Hi everyone, apologies for the delayed response. As you can imagine, the holidays consumed most of our time in the previous weeks.

Let me first outline the efforts we made last month concerning this research, and then I’ll provide our conclusions and reasoning.

Parameters Redefinition

As mentioned in the initial comment, our task was to redefine and suggest the best values for the following four parameters:

- Application unstaking waiting time (currently: 2016 blocks or 21 days)

- Servicer unstaking waiting time (currently: 2016 blocks or 21 days)

- Portal (gateways) unstaking waiting time (to be defined)

- Watchers waiting time - being left for a later version of the protocol upgrade.

We started by listing all the pros and cons of implementing an unstaking waiting time in the protocol.

Pros:

- Price Stability: Prevents large cascade selling events.

- Network Security: Provides time to find new users to take over the unstakers’ responsibilities.

- Prevents self-interested actors from frontrunning an impending default event and provides additional assurances to anyone with POKT exposure.

- Dissuades arbitrageurs trying to stake/unstake quickly, helping to delay withdrawals and giving room to pause in times of crisis.

Cons:

- The token could become less attractive to some investors.

- A too-large waiting time compared to other protocols can make token staking look a bit shady.

The pros side is considerably longer, and this aligns with the observation that any relevant protocol out there didn’t enable an immediate unstaking of funds for the main protocol actors (validators, servicers, parachains, etc.).

So, we approached the problem in three main ways:

- Benchmark unstaking waiting time and solutions from different networks.

- Analyze historical data and simulate some future scenarios.

- Ask the actors from the community who need to wait those times how they feel about it.

Findings

Benchmarking:

As we all know, the POKT architecture involves various agents in the system, and the utility of the protocol token is quite unique. Therefore, we had to compare waiting times for other unstaking agents, mostly validators, in the known web3 networks. Here’s a summary:

| Network |

Unstaking Waiting Time |

| Ethereum |

First come, first unstake. |

| Polkadot |

28 days. |

| Polygon |

Approximately 2-4 days. |

| Avalanche |

14 days. |

| Cosmos |

21 days. |

| Solana |

Approximately 2-3 days. |

| Cardano |

Approximately 5 days. |

| Aptos |

18-21 days. |

| Ankr |

3-4 days. |

POKT values (21 days) are in the upper range but still within standard ranges as on other platforms, providing no concrete reasoning to update any of those values.

Note: Regarding the Ethereum solution, it appears to be a good compromise between protocol security and user experience. Validators can unstake immediately if they are the first ones trying to unstake at the moment; otherwise, they have to wait in the queue. However, this solution has its tradeoffs on the implementation side.

Data Analysis:

Entering the data analysis and simulations phase, we were particularly intrigued by the prospect of drawing meaningful conclusions.

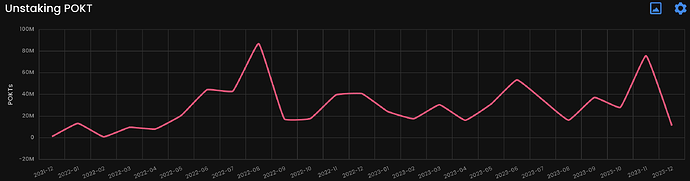

Utilizing the POKTSCAN API, we retrieved historical protocol data and identified instances of substantial unstaking, both exceeding 80 million POKT at specific points in time – on August 2022 and November 2023.

While it’s essential to acknowledge the limitation of deriving comprehensive conclusions from only two data points, a common factor in these cases was the notable price volatility preceding those dates. In Q2-Q3 2022, we witnessed a significant POKT price decrease correlated with the broader crypto market bearish trend. Conversely, in recent months, there has been a substantial increase in the POKT/USD value.

However, it also seems logical that significant shifts in the token price would influence various actors’ choices on when to unstake their tokens.

Regrettably, attempting to quantify an indicator representing the impact of price volatility on unstaking proved challenging and, at present, appears to be a formidable task. We genuinely believe that price movement is influenced by numerous factors, making such an endeavor seem somewhat futile.

Moreover, in a recent instance, we observed a substantial amount of funds being unstaked in the second week of December 2023. However, the prevailing market conditions swiftly absorbed the potential selling pressure it could have generated.

Simulations:

Our secondary approach involved simulating various scenarios to derive optimal outcomes through a parameter sweep. We considered the ideal amount of Staked POKT, primarily falling between 40% and 60% of the total supply, as a factor that could serves as a guiding principle upon which we can conduct various experiments. However, these values are contingent on other parameters yet to be defined during the Shannon update, such as staking amounts, burn mechanisms, treasury, etc. Consequently, experimenting with these values at this stage seemed premature.

Acknowledging the diligent efforts of the Blockscience team in developing the network’s digital twin model, we anticipate that its finalization will provide a more opportune moment to potentially leverage their work. This would enable anyone to validate various additional parameters in the system effectively.

Community Feedback:

Finally, the potential discouragement of new servicers, applications, or portals from joining the network due to extended waiting times appears to be the only appropriate consideration to verify. We attempted to find relevant comments or discussions in the community channels but couldn’t find anything substantial. We suggest opening this topic for current or future network users to express their preferences on whether the current values of unstaking waiting time should be:

- Shorter

- Longer

- Stay the same (21 days)

and provide reasons for your choice. We would love to hear your thoughts on this matter.

Conclusion and Proposed Steps

In summary, we recommend the following course of action:

-

Given the current uncertainty about the optimal approach for this socket, we propose closing it. We’ll continue to monitor the development of the cadcad PocketSimulationModel and consider potential collaboration once it’s finalized.

-

Meanwhile, we intend to maintain the ongoing community discussion, providing a platform for diverse views on the topic.

Also, we wish everyone a happy new year! We are excited to further engage with the project and connect with community members in the coming months. Cheers!