UPDATE 1 - 6/25/2023 ![]() See logged changes here.

See logged changes here.

UPDATE 2 - 6/27/2023 ![]() See logged changes here.

See logged changes here.

Burn And Stake Harnessing (BASH) Deflation Economic Model

PNF recently submitted PUP-32: Accelerating the Road to Revenue (ARR) - #31 by JackALaing to provide a path to deflation and POKTScan released Mint Incentivizing Network Transformation (MINT) - #37 by RawthiL as an alternative approach.

I’m now submitting yet another to consider, built in part on the strengths of their works ![]()

Pros and Cons of ARR and MINT

ARR

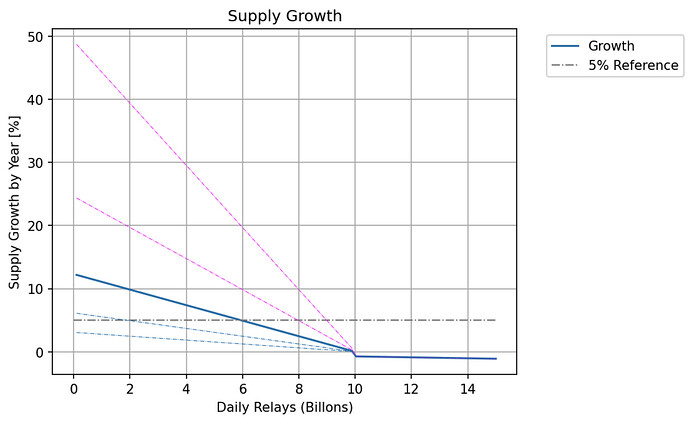

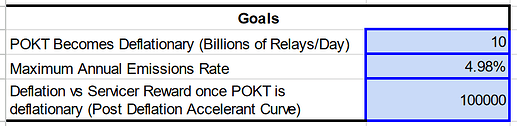

![]() Deflationary by 10B relays a day

Deflationary by 10B relays a day

![]() Consistant USD cost per relay for gateways (very important)

Consistant USD cost per relay for gateways (very important)

![]() Minimal direct buy pressure incentive

Minimal direct buy pressure incentive

![]() No staking incentive

No staking incentive

![]() Relay growth doesn’t expand node ecosystem

Relay growth doesn’t expand node ecosystem

![]() Doesn’t account for USD (too low of a price and the network begins fail)

Doesn’t account for USD (too low of a price and the network begins fail)

MINT

![]() Relay growth can expand node ecosystem

Relay growth can expand node ecosystem

![]() Can achieve deflation by 10B a day (with the right tweaking from my understanding)

Can achieve deflation by 10B a day (with the right tweaking from my understanding)

![]() Can account for POKT price (at least I believe so… but not entirely sure)

Can account for POKT price (at least I believe so… but not entirely sure)

![]() Minimal direct buy pressure incentive

Minimal direct buy pressure incentive

![]() No staking incentive

No staking incentive

![]() Raises cost per relay for gateways (could hinder gateway growth)

Raises cost per relay for gateways (could hinder gateway growth)

BASH

Now I’d like to introduce BASH, which clearly wins because it has more green ![]()

BASH

![]() Deflationary by 10B relays a day

Deflationary by 10B relays a day

![]() Relay growth can expand node ecosystem

Relay growth can expand node ecosystem

![]() Consistent USD cost per relay for gateways (very important)

Consistent USD cost per relay for gateways (very important)

![]() Accounts for POKT price

Accounts for POKT price

![]() Direct buy pressure incentive

Direct buy pressure incentive

![]() Staking Incentive

Staking Incentive

![]() Uses inflation to create deflation

Uses inflation to create deflation ![]()

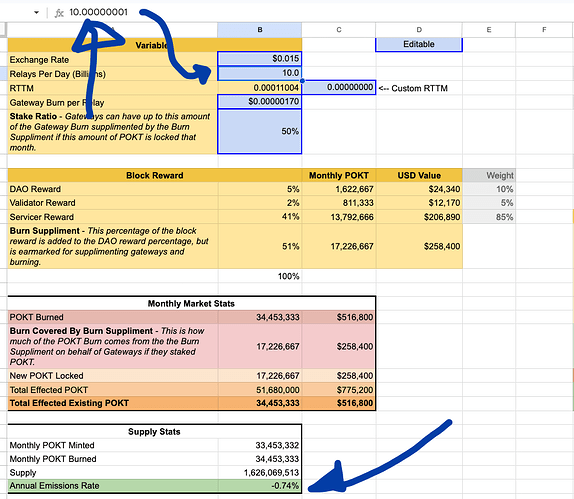

![]() CHECK OUT THE SPREADSHEET: Burn And Stake Harnessing v3 - Google Sheets

CHECK OUT THE SPREADSHEET: Burn And Stake Harnessing v3 - Google Sheets ![]()

