This proposal was rescinded in favor of PEP-27: PoktFund's Wallet - Purpose Built Mobile App. The new proposal was approved by the DAO.

Reserved post for more media

This is a very low bar for what a proposal should be. There are so many claims being made in this proposal that cannot possibly be verified by the community.

That asking price is seriously out of this world, when the only work to show is a generic Figma presentation. So far this DAO has only funded reimbursements and runways for existing products where the community knew the value because the tool already existed. Those proposals where submitted by community members who had a history of contributions to the community.

A proposal should be written in such a way that claims can be verified with references. This proposal has not a single verifiable claim and written in such a way that expects absolute trust in an anonymous proposer.

This proposal is far below the current standard that has been set, and the risk level is off the charts. There is zero chance I will support this proposal.

Hey,

Thanks for the proposal. I don’t see how this costs $2m, especially as you can bootstrap the cross-platform front-end work using hybrid-languages to just get a proof-of-concept working.

Echoing what @shane said, we’ve only funded existing products, and at amounts that are much smaller. For me, as a DAO voter, and as someone with 10+ years in the mobile engineering space, to consider this proposal, I’d need to see a lot more effort provided as to the cost-breakdown, the technologies used, and to be honest, a working version of the product (to some degree) to show how this would work.

Thanks for the proposal!

(Edited for grammar)

Hi Shane, thanks a lot for the feedback. Whilst we appreciate your opinion, we firmly believe that it’s not holistic, hence we ask that the community have an open mind on this proposal leading up to the voting process and during. Doing so will aid in the discussion of the proposal and identify any potential areas that need to be improved or clarified prior to voting or in another revision.

Below is an accumulation of information that gives further context.

Section A - Governance Precedences

We understand that this proposal is the first of its kind. The way the DAO has funded/reimbursed projects in the past has a relatively short track record and consequently as the community matures, we may see a shift in the way we have funded proposals that allow critical development that would have otherwise not have made it. If a talented group comes in and wants to make a large contribution that would bring great value to the ecosystem, should we block this contribution because the group didn’t make smaller contributions first? We don’t believe so. This does not equate to blind trust as Pocket contributions are not the only indicator. We should look at that group’s experience in tech as well. Pocket can benefit by welcoming and attracting talent that can produce a positive impact to the ecosystem. PoktFund has had internal discussions and taken input from those involved in the community, we firmly believe this is the right approach to take that will allow Pocket to attract development and mature.

Section B - Our reputation

In regards to validating reputation, we are a Delaware incorporated company that is verifiable via the state’s registry. To go into some more specifics about our team’s community involvement - Toho & PoktBlade have put time into establishing themselves in the community - which is how they are now voters. Dottie & PoktBlade are versed in the crypto industry and have worked together to help support multiple crypto startups. They have even built relationships with some core members, ultimately contributing to the ecosystem as a whole. We have reached out to these core members to add to our credibility.

While this is our first proposal to the DAO, our team is collectively very tenured and has a commendable track history with the tech industry. We are ready to validate credentials, experience, and other metrics deemed necessary with a neutral party.

Section C - Value & Impact

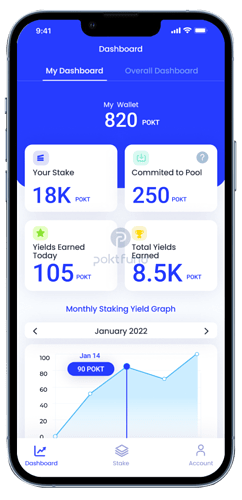

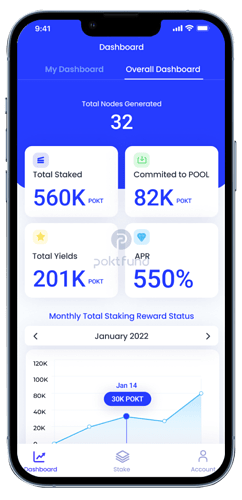

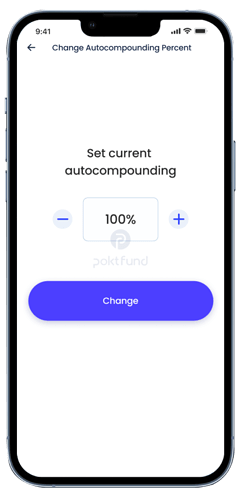

Let’s shift back to the main focus - the value that our proposal brings to the ecosystem. Without repeating the entirety of our proposal, there is no other application available today that provides the same functionality with the same caliber of work that we are proposing. Our proposal was preceded by extensive research. We identified what the user wants and what the ecosystem currently lacks. Our aim is to close this gap. Our UI/UX designer, Kersley, worked closely with engineers and nailed what PoktFund is looking for in terms of usability. This was purpose built for the Pocket ecosystem. We took a more strategic approach and tackled the problems from the user perspective. We set the bar very high - providing an extremely modern, eye appealing, sleek UI that can be used by the mass. There is a lot of value in this. We could’ve launched an unappealing, semi functional application - but this is not the type of direction and standard we’d like to continue adopting. One of our goals is to create a product that prioritizes the user experience - an application that is extremely reliable and user friendly, ultimately instilling trust in the users & providing maturity, value and growth to the ecosystem in the long term.

