PUP-23: Stairway to Sustainable Economics

Attributes

Parameters:

-

USDRelayTargetRange

-

ReturnOnInvestmentTarget

Current Values:

-

$0.0000018 to $0.0000031

-

10 months

New Values:

-

$0.0000068 to $0.0000113

-

24 months

Summary

Pocket Network is actively working on Portal Monetization and the topic has arisen in the comments of the following Forum posts here, here and here. In anticipation of releasing the Portal Monetization product we feel it’s important to update the effective app stakes cost for the service that Pocket Network is providing.

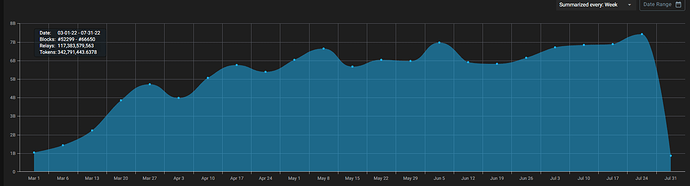

While the growth, speed, and quality of service of our network has increased and we have seen increased demand for App stakes, since May 2021 Pocket Network Inc has been pricing our offering based on the guidelines of PUP-7: Whole Lotta Requests. In this previous proposal, Pocket DAO set the parameter values for 1) USDRelayTargetRange (as a reflection of USDTargetRelay), and 2) ReturnOnInvestmentTarget. This proposal PUP - 23: Stairway to Sustainable Economics aims to update these parameters so Pocket Network can proceed with Portal Monetization and complete our economic flywheel.

The main objectives for this proposal are to:

- Contribute to sustainable economics: by increasing the cost of an app Stake, we can price the Portal service for dApp users to align with the value they are receiving.

Our current prices were calculated in a different environment when our quality of service, brand recognition, and breadth of blockchain support was not as competitive. Given that we have invested time and resources to overcome those pain points, we are in a much stronger position to offer a product of higher value and capture revenue for the community.

- Increase the security of the network: by increasing the price tag for a malicious actor to effectively buy the demand side of the network, we can make our help make the network safer.

By preventing our app stake costs from being disadvantageously cheap in environments when the POKT token price is depressed, the cost of capturing the App side of the Network can be increased and reinforce our safeguards

- Unlock Portal Monetization: by removing barriers to properly implementing shipping revenue collection, the Pocket Network portal team can update the price to reflect the cost to run the network.

The existing price was meant to be digestible for prospect users for only upfront costs. Now that we prepare to ship the Portal Monetization product, we will allow that upfront cost to be spread out. This means we can increase the price while keeping the price tag digestible for prospect users. This increase means an additional amount of POKT that will be purchased in the open market.

Of note: Portal Monetization proceeds will flow into the open market. If the Portal users pay in fiat, stables or other tokens, the payments will be converted to POKT in the open market in a transparent way that is outside the scope of this proposal.

- Stabilize the price: by adjusting the cost calculation methodology to reduce the variability of app stake cost, we ensure a reliable cost-basis for the user.

The existing methodology was too dynamic and dramatically dropped prices for Pocket’s service based on competitors’ entry into the market. This proposed methodology is more reliable and less susceptible to new competitors subsidies, irregular changes, and possible price wars.

In these respects PUP - 23 is an extension to PUP - 7. As a result we take note of famed philosopher Robert Plant who once sang: Pocket Network’s infrastructure is as solid as gold and so we’re are building a “Stairway to Sustainable Economics”.

Background Info

Why does the DAO delegate price adjustments?

For more detailed background information on why the DAO delegates price adjustments, please read the section of the same name with the original PUP - 7: Whole Lotta Requests proposal. As a TLDR,

The DAO Constitution then delegates the operational responsibility of price adjustments to the Foundation, by giving the Foundation the permission to adjust on-chain parameters in order to fulfill the USD targets.

This was designed in anticipation of the need to be operationally responsive to price fluctuations, along with the desire to minimize the operational burden on the DAO. Thanks to these measures, the DAO only needs to vote each time they want to adjust the $ price, rather than every time the POKT price fluctuates

Why should the DAO update the price?

The current cost for a Pocket app stake is 10x the cheapest monthly cost of our competitors. This is what we currently quote dApp developers, ecosystem foundations, and strategic partners. Regardless of the price of POKT, this is an estimated $950 USD per million daily relays as a one time cost (as of July 2022). When we wrote the original proposal, the cost was $2.7k USD per million daily relays.

This proposal aims to do this by adjusting 2 things:

- increase the multiple from 10x to 24x the average monthly cost of our competitors.

