Further Changes

Based on community feedback on the original proposal and the revised proposal, this proposal further clarifies and narrows the scope of “heads down” periods where the Foundation (or, more specifically, the directors) will have the ability to operate with greater agility and flexibility. During these windows, in order for all energies to be focused on action, development, and implementation, directors will be ineligible for DAO removal outside of certain specific situations but will come up for review and removal at the end of each window at the DAO’s discretion. This second revised proposal retains the removal of the directors’ ability to appoint new directors, relegating that responsibility and right to the DAO.

Based on the feedback regarding proper proposal form, this proposal contains proposed language to update the DAO Constitution and the Foundation’s Articles in furtherance of these proposals if they are adopted by the DAO. If this proposal passes, the Foundation GitHub repositories will be updated to reflect these changes.

In addition, I would like to suggest @shane for the first open Director role as part of this proposal. If Shane agrees before submitting for vote, I will edit the proposal to reflect his inclusion in the coming week. I am open to suggestions for the third director slot and will amend based on feedback. My goal is to have both director slots filled before this proposal goes to vote.

Attributes

- Author(s): @o_rourke

- Implementer(s): @o_rourke

- Category: Governance Upgrade / Permission Upgrade

- Replaces: PUP32

Table of Contents

- Background

- Motivation and Vision

- Proposals: Election of New Board of Directors

- Proposals: Remuneration Package

- Proposals: Constitutional Amendments

- Proposals: Article Amendments

- Conclusion

- Copyright

1. Background

Centralized management of a cross-border, jurisdictionally agnostic protocol is a fragile foundation to build on top of. So, the decision was made to launch the DAO shortly after Pocket Network’s protocol launch and to allocate the governance responsibility and power to the DAO by way of the foundation created to serve as the DAO’s legal wrapper in the Cayman Islands. This decision was driven by legal, practical, and philosophical considerations, including moving the legal representative of the collective to a jurisdiction that is more understanding of emerging governance structures, mitigating operational risk for the US-based teams, and, more importantly, leading from the front by creating institutions that are meant to add up to more than the sum of their parts.

When I, and my original co-founders, first designed Pocket Network as a system, the DAO and Foundation were critical parts to the eventual resilience and success of the protocol. A slower moving democratic DAO is meant to provide the checks and balances for a Foundation that has more autonomy is necessary for a foundational protocol providing decentralized access to data across the open internet.

However, recent years have revealed certain inefficiencies that have hampered the protocol’s ability to ship new products quickly and effectively. The network has been at risk of stagnation and there is a culture that inhibits the building of new products that drive usage and adoption for developers, which neglects the fact that a lack of prioritization of economic mechanisms and marketing efforts to drive the adoption of the network undermines the very things that lack of emphasis were meant to promote. We can have all of the adoption in the world but will ultimately fall behind other projects (current or future) if incentives are not aligned and trending in a direction that supports development, growth, and user retention.

The goal is enhanced proactivity, flexibility, and speed.

I believe I am the right person to drive this vision of the Pocket Network forward because I have led the only team that has built not one, but two versions of Pocket Network, and have sourced, sold, and driven the overwhelming majority of network traffic over the course of the past four years. I also understand the specific challenges and promises in front of entrepreneurs and builders in the Pocket ecosystem, having built Grove, a company generating millions in revenue over the last two years on top of a web3 backend.

To be clear, I am not disparaging the Foundation’s efforts or integrity. I anticipate keeping several of the core work streams that are currently in flight and are critical to Pocket’s continued success, including:

- Multichain $wPOKT efforts;

- Gateway-verse;

- Exchanges;

- POPs and Sockets; and

- Incorporating community contributions.

That said, I believe it is in the best interest of the Pocket Network generally to reset the Foundation’s leadership unified behind a singular vision.

I expect that new and developing changes will include:

- Helping the Supply Side (Node Runners):

- Changing the number of maximum chains/services that can be staked per Pocket node; and

- Adjusting the network inflation rate to be temporarily higher in times of high traffic periods.

- Helping the Demand Side (Gateways):

- Increasing the emission rate of newly launched chains/services to be 10x higher for six months; and

- Full rebates for the gateway fee mechanism to remove barriers to entry for gateways.

- Helping the Protocol:

- Increase the DAO Allocation;

- Implementing a concrete marketing strategy; and

- Reposition Pocket Network to be more AI-forward.

- Aligning incentives:

- Making a milestone-based grant for shipping Shannon; and

- Adopting incentivized compensation packages based on the price of POKT.

