Compensation Contemplation

Overview

While rewarding all those who help lift the token price makes sense, structuring rewards as does this revision of PIP-38 is deeply flawed and totally unnecessary. We argue for retro-funding as a far superior reward mechanism. The changes proposed here vastly improve PIP-38 and in no way impede Michael’s ability to revitalize Pocket network.

This post was edited July 24 to move discussion of compensation for shipping Shannon till after that for achieving POKT price targets. We also make clear that retro-funding should be used not just for hitting price targets, but also for rewarding Shannon contributors.

Two Parts

The compensation package has two parts: 48m POKT for completion of Shannon and a combined 292m POKT - a 17.3% dilution of todays’ POKT monetary base of 1.686b tokens - for hitting price targets of $0.50, $1, $3 and $5 (48m + 48m + 98m + 98m respectively). Michael would not participate in the first distribution.

Price Targets

Defining Price Targets: Reputable Source

How does one define price targets? The source needs to be well defined. The TWAP from Coingecko? Some other reputable source? By not defining this clearly we risk cherry-picking from an unreputable source that could lead to an undeserved payout.

Retro-funding for Contributors

The proposal should contain a retro-funding commitment that generously rewards all those who contribute to the achievement of the price targets (the DAO has a proven retro-funding track record). When each of the targets is reached, PNF can prepare retro-funding proposals for a DAO vote. There need not be a three-year limit on reaching these targets. The time frame can be extended or open ended.

Retro-funding gives the DAO a role in determining how grants are allocated. Future retro-funding rounds can be structured in a way that’s responsive to the circumstances and tokenomics that will exist at that time. Among other problems, creating a scheme now needlessly handcuffs the DAO.

Cause-and-Effect Metric Needed

While it’s reasonable to use price targets to trigger a compensation review, other criteria or metrics need to be considered in determining whether to actually pay compensation.

For example, what if the price goes up without appreciable changes to the fundamentals? Can we really expect the token appreciation to endure if nothing on the ground changes? Further, how do we attribute the growth in value? Is that due to Michael and/or other contributors? External factors?

The real question is: Do Michael and/or other contributors deserve compensation if the macro condition improves but the underlying fundamentals remain the same? Other measurements that provide a more well-rounded picture of progress should be considered. Those could be:

-

Trading volume to X value or increased by X%

-

Listings on Tier 1 exchanges

-

Paid relays increased by X value or X%

-

Net inflation (supply growth - burn) less than X%

-

Gateways increased to total count of X

-

Max X% of paid relays from a single source (a metric of diversification)

One or more of these metrics could yield a better picture of the health of the project rather than just the token price.

Hitting the price target must not be a guarantee of compensation. Whether it’s retro funding or not, in determining whether to award a grant the other criteria/metrics would have to be considered. The proposal must make this clear.

Value Creation and Compensation

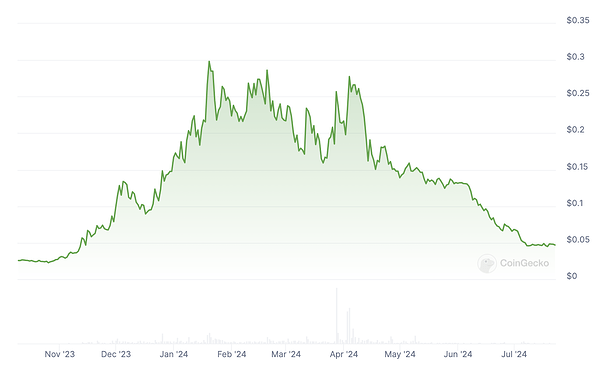

Including this latest bull, which helped drive the price up for about 6 months (now it’s back to the original baseline), there’s been no sustained value creation for the network. By providing short-term price targets of only 30-day duration, we’re setting ourselves up for another chart like this:

If another such chart is generated but with new highs, are we really creating long-term value for POKT holders that warrants compensation?

Retro-funding is much better suited to allowing for these assessments. We can gauge value created and reward accordingly. The spirit of this retro funding would be to assess and generously reward all those who helped create value (devs, directors, marketers, etc.) according to their participation. The DAO could even commit to allocate some percentage of value created to those who contribute, say, 10% of all value created. If the fully diluted valuation (FDV) goes from $100M to $1B, then the DAO would distribute the equivalent of $90M ($900M of value creation) amongst all who contributed to this success.

