around it is in the core of this proposal.

I honestly don’t have “THE SOLUTION” yet and I am in an exploratory mode as I have stated more than once. But I understand that something needs to be done before we get into deeper issues and have more robust solutions in place maybe after V1. I am of an opinion that the discussions, debates and solutioning around the token (utility, economics, governance) should never stop. And that should not be taken as a sign of incompetency but as quest for growth, as this space is still in its infancy.

Having said that here are a few thoughts and requests:

- There should not be a message and expectation for “hard cap” like in Bitcoin. We are working towards a “soft cap” that introduces predictability, that can also be revisited in the future depending on how POKT, its utility and the ecosystem evolve.

Once we have a cap, the “Max Supply” section for POKT in Coin Market Cap (CMC) and Coin Gecko (CG) will get populated; currently it is blank. So that would favour the narrative.

- I would request to explore a more aggressive max supply: a soft cap of 2 Billion instead of 3 Billion. I read the middle ground approach in the pre-proposal above. But I think we will agree that there is no hard science and math behind either.

However if putting a cap is in the core of this proposal, the change has to be optimal “to move the sentiments”.

(Market Cap (MC)/Fully Diluted Value (FDV)) value also in CMC and CG at more >.05 is considered attractive , closer to 1 the better of course (IF we are just talking about the narrative behind max supply). And a soft cap of 3 Billion makes the (Market Cap (MC)/Fully Diluted Value (FDV)) value unappealing IMO, and I am very close to such sentiments because of my day job.

Just as a side note- POKT’s FDV number is a workaround at this moment, uses “Total Supply” in absence of Max Supply.

Hitting the projected max supply timeline is >2037, and this is just too far away to move the narrative/sentiment needle in the crypto space and for a lesser known token such as POKT. We are not talking about Bitcoin here.

An argument could be that burn will be an accelerator and therefore will fulfil the need for aggression in the future.

Yes, but the impact of that is not set in stone and could be a few years away. By then V1 will be done and we should anyway continue to discuss POKT, its utility, economics, etc. Whatever we will implement today is an interim solution.

We need the proposed change to turn the narrative and the sentiment in POKT’s favour, and my fear is to achieve that objective, this transition can’t be a soft one. We will not be able to make everyone happy and there will be tradeoffs. As long as they can be measured, discussed and agreed upon, we should not hesitate to be aggressive. If this works, it will alleviate a lot of Pocket’s financial challenges in the short-run. We need this to work!

Can we please put the soft cap of 2 Billion option on the table, and then measure and discuss tradeoffs (if any)?

How is FDV calculated.? It would seem it would simply be MC * max supply / current supply ?? In which case if max supply was 3B, the ratio MC/FDV would be about 0.53. I understand the closer to 1 the better, but 0.53 certainly falls in the range >0.05. What am I missing?

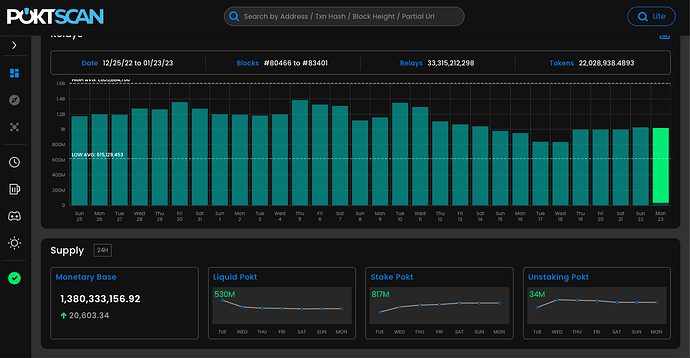

Total Supply figures both in CMC and CG are out of whack.

CG: 1,525,220,027

CMC: 1,146,111,711

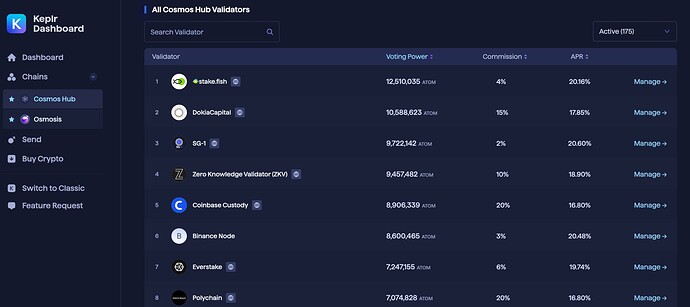

I could have used the CMC number if I had to make it look worse. But I used 1,380,339,114 from poktscan (which I consider more reliable) for my mental math.

But that’s not the precise point I was making about POKT, so please don’t get fixated on that one thing. We will miss the forest for the trees.