Every POKT token holder will agree that we have some of the best fundamentals in the industry. Some highlights include:

- Shannon, a full rewrite of Morse, and a true technological innovation, is expected to launch this year.

- We have multiple gateways excited to build on top of Pocket, despite it being permissioned and difficult.

- We are no longer just RPC - Grove’s AI pilot is in flight, with our Litepaper released.

- Our forum is consistently active, with some of the smartest and deepest-thinking community members in the space.

- $POKT is one of the most decentralized cryptocurrencies in the world - to my knowledge no one person or entity owns more than 7% of the supply.

- $POKT is effectively fully unlocked - we have never played low-float games.

- Grove’s Quality of Service is world-class. We have multiple centralized RPC providers as customers of ours.

- Grove has material, growing revenue despite a hypercompetitive market where many RPC providers provide it for free.

- Grove is the only web3 infrastructure company in the world that has an SLA with hundreds of paying customers fully dependent on a permissionless protocol.

It is my vision that this solid fundamental base be leveraged and reflected by Pocket’s industrywide positioning.

We cannot control the crypto market; we cannot control the macro market; we can control the incentives and dynamics of Pocket Network.

2. Proposals: Election of Michael O’Rourke

Summary: A new board of directors will be appointed, including the confirmation of the interim director. This omnibus form is proper, despite the language of Section 6.2 of the Constitution, because the proposed changes below are meant to be considered in relation to and combination with one another and these proposed changes cannot feasibly be divided into separate proposals without losing their meaning.

Reasoning: This revamped board has been chosen for the purpose of maximizing the chance of successfully implementing the future vision for the Pocket Network by emphasizing the proper combination of experience, expertise, and background of the composed board.

Proposals:

a. Appoint Michael O’Rourke as Director

Appoint Michael O’Rourke as director of the Pocket Network Foundation and notify the supervisor of the Pocket Network Foundation, Campbell Law, to update its register of directors to reflect the foregoing changes.

Within thirty (30) days of the acceptance of the proposals contained in this PIP-38, Michael O’Rourke will resign as Chief Executive Officer of Grove Redefines Our Very Existence, Inc., allocating his full-time efforts to serving as director of the Pocket Network Foundation.

b. Confirm Shane Burgett as Director

Confirm Shane Burgett as a permanent director of the Pocket Network Foundation and notify supervisor of the Pocket Network Foundation, Campbell Law, to update its register of directors to reflect the foregoing changes.

c. Appoint Steve Tingiris as Director

Appoint Steve Tingiris as director of the Pocket Network Foundation and notify supervisor of the Pocket Network Foundation, Campbell Law, to update its register of directors to reflect the foregoing changes.

3. Proposals: Remuneration Packages

Summary: Each of the following is a proposed change remuneration package – the first to the developers of Shannon and the second to Michael O’Rourke individually. This omnibus form is proper, despite the language of Section 6.2 of the Constitution, because the proposed changes below are meant to be considered in relation to and combination with one another and these proposed changes cannot feasibly be divided into separate proposals without losing their meaning.

Reasoning: The goal is to align interests between the various parties building and promoting the Pocket Network.

a. Shannon Remuneration

Approve the following incentive-based compensation package for Shannon developers and contributors.

Subject to the oversight and determination of the Foundation board of directors, the developers and contributors to the Shannon upgrade to the Pocket Network shall be entitled to the following grant of POKT:

- 48,000,000 POKT

Remuneration Package Terms:

- This incentive opportunity will be time limited and will expire three years from the date of approval.

- Payment in satisfaction of this incentive will come from the DAO treasury, be held separately in a multi-signatory wallet controlled by the Foundation board of directors following grant and be distributed to the various developers and contributors at the Foundation board unanimous decision and discretion.

- Except as otherwise determined by the Foundation, upon advice of counsel, any POKT earned pursuant to this incentive package will be locked for four years from the date of receipt, with 25% unlocking each year thereafter, , where receipt means delivery of earned POKT to the recipient’s digital asset wallet address.

- Michael O’Rourke will be personally excluded from this incentive.

b. POKT Performance Remuneration

Approve the following incentive-based compensation package for Pocket Network developers and contributors.

