@JackALaing @lex @iaa12 @o_rourke @Jinx

The point that I find most salient in this thread is the one about massive overpayment to the supply side.

This is 100 percent accurate, we are overpaying the supply side, as so many startups do because it is the hard side of the network. The will, of necessity, end. This is a given.

However, what this point has so far failed to capture is that the overpayment is happening in a commodity, not an asset, and that this commodity is needed for the network to scale.

This is a distinction that is lost on a lot of people who heretofore are used to pricing assets (which is a lot of crypto.) Cash is an asset, homes are assets, stocks are assets. Steel is a commodity, oil is a commodity, grain or lumber are commodities.

Assets are created as a way to store and transfer the outputs of spent energy.

Commodities are the inputs that get consumed during the energy spending process.

Therefore, any economy can be defined as the process of turning commodities into assets.

Q: What happens if an economy runs out of its commodities?

A: It ceases being able to produce assets.

So what does that have to do with POKT?

As POKT is a commodity, the more POKT that exist the more assets (in the form of money) the POKT economy can create. However, the opposite is also true. If we constrain the supply we start to cap the number of assets (stored output) that can possibly be created.

A reduction in inflation would invariably create upward price pressure, however, once all of the available POKT was “spent” in the form of staked nodes, and staked Dapps, the network would no longer be able to grow without either a) re-increasing inflation or b) reducing the number of POKT required to stake a node.

EITHER of these tactics, deployed at a time when the network has hit a mature state, would cause an incredible amount of volatility, which will be much more undesirable in the future than now, potentially unwinding staking businesses, Dapps, and even the network itself.

It is far better to overprovision the POKT network now than risk its underprovision later. I think most of the people on this thread would find that to be an uncontroversial statement. It’s the core assumption in the rewards math in the first place.

It seems to me the debate is by how much we want to overprovision the network, which is a healthy debate and worth having.

But more importantly, I think we need to first agree on what standards we’ll use to measure.

I’d like to suggest that for the sake of the long-term health of the project, we disregard token price and instead focus on market cap.

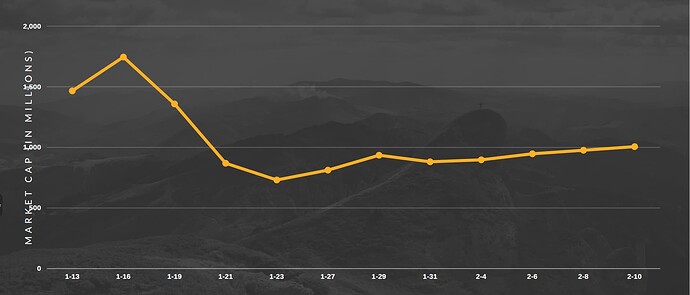

Looking at Mcap, we can see that inflation hasn’t really impacted things all that much, and the most significant catalyst in terms of negatively affecting price was the exchange listings. Market cap and price have both been relatively stable since listings have enabled more efficient price discovery, with the market cap on a slight trend upward (which is exactly what we want).

IMO if we wanted to stabilize prices for those providing service to the network, the best way to do this would be with a POKT settled futures contract. This is a tried and true way for producers to manage price risk and offload that risk to the speculative market.

Were tokens to be less valuable per token than when some in the network bought, long term that will be positive for the network as it will force or otherwise incentivize large holders to sell, thereby increasing decentralization in the network.