I think that you took my comment too negatively. I have said it before, CC is a useful tool for the current time. POKTscan itself is part of it. I do not believe that we can spare it until v1.

The problem I have is that this proposal gives no perspective into whats going to be the path forward, so a temporary use of a service like CC could be seen as the right way to run the Pocket Network. That’s where I disagree. I’ve been thinking in how to change this, but its all in v1 world, where services like CC would not be required so massively at least.

Again, for the current times and until a better tool exists I’m OK with CC.

Thanks for expounding. Talking about v1 is a very different beast, so thanks for providing that clarification.

If chain node pooling was meant to be a long term solution, then it should be baked into the v1 protocol (like gateways were)… but I only see them being most useful in v0. I have much hope for v1 node distribution ![]()

I’m still waiting on answers to my previous questions/requests.

In the mean time here are some thoughts:

(1) Re DAO and Proposer Allocation: I understand there may be good reason to decouple this proposal from any adjustments to allocation percentages. That being said, voters should be aware that if they vote to cut emissions by 60% by passing this proposal there may be need in the near future to revisit distribution of allocations, which could cause servicer rewards to be cut even further if voters decide to raise either DAO or Proposer Allocations (or both).

(2) Re effect of this proposal on price: I reiterate what @cryptocorn and others have said, that there should be zero expectation that cutting emissions will lead to increase or even stabilization of POKT price. @Cryptocorn sites $CAKE recent history as an example of price decline tied to governance action to slash token emissions. I find @Dermot ’s dismissal of this case study as completely missing the mark. CAKE has much closer analogy to POKT (in terms of market cap, in terms of age and stage of maturity of the project, and especially in terms of high-supply-side APR being a driving attractor to the token/project for early investors) than Bitcoin and Ethereum will ever be.

Further @Jinx previously provided a link in his TG channel to a study that show that emission reduction efforts tend toward lower token price, not higher token price… perhaps @jinx could provide the link; I can’t find it at the moment.

I bring this up not as an argument against this proposal, but only that when voting, voters should not have expectation as to what affect on price passing or not passing the proposal will have.

On the other hand, as the POKT token gains meaningful utility via the recently-passed off-chain burn mechanism en route to v1 on-chain burn, passing this proposal does raise the nominal utility value of the token, which represents a price floor that one can reasonably expect to hold , so long as the project remains viable and demand does not drop from current levels. At present, this “utility value” (equating demand side and supply side) is about 0.2 cents per pokt (1.3B relays/day * $0.00000085/relay /600k pokt/day). If the proposal passes, this raises to about 0.5 cents per pokt ((1.3B relays/day * $0.00000085/relay /220k pokt/day). Ultimately, as we bring supply side and demand side into parity, it is desired to have that parity be reached at the lowest absolute values that is reasonable (e.g., ~20 uPOKT burned and minted per relay rather than ~500 uPOKT burned and minted per relay). Toward that ultimate goal, this proposal is a step in the right direction. The question, as @shane put it, is with respect to timing.

(3) Re NR viability and community chains: @shane states, “Ultimately, to me this proposal isn’t so much about inflation, as it is about what the lowest amount the node running ecosystem needs to cover all chains and be performant” Nobody knows where that line in the sand is, and in truth a single line does not exist. We are already non-performant for a number of chains, relying on altruist network and community chains rare-chain support to pick up the slack. This number will grow if this proposal passes. Based on distribution of relay volume per chain, I expect a differential of ~ 6 to 8 chains moving from performant to non-performant as a result of passing this proposal. This number is relatively stable as a function of price (meaning more chains will move to non-performant status as a result of price dropping, but the differential resulting from passing or not passing this proposal will stay fairly constant). Surveying cc results from last quarter, I expect that rare-chain support for most of these additional chains can be added for approximately $200 per month per chain. At current $POKT price points, this price tag for increased rare-chain support is small compared to the reduced emissions.

Bottom line: cc is already being used as a crutch to lean on to get us through v0. This proposal will increase the use of this crutch at a reasonable cost. In an ideal world, there would be no need for altruist and everything would be perfectly decentralized. We are not, however in an ideal world and the pragmatism of crafting the best path to v1 trumps ideals. As cc seems to be working as intended, I do not envision that anything catastrophic will happen with regard to coverage and QoS as a result of this proposal.