Section D - Final

The majority of this proposal’s ask is for funding. We want to bring top tier and much needed development to the Pocket ecosystem and for a fair asking price based on current market rates. We ask the community to allow the PoktFund team a chance to do so.

Thanks for bringing up your concerns. We appreciate the feedback and impressive background!

We want to make it clear that we are not asking for funding in order to deliver proof of concepts. PoktFund’s ask in this proposal is for funding in order to continue the development lifecycle on these products end to end and continuously provide support to the product in the long term moving into 0.8 and 1.0 RC.

We see that the main point of contention here is the asking price. Compensation can vary depending on location, experience, specialization, etc. The compensation we are using for operations is set by the current tech industry market in the U.S. To give you an example, our two full stack engineers combined annual compensation at their existing full-time roles is topping close to $800k USD, and that doesn’t even include benefits. For our engineers to take on full time responsibilities to work on this product, we have to factor this into our budget. While valuation based on technical complexity is one way to go about it, we believe that looking at the cost of operations is much more relevant to the conversation.

We don’t want this entire proposal to be about the asking price. We understand that someone else can make this for cheaper - you can say that for any product in the tech market right now. But some questions to consider are:

- When will someone create this product and how long will that take?

- How much did the ecosystem lose out in terms of value while waiting?

- Did we lose quality for the sake of being cheaper?

- How do we maintain quality products?

What we are proposing to the ecosystem is a need that we’ve identified after extensive research. We’re asking for funding so that we can continue working on it now. We’ve founded a collective team who have the talent and confidence in delivering the scope of work provided here and to continuously provide support to the product in the long term moving into 0.8 and 1.0 RC. We hope that the DAO supports and funds our development so that we can continue build and contribute to the ecosystem.

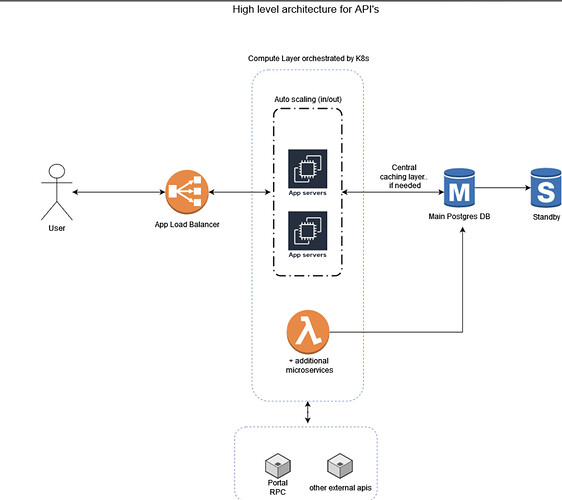

We are able to provide a high level breakdown from our internal documents below. These specifics are subject to change. Moving forward, we’d love to continue doing so through our dev blogs. We’re not going to bore you with the CRUD apis. We’re using what we’ve seen great success with in our previous companies & experiences.

Wallet:

- React Native (Android/IOS)

- Web App will use NextJS

- Portal API as preferred endpoint

Pool:

- React Native (Android/IOS)

- NextJS for SSR/SSG

- App Servers / Microservices powered by Typescript and PostgREST

Shared Services:

- Purpose-built libraries for Pocket

- Leverage pocket-js sdk (needs better TS support)

- Offchain indexing and caching for analytics

For infrastructure automation, optimization, and management, this is still something in the works. We are committing to providing open source resources for this. Some examples we have in mind for open source material are creating an actual cluster of fleets, increasing observability in fleets, and scripts to automate deployment of Pocket & other chains as part of our product.

Below is a general architecture for our API’s.

Thank-you @BaaSPoolLLC for the response. I appropriate the openness to reply to constructive feedback and critiques.

I’m still concerned with the lack of verifiable data provided in your responses. Let me elaborate by taking specific claims and ask for verifiable context.

Could you please provide verifiable data on the teams past experiences? This can be a combination of press releases, LinkedIn profiles, GitHub profiles, etc. Without ways to validate these claims, we are simply trusting this proposal at face value, which makes me very uncomfortable. That is what I mean by blind trust… we have to blindly trust the proposal that this team has the expressed experience.

