Author: Daniel Ward

Recipient: Pocket Network

Category: Imbursement

Fulfills: N/A

Related Installments: PUP-12

Asking Amount: $2,000,000

Dissenting Opinions: N/A

The current issues facing the POKT community regarding the declining token price are a monetary phenomenon: excessive printing of tokens, inflationary rewards, selling POKT into a thin market to cover node expenses, etc.

To not view and address the issues at hand as a monetary problem is a significant error in my opinion. The recommendations I have put forth will work hand in hand with WAGMI and the proposed reduction in infrastructure costs to bring stability to the POKT ecosystem and restore confidence in investors and potential investors.

In POKT’s Monetary Policy it is written: “This shift to long-term sustainability revolves around burning POKT to ensure the POKT supply is stable and doesn’t lose its value as a form of consideration to Service Nodes.” POKT burning is necessary for a stable system. Quite simply, the system must cease being hyperinflationary.

In addition, I have several recommendations which will be value-added to the POKT project and extremely supportive of the token price:

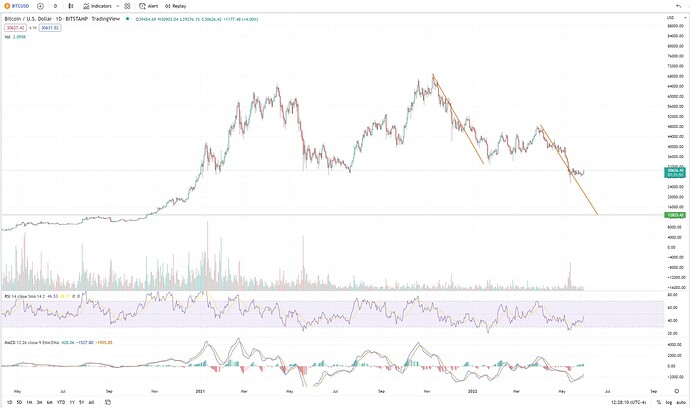

- Immediately back a percentage of the Pocket Network treasury with physical gold, physical silver, and Bitcoin. Bitcoin should be purchased when/if it goes sub $20,000. Statistically speaking Bitcoin has a good chance of making a “Bearish measured move” down to sub-$13,000 per Bitcoin (see chart). For this endeavor the Pocket Network raises the funds from its Treasury, sells a portion of its POKT tokens OTC as to not affect the thinly traded market or raises funds via Venture Capital, etc.

- This would be a fantastic press release and give confidence to investors that POKT has tangible assets backing the project.

- Initial Budget: $800,000 for physical gold, $600,000 for physical silver, $600,000 for Bitcoin.

- This diversifies Pocket Network’s holdings and puts a percentage of its funds to good use.

- Physical gold, silver and Bitcoin are liquid and can be sold if funds are suddenly needed.

- The physical gold and silver will be vaulted and insured at one of several locations in the United States (DDTC in Delaware, Dakota Depository in North Dakota), or overseas with Matterhorn Asset Management, etc.). Vaulting and insurance fees average $4500 annually for $1,000,000 in precious metals. I recommend buying gold American Eagle 1-troy ounce coins as well as 1-troy ounce silver coins: Canadian Maple Leaf, Australian Kangaroo, South African Krugerrand, American Eagle, etc.

- Both physical gold and silver have extremely “bullish” charts which statistically support powerful moves to the upside in the coming years (see attached charts).

- In my opinion Bitcoin will continue to gain worldwide acceptance and value as the fiat monetary experiment by Central Banks fails. I expect the price of Bitcoin to exceed $200,000 in the next 5+ years.

- Create an investment and management company for the Pocket Network. Send 2% of all future Pocket Network revenue, quarterly, to this company for investment diversification: specifically, investments in equities, land, and natural resources; e.g. Berkeshire Hathaway stock, Index Funds (SPY, QQQ, VO, TLT, RJA), Real Estate Investment Trusts (REIT’s), raw land, etc.

- This diversification will smooth out the rough patches during crypto bear markets and should give more stability and a solid foundation to the price of the POKT token in the coming years.

- Conduct a semi-annual review of the investment portfolio to ensure that benchmarks are being met (comparison to general market indices, etc.). Present a forecast and analysis of economic conditions to the Pocket team. Make recommendations and adjustments to investments as needed. The author of this proposal has agreed to direct the investments pro-bono for a period of two years and is responsible for the success of this project and the setting of key milestones and deliverables. However, the Pocket Network is welcome to hire an outside Investment Advisory service if desired.

- All funds would be under the control of the Pocket Network. In addition, the author of the proposal has agreed to purchase the precious metals on behalf of Pocket Network at a significant discount to the prevailing market rates.

- Investment allocations will be at the discretion of the investment advisor. providing that they are investments reflective of a sound Fiduciary nature.

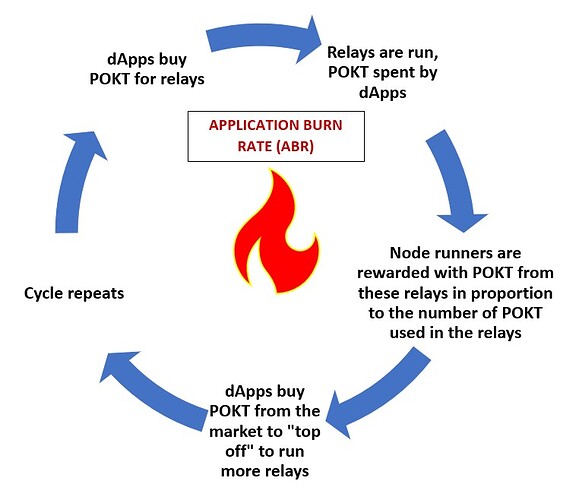

- Immediately implement a gradual and incremental Application Burn Rate (ABR) to eventually keep POKT emissions in line with paid demand.

- The ABR should be fully implemented within 6 months to a year or such time that the DAO and POKT Network finds is the best fit for the ecosystem. My recommendation is “sooner rather than later.”

- The ABR extends to all groups including early investors and companies who are receiving free relays.

- When the ABR is fully implemented, token creation cannot exceed what developers are buying to run dApps or “topping off” with more POKT to continue running them.

- To allow for future expansion and the provisioning of new nodes several methods can be discussed to achieve this at a future date.

Incorporating the Application Burn Rate is a sound monetary policy and creates a virtuous cycle:

Gold chart: Very bullish cup and handle

Silver Chart, very bullish Flag Formation

Bitcoin Bearish Measured Move

When looking at the POKT token through the lens of a “currency” that is used within the POKT ecosystem it becomes clear that currencies need to be a store of value in addition to their utility. This creates long-term stability, investor confidence and a firm foundation on which to build the rest of the project. Note that parts of these recommendations in this proposal can be adopted separately without nullifying the entire proposal.

Author and Contributor: Daniel Ward, Private Equity Risk Manager and Business Development. Former Series 7, 63, 24, 55. Mr. Ward has over 20 years of experience in wealth management, business development, risk management and is also the owner of True Metals Group (www.FortressBullion.com), a family-run company he founded in 2008 and now serves in the role of Advisor.

All Copyright and related rights waived via CCO