Attributes

Author(s): Corey Duzy, Account Manager - Messari Protocol Services

Recipient(s): The funds will go to Messari Protocol Services, the public-goods-funded arm of Messari that provides open-source data, analytics, and reporting for DAOs.

Category: Relationship

Asking Amount: $25,000 in POKT or USDC per quarter ($100,000 total over four quarters)

Summary

We propose that Messari continue providing investor relations services for POKT DAO with in-depth reporting and research. This would serve to better inform existing stakeholders, as well as attract new ones, while building out the open-source data infrastructure for the community.

These reports will be a continuation of the previous quarterly reporting, live as free resources on Messari, and will be distributed through our newsletter, social media channels, and third-party distribution partners including Bloomberg, S&P Global, and Refinitiv — which reaches an audience accountable for over $10 trillion in value.

Abstract

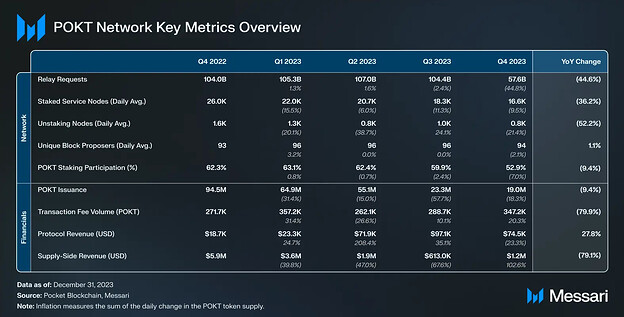

Beginning in Q2, Messari will provide 4 quarterly reports that present and analyze major KPIs and fundamental metrics which will include:

- Amount of POKT staked

- Relay requests

- Protocol revenue

- Service Node rewards data

- Gateway breakdown

Where relevant, these data points will be split on a per-chain basis. The report will also delve into major governance developments, upgrades, and key roadmap initiatives on a recurring basis.

- Pocket examples include: Q2 2023, Q3 2023, Q4 2023.

- Examples of other projects include: The Graph, Filecoin, Livepeer

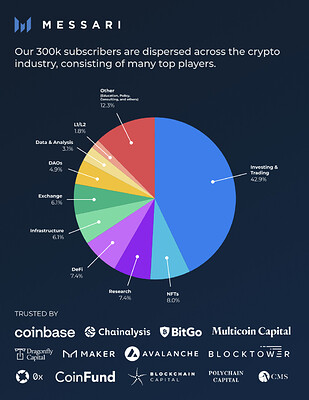

Messari’s reporting on Pocket will be distributed to a wide crypto native audience through the Messari newsletter (comprising +350k investors and builders in the space), Messari’s Twitter account (360k followers), and three of the largest traditional research platforms in the world.

- S&P Global

- Capital IQ: 12,000 enterprises

- Bloomberg

- Bloomberg Terminal: 325k users

- Refinitiv

- Refinitiv: 40,000 enterprises and 400,000 users

Why Messari’s Distribution Matter

From crypto-native builders to traditional finance capital allocators , Messari’s audience is the most diverse in the space. While anyone can offer distribution on Twitter and via a newsletter (though Messari’s has over 350k community members), we make Protocol Services clients visible to the highest-value research channels in finance — which accounts for over $10 trillion among Messari’s partners.

Otherwise, ticker symbols like GRT, LPT, and even POKT would not be available to query on a Bloomberg Terminal, S&P Global, or Refinitiv. This global audience of the largest enterprises in the world is a necessary demographic to accelerate adoption for protocols. Messari provides a source of truth and firmly believes that getting projects in front of top investors and researchers will only benefit the community as it matures.

Motivation

This proposal aims to enhance the clarity and accessibility of data analysis within and beyond Pocket’s ecosystem. Publishing research that covers the most pertinent onchain metrics, impactful governance initiatives, and core protocol developments, we enable existing stakeholders to make better-informed decisions about interacting with the protocol. From infrastructure providers running Service Nodes to projects building with Pocket RPCs to investors participating in governance, our analyses inform participants as they guide the strategic direction of the protocol.

In addition, our distribution of Pocket coverage will grow the ecosystem by attracting new stakeholders. Without adequate investor relations services and standardized reporting, it can be difficult for new entrants to find reliable data with the necessary context to gain actionable insights. Messari aims to create the 10Q equivalent for decentralized protocols: In the same way that anyone can go to a publicly traded company’s financial statements to learn more about the company and its performance, anyone can publicly see Pocket’s reports to learn more about the protocol and observe its performance. Over time, this will bring more stakeholders into the ecosystem who will be more likely to contribute value to the DAO, allocating their time and resources to grow the network.

Lastly, not only is Messari creating these reports but we’re ensuring they are distributed to a global audience that can consume them. This is done through Messari’s channels of over 350k crypto-natives, which reach most of the industry’s active professionals, and through our distribution relationships with Bloomberg, S&P, and Refinitiv. This goes a long way to further professionalize Pocket to key demographics outside of crypto including major funds, banks, financial service companies, and large enterprises in the world that will better grasp the magnitude of economic activity generated by the protocol. As more of these players get involved in crypto (i.e., Polygon/Starbucks or KKR/Avalanche) they’ll be able to expend substantial resources investing and participating in the onchain economy.