This is a very general statement, and again, no verifiable context is given. Can you elaborate on the startups, their roles, and the time frame of their work?

Ah, I didn’t realize that you have relationships with core-team members. This could be a great way to put a lot of credibility towards this proposal if you expand on your history with the core-team and if they were able to vouch for this project.

It would also be great to have examples of how you have contributed to the ecosystem as a whole. That statement was very general, and specific would help with verifying.

I’m not sure what this means. If there is a commendable track history with the tech industry, why does it have to be secret from the voters? So far it sounds like this team has been with notable crypto startups and has a solid network… why now does the team require so much obfuscation?

Can you make that research open-source?

I’m concerned with the starting focus on designing and planning the UI, instead of infrastructure, node management, key security, and the entire backend. In any development project, the frontend typically is what is implemented last once the huge web3 engineering challenges are built and tested. UI is important, but for something like this, where POKT user funds are at stake, the backend is everything. Focusing on UI is putting the cart before the horse.

If you were to first provide the backend open-source materials you mentioned above that would be a good start for allowing the community to validate the security of this service, before investing this amount of POKT.

PEP-23 is now up for voting. We are still open to discussion throughout the voting process - so if you are still at edge, please do post so we can provide more insights.

https://gov.pokt.network/#/proposal/QmUXRwaiqagKb1BMJPSCr4iGYJwu1RXKjuf31UAVjUJXUC

Asking for 2.0 M POKT and only review this proposal for 4 days? A big WoW from me.

Agree with all the points @shane has mentioned. The requests were specifically made to disclose more information, but I feel the answers were merely argumentation & justifications.

I will be rejecting this proposal because of these reasons:

-

Unsure about the ability of the team to execute

Both profiles shared in the proposal are sales talents. I do not see anything about the engineering team or their achievements. The only validation I have is that two of them are Pocket DAO voters. But there are community paths to become voters that do not require a lot of tech skills. Therefore, being a DAO voter isn’t necessarily a testimony to the technical ability. Furthermore, I have no clue whether the engineering team has some web 3 experiences. I have no visibility on their web 2 experiences either. -

No traction or milestones

I can’t help but wonder what have you achieved so far that has created value for Pocket Network and its stakeholders? Where is the MVP? Pocket DAO has never funded an idea on paper. We would like to see the work done and usually, proposals are for reimbursement. If you are a project that has delivered a product to the community, then you can ask for reimbursement and additional funding according to milestones planned. Especially for $2m ask, I would have expected milestones and deliverables with only a small part of the $2m asked for immediate development. -

Dont want to share information - Red Signal!

That in VC terms is a big Red Signal. You either bring people who vouch for you strongly or you show me proofs, referrals, certificates, or anything you can think of to convince me that you have the experience, skills, and the ability to execute. Otherwise, why should I give you $2m? I am sorry I bothered more about DAO fund money than the privacy concerns of FAANG & its employees! -

Long term commitment of team members

For both the profiles shared, they are currently working in other companies. Also, reading through the answers I have a strong feeling the engineers are more concerned about their salary at FAANG. Such high salaries at the early stage of any company/project is a death spiral. And there is always the risk that they might leave for better opportunities (or rather have you discussed an ESOP plan?). You cant fund a project with $800k for two people. I have never done it in VC so far and would not recommend it. -

Lastly, just 4 days of review to get $2m? Funding is easy these days but not that easy!

Hi, thanks for the proposal. We certainly could use multiple mobile wallets within the Pocket ecosystem. That said, I echo @shane and @ArtSabintsev’s concerns on this. I will be voting no due to amount being asked for and the rushed nature of the proposal.

Given your stated experience and income, your group, more than most, is best equipped to build out a working product before receiving any disbursements from the DAO.

This is an important standard for Pocket to continue to upkeep to ensure the DAO is funding the right projects in an adversarial environment on the internet. The type of model you are proposing is more suited to professional VC’s who careers are built on making bets on unproven products or teams.

I would argue that the groups experience outside of web3 or Pocket Network’s community is mostly irrelevant. Your integration into web3 communities and building trust among your peers is what matters. If you haven’t built that trust, building a working product first or open sourcing your code is great way to start.

Existing tools have been built by people of all experience ranges, and to get blanket approval for this amount without anything to show is not a standard the DAO should hold itself to.

Thanks for the proposal. Good to see Pocket getting looked by a big tech team that is enthusiastic about Pocket given how early we are. The value the Pocket ecosystem stands to gain from this is astronomical and at a relatively fair price point too. Although I can understand the others sentiment when it comes to reimbursement, I think funding rather talented and highly professional teams in advance is worth the slight risk if we want to rapidly mature. The DAO treasury is huge and the need for this is large. I am in full support of this proposal.

