Great discussion!

I am sensitive to the following before I share further thoughts:

-

This can’t merely be an intellectual exercise. Something really positive needs to come out of this, otherwise we are wasting our time and we will lose trust in the community as @Cryptocorn said.

-

I would be lying if I say that I am not watching the lack of traction in POKT’s price in the current market. That’s my day job.

I would urge us to not be in the “lets just build and ignore the market” zone. That’s generally doesn’t end well. Let us do everything (check all the boxes)- that would be my humble request. And there are experts building and shipping, so there is no conflict here.

Token value is at the centre of this proposal (without mentioning that explicitly). I understand very well who can discuss price and who cannot; this is a community-run initiative and therefore there are no restrictions.

Which leads to:

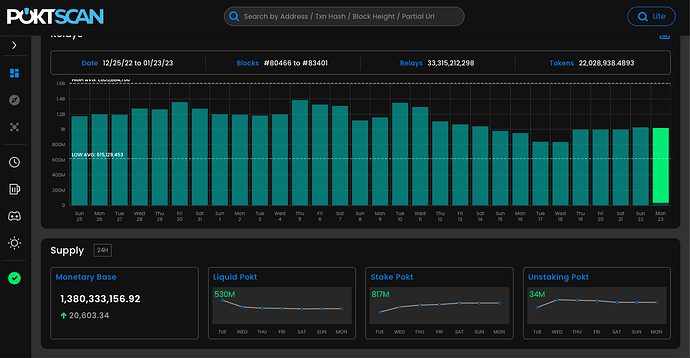

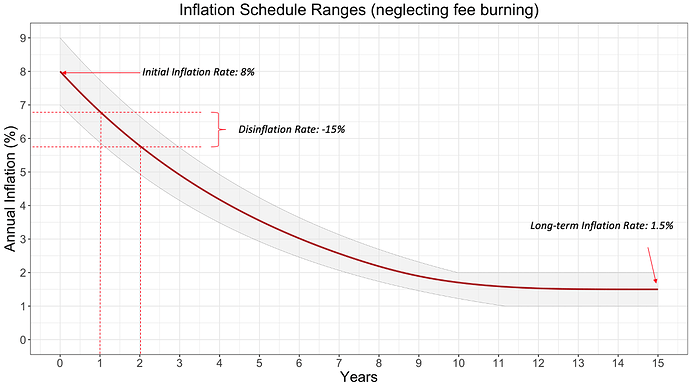

a) We desperately need positive catalysts in this project- inflation cuts, successful V1, relays/more chains, partnerships, dapps, major exchange listing, etc. All of them will somehow contribute.

b) Time is also of essence; sure we need to come up with a robust and sustainable solution for inflation reduction and supply control but we need to be time-conscious.

-

Having a narrative and building that narrative don’t have to be cringe and scammy by default. I see many coders and builders averse to any kind of narrative building. Referring to my earlier statement- let us plz check all the boxes.

-

I hope we are not going to get push backs from the node runners. I am not sure what their % is amongst the DAO voters. Pocket is not in the business of running nodes- I agree with the sentiments I have read, including from our dear friend Vitaly. On a related note- 13% staked ETH VS 59% staked POKT, that should tell us something.

Value accrual to the POKT token will ultimately help all stakeholders (including node runners) and alleviate many current problems.

Now-

I would want this to be collaborative within this core group and therefore have consensus. Clearly @RawthiL is not convinced, and therefore I agree with @Cryptocorn that we have to integrate his views and solutions into this.

Which leads me to @msa6867 's question-what exactly does he mean by floating supply.

My guess is that it relates to what pro fish was/is modelling and is similar to ETH’s tokenomics. But I would let @RawthiL explain.

At this moment, we are discussing SER and then we have pro fish 's unfinished model. Is there a way to make this into one instead? There are different ways to do it- one way could be elimination or deferral by prioritisation.

Basically we need to optimise our time, effort and resources.

And if this requires to make this a paid project, why not? Therefore I am open to @Cryptocorn 's suggestion.

But I request you all to focus on consolidation please and concentrate time, effort, resources in one common project/mission.

@msa6867 , I would suggest to wait before creating further drafts/proposals. We all need to align first. Also btw how many years will it take to hit max supply of 2B?