(4) Re IP generation: too aggressive cuts in emissions runs the risk of diving out top content creators from the POKT ecosystem who essentially pay for that content creation out of node running pay. Nor can these players expect to turn to the DAO as an alternate source of funding as inflow to the DAO treasury itself is cut by 60% as a result of this proposal. This is an important intangible that voters must factor into their decision; it isn’t just about creating a minimally-viable supply side.

Thanks for your input as ever @msa6867

I’ll let others chip in on the other more substantive points.

To clarify wrt your comment on Pancakeswap. I fully agree that this proposal shouldn’t be taken as one based on increasing the price, which is why we have been very clear in all of our messaging. This proposal is about something much greater than price, it’s one key step (among many) on the path to:

While we do expect this proposal to help bring in new contributors and talent to the Pocket ecosystem, nobody at PNF expects this to be an overnight success; we are playing the long game here, which is important as these improvements build on each other and compound over time.

But to stress again, CAKE is a very poor comparison to POKT as it is a purely retail-focused token with no real utility, no builder community, and, most importantly, no institutional investors, never mind the many other differences. And I find it bizarre that this was even mentioned as a comparison again.

Let’s please focus on more substantive arguments.

This is the study that was referenced:

Thanks @dermot. I absolutely agree that focus should be on substantive arguments and also that concern over short term price drop as a result of this proposal passing is not a substantive argument against the proposal (just as hope for price stabilization or increase is not a substantive argument for the proposal). In other words, the macro environment is highly complex driven by a multitude of factors beyond dour control.

I personally think pancakswap is a legit project with a reasonable roadmap to long term success. But I am fine with agreeing to disagree with regard to its merits and drop further reference to it since it’s use case (as a CEX whose supply side is liquidity) is in a different sandbox to the Pocket Network use case (as a utility token whose supply side is hw/sw infrastructure). The reason it was mentioned again was because a point of similarity between the two tokens - despite whatever differences you wish to emphasize - has been that demand for tokens to lock on the supply side for yield has been a major driver of price action and that as attractiveness of yield on providing supply suddenly drops via governance action, some suppliers will decide to unlock and may further decide to liquidate, with unknown consequence on price. Again this is not an argument against this proposal, so don’t read it that way. Just that whatever governance action is taken or not taken, be prepared for a continued roller coaster ride in price action.

I posted a new thread with a spreadsheet that gives a detailed look at the way different parameters would likely affect different size node runners. I put it as a separate thread to keep this thread focused on inflation specifically.

However there is a lot of crossover, and it specifically has a variable which can be set to this proposal’s inflation rate.

Instead of guessing what effect different parameters will have on different sizes of node runners, this just puts our entire node landscape in an adjustable spreadsheet.

Check it out: GoP - Game of Providers

The $254k figure was highlighted as a benchmark against Infura, which manages to charge users a similar amount for equivalent relays, to make the point that this amount should at least be safe to move forward on today. If we can’t match that, how can we expect to compete with other RPC providers? Whether price continues to drop from here is irrelevant to the decision today – if the downward trend that you identified continues, we’ll end up in the same place regardless of this proposal passing or not.

We are not proposing that this specific figure actually be locked in as a theoretical USD limit. See in bold:

The decision about whether to drop certain chains is outside the scope of this proposal. The message you quoted was a call to reframe our thinking to be more intentional about our “network spending” around a chain’s potential to contribute to our protocol revenue. This would be a mindset shift that may lead to future proposals if the path we go down leads to certain chains being nonviable economically. There are no contractual obligations for the protocol or node runners to maintain support for certain chains.

I have edited the proposal to add the following details as requested by @msa6867

Just so my feedback is here as well. ARR has a few blind spots that create an imbalanced ecosystem in curtain market conditions. The main one is it does not account for varying market conditions.

POKT Price Creates Imbalance

If the POKT price is reduced to $.02C by the time POKT hits 10B relays a day, the Servicer economy would be sitting far below what it tenable. ARR is designed so that regardless of what happens with the price, deflation is always prioritized, at the expense of the Servicer, Validator, and DAO economies.

