As you say this can be seen as simple change of cost plus a bias:

MaturityRelayCost = PercentBurntoMInt * MaturityRelayCharge * epsilon

and then just

RTTM = RTTM_0 + RTTM_proposed

The one is a fixed bias in POKT and the second is the proposed controlled RTTM obtained from the linear functions ans so on. This is more complex than the current approach that some already call too complex.

As you say below, maybe a hard cap on RTTM will solve this more simply.

I would love to hear your rationale on this, as we need consensus on these values. Nevertheless I have to admit that the feedback from portal runners such as @poktblade and @ArtSabintsev are the ones we need to give more weight.

I agree that giving some flat rate for a little while is OK and might help them. More after seing that growth is not going as fast as expected.

I agree with the objection of denominating the supply side in USD, but given the token exchange rate instability and the low weight that the Pocket Network has in the relay market, it is necessary to give up some control over the emissions to try to keep the exchange rate in rails (this is a consequence of the economic trilema, something that we cannot avoid). We would be glad to give up this as soon as we can and transition to a POKT denominated economy.

Please keep in mind that in contrast to RDI, this proposal is only viable is parameters are set together, “hyperinflation” is only possible if there is no burning counterpart.

Just to clarify to everyone, a price of 0.001 USD/POKT is a lot. Is the same as the one that POKT suffered going from 1 USD/POKT to 0.03 USD/POKT. While I highly doubt that we can suffer such depreciation process again, everything is possible. It is correct to analyze these extreme cases.

This is an interesting take, if I understand correctly you are saying that our economy might be stable in maturity but the nominality is too high. In simple words, the exchange rate would be stable low in 0.001 USD/POKT. We don’t want this.

While I believe that this is a very unlikely outcome I agree that we need safeguards.

