Attributes

- Author(s): Michael O’Rourke (PNI CEO), Arthur Sabintsev (PNI COO), Laxman Pichappan (PNI CFO)

- Recipient(s): Pocket Network, Inc

- Category: Imbursement

- Asking Amount: 30,000,000

Summary

Pocket Network Inc. (PNI) is requesting 30M POKT from the Pocket DAO treasury.

This proposal highlights the reason behind why we believe we should ask the DAO for POKT in the first place, the need for the POKT, as well as a detailed history of our previous POKT sales. The primary reason we are asking for this POKT is to increase all employee and contractor vesting commensurate with the scale of what we are building and in comparison to what the network has earned.

The current DAO treasury sits at about 120M POKT. For the avoidance of doubt and transparency, we believe it is important for the community to understand the full details of PNI’s POKT history before asking for this amount from the DAO.

Motivation / Background

Our core motivation is that PNI has not historically asked for anything from the DAO, and given the company’s initial treasury allocation, we are extremely low on POKT in the company’s treasury after token grants and token sales following our launch.

In 2022, Pocket Network Inc. (PNI) has grown in size (e.g., headcount) and scale (e.g., product offerings) as we continue to build out our burgeoning ecosystem. At the same time, the community has stepped up in adding many of its own enhancements and bugfixes to the protocol and gateway. Many of the community submissions, have been reimbursed at rates [1, 2, 3, 4] that go well beyond the average PNI’s staff-members 4-year vesting cycle, as the model used for compensating DAO contributors uses the current value of POKT while PNI has used the arbitrary value of $1.00/POKT, both in the previous bull-market and current bear-market.

Aside from the imbalance around compensating staff-members and DAO contributors, PNI’s own reserves have dwindled down to ~15.3M POKT, which affects our ability to hire top talent. We would like to rectify both of these imbalances by requesting 45M POKT from the DAO to properly compensate current staff-members and bolstering our coffers to hire talent in the future.

Up until now, our primary motivation has been to provide as fair an environment as possible following the launch of Pocket Network in July 2020. To achieve this, we:

- Forced all POKT holders, regardless of how long you’ve worked with us or how early you invested, to run a maximum of three nodes for a year after launch (August 2020 - August 2021)

- Chose not to run any nodes until December 2022

- Left PNI and PNF reserves with 8.9% (57M POKT) each at launch

- Sold POKT, at launch, from our treasury to all purchasers, accredited or not, with strong limits on how much could be purchased and strong usage requirements related to staking and using POKT

We began with a supply of 650M and have nearly tripled the supply in 2.5 years with intentional dilution from the initial largest POKT holders. As a direct result, we have created one of the strongest and most committed communities in web3 with what we believe to be one of the fairest launches for new Pocket ecosystem participants.

In addition, the vision of PNI’s future has evolved over the years. Early on, we anticipated dissolving the company, and fully working for the DAO directly. This would have resulted in all of us associated with PNI having salaries paid by the DAO. Today, this is no longer the vision. Automattic, the company that built Wordpress is a great example of how a for profit organization can be synergistic with the broader ecosystem. I am also extremely optimistic with the Foundation’s efforts to continue to reduce friction from the ecosystem alongside PNI.

To build out that infrastructure within the DAO takes time and focus, and we decided to put our efforts in growing the protocol instead. As such, some of the early decisions we made were with a future of dissolving the company in mind.

At the end of the day, our goal is to be a profitable, sustainable company within the ecosystem to show the path forward on how to build more businesses on top of the protocol for other entrepreneurs in the ecosystem.

The history of PNI POKT sales and allocations

We launched mainnet with 650M POKT in circulation. In our docs, the initial distribution has been made public. Including other programs from initial allocations, PNI had a total of 113,750,000 POKT that was not allocated towards founders or employees. PNF began with 57,850,000 POKT. Sales have been made from both treasuries to continue funding operations. From some of the larger POKT vested employees and co-founders leaving, PNI had an additional 36M POKT that was available to sell.