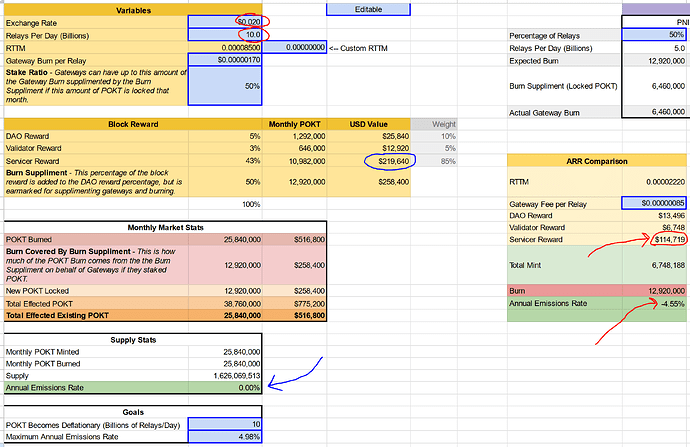

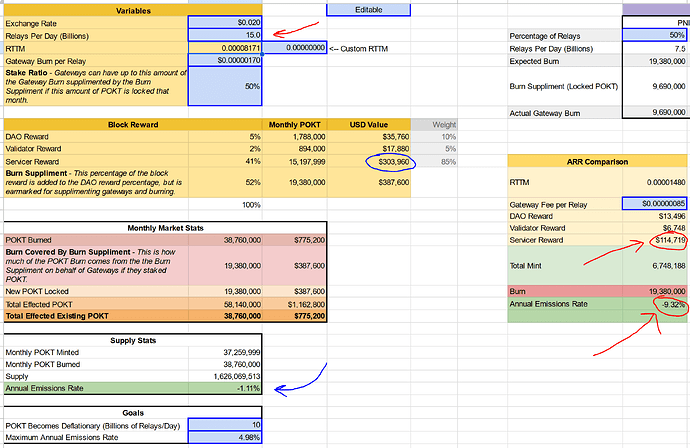

That is hugely problematic and unnecessary. On the flip side, what I’m proposal with Burn And 🥩 Harnessing (BASH) Deflation Economic Model provides the same amount of tokens burned as ARR, but does not have the deflation imbalance (see left side of image above with the blue markings).

When looking at 15B relays, ARR again prioritizes deflation despite the fact that 50% more hardware is required to service 5B more relays. This type of model could likely crush QoS if relay growth does not allow servicer growth to account for more costs.

I created a section in the BASH spreadsheet that shows what ARR would look like with different market situations (as shown above). Changing the price and relays shows the imbalance that only favoring deflation will create. I encourage everyone to check it out.

The only outcome I could see is there will need to be future proposals for ARR at different price and relay points. Regarding BASH, comments about it specifically are welcomed on it’s thread, but I wanted to put the relevant issues with ARR in this thread for posterity’s sake.

Hi Shane - I’ve responded separately on the Bash thread to your proposal - Burn And 🥩 Harnessing (BASH) Deflation Economic Model - #19 by Dermot

But with regards to your challenge to the fitness for purpose of ARR in a super deflationary scenario, we have much bigger problems if POKT falls to 2c. And much more than a simple change to how much we pay our supply side will be on the cards. So in that scenario, I’m not sure how helpful BASH will be in that position either. As I’m sure that the supply side will notice that the unit value of their rewards are on a downwards trend, and may look to exit before it gets any worse. This is why we need to ward off inflation now and send a very clear message in this regard.

Everything else re gateway staking, increases to stakes more generally, parameterising the gateway burn are all on the cards, but just aren’t top priority. They can happen afterwards with sufficient research and debate.

We believe that the emission reduction proposed by ARR is the first necessary step towards making Pocket more attractive to new builders, contributors and node operators by demonstrating that the Pocket Network community cares about the long-term economic sustainability of the protocol.

Further, ARR doesn’t preclude any future proposal to add any of the new parameters or mechanisms proposed by MINT and BASH once they have been sufficiently debated and tested. Voting for ARR doesn’t mean voting against the additional parameters proposed by BASH or MINT, it’s simply a vote to reduce emissions. Any questions about gateway staking, parameterizing the gateway, defining a more dynamic gateway fee schedule, or tying emissions more directly to gateway fees, should be deferred to other proposals.

