Hey everyone,

Since this all began two weeks ago with Grove desiring to reconstruct PNF, I’ve been the one closest to all involved parties. I doubt anyone in POKT has more information, from both sides, than myself. Due to being interim Director, I feel it is my duty to provide general context for all stakeholders so that everyone can operate off the same information.

Many individuals knew about Grove’s plan to replace PNF, which had led to beliefs that there was frontrunning. To prevent any possibility of that here, this document has not been shared with anyone other than for a high-level legal review.

MISCONCEPTIONS

From Michael’s proposal, to chats in the Den, many claims have been made, either directly or through innuendo, that are factually incorrect. These misconceptions feed into narratives that the DAO was broken or that an org like PNF can’t effectively operate in tandem with a DAO.

Those are very valid areas to consider when looking at Michael’s proposal. However, there should be complete clarity on the whole situation, so everyone is making educated decisions.

PNF should have known about Grove’s financial situation

PNF was not fully aware of Grove’s financial situation. PNF and Grove have bi-weekly calls and Grove’s financial situation was always presented positively since I joined in February. I’ve heard from both sides that a year ago, Grove did communicate the difficulty of closing a raise, and was considering dropping protocol development and had “thought experiments” to shift towards Lava. PNF helped settle things with Grove, took on talent recruitment costs, and began paying 1/2 of the salary of a new hire at Grove’s request.

Grove successfully closed their raise shortly after, and there weren’t further discussions about PNF subsidizing protocol, until very recently. However, even these discussions about providing more financial support did not come with the full context of Grove’s financial situation.

Past PNF Directors wouldn’t support the protocol team

Since my being the director, I’ve learned significantly more about Grove’s situation than what the past directors knew. Within PNF, it has been universally agreed that if there was an understanding that Shannon may not ship due to resource constraints, all measures would have been taken to ensure it ships.

PNF also provided project management and research personnel. A very notable Matteo contribution was suggesting not going with Celestia due to concerns it was too early for their tech. This turned out to be true, which eventually caused the team to pivot to being a Cosmos based L1.

Last year the protocol team asked PNF to take all tokenomic responsibilities. PNF agreed to take this on. Once PNF brought me on for Shannon product management, I built the core tokenomics mechanisms, enabling trustless gateways, gaming protections, and am working with Ramiro to finalize the right minting algorithm. I also introduced another on-chain actor, “Sources”, which was also about to be released in Morse (via a proposal I was going to post the week of Mike’s proposal).

PNF contributed in various other ways, like marketing, community engagement, building/running bounty programs, etc. PNF also just signed a contract to bring on another protocol developer who was contributing via bounties.

PNF did not have a retail strategy

PNF had many initiatives in the works to bring in more retail holders.

PNF laid the foundation through:

- NodeWallet (October 2023)

- wPOKT + Bridge (October 2023)

- NodeWallet SDK for 1-click staking (January 2024)

PNF’s products being built:

- Multi-chain wPOKT (See proposal here)

- POKT x DeFi (See scope documentation here)

- POKT Unified App (1-click staking to node providers, bridge, tokenomics dashboard)

POKT Unified App in development

PNF did not have a plan for T1 exchanges

This is a situation where the opposite is the truth. PNF had ongoing conversations with many exchanges, including Coinbase and Binance. PNF had direct feedback on what would be needed to get a listing:

- Significantly more POKT holders

- Improved liquidity

- Price improvement

- Launching Shannon (Binance specifically asked about Shannon, and was even aware of the Shannon testnet launch delay)

PNF’s solutions:

- Multi-chain wPOKT (wPOKT on ETH created notable increase in liquidity and price action, which exchanges did notice and were open to seeing how POKT would sustain the momentum with Multi-chain wPOKT)

- POKT x DeFi (use a multi-chain LP incentive strategy combined with a tailored co-marketing and KoL campaign for each launch to generate 250k wPOKT holders, up from the 5k today, while increasing liquidity with a goal of $.60 price stability pre-Shannon)

- Drive relay growth via new gateways (significant growth was expected from late July onwards)

- Hit Shannon roadmap targets (to provide exchanges with updates on progress and show ability to hit targets)

Dermot has had experience with not only listing POKT on many of our current exchanges, but has been involved with getting other coins listed on exchanges, including Binance. PNF’s strategies were specifically derived from the feedback from T1 exchanges. The Bitget, Crypto.com app and Upbit listings were also the first new listings for POKT since early 2022.

PNF’s tokenomics were not considering node runners

PNF has direct relationships with all the major node runners. While Michael suggests that node runners have been providing him feedback on POKT’s current tokenomics, that feedback was not given to PNF.