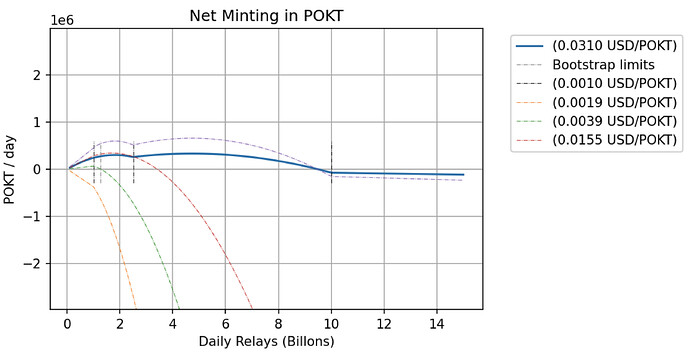

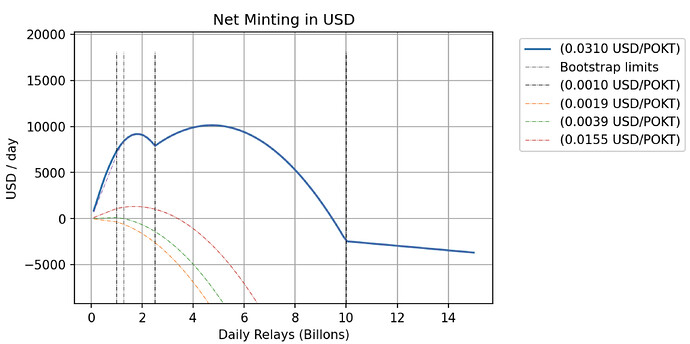

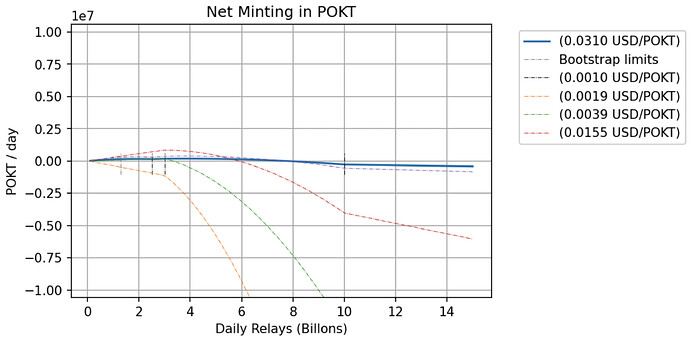

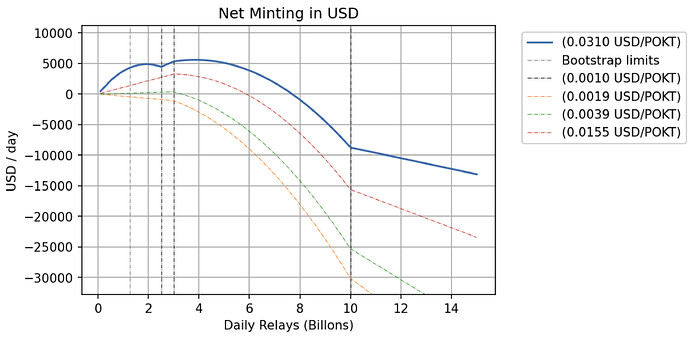

I like this idea, let me explore it. I will test the cases of extreme POKT depreciation:

0.0155 USD/POKT(1/2 current price, as reference for main post graphics)0.003875 USD/POKT(1/8 current price)0.0019375 USD/POKT(1/16 current price)0.00096875 USD/POKT(1/32 current price, almost the ~0.001 that is used in the shown calculations)

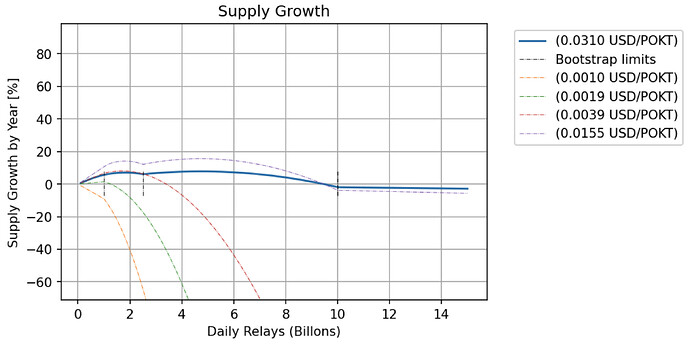

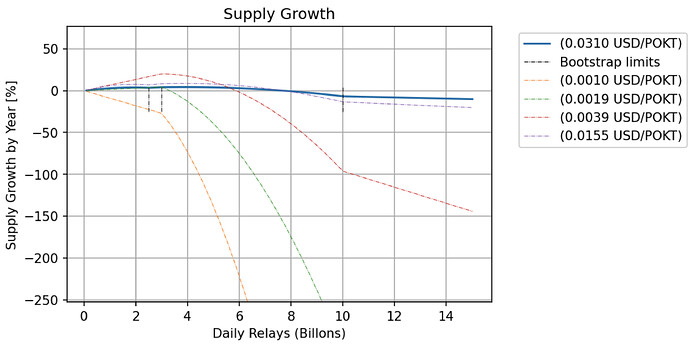

Keeping the proposed values and setting a hard threshold of RTTM <=500

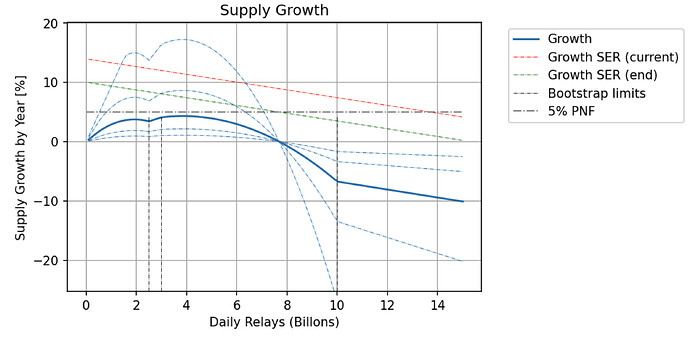

This simple addition set a cap to inflation of ~20%. Anyway, I feel it is very difficult to reach this situation, as we cannot possibly support all the supply side with 15 K USD / Month, probably the exchange rate is going to stabilize before or the supply side will collapse.