I agree with @RawthiL that both 3 billion and 2 billion are arbitrary numbers, and therefore my challenge is to be aggressive if we are setting a “soft cap”- A) (Market Cap (MC)/Fully Diluted Value (FDV)) as close to 1 as possible, and B) That will bring predictable timeline for max supply to hit to something more reasonable instead of a ridiculously long one of 15+ years from now. That just doesn’t help what we are trying to solve here, which is to turn around the supply side narrative and sentiments in POKT’s favour. We have to make this work!

And therefore I am challenging to put 2 Billion on the table, and then discuss measurable tradeoffs and risks (IF ANY).

Wanted to add a few:

A) We are talking about supply side economics here, and not demand side. This is no way to undermine the importance of demand side and I also don’t see any conflicts anywhere, they are mutually exclusive. Moreover, an aggressive change in the supply side (narrative) complimented by “right” kind of marketing (narrative building) could boost demand for speculative buying and investment for the token itself. And that’s not detrimental in anyway.

B) Here is some content about the importance of FDV from an OG Jordan Fish (aka Cobie), who has been around for 12 years in the crypto space and there are only a handful of such kinds, and 2 respected VCs with clean reputations, who are also ETH bulls:

- On the meme of market caps & unlocks - Cobie

- Bell Curve Podcast: Peak ETH: Ethereum's Monetary Policy Explained | Roundup - Blockworks (14th min - 17:20)

Btw, I am not just sharing content from random CT/YT influencers to make a point. These are thoughtful examples.

FDV and MC/FDV are important metrics, specially for lesser known/small cap projects.

C) I want to reiterate that Sustainable Emission Reduction (SER) - #10 by Caesar is still my idealistic view point, where I suggest a holistic introspection of everything around the POKT token before deriving the supply side model. My idealistic stance and in that my agnostic stance to SER have not changed.

However, that may not be very pragmatic and we desperately need positive catalysts in this project. Plus as I said, I am not seeing conflicts and detriments in the present and in the future.

My assumption is that SER is likely to move to the proposal and voting stages and given that assumption, I want to support in the best possible way given my exposure to markets and narratives. Therefore my request to discuss and debate the aggressive option on the table to move the needle.

It is difficult to either be against or in favor of this proposal as it is, but I’m inclined to be more on the “against” side.

In one hand this proposal tackles a recurring problem of the Pocket Network that is inflation. It proposes a way to make emissions more predictable. On the other hand it relies on a MaxSupply, which is a whole concept on its own and this proposal cannot function without a MaxSupply. Moreover the MaxSupply s being chosen lightly and it does not seems to be a step towards a Floating Supply (which I believe to be more inline with the POKT token).

Now, I fear that if this proposal passes and we set a MaxSupply as defined here, the news about POKT having a max supply will be more important than the fact that this proposal tried to fix inflation. Then, if any value is set today, we will need to stick to it or any future value will not be credible.

I agree with @Caesar about the narratives and the problem that this proposal creates. Proposing a value too high like 3Bn wont have any real effect besides filling the checkbox “has a max supply”, this wont attract many investors (only the dumb ones). Also, setting this value too low, will put the tokenomics into an unnecessary stress. Reducing too much the tokens available to mint wont magically drive the price up and will only (potentially) benefit current holders, not future investors.

I think that the best way would be to target inflation rates and not max supply. We need to estimate (under different scenarios) where the token supply will lie once application burning hits and target that zone. I think that narratives can be build upon an strong and consensual tokenomics model, it will require more work but will bring better results. (I do not want to mix subjects here, so I wont go any deeper into this.)

Thank you @Caesar and @RawthiL for good discussions. I will updated the table to show all the way down to 2.0B max and I will add a column to show the time period to halving the inflation. I think “time to inflation halving” is the best way to compare inflation

What I am inclined to do is separate this into two proposals. This one would focus on the framework with a default, less aggressive target to take effect March 1, with a companion concurrent proposal focused specifically on right-sizing the target value. There is precedence for this approach with PUP11/13 and PIP22/PUP21. I would invite @Caesar to co-author the second companion proposal. Let me know if this approach makes sense.

I will respond the the rest of the recent discussion shortly. In the meantime, @RawthiL can you please expound on the following:

As far as I can tell, the proposal is perfectly compatible with the goal of eventually hitting a zone where app burn balances emission, while scratching the investor/market place itch of “what happens with token supply if there is significant delay in app burn turning on.”

What I meant is that the the target value, the MaxSupply proposed here, is not the result of analyzing the growth of the network and the app burn scenarios. The proposal is compatible with it, but there is no analysis nor narrative that indicates that the proposal was written in that spirit.

Also, if only the narrative about this proposal being an step towards a floating supply is added, then the analysis would be lacking.

As far as I can tell, the proposal is perfectly compatible with the goal of eventually hitting a zone where app burn balances emission, while scratching the investor/market place itch of “what happens with token supply if there is significant delay in app burn turning on.”