The Design

Structurally, it doesn’t look much different than what ARR offers, but with it has two unique components

- Burn Supplement

- Stake Ratio

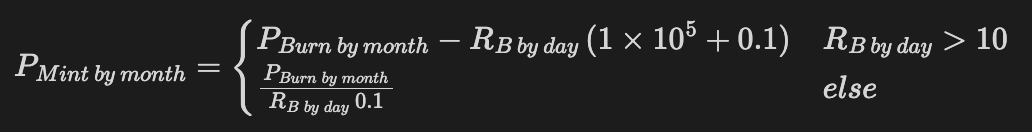

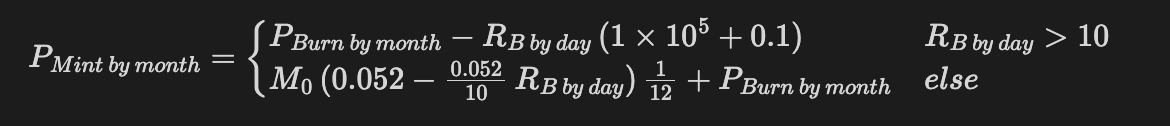

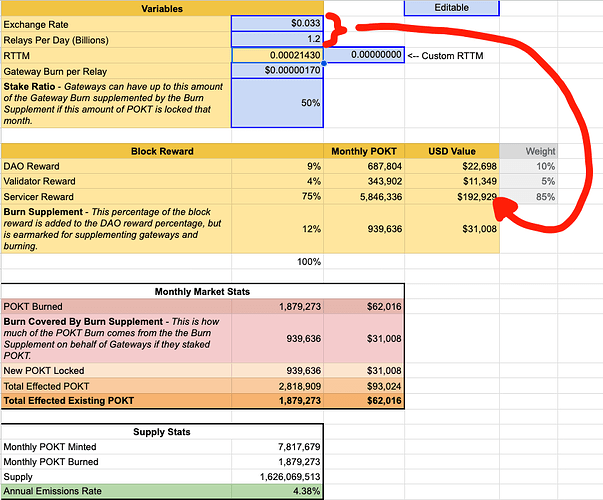

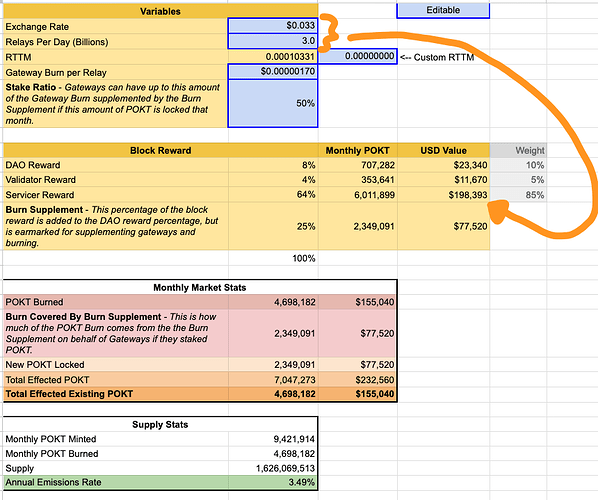

Burn Supplement & Stake Ratio

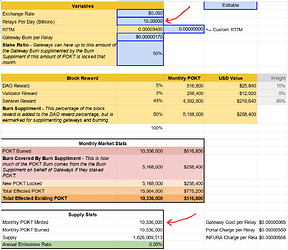

The main difference with BASH is it creates an incentive for more POKT to be bought and staked on the network. It does this by having two requirements for gateways:

- Gateway are required to burn an amount of POKT per relay they send through the network (AKA: Gateway Burn per Relay).