However, if instead of retro-funding, compensation is included as part of this PIP, we must opt for something more enduring like a 6-month TWAP to ensure this isn’t just a pop in the price due to a marketing blitz, short-term incentives, or some sort of unsustainable liquidity increase. The goal should be a lasting increase in value to the token that sets a new baseline for the project.

Unnecessary and Harmful Inflation

The tokens minted to pay the price-target compensation - representing a 17% dilution of the POKT monetary base - could jeopardize the token price once unlocked. See Shane’s recent post in the Den. That there is a 4-year lock and requirement they be released afterward at the rate of 25% a year only kicks this can down the road. Why weaken the token if we don’t have to?

Retro-funding makes it possible to calibrate the grant amounts and tailor the terms in a way that will not hurt the token price.

Alignment of Michael’s Financial Interests with the DAO’s

The tens of millions of POKT Michael currently holds should be incentive enough to reach all the price targets he cites. (Michael says he will not be drawing a PNF salary until he feels “comfortable with runway and where we are headed.”)

However, the current compensation structure misaligns his financial interests and those of the DAO. As noted previously:

We strongly urge Michael to accept retro-funding for his own compensation. It’s the ideal and simplest way to align his and the DAO’s financial interests. However, if he chooses not to do so, he could be given - as suggested in my earlier post - a very attractive threshold option as an alternative to what’s been proposed in this latest revision of PIP-38.

Other Items That Need Addressing

The proposal should make clear that if Michael loses his directorship, he is no longer eligible for compensation for price targets that are hit subsequently.

This is unclear. What does “date of receipt” mean?

Shannon Completion

For the reasons that follow, our view is that the best way to compensate those who worked on Shannon is retro-funding.

Cryptocorn argues that the 48m incentive for shipping Shannon may be needed to complete work on the upgrade. To assess the validity of this argument, Michael would have to disclose whether the engineers and devs working on Shannon already have token packages, and if so, how big. We also would need to know how much POKT Grove is sitting on that could be (further?) allocated to them. Lastly, if Grove has not given these guys tokens and doesn’t have any to give them, it can give them equity if they don’t see upside. Why is it the DAO’s responsibility to incentivise them?

It’s also worth asking what happened to the 30M POKT tokens from PIP-49. In 2023, the DAO bailed out Grove which didn’t have enough tokens to incentivize its 66 employees. Grove then turned and slashed its headcount by over 50%. It’s unknown what happened to these tokens and if Grove recouped them. It’s also been noted by Michael that the protocol team turned over - resulting in the likely recovery of their tokens too.

If Grove were following standard operating procedures, it would have recouped most of those tokens from employees that were let go and reallocated them to mission critical staff that was retained or new hires. It’s difficult to believe that with that amount of tokens to play with, plus equity incentives in Grove, there is an urgent or imminent retention issue regarding the protocol team.

There’s some speculation in this (I’m assuming that these tokens were repurchased by Grove according to a token plan), but either way, the DAO is owed clarity on the outcome of PIP-49 before deciding on new compensation for these same individuals that were among the beneficiaries of 30M POKT. If the DAO mints tokens to pay those who are already well taken-care of, then we’re just making the rich richer at the expense of current holders.

Retro-funding is Shannon Solution

If the DAO is to provide these guys a reward, it should do so by retro-funding. In justifying and quantifying retro rewards, the questions on what they got and should be getting from Grove can be properly considered.

To summarize, to decide on whether the DAO should reward the Shannon shippers, we need transparency from Grove. Any DAO rewards should come from retro-funding.

Conclusion

Retro-funding is the way to go with compensation for sustained price rises that can be traced to actions by contributors. Michael, however, is a special case. To properly align his financial interests with those of the DAO, he should either agree to retro-funding (or have to reach agreement on threshold options with TWAPs of at least six months). Replacing the price-target payouts with retro-funding preserves all the upside of compensation and eliminates all the downsides including inflation.

Cannot Vote for PIP-38 As Is

In good conscience, we cannot support PIP-38 unless retro-funding replaces the ill-conceived 48m and 98m POKT compensation pools including the one for shipping Shannon. Also, clarification must be provided on what constitutes hitting a price target. Further, it must be made clear that retro grants will be awarded only to those who contributed to the price rises by value creation and that hitting the price targets alone will not guarantee anyone a retro grant.