Needs Being Met

Bruce_Ishkoday gave a detailed description defining Pocket’s value proposition. We largely agree with the sentiment and wish to expand. The following three paragraphs take liberally from what Bruce wrote and provide a concise and integrated version, adding to his beliefs about Pocket’s value proposition.

The public often conflates the value proposition of crypto with Bitcoin. However, not all cryptocurrencies were developed with a simple purpose: to address the mismanagement of central banks. Unless it’s Bitcoin, scarcity is not a value proposition. Pocket redirects the conversation to decentralized coordination at scale.

Protocols like Pocket implement unique tokenomics that form the interactions of decentralized systems. Staking by providers incentivizes honest behavior and locks up liquidity, decreasing sell pressure; and settlement/revenue burns drive value to existing holders. This is tangible, where protocol economics — not scarcity — drives value. Additionally, Pocket Network is the only protocol decentralizing RPC middleware for the space by enabling permissionless gateways. POKT is a core utility to the ecosystem, and Pocket Network is a core piece of infrastructure for the industry. We believe this message should continue to be propagated to people inside and adjacent to the crypto space (our audience)!

Our quarterly reports cover the value propositions and analyze key metrics for various protocols, from Pocket to Ethereum. We break down complicated new upgrades and explain the bottom lines driving protocol usage and revenue. Expanding on Bruce’s point: Developers and validators should be the only ones we expect to understand complexities like dank-sharding. The space needs more accessible research that covers everything (even the simple stuff), focuses on data-driven key metrics, and contextualizes how they’re changing and why they’re important for stakeholders. We create these reports to advance the accessibility of the space, and so protocols can focus on building.

Budget

Messari proposes $25,000 in POKT (or USDC) at the beginning of the first quarter to be reported on (July 1, 2024) and then $25,000 in POKT at the beginning of the next 3 quarters (Oct. 1, Jan. 1, Apr. 1). The amount is fixed in USD therefore the amount of POKT from the treasury will be determined based on the prevailing market rate on the day of payment. Otherwise, payments in USDC are also accepted.

Rationale

Investor relations are a critical function of any organization, whether a public company or a DAO. Hiring in-house to perform these functions would be significantly more expensive (and wouldn’t have the distribution). Yet, Messari achieves economies of scale having done this type of reporting for over 70 projects.

Other DAOs are investing substantial resources into these services:

- MakerDAO has a Strategic Finance team doing their reporting for $1.3 million/year.

- Aave is spending $1.5 million on similar services for a 12-month contract.

We recognize this is not apples-to-apples and these scopes are broader than just reporting/analytics; however, it showcases the substantial work that goes into these types of services.

Other Concerns

Do we get inclusion into paywalled reports?

This proposal does not guarantee inclusion into paywalled reports via Messari Enterprise. However, we understand the grievances felt by being excluded in the most recent DePIN report and the end-of-year Theses. Our infrastructure analysts take the blame for not highlighting middleware and RPCs as much as consumer-type DePIN like Helium, DIMO, etc. That being said, Pocket and the RPC industry are on all analysts’ radars. This proposal does guarantee inclusion in Messari media, such as analyst calls, podcasts, etc., throughout the deal term.

What are we paying for?

We understand that quality DAOs aim for impactful spending; that’s why we are proposing this type of transparent, fundamentals-based reporting and offering our high-value distribution network to ensure Pocket’s analyses are widely available to investors and builders. Our network of third-party partners accounts for over $10 trillion among asset managers, venture capital firms, family offices, hedge funds, etc. As the cycle starts to turn and capital is allocated to various projects in the space, we think it’s more pertinent than ever that all market participants understand the true value offered by decentralized protocols.

Onchain data is freely accessible, can’t others just view it?

Even though blockchain data is open by default, as an RPC protocol, the Pocket ecosystem knows better than anyone that it’s not easy to access. To further contextualize it and make it accessible to a broad audience also requires a significant amount of work. Most people would rather read an article breaking down key metrics with targeted insights, than sift through and parse raw data themselves. This is where we provide value: we employ sector-specific analysts who work full-time to synthesize information and create an articulate narrative.

Shouldn’t this be done in-house since Pocket representatives understand the protocol better than anyone?

It’s true that Pocket community members understand the protocol better than anyone. However, reports created by third parties are often viewed with more credibility by outsiders, and often reach a wider audience — this is especially true when using Messari as the third party, given the expansiveness of our distribution network. Research from participants too close to the protocol would likely be considered too biased, and time/resources would likely be better spent on other endeavors. Outsourcing this type of reporting and research to a company specializing in this work provides a lower cost (we’ve already discussed costs breaching $1 million for other protocols doing similar activities in-house). It also has additional benefits such as broader distribution, which can be a strong growth driver and can’t be replicated with in-house operations.

Deliverable(s)

The Q2 report will be released following the end of the second quarter (June 30, 2024) with each consecutive report delivered 3 months later. Podcasts, analyst calls, and other initiatives will be conducted between quarters.

There is also a termination clause at the end of Q3 where the DAO can cancel the engagement if it feels that it’s not receiving enough value from our services.

Contributors

Micah Casella - Senior Research Analyst with a focus on infrastructure. Formerly a Quant at Bank of America and Contributor to Staking Rewards. Bachelor’s degree in Actuarial Mathematics.

Additional resources

Mihai Grigore - Head of Protocol Services Research

Mike Kremer - Data Engineer