- recalibrate the way we calculate the multiple

– from cheapest cost of our competitors

– to the average of the 2 highest cost competitors

ReturnOnInvestmentTarget = 24 months

In PUP 7, this value was voted on as 10 which is a proxy for 10 months of cost upfront to own the app stake. In this proposal PUP - 23, we propose this value be 24. This essentially would increase the cost so it goes from 10 months of the average of centralized competitor rates to 24 months of the same rates.

This 2.4x multiple on the most recent rate is important to get back us to sustainable economics by leaning accomplishing the following 3 main goals:

- Leveraging the fact that Users own their infrastructure

- Generate more demand side revenue for the ecosystem

- Unlock the Portal Monetization product

Own your infrastructure

One of Pocket’s unique advantages is that staked dApp users effectively own the bandwidth they use. This is meant to align the interests of the users with the network. This is not true of our competitors which will give users 10 months of service at this same price with no equity, stake or ownership of the bandwidth. Centralized competitors have implemented SaaS models that are meant to keep users paying in perpetuity.

More demand-side revenue

By collecting more demand-side revenue from app stakes than we have in the past, Pocket Network is able to bring relief to the entire ecosystem. With a higher cost per app stake, we can increase the amount of POKT demand side buying pressure which would provide new liquidity into the market and benefit the supply side of our ecosystem which currently gets paid in POKT.

With the estimated cost of the supply-side of the network decreasing after PIP - 22, PUP - 19 and the light client, we have an opportunity to make the most of the existing market of available relays. If we estimate a capturable market of $5M monthly recurring revenue across the RPC industry today, that’s over $120M of available application sales available to us, not including growth of our nascent industry.

This provides a strong counter balance to decreasing the annual cost of operating Pocket Network to under $5M a year. This proposal unlocks the Pocket Portal to take any equivalent payment of stable, fiat, and other limited Native tokens, and funnel that revenue into purchasing POKT on the public markets. This would be an additional option to any users who of course can bring and stake with their own POKT tokens. This closes the loop of the two-sided marketplace we have intended from the beginning.

Unlock the Portal Monetization product

The Pocket Network product team is adding a 2nd option to the user to spread their app stake over time. At present this option doesn’t exist, and the Portal Monetization process aims to productize the collection of revenue using different payment methods. The objective is to reduce the barrier to entry for those who are unable to pay for a full POKT stake up front.

USDRelayTargetRange = $0.0000068 to $0.0000113

This parameter range wouldn’t change with this proposal. Pocket Network would continue to adjust it dynamically based on the details outlined in PUP - 7.

USDRelayTarget = $0.0000091

The way we calculated the parameter is not as relevant due to recent developments. Hence we propose we update it (and the < USDRelayTargetRange > as a result). In PUP - 7, the methodology was such that we took the lowest price point among competitors as outlined below:

The last point is the strongest factor in our opinion, which is one of the reasons we’ve been subsidizing relays until now. It is our view that we should maintain a cheaper price at least until we have caught up to our competitors with quality of service and usability.

To achieve this cheap price, we take the minimum cost being offered by alternate service providers, attach a target buffer that pads the lower and upper end for a target range, and then adjust off-chain governance parameters that make up the Relay Throughput (see appendix).

Now that Pocket has caught up to our competitors with quality of service and usability, we feel compelled to revisit this. When we wrote this proposal there were 3 competitors and prices didn’t change much . Since then there have been 2 additional competitors to the list and we have seen prices change significantly.

Given the introduction of new tiers as well as a generous expansion of free tiers from our competitors, there has been a race to the bottom as far as pricing. In May 2021, the cost for ~1 million relays was ~$2700 USD. Right now, the adjustment of the has cut that cost to ~$950 USD. Simply put, this means that the PUP 7 methodology could return less and less revenue to the pocket token economics (and the community members, token holders, and network participants as a result) over time.

As an alternative, we propose that we remove the calculation of being a monthly multiple of the ”minimum cost being offered by alternate service providers” and replace it with being a monthly multiple of the average of the 2 most expensive being offered by alternate service providers. Remember, since POKT is the token of Pocket Network’s economy users are also owners in the value accrued to POKT (e.g. “Web3 is the internet owned by the builders and users, orchestrated with tokens” - C. Dixon), this commands a competitive fee as it is a distinct difference relative to alternatives who are extractive from their users.

This provides the network with the following benefits:

- Less thrash: since we are taking an average of 2 values, no single price change will drastically change our overall pricing scheme.

