Attributes

-

Author(s): Jack Purdy, Director of Business Development - Messari Protocol Services

-

Recipient(s): The funds will go to Messari Protocol Services, the public-goods-funded arm of Messari that provides open-source data analytics and reporting for DAOs.

-

Category: Relationship

-

Asking Amount: $26,250 in POKT per quarter

Summary

We are proposing that Messari provide investor relations services for Pokt DAO with in-depth reporting and research. This would serve to better inform existing stakeholders as well as attract new ones. while building out the open-source data infrastructure for the community.

These reports would live as free resources on Messari and would be distributed through our newsletter, social channels, and third-party distribution partners including Bloomberg, S&P Global, and Refinitiv.

Abstract

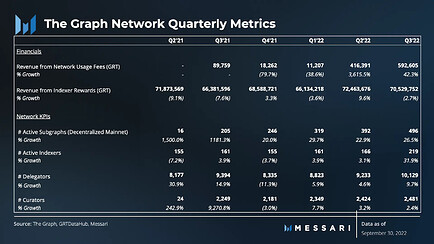

Beginning in Q2 we will provide 4 quarterly reports that present and analyze major KPIs and fundamental metrics which will include:

- Amount of POKT staked

- Number of relays

- Number of applications

- Rewards data

- Latency/uptime of providers

Where relevant these data points will be split out on a per chain basis as well as individual application use (DeFi, NFT, gamint, etc.). The report will also delve into major governance developments, upgrades, and key roadmap initiatives on a recurring basis. Examples include: The Graph, Filecoin, Livepeer

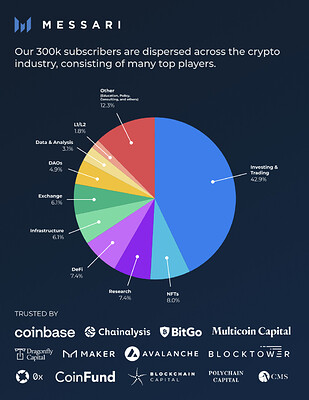

They will be distributed to a wide crypto native audience through the Messari newsletter comprised of 300k investors and builders in the space along with three of the largest traditional research platforms in the world.

- S&P Global

- Capital IQ: 12,000 enterprises

- Bloomberg

- Bloomberg Terminal: 325k users

- London Stock Exchange (formerly Thomson Reuters)

- Refinitiv: 40,000 enterprises and 400,000 users

Motivation

This proposal is designed to improve the data analytics and research available to the Pocket ecosystem including core on-chain metrics, governance initiatives, and core protocol developments. This will enable existing stakeholders whether its infrastructure providers running nodes, projects using the network, or investors participating in governance to make better informed decisions in order to guide the strategic direction of the protocol.

In addition, this will grow the Pocket ecosystem by attracting new stakeholders. Without adequate investor relations services and standardized reporting, it can be difficult for new entrants to find reliable data with the necessary context to make gain actionable insights. We aim to create the 10Q equivalent in the same way anyone can go to Apple’s financial statements to learn more about the company and its performance, anyone can publicly see Pocket’s reports to learn more about the protocol and observe it’s performance. Over time, this will bring more stakeholders into the ecosystem who will be more likely to contribute value to the DAO, allocating their time and money to grow the network.

Lastly, not only are we creating these reports but we’re ensuring they get sent out to a wide audience that can consume them. This is done through Messari’s channels of over a quarter million crypto-natives, which reach most of the active professionals in the industry as well as through our distribution relationships with Bloomberg, S&P, and Refinitiv. This goes a long way to further professionalize Pocket to world outside of crypto including major funds, banks, financial service companies, and large corporates in the world that will better grasp the magnitude of economic activity generated by the protocol. As more of these players are getting involved in crypto (ex Polygon/Starbucks or KKR/Avalanche) they’ll be able to expend substantial resources investing and participating in the on-chain economy.

Needs Being Met

Link to relevant Feature Requests and/or Proposal Requests from the Needs category in Discourse, which your proposal fulfills.

Budget

We’re proposing $26,250 in POKT at the beginning of the first quarter to be reported on (Apr 1) and then $26,250 in POKT at the beginning of the next 3 quarters (July 1, Oct 1, Jan 1). The amount is fixed in USD therefore the amount of POKT from the treasury will be determined based on the prevailing market rate on the day of payment.

Rationale

Investor relations are a critical function of any organization whether its a traditional company or a DAO. Hiring in-house to perform these functions would be significantly more expensive (and wouldnt have the distribution) but Messari is able to achieve economies of scale having done this type of reporting for ~40 projects.

Other DAOs are investing substantial resources into these services with examples including:

- MakerDAO has a Strategic Finance team doing their reporting for $1.3 million/year.

- Aave is spending $1.5m on similar services

We recognize this is not apples to apples and these scopes are broader than just reporting/analytics but I think it showcases the substantial work that goes into these types of services.

Dissenting Opinions

The price is too high!

While we understand its a bear market and spending is tight, we think that in times like this it’s even more critical to highlight fundamentals as far too often “price go down” becomes the barometer of success. By shifting the focus to what really matters rather than market forces it highlights the true value offered by decentralized protocols.

On-chain data is freely accessible, why do we need to pay someone to give it to us?

Even though blockchain data is open by default, there is still a significant amount of work needed to put it into a digestible format. Most people dont want to sit through and parse raw data which is why there is value in having a sector-specific analyst whose full-time job is synthesizing information to take it and create an articulate narrative.

Shouldn’t this be done in-house since they understand Pocket better than anyone?

While yes, those building a protocol understand it better than anyone that doesn’t mean their time is best spent making sure everyone else can understand it. Outsourcing this type of reporting and research provides a much lower cost way to keep everyone up to speed and has additional benefits such as broader distribution that can be a strong driver of growth, something that can’t be replicated by doing in-house.

Deliverable(s)

Q2 report released following the end of the quarter (6/30) with each consecutive one coming 3 months after

There is also a termination clause at the end of Q3 where the DAO can cancel the engagement if they feel they are not receiving enough value from our services.

Contributor(s)

Mihai Grigore - Senior Analyst focusing on key metrics and technical understanding of Web3 protocols. He currently covers research and reporting for Livepeer, Filecoin, The Graph, ENS, and Braintrust. He previously worked in data science at UBS and Swiss Re, and started two tech ventures. Mihai completed his PhD in information systems at the Swiss Federal Institute of Technology Zurich (ETH Zurich). His background is in computer science and math.

Additional resources

Mike Kremer - Data Engineer

Ryan Celaj - Research analyst

Copyright

Copyright and related rights waived via CC0.