We hold the principle that making changes in a simple step-wise fashion is preferable to trying to design the perfect complex system upfront. Our first proposed step is to address the problem of excessive emissions. As the community appears to be generally in agreement with this direction, this proposal is now up for a vote.

It is my opinion it is too early to make changes and too soon since the last. Portal migration traffic issue has fixed and relays are increasing. POKT is already attractive to builders. Let’s get RC-0.10.0 implemented first to see what happens and then come back to the table.

I thank Jack and everyone for taking their time and working hard on POKT economics. I appreciate the effort that went into this proposal, and grateful of people thinking how to improve tokenomics of POKT. Unfortunately, I don’t think this proposal is the right idea, at least not at this time.

- The agreed upon proposal we have in place already reduces the inflation to single digit numbers (same as Spain, Belgium, Germany, etc.) reasonably quickly, but it does so gradually without any sudden jerks to the fundamental financial parameters. Losing 60% of revenue overnight is massive. Any massive change to a network that wants to inspire investor confidence should happen over time, with a long runway.

- 220k POKT emission is NOT enough for a diverse and healthy supply side.

- 220k POKT emission doesn’t all go to node runners. With 50/50 rewards share, it is more like 110k POKT. This means top 3 node runners, each with ~8000x 15k stake as of today, would only make $14,000 per month in gross revenue BEFORE hardware, labor, legal, insurance, marketing, customer support, etc. This will very likely drive many node operators out of business / out of network and most certainly won’t make Pocket more attractive to new node operators – one of the top motivations of the proposal. Node operators leaving the network is bad for decentralization, which is arguably the biggest advantage of Pocket.

- Comparing 220k daily POKT emission to Infura is flawed, because 1) Unlike rewards share, Infura doesn’t give a large % of their revenue to their investors and their relationship with their investors for much longer term (vs. customers of node operators, which can move between providers easily and quickly). 2) Infura achieves that pricing point using scales of economy. Infura couldn’t afford it sustainably if all they did was 1.3B relays 3) For 10B relays, Infura would already charge 6x of what Pocket would emit – remember, 220k is constant up to 10B but Infura figures mentioned in the proposal is for 1.3B relays 4) While appreciate of what PNI/PNF/DAO does, Pocket node runners of course have costs other than pure node running such as marketing, customer support, legal, technology development, etc. and of course, rewards share. 5) Unlike POKT, Infura has vertical integration, which allows them to make optimizations that is not possible in POKT. For example, to get discounts, they can make longer term commitments with their cloud providers, because they don’t have to protect themselves against sudden swifts in fundamentals economics like this. 6) Infura can differentiate itself with more than price or perf when times are tough (say, better documentation, customer support, even website design for that matter) CherryPicker doesn’t care ANYTHING but perf, which is very costly.

- Reduced rewards might cause sell offs. Because a sudden drop like this might give the impression that network is not doing well. Similarly, node operators going out of business will demoralize some of their customers, taking their investments elsewhere with them. Sure, love it or leave it. But the problem is, this can start a negative spiral - initial sell off triggering price reduction, which triggers more sell off, and further price reduction. Granted, a small probability, but not to be completely dismissed.

- 220k POKT emission doesn’t all go to node runners. With 50/50 rewards share, it is more like 110k POKT. This means top 3 node runners, each with ~8000x 15k stake as of today, would only make $14,000 per month in gross revenue BEFORE hardware, labor, legal, insurance, marketing, customer support, etc. This will very likely drive many node operators out of business / out of network and most certainly won’t make Pocket more attractive to new node operators – one of the top motivations of the proposal. Node operators leaving the network is bad for decentralization, which is arguably the biggest advantage of Pocket.

POKT doesn’t owe business-model node operators a guaranteed market to profit. Labor, legal, insurance, marketing etc are aspects of a business that spun out of demand for node services. They made tons of money when POKT was over 1$, charging amounts unbelievable by today’s standards, even with newer software optimizations taken into account. Funny that you say node operators leaving is bad for decentralization. Because node operators are definite points of centralization. Especially ones holding very large amount of nodes and are prone to US regulations.

- Reduced rewards might cause sell offs. Because a sudden drop like this might give the impression that network is not doing well. Similarly, node operators going out of business will demoralize some of their customers, taking their investments elsewhere with them. Sure, love it or leave it. But the problem is, this can start a negative spiral - initial sell off triggering price reduction, which triggers more sell off, and further price reduction. Granted, a small probability, but not to be completely dismissed.

