Just so my feedback is here as well. ARR has a few blind spots that create an imbalanced ecosystem in curtain market conditions. The main one is it does not account for varying market conditions.

POKT Price Creates Imbalance

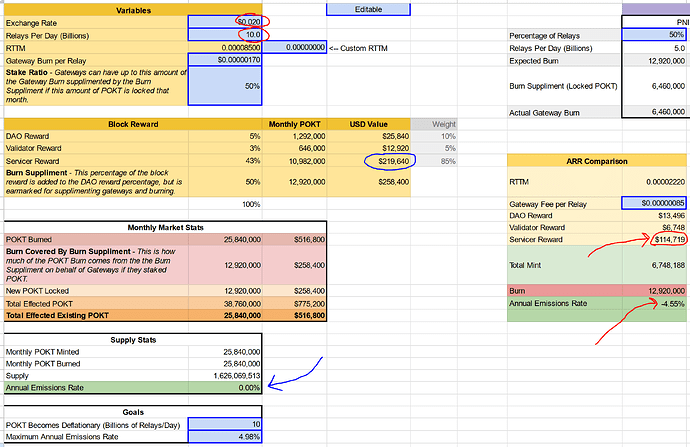

If the POKT price is reduced to $.02C by the time POKT hits 10B relays a day, the Servicer economy would be sitting far below what it tenable. ARR is designed so that regardless of what happens with the price, deflation is always prioritized, at the expense of the Servicer, Validator, and DAO economies.

That is hugely problematic and unnecessary. On the flip side, what I’m proposal with Burn And 🥩 Harnessing (BASH) Deflation Economic Model provides the same amount of tokens burned as ARR, but does not have the deflation imbalance (see left side of image above with the blue markings).

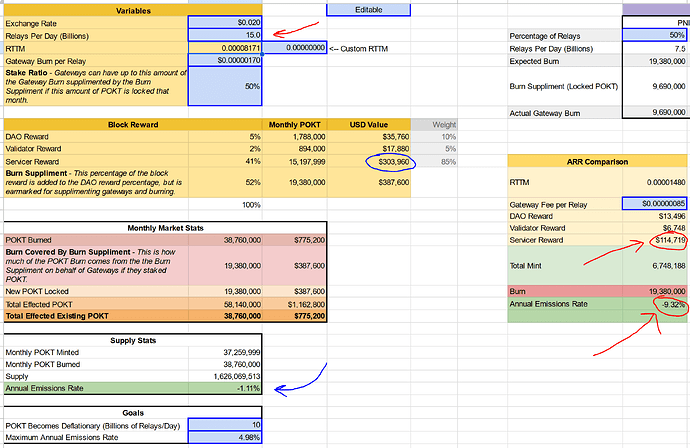

When looking at 15B relays, ARR again prioritizes deflation despite the fact that 50% more hardware is required to service 5B more relays. This type of model could likely crush QoS if relay growth does not allow servicer growth to account for more costs.

I created a section in the BASH spreadsheet that shows what ARR would look like with different market situations (as shown above). Changing the price and relays shows the imbalance that only favoring deflation will create. I encourage everyone to check it out.

The only outcome I could see is there will need to be future proposals for ARR at different price and relay points. Regarding BASH, comments about it specifically are welcomed on it’s thread, but I wanted to put the relevant issues with ARR in this thread for posterity’s sake.