@Dermot I appreciate your passion for ARR, but don’t try to sell it a great (or even good) proposal. Take the win and start building the next step because, as you say, ARR is only a step in the right direction, nothing more. Its a step that the community is willing to do, but not due to the fitness of ARR.

ARR wont:

- Create buy pressure: It does not act on this front at any extent.

- Reduce sell pressure: Node running costs are not related to emissions, a server cost the same regardless of how many POKT we print.

- Bring contributors into the ecosystem: Actually it will kick-out some of them as the node running becomes impossible to sustain (not saying that we need to try to keep them either, just describing)

- Increase POKT exchange rate: It does not provide any mechanism for this to happen, its all hopes and market sentiment modulation.

ARR will:

- Show that the Pocket Network is trying to lean away from the seignorage paradigm (minting out of thin air). This is a great step that might bring capital to the system (not builders).

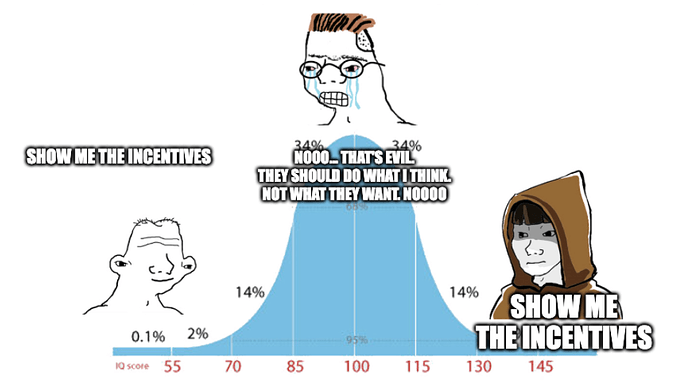

- Make some telegram folk (briefly) happy (or encourage them to ask for 2% or 0% supply growth).

I agree with some points made by @bulutcambazi , but I voted yes on this proposal, because I think of it like what it is, a step. A band-aid. I hope that once we remove ARR out of the way we can start thinking in Pocket economy as we should.

Funny, because a faster plan was proposed and the community decided to go with the current one. The community acknowledged it was the right speed when the community voted.

This is very unhelpful for the DAO. You are saying that the community discussing, agreeing and voting on SER did not responded to the community? Who are “those looking for more sustainable economics” if not the DAO (which is the community)?

Fingers crossed. That’s all we can do. More specifically, all that ARR offers.