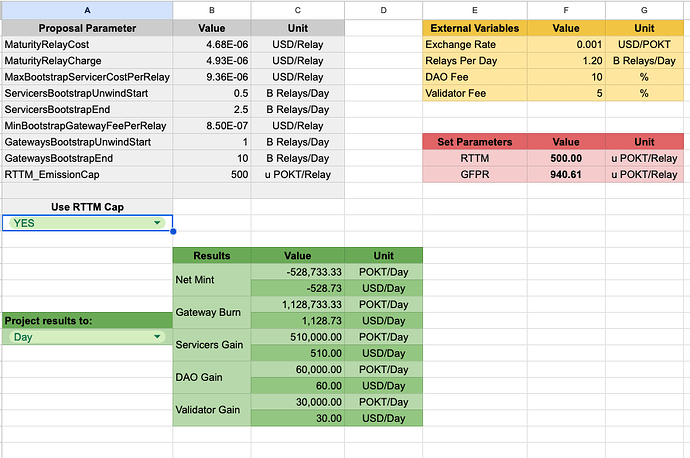

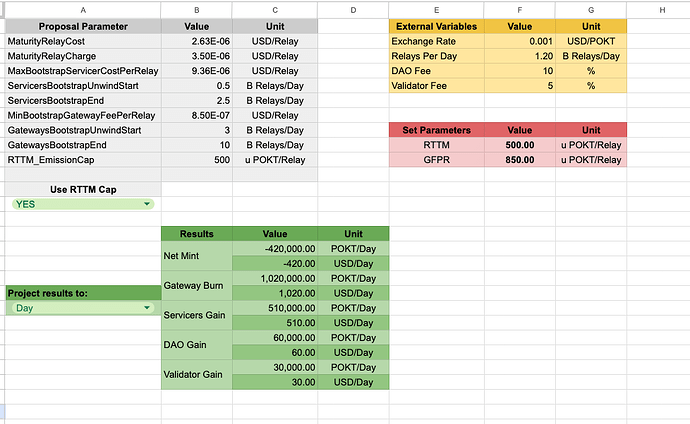

Using the new values and setting a hard threshold of RTTM <=500

The new values mentioned by @msa6867 are:

MaturityRelayCharge = 0.0000035

GatewaysBootstrapUnwindStart = 3 B

MaturityRelayCost = 0.75 * 0.0000035 = 0.000002625

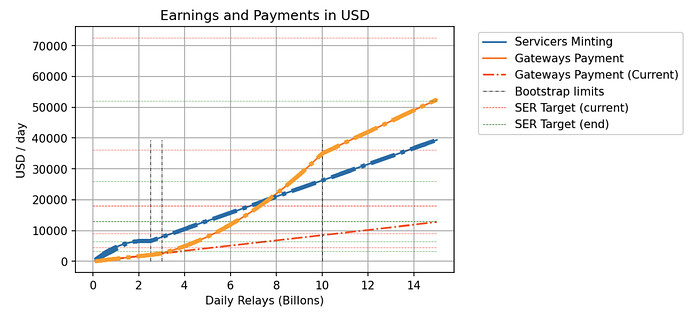

Results are similar wrt supply growth. The main change observed is in the gains of node runners and servicers payments.

Differences in parameters sets

To compare with proposed values to the ones in the analysis, I will use the parameters mentioned here but the exchange rates in the original analysis.

The adjustment of the prices to the supply side and the charges to the gateways moves the supply attrition threshold to ~8 B relays / day. This is paid by a cut of ~50% to node runners incomes. Also the movement of the GatewaysBootstrapUnwindStart does not create a significant change to the supply growth profiles, as the GatewaysBootstrapEnd is unchanged. The extended “stability” of the gateway price is paid with a more step growth of the GatewayFeePerRelay during the gateway bootstrap unwind phase.

Conclusion

While I still wait for Gateways runners opinions on the subject, I have no functional objection on the proposed changes (new values + cap).

I could argue that the proposed cuts to node runners are too high, because we will not reach current levels of emissions (denominated in USD) until ~6B relays/day as opposed to the proposed parameter that achieved this in 4 B relays/day, however this is about projection.