Attributes

- Author(s): @adam

- Parameter: RelaysToTokensMultiplier, DAOAllocation

- Current Value: RelaysToTokensMultiplier: .01, DAOAllocation: 10%

- New Values: RelaysToTokensMultiplier: 0.003162, DAOAllocation: 20%

Summary/Abstract

While we decide on a long-term future framework for determining the RelaysToTokensMultiplier, it makes sense to bring down the inflation to a reasonable level so the discourse isn’t rushed. I’m working on a second proposal that may trigger substantial debate. I suggest a change to the parameter that would, at current relay/node levels, provide for a 80% annual return for node runners in one year and a 10% increase to the DAO allocation from minted tokens to encourage the growth of the network. As relays increase, node rewards will increase as well.

Motivation

As the original proposer of the WAGMI proposal, the general reception has been positive, yet there is still room for improvement and debate. I’m working on a counter proposal with @o_rourke to propose a system that is more inspired from the original economics. While I believe there will be a large amount of support for this new proposal, I would like there to be ample time to debate the proposals.

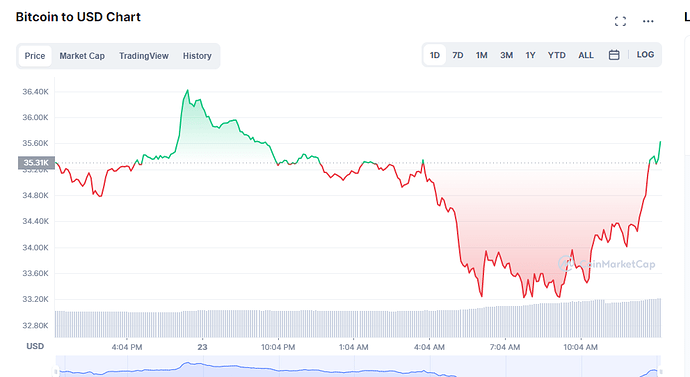

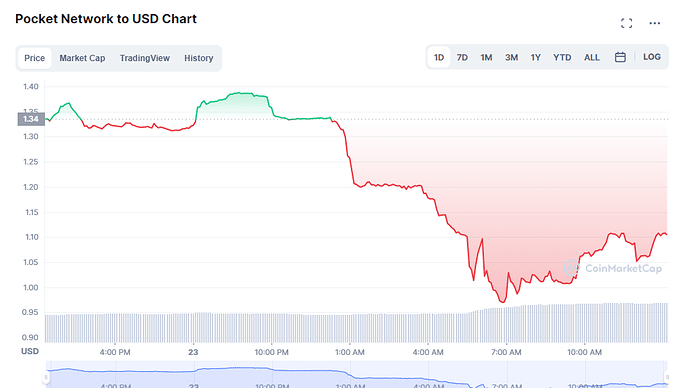

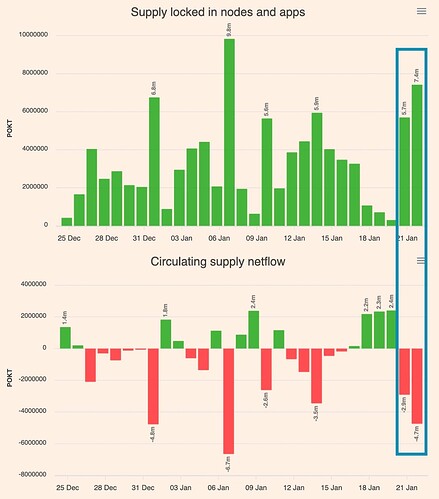

Meanwhile, daily inflation remains in the millions, which is a major concern for new participants and those deeply familiar with the project. With the new listing, I believe that this is creating uncertainty in the market. It’d be much more effective to rein in inflation during the debate, with the option to change it down the line or implement one of the frameworks that will be suggested.

The intended effect of the RelaysToTokensMultiplier parameter change will bring annual POKT returns equal to roughly 100% return on a node over the course of 15 months, all else being equal. That said, as relays continue to grow and as node count increases, this is subject to change. In essence, we’d be bringing down per node token incentives to about 41 POKT per day - about 15,000 annually.

Further, the change to the DAOAllocation, which I’ll call the DAOAllocation, is intended to increase the DAO treasury and keep up with inflation. To give the reader a sense of the inflation impact on the DAO treasury, the treasury is being diluted at about .5% per month at current rates. An increase to the DAOllocation would not fully offset this dilution, but would make the dilution less impactful.

Rationale

A change to the RelaysToTokensMultiplier to 0.003162 is designed around the concepts debated thoroughly in PUP-11: WAGMI. At this new parameter, at 300M daily relays, we’d mint 345M tokens over the course of 12 months which equates to roughly 41% annual inflation.

Please see a calculator here: RelaysToTokensMultiplier Update w/DAO - Google Sheets

Dissenting Opinions

-

Node growth will slow - There is a tradeoff in growth of new nodes coming online balanced out with Pocket’s growth in relays. While there should be a slowing of growth due to the reduction of rewards, I believe that relay growth will result in continued demand for nodes. Further, certainty around inflation will cause an increase in token price to offset some of the lost rewards meaning that on the net, rewards won’t decrease as much as first blush would suggest.

-

Let the market work out the price / Our market is so big that near term inflation doesn’t matter - This is an argument we’ve heard repeatedly in WAGMI, but there is a very real notion that token price matters externally for the success of the project. I wish this wasn’t the case, but a negative opinion of a token that reduces from where we are today to something far less, caused by inflation, would forever put a stain on the token itself and the project as a whole. This is a risk not worth taking. This argument is mostly made by those that have made a large amount on POKT already which puts new entrants in an awkward position.

-

The DAO gets enough tokens as is, they don’t need more - While the DAOllocation is 10% of the currently minted tokens, it’s far less than I think is needed for the long-term benefit of the network. The near term investment will pay dividends to growth. I would encourage node runners to allocate a portion of their rewards to grow the protocol they depend upon for token incentives.

Analyst(s)

@adam, Core Team Member, NachoNodes Partner, pun maker, pikpokt on discord

Copyright

Copyright and related rights waived via CC0.