- Gateways are to stake POKT to have their Gateway Burn reduced (AKA: Burn Supplement)

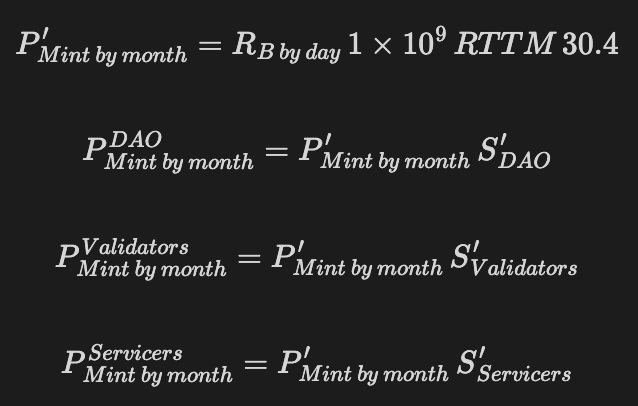

Burn Supplements - is a fund that is part the block rewards (like DAO, Validator, and Servicer rewards). No code changes are required on the network, as the Burn Supplement will actually just be part of the DAO’s cut and PNF will separate it for burning. If a gateway stakes their expected amount of POKT, the Burn Supplement will be used to supplement a percentage (AKA: Stake Ratio) of the Gateway Burn.

Stake Ratio - defines the amount of the Gateway Burn that the Burn Supplement will cover.