- Premium servicing: by taking the 2 most expensive of alternate service providers, we are anchoring to those best in class who are bringing in real revenue vs. the recent projects that are offering close to free service by subsidizing demand

- Competitive economics: by taking the 2 most expensive of alternate service providers, we are working towards returning as much revenue to the Pocket Network as our competitors extract from their user base. Originally, we were taking the least expensive of the original set of 3 competitors. Now that there are significantly more competitors with only a limited offering, we want to avoid partaking in a race to the bottom among them.

Anti-goals

To achieve the 3 main goals listed above, this proposal is intended to be as focused as can be. For this reason, we also have the following anti-goals:

- Competing with other providers solely on price

We maintain that our unique decentralized product with a staking model is not an apples to apples comparison with others.

- Overanalyzing or “boiling the ocean” in trying to find a single cost for every user persona

Our competitive intelligence exercises have revealed a myriad of pricing strategies across other infrastructure providers based on different products. It is extremely complex to calculate fixed app stake cost with a pricing structure that varies based on use case. As a result, we intended to keep the protocol level app stake cost uniform.

- Relitigating PUP -7

This proposal is merely an extension of the previously voted upon PUP - 7. That proposal was based on Pocket’s unique protocol design and PUP - 23 is not meant to take a affirmative or negative stance on that decision; it is merely meant to update the parameters to match the current environment.

# Conclusion

These proposed 2 parameter changes in tandem will make Pocket Network token economics more competitive, predictable, and accretive. Revenue design can be a large strategic decision, and doing so on a protocol level is even more difficult. However, it is clear at this point that we have to first start by remedying PUP 7 in order to get cost calculations back on track so we can ship Portal Monetization. Ultimately, this will be the first among several steps down the path (or up a stairway) to more sustainable economics.

Dissenting Opinions

We should leave the parameters at current levels

Leaving the parameters at the current levels runs several risks. They are outlined in the section above. As a quick recap, leaving the app stakes costs where they are now broadly put us at risk of not achieving 1) economic sustainability, 2) network security, and 3) Portal Monetization adoption.

However, an equally important business issue is that Pocket Network could be “leaving money” on the table. This 10x the monthly average of competitors rate was calculated when the cost of running the network was significantly lower, our quality of service was not as competitive as our centralized competitors , and Pocket Network had less brand recognition.

Several developments have happened since then:

- Our quality of service has improved to even exceed our centralized competitors on critical performance metrics (creating more parity between us and the centralized route)

- Our brand recognition has improved greatly (unlocking partners like Polygon Studios, Aave, and Harmony that were reticent to be users back then)

- Our support of various blockchains has broadened (expanding our total addressable market and users that are willing to pay us for critical infrastructure services)

While we have users that are paying to use our service now, we are confident based on our business development conversations that we can charge more for service, add the product feature to split that cost out in monthly installments, and infuse more buy pressure for POKT in the open markets.

Won’t raising app stake prices make demand go down?

This is a valid concern. It is intuitive that all else equal, customers prefer a lower price.

However, there are a couple of details to outline here:

- We are not raising app stake prices in a vacuum

We are actually restoring prices to be comparable to what we had originally proposed, and then increasing it over a longer period so our Portal Monetization pricing structure is more sensible. We are not proposing we change the price out of turn. We are proposing we change the price so make progress on the Portal Monetization strategy.

- Our unique staking model means that “all else is not equal”

We maintain that since our Node Runners give a service on a perpetual basis based on the staking model, our competitor’s SaaS model should not be equated to the pricing model that Pocket offers.

- Price can signal the quality of the product

Our Business Development team has received multiple data points that there are competitors that offer their services for free on an ongoing basis. We have also seen offers from competitors win deals from apps and blockchain foundations that are in the seven figure range. Given the rationale outlined in sections above, we are confident that our proposed price point signals a high quality of our product. When we were bootstrapping the network and only single digit million daily relays, we largely subsidized our network. Now that our service has improved and we have scaled into more than a billion daily relays, Portal Monetization aims to have the price signal a better quality.

So how much will this cost to the User? Why are these costs so confusing?

Adjusting parameters are the mechanism for the DAO to give guidance to Pocket Network. Changing these 2 discussed parameters values update the cost of an app stake which is a main input into Pocket’s token economics. The cost of an app stake dictates how much the demand side pays the protocol for the service that the supply side provides.