The one recent tokenomics feedback was from Jinx after PNF discussed a new proposal to increase the DAO take to enable sources. The feedback provided was that node runners were struggling and reducing their rewards would be too much. PNF heard the feedback and went back to the drawing board.

The only conversation PNF had with Michael regarding tokenomics was Monday, May 24th. Michael reached out to me to talk about tokenomics. We discussed Shannon, and some other ideas Michael had for gateway payments. In that conversation Michael said he believed we should find a way to increase node runner APY. I agreed and following the call began sending him information on possible strategies. No further feedback was given and PNF learned of Grove’s new strategies from Michael’s proposal, like everyone else.

Three weeks ago PNF was very active in the community when node running APY was the subject and advocated for finding a solution to increase their rewards and drive more buy pressure from the staking ecosystem. PNF was considering many options, including some that went as far as introducing a 3B token cap pre-mine to introduce significant treasury for incentivizing network participants and growing DeFi strategies. Everything was on the table and PNF was open to flushing out any new kind of strategy.

The providers that were working with Michael on his proposal strategies were not communicating their desired tokenomics to PNF who was the one at the time with the ability to enact changes. With Shannon’s continual delays, PNF had already started prioritizing node running strategies, originally expected to happen in Shannon and was bringing them into Morse, like changing MaxChains, building a 1-click staking dashboard, and supporting multi-chain liquid staking initiatives. So while many supplier based strategies were in the works, and PNF was actively exploring many others, the providers involved in Mike’s proposal were not communicating with PNF about their concerns or desires.

PNF should have had protocol under them from the start

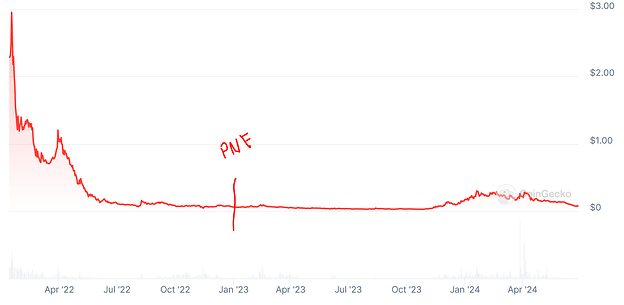

This indeed would have given PNF much more say in this kind of situation. The primary challenge was that in 2022 Michael converted around ~$8M of POKT into USD from PNF’s treasury, but when PNF and Grove split, PNF was only given $1.59M worth of the stables, with an obligation to pay over $500k for a previously agreed Copper integration along with Cayman admin and POKT IP fees. So PNF’s stables holding for building were right around ~$1M. PNF did still have POKT and did some OTC trades, but POKT was at it’s all time low at $0.05 from the high a year prior at $3.

Considering the resources it had, PNF opted for Grove to continue funding the protocol team since much of their funding came from PNF’s treasury. PNF was also operating on Grove’s timeline of Shannon by Q4 2023, leaving plenty of time to transition protocol ownership after Shannon was shipped. This timeline did not turn out as expected, with the current estimate being Q1/Q2 2025.

RISKS

There are many risks associated with this situation and this proposal. Every voter should be educated on what the risks are to better understand their vote, or potentially suggest changes.

Exchanges

Michael’s proposal mentions that he will get POKT on Tier 1 exchanges. From the information I have gathered, and from digging directly into the criteria they provide, Michael’s proposed plan does, in fact, put the project in a place where it will be less likely to get onto a Tier 1 exchange. It also runs the risk of POKT being delisted if current exchanges get wind that POKT no longer has a functioning board or DAO, and doesn’t have predictable economics. For example, when PNF got POKT listed on Upbit, the due diligence work required mapping out POKT’s projected tokenomics for the next five years.

Michael’s proposal is establishing a “trust Michael’’ system, which may be sufficient for some in the POKT community who knows Michael, but this will be a huge red flag when trying to get on T1 exchanges.

$GROVE Coin

I’ve heard, in person, from 3 different Grove employees about the different possibilities around forking the network and launching Shannon under a different coin. This strategy goes back to last year and has been widely discussed with some Grove investors. This option was seen as the path of least resistance to bypass PNF and the DAO.

While it has been stated that forking isn’t Grove’s plan right now, I personally find enough context to believe it is a contingency plan. As Michael said in the community call, forking was seen as the nuclear option, and all context suggests that it remains an option if this proposal does not go through.

Validation Control

Another strategy that Grove has considered is using their 80M POKT tokens to control POKT’s validation. This means they could centralize the validation under their control to reorganize PNF and the DAO. Calculations were made, and this was seen as a viable option.

Michael has suggested that POKT’s validators could always work together to change the network if they do not agree with his vision down the road, however that redirection strategy could be thwarted if Grove centralizes validation using their POKT holdings.