Subject to the oversight and determination of the Foundation board of directors, the developers and contributors to the Pocket Network shall be entitled to the following grant of POKT:

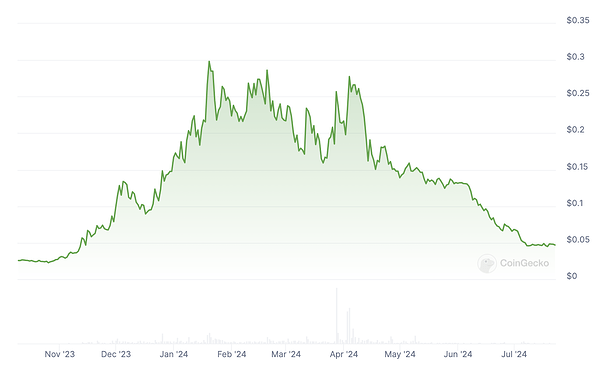

- $0.50: 48,000,000 POKT*

- $1.00: 48,000,000 POKT*

- $3.00: 98,000,000 POKT*

- $5.00: 98,000,000 POKT*

*All prices are the average trailing 90-day price.

Remuneration Package Terms:

- This incentive opportunity will be time limited and will expire three years from the date of approval.

- Payment in satisfaction of this incentive will come from the DAO treasury, be held separately in a multi-signatory wallet controlled by the Foundation board of directors following grant and be distributed to the various developers and contributors at the Foundation board unanimous decision and discretion.

- Except as otherwise determined by the Foundation, upon advice of counsel, any POKT earned pursuant to this incentive package will be locked for four years from the date of receipt, with 25% unlocking each year thereafter, , where receipt means delivery of earned POKT to the recipient’s digital asset wallet address.

- Average trailing 90-day price will be calculated using the volume weighted average price (VWAP) for the preceding 90 days of trading using price data gleaned from CoinGecko .

4. Proposals: Constitutional Amendments

Summary: Each of the following is a proposed change to the Pocket Network Constitution. This omnibus form is proper, despite the language of Section 6.2 of the Constitution, because the proposed changes below are meant to be considered in relation to and combination with one another and these proposed changes cannot feasibly be divided into separate proposals without losing their meaning.

Reasoning: The reasoning and intention of each change is described within the description of each “Proposed adjustment.”

Proposals:

a. Sections 4.6 and 4.7: The Council’s Control of the Foundation

Approve the following change to the language of the DAO Constitution:

Current Language:

4.6 The Council’s control of the Foundation is hard-coded into the Articles of Association of the Foundation, which separates the powers of all Foundation agents and defers those powers to the Council:

- Directors/Supervisors are appointed/removed by each other on behalf of the Council

- Directors must resign from other positions of authority in the Council (except Voter)

- Supervisors ensure that Directors comply with the articles

- No Supervisor decision is valid without Council approval.

4.7. New Directors/Supervisors will be appointed/removed according to PIPs approved by the Council.

Proposed Adjustment: Clarifies that there are limitations on the Council’s control of the Foundation, as defined in the Foundation’s Articles and otherwise.

Proposed Language:

The Council’s control of the Foundation is hard-coded into the Articles of Association of the Foundation, which defines the powers of the Foundation’s directors, officers, and supervisor, and clarifies the DAO’s oversight and power (through and by way of the Council) over the Foundation. Examples of this oversight and power over the Foundation include:

- Directors and Supervisors are appointed and removed on behalf of the Council;

- Directors must resign from other positions of authority in the Council (except Voter);

- Supervisors ensure that Directors comply with the Articles; and

- No Supervisor decision is valid without Council approval.

4.7. Subject to the processes and procedures outlined in the Articles, Directors and Supervisors are appointed and removed according to PIPs approved by the Council.

b. Section 4.9: Right to Refuse

Approve the following change to the language of the DAO Constitution:

Current Language:

4.9. The Directors and Supervisors of the Foundation can refuse the Council’s decisions subject to the limitations imposed on them by the law and their duty to steward Pocket Network. If they refuse without cause, the Council may remove them.

Proposed Adjustment: Clarifies that there are limitations on the removal of directors pursuant to the Foundation’s Articles.

Proposed Language:

4.9. The Directors and Supervisors of the Foundation can refuse the Council’s decisions subject to the limitations imposed on them by the law and their duty to steward Pocket Network. If they refuse without cause, the Council may remove them, subject to the mechanics and procedures contained in the Foundation’s Articles.

c. Sections 6.5 and 6.8: Parameters

Approve the following change to the language of the DAO Constitution:

Current Language:

6.5. The following parameters will be governed by the Foundation in order to fulfill the target values for USDRelayTargetRange and ReturnOnInvestmentTarget set by the Council: BaseRelaysPerPOKT & StabilityAdjustment. The Foundation will anchor around the Council’s target according to a 14-day average; if the actual relay price exceeds this target range temporarily, the Foundation can ignore it, but if the range is exceeded on average for 14 days, the Foundation must respond. […] 6.8 All other On-Chain parameters not specified above will be governed using Majority Approval in votes lasting 7 days.