Example

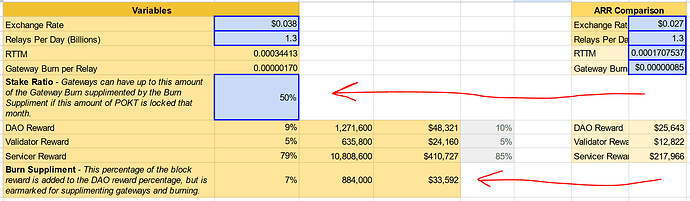

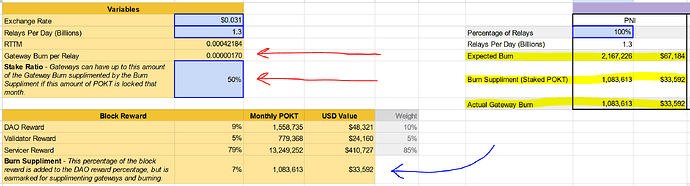

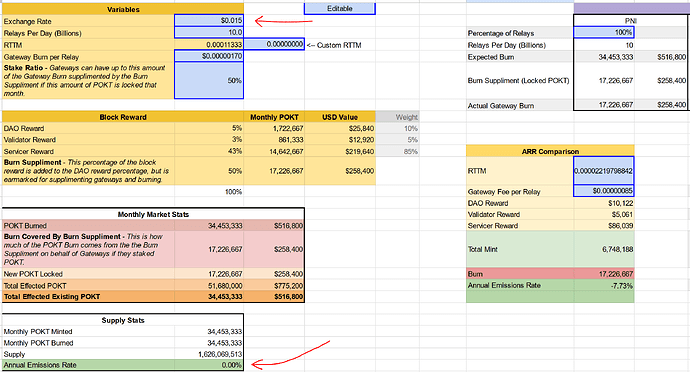

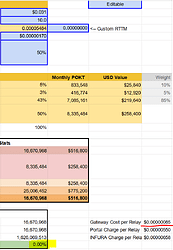

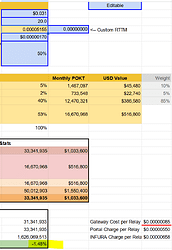

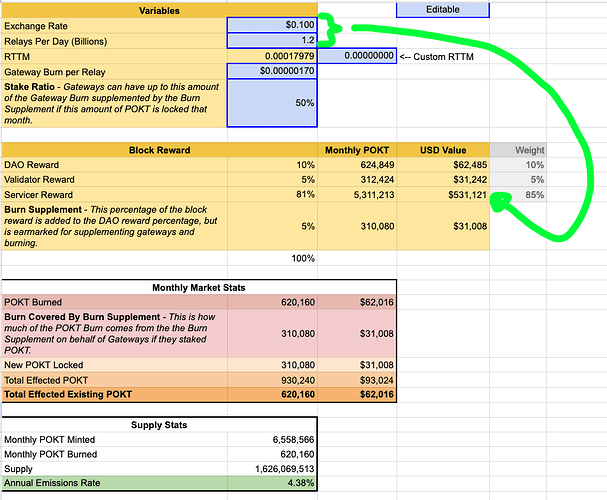

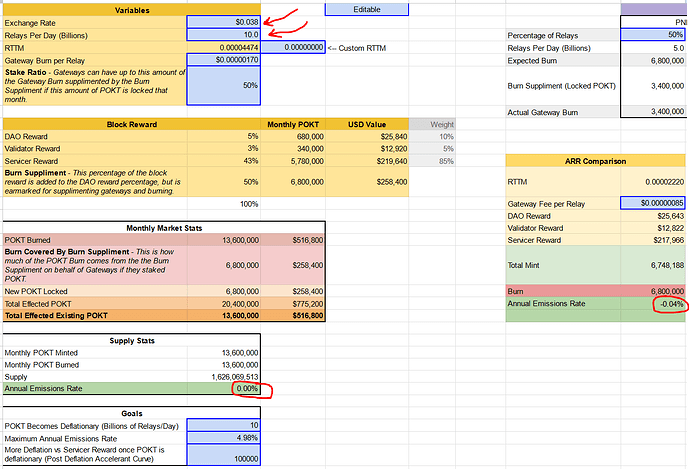

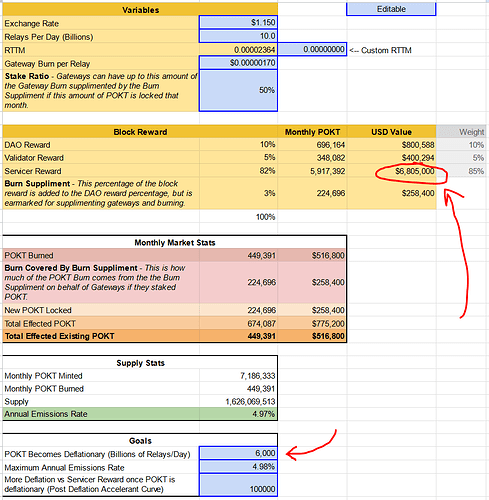

In the image below you will see the Stake Ratio is set to 50% and the Gateway Burn per Relay is set to $0.00000170 (the two red arrows). This means that the Burn Supplement will cover 50% of the $0.00000170 Gateway Burn if they stake 50% of their Gateway Burn.

It is easy to see how this plays out with the highlighted PNI example on the right. PNI did 1.3B relays a day over the course of a month and is expect to burn $67,184 (in POKT obviously). However if PNI stakes 50% of the Expected Burn ($33,592), then Burn Supplement will cover 50% of the Expected Burn. This means that the end of the month PNI has:

- Staked

$33,592 - Burned

$33,592

However, looking at the network, the Burn Supplement covered 50% (or $33,592) of PNI’s Expected Burn, which you can see with the blue arrow. So technicaly, at the end of the month, the POKT Network has:

- Staked

$33,592 - Burned

$67,184(PNI’s Burn + the Burn Supplement)

ARR Comparison

As an comparison, ARR has the Gateway Burn per Relay set to $0.00000085 which results in $33,592 being burned with 1.3B relays a day. With BASH, the network burned $33,592 of PNI’s existing tokens and $33,592 of tokens that were minted for the Burn Supplement. This means that both ARR and BASH burn $33,592 worth of existing tokens. The final results:

ARR End Result:

- Burned

$33,592existing tokens

BASH End Result:

- Burned

$33,592existing tokens - Staked

$33,592existing tokens

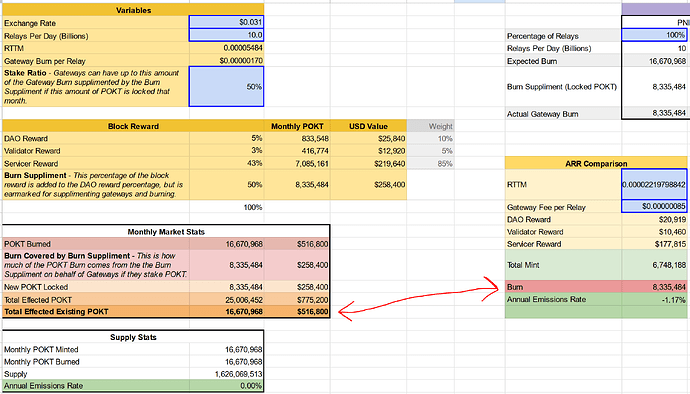

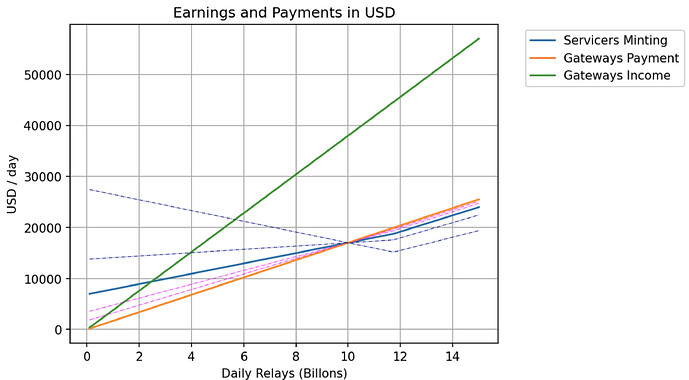

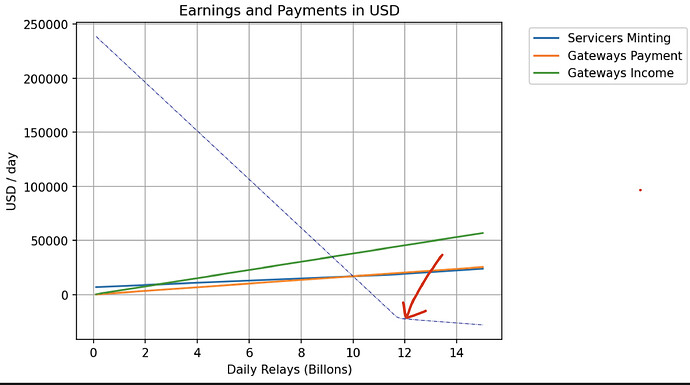

The result is BASH doubles the amount of existing tokens through burning and staking combined, resulting in double the potential effect on the buy market. This effect compounds as the network grows in relays. See the effect if the network hits 10B relays a day.

