I will update the text on my next edit to remove that verbiage

This was discussed first in Telegram group " the Den". I do not have a pointer to the first discussion. This was followed up by long dm conversations between myself and Vitality. I have created a research thread on the Forum to capture the public discussion thread and will add to that thread redactions from our private discussions; I will add a pointer to this research topic in this proposal.

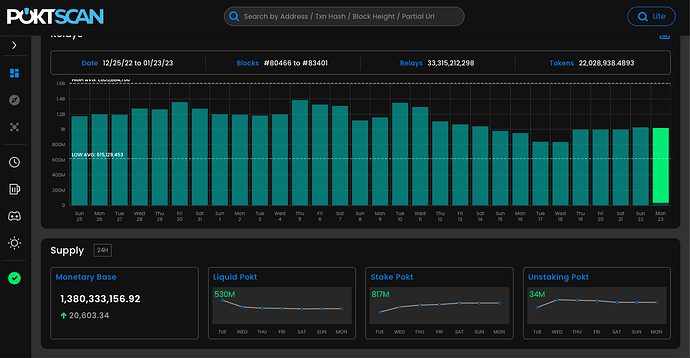

I am in the middle of working on this. what you ask is a very important consideration and can be the basis of an argument for following up FREN with much more aggressive emission cuts than are outlined in this proposal. The premise being : either we aggressively cut production costs (e.g., by aggressively lowering inflation and/or by aggressively increasing network usage) or the market will cut them for us (by slashing POKT price).

The absolutely most important factor in reducing production cost and over-provisioning is though sales. All else being equal, if we can triple our relays over the next few months, that would slash production costs by two-thirds (on a per relay basis, which is the only basis that matters).

The approach outlined in this proposal should work well , IMO, if we hit the targets outlined in at the “State of the Union” presentation. If we slip from these targets, I think further slashes to inflation will be warranted to make up for the underperformance on the demand side. Conversely If we outperform these targets with paid relays, we can find ways to reward the network providers in such a way as to not violate the 3B cap (or whatever the DAO decides) narrative. This would be the beginning of morphing into the approach Vitality has been advocating and which I think can be pursued on top of DAO deciding what happens post Jan 1 rather than delaying all action until we have it all figured out.

I agree. the demand-side approach to inflation would solve this dilemma. See my above thoughts on how to handle under- or over-shooting demand targets as the beginning of morphing to incorporating demand into the equation