Proposed Adjustment: Allow for greater flexibility when making parameter adjustments by delegating further responsibility to the Foundation.

Proposed Language:

6.5. The following parameters will be governed by the Foundation in order to fulfill the target values for USDRelayTargetRange and ReturnOnInvestmentTarget set by the Foundation: BaseRelaysPerPOKT & StabilityAdjustment. […] 6.8 All other On-Chain parameters not specified above will be governed at the discretion of the Foundation.

d. Section 7.2: Distribution of Treasury Funds

Approve the following change to the language of the DAO Constitution:

Current Section:

7.2 It is forbidden to propose or approve unconditional general distributions of the Pocket Core DAO Treasury to token holders, which may be misconstrued as dividends.

Proposed Adjustment: Provide additional clarity as to determining whether distributions are unconditional to avoid decision-making gridlock.

Proposed Language:

7.2 It is forbidden to propose or approve unconditional general distributions of the Pocket Core DAO Treasury to token holders, which may be misconstrued as dividends. Notwithstanding the foregoing, the responsibility for determining whether such a distribution is improper shall fall to the Foundation, its board, and (as applicable) the Executive Director.

e. Sections 8.11, 8.12, and 8.13: Protocol Upgrades

Approve the following change to the language of the DAO Constitution:

Current Section:

8.11 Protocol Upgrades (including changes to the ACL) will be approved by the Council according to the PIP process. 8.12. Upgrades are pushed to Nodes in a dormant state then, once the Council has signaled approval, the Foundation will activate the upgrade retroactively by submitting a Governance Transaction. 8.13. Pocket Core’s upgrade process is permissive. Node operators can keep pocket-runner on their Pocket Core installation if they consent to automatically updating their Nodes according to the Council’s decisions. If they decide they want to refuse the Council’s decisions, they can replace pocket-runner with their own versioning software and ignore Governance Transactions. This power is subject to a Tendermint consensus test, whereby 66%+ of the nodes must refuse the Council’s decision in order for the blockchain to continue to operate normally without forking.

Proposed Adjustment: Allow for greater flexibility, subject to the restrictions implemented in the Foundation Articles, by granting authority to the Foundation to implement Protocol Upgrades without the PIP process.

Proposed Language:

8.11 Except as otherwise limited by the Articles governing the Foundation, Protocol Upgrades (including changes to the ACL) shall be approved by the Executive Director, should one be appointed, or the board of directors of the Foundation generally. 8.12. Upgrades are pushed to Nodes in a dormant state then, once approved, the Foundation will activate the upgrade retroactively by submitting a Governance Transaction. 8.13. Pocket Core’s upgrade process is permissive. Node operators can keep pocket-runner on their Pocket Core installation if they consent to automatically updating their Nodes according to the Foundation’s decisions. If they decide they want to refuse the Foundation’s (or the Executive Director’s decisions, as the case may be), they can replace pocket-runner with their own versioning software and ignore Governance Transactions. This power is subject to a Tendermint consensus test, whereby 66%+ of the nodes must refuse the Foundation’s decisions (or the Executive Director’s decisions, as the case may be) in order for the blockchain to continue to operate normally without forking.

5. Proposals: Article Amendments

Summary: Each of the following is a proposed amendment to the Articles of Association of Pocket Network Foundation. This omnibus form is proper, despite the language of Section 6.2 of the Constitution (which applies as changes to the Articles constitute a “Governance Upgrade” as defined in the Constitution), because the proposed changes below are meant to be considered in relation to and combination with one another and these proposed changes cannot feasibly be divided into separate proposals without losing their meaning.

Reasoning: The reasoning and intention of each change is described within the description of each “Proposed adjustment.”

Proposals:

a. Article 1.5: Requirement for DAO Resolution

Approve the following change to the language of the Foundation Articles of Association:

Current Article:

Requirement for DAO Resolution 1.5 Unless otherwise specified herein, no Ordinary Resolution or Special Resolution passed by persons entitled to attend and vote at a general meeting shall be valid or take effect until such Ordinary Resolution or Special Resolution has been approved by Supermajority DAO Resolution.