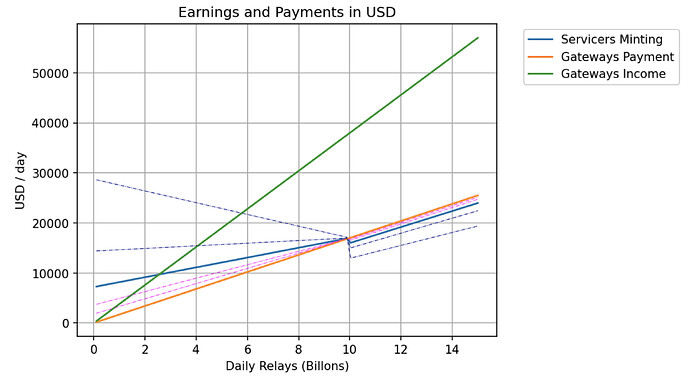

Under The Hood Effects

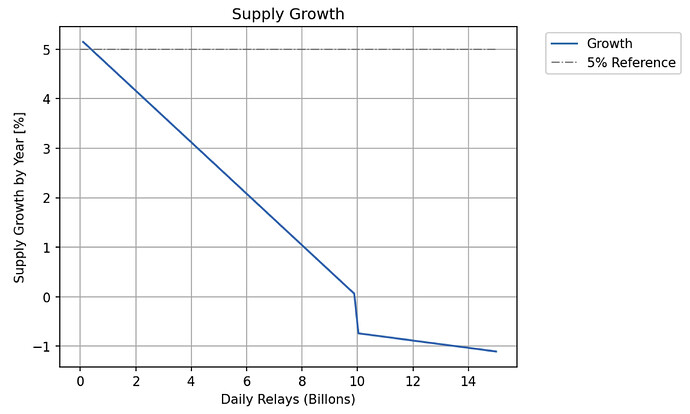

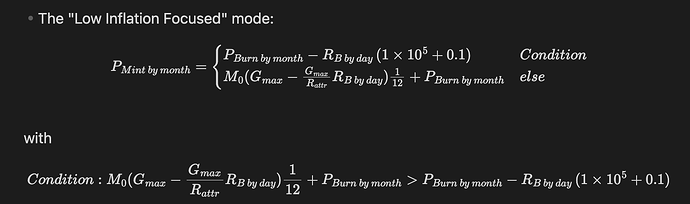

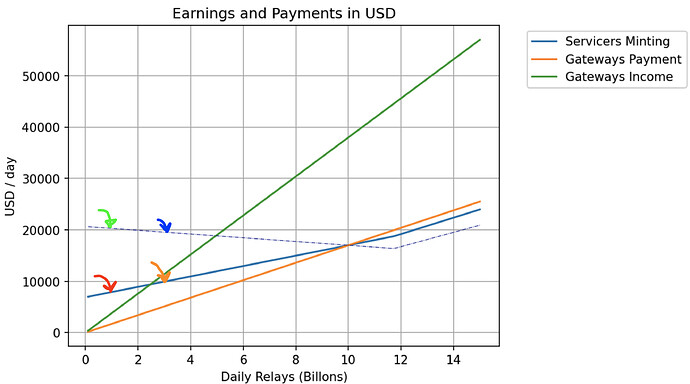

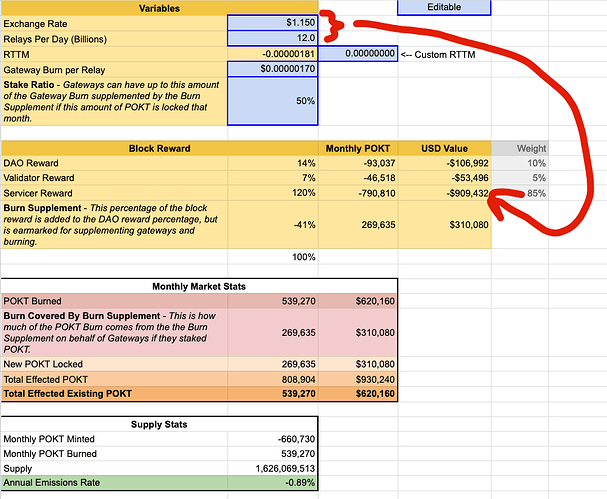

Deflationary

Deflationary

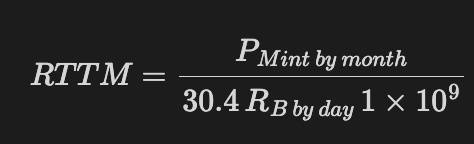

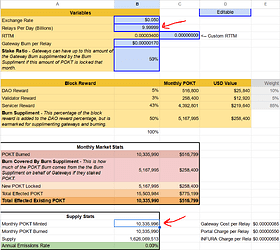

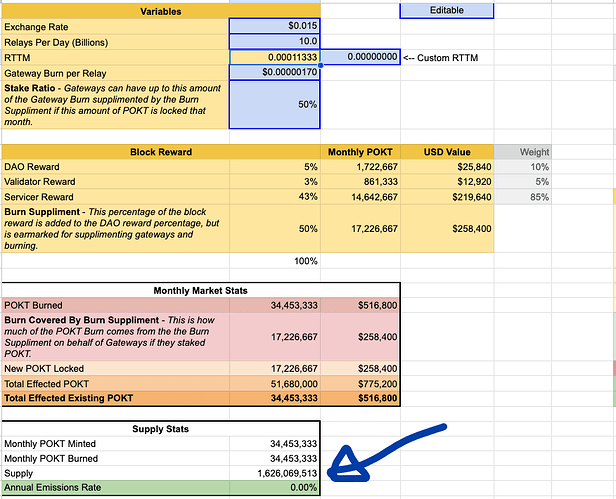

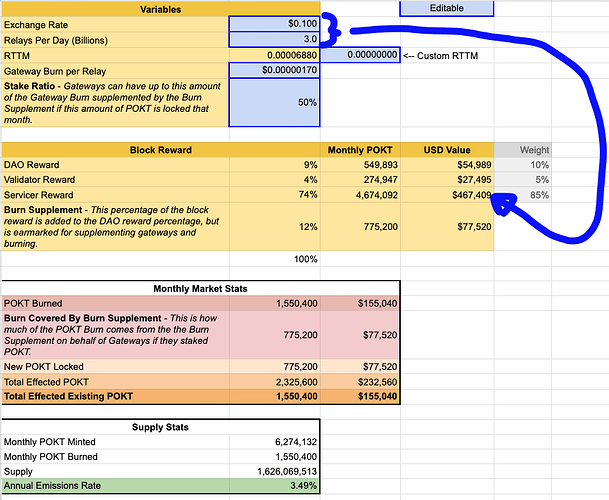

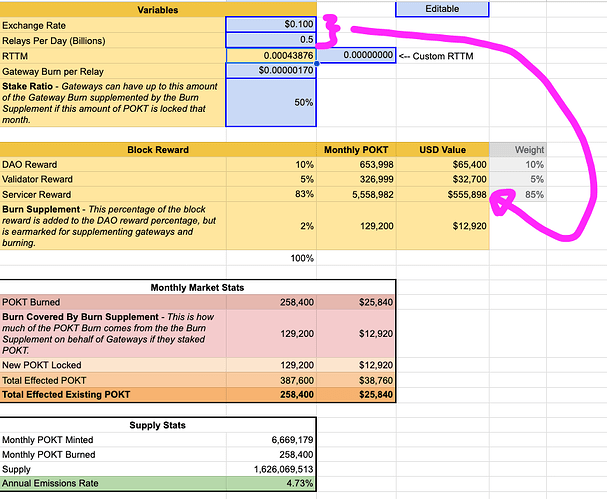

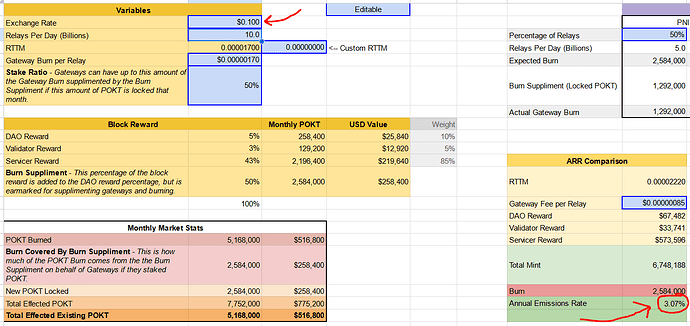

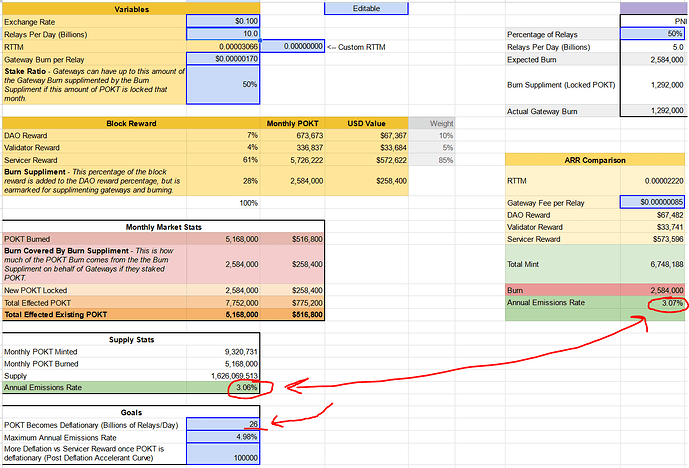

Above 10B relays a day, POKT would become deflationary. Play with the spreadsheet to see what the Annual Emissions Rate would be at different market conditions.

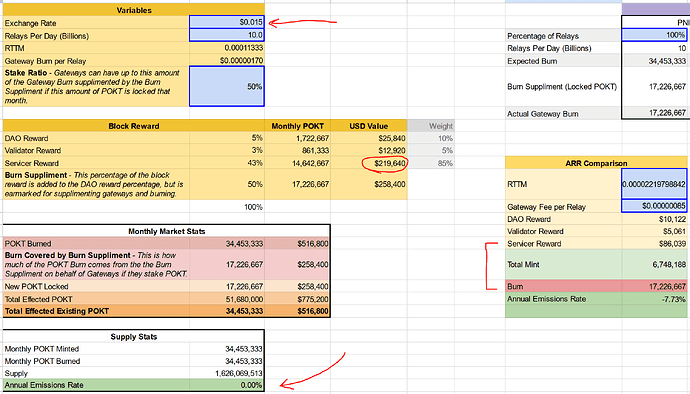

Accounts for POKT price

Accounts for POKT price

One of BASH’s main features is it anchored to a USD constant without producing waste. This is achieved by allowing the Gateway Burn per Relay (which is USD derived) to define how the rest of the parameters change.