Using this guidance, the price of a Pocket endpoint will reflect these values:

| Scenario | USDRelayTarget* | ReturnOnInvestmentTarget | ~ Cost per million daily relays (USD) |

|---|---|---|---|

| Original PUP - 7 values in June 2021 | - | 10 | $2,375 |

| Revised PUP - 7 value in February 2022 | $0.0000025 | 10 | $950 |

| Newly proposed values with PUP - 23 | $0.0000091 | 24 | $6,625 |

Source 1 2 *using an updated calculation for Price per Relay

With these costs in mind, Pocket Network (and any other Portal service provider for that matter) will price service accordingly.

Portal Monetization will introduce various payment methods over time. Regardless of which option a user chooses, they will still pay approximately the same price that can cover the ~ Cost per million daily relays for how many relays they are staked.

Interestingly enough, if other parties build and operate new portals, they can use whatever pricing structure they desire. They can decide to set a price more than or less than the cost for an app stake. However, their cost for an App Stake would be the same protocol level for ~ Cost per million daily relays.

The calculator that guided our cost model seems to have changed.

Correct.

Pocket Network Inc uses these tools for guidance. Based on community member feedback, we propose to simplify the model and reword some of the terms.

The main difference is that we updated the USDRelayTarget to have the same calculation as a Price per Relay. This is not a linear calculation because each competitor measures a request different (Pocket uses a relay, Alchemy uses compute units, Quick Node uses API credits, etc). This proposal is a useful occasion to standardize our pricing models as best as we can.

Previously we were using a larger unit value that was particular to how we calculate base throughput. However, with a more standardized Price per Relay, we maintain like the math is clearer. This adjustment also shows the previous values for PUP - 7 for comparison purpose. Regardless of the outcome for PUP - 23, we are inclined to use this updated USDRelayTarget definition, and so it is important we highlight these changes in the calculator.

Why more expensive than the competitors?

In the section <Why should the DAO update the price?> we outline why we think Pocket is unique enough to warrant a premium. This rationale is long standing and based on our unique protocol.

However, there are some additional considerations that expand on this and further justify why our service would be worth more to a user.

- We are not charging additional per call type (Alchemy, ANKR and Quicknode charge more based on how expensive the call is )

- We are not limiting number of endpoints or number of networks

- We support more networks than any of the competitors

These features that may change over time for both us and competitors. These are not based on protocol, but Pocket Network has no reason to change them any time soon.

In it’s totality, Pocket Network’s product design and features makes a unique value proposition to users.

Aren’t all stakes close-to-free anyway due to Gigastakes?

Nothing will change about how the free tier is configured as per PUP - 9: Gigachad Pocket Portal Free tier. For context, Gigachad stakes is a technological design that enabled Pocket Network to provision app stake access for free tier usage during V0 product design. Until V1, Gigachad stakes will remain in place for scalability reasons regardless of the outcome of this proposal.

The cost for app stakes laid out in both PUP - 7 and PUP - 23 is the quoted rate we use for dApp developers, foundations, and new chains. This guides us in collecting revenue for the demand side access to our network, beyond the free tier. Nothing about the free tier is impacted by these proposals.

Won’t this impact my current Node economics?

This will actually positively impact current node economics. All else equal, the economics of PUP - 23 will increase the demand-side buying pressure by ~7x of POKT and should be a positive force to token economics. This would in turn, positively impact POKT token economics thus adding to node operator revenue (in fiat terms), and slow down the impact of inflation.

This would adversely affect the Node Runner configuration

These parameters should have no impact on node configuration as it has been the case in the past.

Applications won’t pay this much in advance

This is actually one of the main impetuses for our Portal Monetization strategy. We aim to give the option for users to pay this amount over a longer time period and then be rewarded with ownership of the stake at the end of the 24 month period.

Additionally, it is much easier to lower prices rather than increase them when going to market.

Copyright

Copyright and related rights waived via CC0.

Appendix: How Relay Throughput is Calculated Based on Stake

The relay throughput for an application is determined by the MaxRelays parameter, which is defined by this Protocol Throttling Formula:

MaxRelays = StabilityAdjustment+(ParticipationRate∗BaseThroughput)

Base Throughput

The purpose of the Base Throughput is to set the number of Relays an Application can get based on how much POKT they stake. This is the most direct way to adjust the Max Relays for the long-term and is updated at the discretion of the DAO.

For more details on the Base Throughput, see the documentation here.

As noted, the BaseRelaysPerPOKT parameter is not suitable to be fully-automated as it is susceptible to the Oracle Problem. As a result, it is incumbent upon the DAO to regularly adjust rates based on what we vote on as an acceptable cost structure to Apps.