Proposed Adjustment: Remove the requirement for DAO Resolution approval for day-to-day decision-making, while establishing a list of “sacred rights” that require DAO approval.

Proposed Language:

Requirement for DAO Resolution 1.5 All Ordinary Resolutions passed by persons entitled to attend and vote at a general meeting shall not require approval by Majority DAO Resolution and shall be valid and take effect upon passage; all Special Resolutions passed by persons entitled to attend and vote at a general meeting shall not require approval by Supermajority DAO Resolution and shall be valid and take effect upon passage. Notwithstanding the foregoing, any Ordinary Resolution or Special Resolution shall require the proportionate approval of the DAO in such case as the resolution(s) purport to: (a) liquidate, dissolve, or wind-up the business of the Company; (b) amend, alter, or repeal any provision of these Articles or the DAO Constitution; (c) hard fork the Pocket Network (as is referenced in Article 1.1 of these Articles) where “fork” means any major technical upgrades or change and a “hard fork” means a major technical upgrade or change that is incompatible with the then-existing Pocket Network, causing a permanent split into two separate networks that run in parallel; (d) authorize or amend any remuneration package for directors or their delegates, non-secretary officers, or the secretary, except as otherwise permitted by Article 4.38 of these Articles; (e) unless the aggregate indebtedness of the Company and its subsidiaries for borrowed money following such action would not exceed $1,000,000.00, and other than bank lines of credit incurred in the ordinary course of business, create, or issue, any debt security, create any lien or security interest (except for statutory liens of landlords, mechanics, materialmen, workmen, warehousemen, and other similar persons arising or incurred in the ordinary course of business), or incur other indebtedness for borrowed money, including but not limited to obligations and contingent obligations under guarantees, or permit any subsidiary to take any such action with respect to any debt security lien, security interest, or other indebtedness for borrowed money; or (f) create, or hold capital stock in, any subsidiary that is not wholly owned (either directly or through one or more other subsidiaries) by the Company, or permit any subsidiary to create, or issue or obligate itself to issue, any shares of any class or series of capital stock, or sell, transfer, or otherwise dispose of any capital stock of any direct or indirect subsidiary of the Company, or permit any direct or indirect subsidiary to sell, lease, transfer, exclusively license, or otherwise dispose (in a single transaction or series of related transactions) of all or substantially all of the assets of such subsidiary.

b. Article 4.1: Minimum Number of Directors

Approve the following change to the language of the Foundation Articles of Association:

Current Article:

Minimum number of directors 4.1 The Company shall at all times have at least one director.

Proposed Adjustment: Set the number of board members to three, with a managing or executive director taking day-to-day action on behalf of the Foundation and two additional directors making up the remainder of the full board.

Proposed Language:

Number of Directors; Board Composition 4.1 The Company shall at all times have at least one director and shall have no more than three directors. Consistent with Article 4.28 of these Articles, the directors may appoint one director to serve as “Executive Director” who shall have agency to act on behalf of the Company. Subject to the supervisory powers of the remainder of the board of directors and those given to the chairperson of the board (if any), the Executive Director of the Company (if appointed) shall have general supervision, direction, and control of the business and the officers of the Company and shall have the general powers and duties of management usually vested in the office of chief executive officer of a corporation and shall have such other powers and duties as may be prescribed by the board of directors or these Articles.

c. Article 4.8: Removal of Directors

Approve the following change to the language of the Foundation Articles of Association:

Current Article:

4.8 A director may be removed by Ordinary Resolution.

Proposed Adjustment: Create windows of review and adjustment to board composition, other than for cause, allowing for heightened stability and to allow directors to take actions that may be unpopular in the short term that are to the benefit of the Foundation and the DAO. Further create a mechanism to allow for the removal of directors for cause outside of decision windows.

Proposed Language:

4.8 Any director may be removed: (a) without cause, by Ordinary Resolution during either of two semi-annual “review periods” which shall be January and July of each calendar year; or (b) for cause, by Special Resolution. Termination or removal of a director for cause pursuant to this Article 4.8(b) may occur if, and only if, the director: (x) materially breached any provision of these Articles or habitually neglected his or her duties; (y) misappropriated funds or property of the Company or otherwise engaged in acts of dishonesty, fraud, misrepresentation, or other acts of moral turpitude, even if not in connection with the performance of the director’s duties, which could reasonably be expected to result in serious prejudice to the interests of the Company if the director were retained as a director; (z) secured any personal profit not disclosed to and approved by the Company (and, as applicable, the DAO) in connection with any transaction entered into on behalf of or with the Company or any affiliate of the Company; or (aa) failed to carry out and perform duties assigned to the director in accordance with the terms of these Articles in a manner acceptable to the remainder of the board after a written demand for substantial performance is delivered to the director which identifies the manner in which the director has not substantially performed the director’s duties, and provided further that the director shall be given a reasonable opportunity to cure such failure.