So are we supposed to keep rewards high to please node provider companies? When their massive profit realizations for months were what caused the massive drop in price. It seems like when the node operators are winning, the project is losing. Maybe if greedy ones go out of business, more people can learn to set up their own node, or smaller and better optimized node provider companies could pop up. The fundamentals are strong and even if we get set back temporarily, we will know that value extracting actors left and surely the strong fundamentals will make sure POKT comes back stronger and healthier.

almost had tear in my eyes reading this. We must heed to these pleas.

It is my opinion it is too early to make changes and too soon since the last.

If not now, when?? It is true that SER passed “only” 130 days ago, but much has changed since, and even at the time a lot of the community acknowledged that SER would take far too long to get inflation down to more sustainable levels (when compared to Pocket’s levels of demand)

Portal migration traffic issue has fixed and relays are increasing. POKT is already attractive to builders

Yes, Pocket is attractive to its current community, but without proving our sustainability to a broader external audience, we will struggle to bring in fresh talent across every stakeholder category we care about - supply, demand, protocol, governance, investor, and so on

Any massive change to a network that wants to inspire investor confidence should happen over time, with a long runway.

SER passed 130 days ago, and it was clear from the moment it passed that it wouldn’t be enough, at least to those looking for more sustainable economics. SER was a fudged compromise negotiated by and between the community without any of our involvement.

Since then, PNF has been leading discussions into our economics, engaging with all of the key stakeholders within Pocket, as well as many builders and investors currently sitting outside of our community. The sustainability of Pocket’s economics is a major barrier to entry for outsiders, and a known problem within Pocket’s community.

Voting against ARR will be the perfect confirmation bias for all those who think that Pocket’s community will never make the tough upfront decisions required to reform its economics in time. While ARR is not a panacea, it’s a step in the right direction. And sends an important message to the new stakeholders we want to attract.

220k POKT emission is NOT enough for a diverse and healthy supply side.

To do this I respond with the following extract from the original proposal. Yes, nodes have additional costs, but way less than they every would have on their own as a standalone blockchain API provider.

Infura’s pricing accounts for a reasonable margin to fund their customer support, sales, marketing, and engineering functions, as well as their non-node running infrastructure, on top of their node running costs.

All non-node running costs in Pocket are currently accounted for by PNI, PNF, and the DAO, and not Pocket’s node running community, which should give us the confidence that $3m+ per year in incentives is more than enough to incentivise a sufficiently resilient and performant community of node operators that have to pay very little in terms of customer acquisition costs relative to starting their own centralized offering (provided, of course, that they pay for their own POKT), even if the significantly reduced rewards may prompt some unstaking/consolidation.

Comparing 220k daily POKT emission to Infura is flawed

I agree with this assertion, but for a different reason than you. Mainly, that we should be able to do much better than Infura and any other centralised/“decentralised” competitor. Everything in our ecosystem thesis is ultimately about how we overcome the RPC trilemma to achieve this:

it should be noted that in the long-run we should not be willing to settle for matching the cost of centralized providers like Infura. If the wholesale strategy being pioneered by PNI is to have any merit, and the addition of gateway intermediaries with their own operating costs is to be economically viable, the protocol itself should be spending less on the supply-side than the equivalent cost of Infura et al.

For 10B relays, Infura would already charge 6x of what Pocket would emit – remember, 220k is constant up to 10B but Infura figures mentioned in the proposal is for 1.3B relays

It is true that the figures in the proposal are for 1.3B relays, but it’s important to bear in mind two key points:

-

Node runner costs don’t scale linearly with relays. My understanding is that the current number of staked chains would be pretty much sufficient for 10B relays.

-

More relays means more protocol revenue. Which will further cut net inflation by way of the burn. Even if the current gateway fee stayed constant (which is highly unlikely given that it is currently artificially low to help bootstrap the current gateways), at 10b relays, there will be a hell of a lot more buy pressure on POKT from gateways alone, nevermind any other source

All holders of POKT will benefit from a reduced supply, including node runners, as it is likely that their node rewards will go up as each unit of POKT they receive for the work will be more valuable (unless there is a USD cap, which is a separate conversation, and explicitly not part of the ARR proposal).