In the case of POKT hitting 10B relays a day with a POKT price of $15c, ARR would crush the Servicer economy and produce significant overburn (Annual Emmisions Rate of -7.73%). BASH on the other hand, is able to maintain the Annual Emissions Rate goal of 0% (making POKT deflationary) but still maintaining a realistic node economy.

Node Ecosystem Growth

Node Ecosystem Growth

BASH also enables the Node Ecosystem to grow as relays grow once 10B relays a day is achieved, regardless of the POKT price. Prior to 10B relays a day, there are two options:

- Adjust parameters to reduce node rewards now (takes some custom configuring)

- Allow nodes rewards to decrease gradually until 10B relays

Both options are possible with BASH, but after 10B relays, POKT would continue to become more and more deflationary while also increasing node rewards and increasing the amount of burning and staking of existing POKT.

Direct Buy Pressure

Direct Buy Pressure

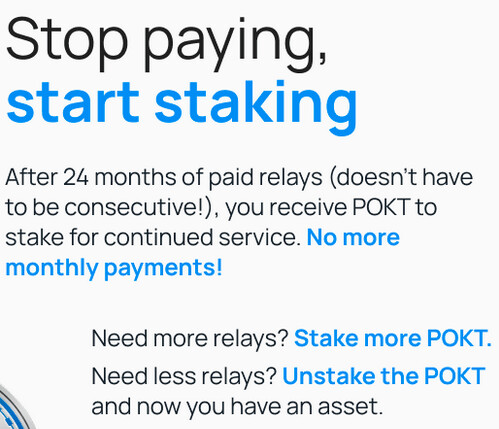

In order for gateways to stake POKT, they will likely need to regularly purchased it, especially once relays pick up. It would make sense that revenue from customers could be used to purchase the POKT.