For purposes of this Article 4.8, the director shall not be terminated for cause without (i) reasonable notice to the director setting forth the reasons for the Company’s intention to terminate for cause and a reasonable opportunity to cure such situation (if capable of cure), (ii) an opportunity for the director, together with counsel, to be heard before the board, and (iii) delivery to the director of a notice of termination from the board of the Company, finding that, in the good faith opinion of the board, the director had engaged in the conduct set forth above and specifying the particulars thereof in detail.

d. Article 4.38: Director Compensation (Remuneration)

Approve the following change to the language of the Foundation Articles of Association:

Current Article:

4.38 A director or officer shall only be remunerated for services rendered. Any agreement between the Company and a director or officer concerning the remuneration of such director or officer shall be null and void where such agreement: (a) entitles such director or officer to participate in any distribution, dividend or transfer of assets of the Company or awards or entitles such director or officer to any profits or any assets of the Company, except where the transfer or entitlement of assets is in the form of a POKT token grant subject to at least 3 years vesting; or (b) sets the remuneration according to a percentage of the turnover, income, profits or earnings of the Company; or (c) agrees to remunerate the director or officer for an aggregate sum exceeding US$300,000 per annum (as of January 2023), adjusted annually for inflation by reference to the Consumer Price Index as measured by The Bureau of Labor Statistics, where such aggregate sum includes the annual vesting amount of any POKT token grant, and the value of the per annum vesting of such POKT grant will be determined by the prevailing market price as at the time of the grant and shall not exceed 50% of the director’s US$ salary.

Proposed Adjustment: Allow new compensation agreements for directors and officers, including performance-based incentives, at the pleasure of the DAO.

Proposed Language:

4.38 A director or officer shall only be remunerated for services rendered. Any agreement between the Company and a director or officer concerning the remuneration of such director or officer shall be null and void where such agreement: (a) entitles such director or officer to participate in any distribution, dividend or transfer of assets of the Company or awards or entitles such director or officer to any profits or any assets of the Company, except where the transfer or entitlement of assets is in the form of a POKT token grant subject to at least 3 years vesting; or (b) sets the remuneration according to a percentage of the turnover, income, profits or earnings of the Company; or (c) agrees to remunerate the director or officer for an aggregate sum exceeding US$300,000 per annum (as of January 2023), adjusted annually for inflation by reference to the Consumer Price Index as measured by The Bureau of Labor Statistics, where such aggregate sum includes the annual vesting amount of any POKT token grant, and the value of the per annum vesting of such POKT grant will be determined by the prevailing market price as at the time of the grant and shall not exceed 50% of the director’s US$ salary.

Notwithstanding the foregoing, the Company may authorize by General Resolution (with approval of the DAO consistent with the requirements of Article 1.5 of these Articles) compensation packages for directors or officers that are inconsistent with the limitations imposed by this Article 4.38 of these Articles.

6. Conclusion

There is a lot in this proposal. I have put it all within one because our current situation merits quick change and adaptation. While I remain a firm believer in the governance model of Pocket Network, it’s evident that we need to reach a scale where its checks and balances are truly beneficial.

I care about the price of $POKT. The technical talent and brilliant community we have deserves better. At this stage in our development, it is crucial to have a fully integrated stack from the protocol to the gateway layer, allowing the community to move swiftly and enabling others to build quickly and efficiently.

I am profoundly thankful for the role the current Foundation has played. Their efforts have always been guided by the highest integrity and dedication to Pocket Network. The Foundation has laid the groundwork upon which we can build, and their contributions have been invaluable. However, the current situation calls for a change in strategy, and therefore, leadership, to prevent stagnation and drive the network forward.

I care deeply about the success of Pocket Network and its potential to become the routing layer for all traffic on open data sources. My commitment to this mission is unwavering. With your support, I believe we can create a thriving ecosystem that lives up to the incredible potential of Pocket Network. Together, we can ensure that Pocket Network not only survives but thrives as the backbone of decentralized infrastructure.

7. Copyright

Copyright and related rights waived via CC0.