We have made the following sales:

- Shortly after launch in 2020 we sold $9.5M at an average price of $0.12/POKT between May 2020 and November 2020. This amounts to about 80M POKT.

- In summer 2021, we along with PNF sold $10.5M at an average price of $0.26/POKT between July 2021 and December 2021. This was about 40M POKT. This was split between both the foundation treasury and PNI’s treasury. PNF sold 26.6M and PNI sold 12.4M.

- On August 15th, 2022, we made a $3M OTC sale of 18,750,000 POKT at $0.16/POKT.

This results in a total of 138,750,000 POKT sold between the two organizations to help fund operations in building out the current ecosystem. With an initial allocation of 171,600,000 POKT between PNF and PNI, this leaves about 32M POKT between the two organizations. Note that we have grouped the organization’s POKT sales together because most of the proceeds of these sales have gone towards PNI’s operating costs as the core contributors to the ecosystem. This will change with PIP-26, as part of an evolution towards PNF supporting a more pluralistic contributor ecosystem and PNI becoming a more independent organization, and PNI will need to find ways to become a more self-sufficient operation.

Today, our average POKT grant to employees and contractors is around 400k POKT, vested over four years. We scaled the company from 20 people to 65 people over the last 12 months, and most of our existing grants were given when the price of POKT was above $1. We are still early in Pocket’s existence and I believe those who are putting in an incredible amount of effort should be rewarded for this work, particularly in comparison to some of the proposals we have seen throughout the year 2022.

There is a severe disconnect between our average employee grants and what the average PEP asks for in POKT over the last year. This has been pointed out by community members in previous proposals. I can attest that this has caused resentment and frustration at times from PNI employees seeing some of the grants having passed. In the current macro market, I believe we will be in a slog of a market for the next 12 - 24 months, and it’s important that we provide enough incentives for those who are building the protocol and the tooling around it.

Between additional hires and these sales, this has left PNI with 12.5M unallocated POKT on our books.

Rationale

There are two reasons in asking for this POKT:

- To meaningfully increase the POKT allocations of existing employees and contractors

- To ensure we are able to offer competitive packages to future employees and contractors

To date, PNI has funded all operations through token sales. As a result, it has left PNI with limited remaining POKT in its holdings (~12.5M POKT). Revenue generation has just begun, with a clear Go-to-Market strategy and roadmap to grab market share. With 12.5M POKT ($1.2M at today’s market rates) would add only a month to the runway. PNI has operated to date through its token sales with the goal of subsidizing the network to grow it.

With the limited treasury, all grants to employees are negligible in value over a 4 year period. This also misaligns employees who have token grants. With this additional infusion of 45M POKT, PNI bridges that gap significantly in aligning incentives across all stakeholders.

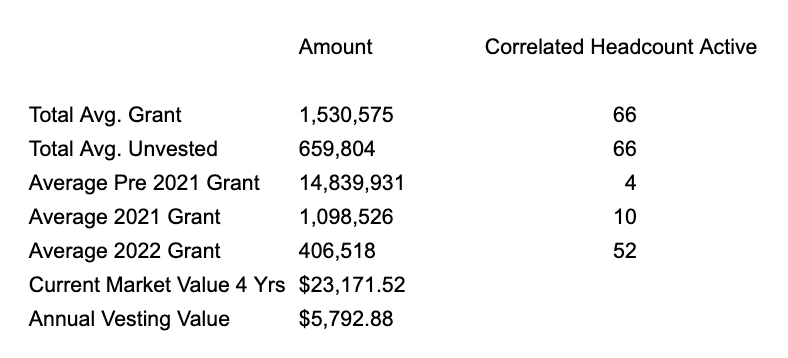

Below are our current usage and allocations of POKT:

In the current market for talent, we need to be able to offer competitive packages of POKT to ensure incentives continue to be aligned.