Select Insiders

According to Grove, some insiders were consulted on what plan Grove should pursue, prior to communicating with PNF on Friday, May 28th. This seems to include some staking providers and some investors. PNF heard earlier that week that Michael was planning to take over PNF through investors that were just briefed on the plan. However PNF didn’t know the details until Dermot’s meeting with Mike on Friday.

It is concerning that these plans involved some parties but not others. Regarding investors that were part of this plan, it is also hard to know if this is about their investment Grove as a company, or about seeing POKT improve as an ecosystem. Grove is also doing a new fundraise which has struggled, so it is not clear if controlling POKT is an ask from current or potential Grove investors.

Lack Of Clarity Around Funds

When Grove last year asked for 30M POKT (25% of the DAO treasury), they disclosed that they only had 15M POKT left. However today they have over 80M (and had over 90M a few months ago) according to the monthly investor report released on Telegram. When I asked Grove about this, this is the origin of the tokens:

- 15M - Grove believed they had prior to the DAO proposal last year

- 24M - Grove received from the DAO proposal last year

- 12.5M - Michael injected from his own wallet

- The remaining 28.5M - Unsure, but Grove found more wallets sometime after the DAO proposal passed last year. Some may have come from staking rewards, though Grove stated they have already sold rewards through OTC.

A substantial portion of their $POKT Treasury aren’t liquid funds, but are allocated to employees and investors from their last round. This was unknown to PNF, as it looked like Grove had anywhere from $4M to $15M worth of POKT able to be sold, as PNF has done via OTC to fund itself the past year.

If it is confusing to understand Grove’s Stakeholder Reports, there is a risk that PNF financials and the usage of the DAO treasury will fall into a similar result.

Clear separation between Grove and PNF

Michael has stated that his sole focus will be PNF since Grove operates on its own under Arthur. The community has been assured that there will be clear separation. However, Michael’s plan states that he plans to bring in contractors from companies with the POKT ecosystem, and nothing is barring Grove from getting more contracts. For example, regarding PNF business development, Grove’s BD team has reached out to me with questions regarding PNF’s current BD responsibilities.

Without proper oversight, the legitimacy of PNF as an independent agent will be in question if Michael is providing Grove with additional resources through personnel contracts.

Increase sell pressure on POKT

Michael’s proposal increases inflation to 20% - 30% each year, from the 5% it is today. Most of that increase is going to the DAO, which Michael would control.

If the expectation is that the increased POKT minted to PNF will extend PNF/Grove’s runway, then that will add significantly sell pressure to POKT. There may have been an opportunity to lock up more POKT while increasing liquidity with PNF’s original POKT x DeFi strategy, but that now won’t be possible in the immediate future.

Substantially increasing inflation to use for extending the runway is a risk to the token price. This kind of strategy needs to be well thought out to prevent unmanageable negative effects on the token price.

CONCLUSION

Ultimately, Mike’s proposal is not about a disagreement of strategy between him and PNF, because there has to be communication for there to be disagreements.

Michael, Grove, and the investors + providers behind this proposal could have communicated with PNF about their concerns, if the desire was to find the right strategy. POKT runs a risk of constant ecosystem turmoil if strategy changes are done via personnel replacements, instead of via stakeholder collaboration and engagement.

Right now, my priority as PNF’s sole remaining member is complete communication with the POKT stakeholders during this time of confusion and discourse. Everyone should have as much information as possible for such a fundamental change to the POKT ecosystem. I would like to be a part of ending this cycle of communication failures, and give everyone the information they need to be a part of the solution.

NEXT STEPS

Today my goal is to preserve as much resources as possible to help POKT prepare for the future. As mentioned by others in Telegram, Grove has enough runway in hand to make it to October. Additional runway is still meant to come in from Michael’s investment into Grove’s round from last year, which if delivered will fund Grove through Q1 2025.

PNF’s available stables will sit around $100k by the end of July. PNF was closing an OTC deal to secure a runway for PNF through the end of the year, with the expectation that Shannon was going to launch in Q3. However, due to recent events the OTC deal fell through, and with Shannon’s pushed back to Q1 or Q2 of 2025, PNF needs to operate in emergency mode.

Grove’s current burn is around $350k a month, with the protocol team being around $70k of that. It is not clear what is the best course of action, especially since the OTC deal was lost to extend the runway.

The DAO needs to decide how they want to proceed with PNF, which comes down to two options:

- Rebuild PNF with $100k in stables and 50m POKT (between PNF’s and the DAO’s treasuries).

- Establish Michael over PNF and put all PNF and DAO funds under his control.

Both options have risks, many of which I mentioned above, but I believe the DAO now has all relevant information to make an informed decision.

Yours Faithfully,

The Grand Sultan ![]()