The proposal is simple and thus it is compatible with many scenarios. It just sets a growth speed and a max supply. Being simple is good and is versatile enough to adapt to many scenarios. However, I’m more interested in the “why” than in the “how”.

Why are we going to select these parameters and not others?

Currently the proposal only answers this question based on arbitrary selected MaxSupply and a given time to inflation halving.

In order to understand and accept that this proposal is just an step towards floating supply, much more analysis is needed as there is no reason to think that the selected values are the correct ones.

Thank you for the clarification

Lots of helpful analysis and added viewpoints.

It seems we can either:

a) Cap supply at the proposed 2bn, 2.5bn, 3bn numbers.

b) Create a floating supply.

I suggest two things for next steps:

-

another proposal where Ramiro/MSA/Others are compensated to continue profish’s work, and build out the research/models to be able to forecast both a floating and fixed supply under different scenarios with reasonable confidence.

-

When this work has been completed and the community has had a time to read and react, @JackALaing can set up a debate, similar in style to the one we had for FREN, where community members (Caeser, Ramiro, MSA, Vitaly etc) can discuss the proposals so that the community can come to hopefully a general consensus that is backed with good data/analysis to vote on.

I veer towards the idea that it is better that we have a single proposal and implementation on a ‘cap’ or similar, than implement one number and supersede it with another - explaining the narrative will get lost and it’ll make us ‘look’ untrustworthy even if we’ve clearly signalled and explained it beforehand.

I am taking everything under advisement. In meantime, I am going to ask you to expound on the following same as I did for @RawthiL … I fear the term is being used as a catch-all bucket

without actual meaning.

b) Create a floating supply.

I have expanded Table 1 and added the following paragraph just above table 1 :

The last column of Table 1 lists other cryptocurrencies with emission reduction schema that fall approximately into each row of the table. As seen, a number of projects adopt a tokenomics that incorporates the equivalent of a month emission reduction close to 1.4%. Many of these trace their history to emulating bitcoin’s emission-halving scheme which takes place approximately every 4 years. This column can be more fully populated as reviewers suggest new tokens to add to the table. Emission halving in the two-to-four year time frame creates an approximate balance between decreasing rewards and decreasing operational and capital expenditures needed to generate those rewards in keeping with Moore’s law and its approximate equivalents as applied to processing, memory and storage.

Great discussion!

I am sensitive to the following before I share further thoughts:

-

This can’t merely be an intellectual exercise. Something really positive needs to come out of this, otherwise we are wasting our time and we will lose trust in the community as @Cryptocorn said.

-

I would be lying if I say that I am not watching the lack of traction in POKT’s price in the current market. That’s my day job.

I would urge us to not be in the “lets just build and ignore the market” zone. That’s generally doesn’t end well. Let us do everything (check all the boxes)- that would be my humble request. And there are experts building and shipping, so there is no conflict here.

Token value is at the centre of this proposal (without mentioning that explicitly). I understand very well who can discuss price and who cannot; this is a community-run initiative and therefore there are no restrictions.

Which leads to:

a) We desperately need positive catalysts in this project- inflation cuts, successful V1, relays/more chains, partnerships, dapps, major exchange listing, etc. All of them will somehow contribute.

b) Time is also of essence; sure we need to come up with a robust and sustainable solution for inflation reduction and supply control but we need to be time-conscious.

-

Having a narrative and building that narrative don’t have to be cringe and scammy by default. I see many coders and builders averse to any kind of narrative building. Referring to my earlier statement- let us plz check all the boxes.

-

I hope we are not going to get push backs from the node runners. I am not sure what their % is amongst the DAO voters. Pocket is not in the business of running nodes- I agree with the sentiments I have read, including from our dear friend Vitaly. On a related note- 13% staked ETH VS 59% staked POKT, that should tell us something.

Value accrual to the POKT token will ultimately help all stakeholders (including node runners) and alleviate many current problems.

Now-

I would want this to be collaborative within this core group and therefore have consensus. Clearly @RawthiL is not convinced, and therefore I agree with @Cryptocorn that we have to integrate his views and solutions into this.

Which leads me to @msa6867 's question-what exactly does he mean by floating supply.

My guess is that it relates to what pro fish was/is modelling and is similar to ETH’s tokenomics. But I would let @RawthiL explain.

At this moment, we are discussing SER and then we have pro fish 's unfinished model. Is there a way to make this into one instead? There are different ways to do it- one way could be elimination or deferral by prioritisation.

Basically we need to optimise our time, effort and resources.

And if this requires to make this a paid project, why not? Therefore I am open to @Cryptocorn 's suggestion.

But I request you all to focus on consolidation please and concentrate time, effort, resources in one common project/mission.

@msa6867 , I would suggest to wait before creating further drafts/proposals. We all need to align first. Also btw how many years will it take to hit max supply of 2B?