Submitting proposals for public goods we build and maintain

We have never done submitted proposals for any tool or public good we’ve built. Now that PNF and PNI have split, this makes PNI like any other company in the ecosystem. Any future grants that we submit from the DAO will be for open-source public goods that we build and maintain, just like any other contributor, according to the same set of rules. This solves several concerns by aligning PNI’s incentives with the community and enabling continuous incentives for everyone pushing this project forward internally.

Budget

The plan for the funds is as follows:

- 20M POKT will be committed to current staff-members in the form of new 4-year cliff vesting agreements. During each staff member’s vesting period, their tokens will be run in aggregate with PNI’s nodes, and the rewards (less taxes and node-running costs), will be provided to each staff-member once a month. As an individual’s tokens vest, their vested tokens will be removed from PNI’s node-running pool and sent into each individual’s custody to do with as they please.

- 10M POKT will be committed to future hires to ensure we can offer very competitive packages for high-caliber talent. PNF has agreed to escrow these funds until we hire these key people.

As mentioned above, while no one has a crystal ball, I believe we will be in a difficult market for the next 12 - 24 months. 10M POKT for future grants gives us the ability to bring on the absolute best talent with competitive packages, given the price of the token today and where we believe it will be in the future. For example, a competitive package of an additional $50k a year (comprising 25% of base salary) in POKT over 4 years, at time of writing results in 3.3M POKT alone.

Dissenting Opinions

Why didn’t you sell POKT when the price was higher to conserve treasury?

Hindsight is always 20/20. We began having conversations around our more recent sale when the price was $0.18. We priced the sale between $0.23 - $0.36 depending on how long the purchaser’s lockup was. Throughout the process the price of the token began increasing significantly, and we were not going to renegotiate with purchasers who had already been partners with us for some time.

Why does PNI stake employees’ unvested POKT?

The reasoning is two-fold:

- Many of the individuals we hire come from well established non-crypto tech companies where certain perks, such as ASPP/ESPP or RSUs are commonplace. As we are a private entity, and as we desire to hire experienced talent to grow PNI to compete with other players in the wider ecosystem, it behooves us to compensate these individuals accordingly. As we need to preserve fiat to pay for our non-personnel COGS (e.g., infrastructure-spend, vendor platforms), marketing budgets, and sales budgets, we are able to save on some of the cash using this dividend-like payout on a monthly cadence.

- We believe it is incumbent on each individual to understand how the various parts of our ecosystem work, and we believe there’s no better way to do so than making them first-party stakeholders by providing them access to tokens ahead of their 1-year cliff.

Does PNI believe it’s good to control an even larger percentage of the network?

As we plan on running nodes with unvested tokens, and as we do not plan to take on more than 20% of the validator pool, the plan is to methodically add to the servicer and validator pools to stay within those boundaries.

The expectation is for the PNI validator pool to decrease to single digit percentages over time. Over the long run, no single provider should have more than 5% of the network at any given time.

This is 24.5% of the DAO’s treasury. This is far too much after inflation continues to be lowered.

I would advocate for increasing the DAO’s capacity to give more grants moving forward by increasing the DAO percentage. As we continue to lower inflation, I believe it’s going to be critical to get more POKT in the hands of folks who are active in improving the protocol. This means increasing the amount of POKT not in circulating supply via the treasury rather than deleting it from existence. Additionally, as the foundation operations begin to get ramped up, I anticipate more POKT being allocated moving forward.

How can we be confident that you won’t ask for more POKT moving forward?

With the hiring of our CFO, Laxman, we have completely rehauled all our controls and projections. We are in a place where we feel extremely confident that we will never have to ask the DAO for POKT again.

What if this proposal doesn’t pass? What will you do?

We will move forward regardless. Until we have enough POKT in our treasury, it may be more difficult to hire talent as we will be negotiating from a position of less strength. Up until now, it has been PNI that has fundamentally driven the value and growth of the network over the last 2.5 years. By hamstringing our ability to bring on the best, the implications for the network are that it takes longer to hire the best talent, as we cannot offer competitive packages with upside.

Copyright

Copyright and related rights waived via CC0.