While I am all for seeing more Pocket wallets, particularly for mobile, the asking amount seems far too high, particularly given I would expect this is a closed source and for-profit project. I would think something closer to 30k to 50k POKT would be more appropriate for something like this.

@nelson Maybe from overseas freelancers but from the team described above? You’d be lucky to keep development going for a week on that budget. I use to professionally source from similar backgrounds as posted in this proposal before switching over to dev.I’m purely in node running now but I wouldn’t even be comfortable offering that low of an amount to a quality team of 5 and expanding for what would bring me value in the millions. I don’t see anything wrong with the valuation here given the context of the team but it seems the main area of conflict is the consensus on whether the current members of the DAO who are largely in favor of reimbursement (which is ideal, we get to see product first) think funding in advance for the right teams would be worth the risk rather than completely lose the opportunity.

I feel silly saying these things, but you don’t just give someone money to work on a project. You set up milestones and deliverables. Did they meet the milestone? Yes - here’s your agreed upon amount for that deliverable. Move on to next milestone. Didn’t meet it? Time to reconsider the entire project.

Given the need for a wallet, I would consider support for a more modest proposal with clear milestones to be able to disburse funds as needed.

I understand that your group looking to cover your existing expenses, but keep in mind this is a more than a magnitude greater in POKT that what we’ve seen previous full product proposals pass for, with much less having been completed.

Can you elaborate on what you plan on building that is open source here?

Agreed with all of this. The DAO is not a Silicon Valley VC fund, and should not be treated as one. Unconditionally opposed.

I see 3 main issues here that need to be addressed before the DAO will feel comfortable approving this (or an amended) proposal.

Lack of Trust

I won’t rehash what others have said but I believe lack of trust is one of the main reasons for this proposal being rejected (so far); it’s not just about the money. In an adversarial environment with a honey pot such as the DAO currently has, voters will be on high alert and therefore care must be taken to establish trust. It could be through a mix of doxxing the contributors, bringing in testimonials from other trusted parties (such as the core team member who you haven’t elaborated on), and sharing more verifiable products of your past labor.

Aside: it’s going to be hard for you to build trust in your fractional staking pool without doxxing your team. So it may need to happen eventually.

This lack of trust was exarcebated with how quickly the proposal was pushed to a vote. Voters who might have been open to a compromise after back and forth due diligence are now more suspicious.

Grants for Public Goods, Not For-profit Initiatives

As a general principle, I believe the DAO should be focused on grants for FOSS public goods, not providing seed capital to for-profit initiatives. It seems some others share this sentiment.

PoktFund’s fractional staking product is likely to be a very lucrative for-profit initiative that addresses the need this team has for financial security. There are many businesses in the Pocket Network ecosystem who have grown to at least 7-figure annual revenues and have actually been able to raise private capital off the back of this. I would suggest that your team ought to be able to do the same. I would therefore recommend that the fractional staking product be excluded from this proposal, the budget lowered accordingly, and funds raised elsewhere; perhaps existing investors in the Pocket Network ecosystem would be interested.

That leaves the following FOSS contributions that the DAO can provide grants for, which I would support in the form of separate grant proposals with more modest budgets and milestone-based funding:

- Mobile Wallet: This would be a valuable public good if it was open-source and compatible with v0.8’s non-custodial staking. Without leveraging non-custodial staking, I’m not sure what the use case of a mobile wallet would be.

- Pooling/Staking API: Your proposed Pooling API would be a valuable public good if it was open-source and expanded to include 1:1 staking functionality that leverages v0.8’s non-custodial staking. I imagine this being integrated into wallets (including your mobile wallet) to enable community members to more easily stake with third-party providers. If this is going to be a closed-source API, we would need to understand how Poktfund plans to profit from it in order to understand to what extent this can be considered a public good.

- Misc Open-source Tools: In the proposal and the comments you have listed the following components that could qualify for separate grants – automated deposits/withdrawals, automated infra provisioning, infra optimizations, admin tools, purpose-built libraries, Typescript SDK, off-chain indexing and caching for analytics.

Milestone-based Funding

If a full reimbursement approach is not on the cards, due to contributors being risk-averse, at the very least we should be using milestone-based funding. The DAO could provide a small tranche to fund a PoC but you can’t expect the DAO to fund significant runway and team growth without proving that the concept works.

Back to my point about public goods vs for-profit initiatives, I think it’s reasonable for the DAO to compensate you for your efforts in building public goods, but to leave you to fund your own growth through the for-profit pooling business and associated private fundraises.

If the above funding approach doesn’t work for you, then it falls back to the need for you to establish more trust.