If customer revenue is buying the POKT, it would make sense for gateways to allow the POKT to be staked on behalf of their customer, providing bit of a POKT rebate for using their gateway services.

Example:

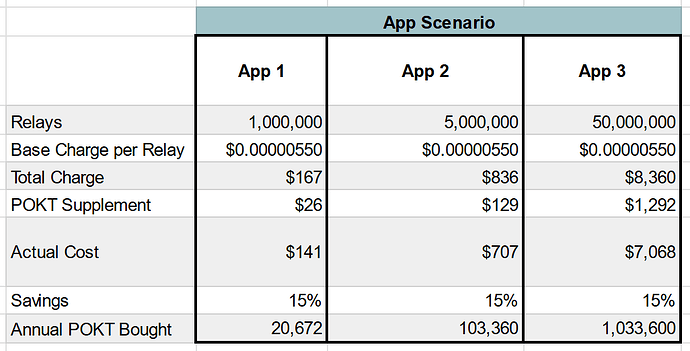

In the spreadsheet, I have included 3 customer examples.

App 1 would be charged $167 per month, but $26 of that would come back to them in the form of POKT being staked on their behalf, meaning the actual cost had a 15% savings. Allowing the app developers to own staked POKT would provide:

- Great marketing opportunities (diferenciates POKT from other services

- Allow app developers (who actively use POKT) to own staked in POKT (a real benefit leading up to v1)

NOTE: PNI already does something similar to this on their own, (I believe it is 60% of their customer payments to go towards POKT purchasing, though not sure if that has changed since the burn went into effect), but with it integrated into our economic model it will be more easily tracked, and more importantly, required for all future gateways.

If you think about it, app developers would make the perfect node staking clients. They are using the service and getting value from it directly without expecting significant POKT return rewards. The more app developers we can get to join the node economy through a mechanism like this, the more stable and healthy I believe the node economy will be.

Implementation

There is some solutioning that will be required to make this possible. Between POKTscan, PNF, and others in the community, I believe it can be done efficiently.

Monitoring/Tracking

Just like there are monitors for PNI’s weekly burning, there would also need a monitor to track the POKT being sent from gateways to stake. This ensures that everyone burning and staking as required by PNF to operate gateways.

Gateway Staking = DAO Staking

BASH requires gateways to stake POKT and there are a few ways it could be done, but the best way to me would through what I call DAO staking.

DAO Staking is where gateways must submit their POKT to be staked. Ultimately they are submitting it to PNF who is representing the DAO, but the idea is that it is being held by a third party, apart from the gateway. The DAO (via PNF) can commission node providers to stake the tokens on behalf of the gateway.

The rewards could go to the DAO, go the gateway, the app user, be burned, or just sit dormant. There are some options.

With the coming of wPOKT, this could actually be a very clean process where all gateway stakes are done via wPOKT. PNF would regularly take the wPOKT from the designated account and send it through the bridge and stake it on behalf of the gateway/user. Some custom development work would likely be needed to make this possible, but it could be a worthy endeavor as it would provide direct wPOKT utility and potential volume.

With the proper tooling it could be easy for gateways to submit wPOKT (or POKT if need be) for staking in a mostly automated fashion.

Transactions

Similar to SER, this model would require regular governance transactions by PNF. To account for it’s unique calculation, the following parameters would be regularly adjusted in accordance to the BASH model:

- RTTM

- DAO Block Reward

- Validator Block Rewards

- Servicer Block Rewards

V1 Potential?

The more I play with this model the more I feel that a continuous burn + staking requirement could be viable v1 mechanism. It allows the burn to be lower, while still providing token lockup.

Conclusion

This is either my economic magnum opus, or I have one variable wrong and it all falls apart ![]() I’d encourage anyone able to push the spreadsheet hard and verify that it is producing correct outcomes.

I’d encourage anyone able to push the spreadsheet hard and verify that it is producing correct outcomes.

If it is all correct, then I believe this is a worth while economic plan to consider. I know that for me I feel this hits everything could hope for right now. GRIP is welcome to do their thing. I’m doing this as a pre-proposal because I need more economic eyes on this to know it works.

I will still continue playing with it and will let everyone know of any updates, but my brain is fried from the amount of hours I have put into this. Going to the beach tomorrow to heal

Credits

This is actually a combination of PNF and POKTScan proposals with a mix of PNI’s strategy of using customer revenue to purchase POKT. I was able to put them together with my own twist, but major kudos for the work they have all been producing on the economic front to make this possible. Open to any feedback ![]()