We are currently undertaking a large-scale research effort to create better frameworks for token mechanics especially for web3 protocols in the hardware resource provisioning sector.

We have recently published part one, where we have compared emission schedules of various web3 networks, including of course Pocket network. You can find the report here.

We wanted to share some additional data with the Pocket community though, that is not in the report.

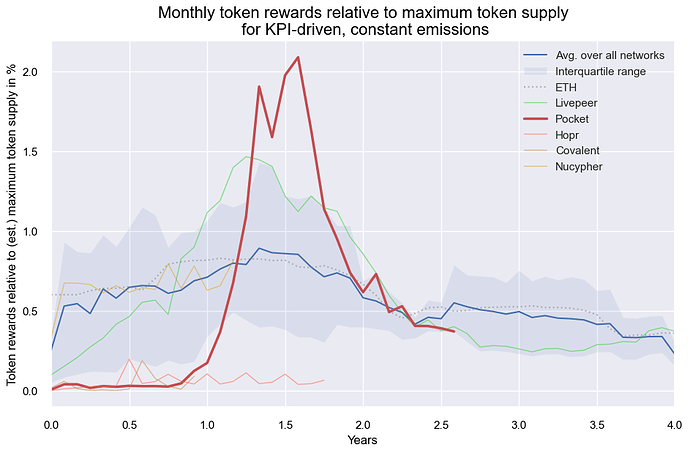

First off, we have classified Pocket’s token rewards to be in the category of KPI-driven and constant emissions. For that category the token rewards are tied to a KPI, which is the RelaysToToken-Multiplier in our case and they follow a constant amount or rate (not decaying to 0) as long as the underlying KPI is constant.

Within that category there are currently also the following projects we analyzed:

- Livepeer

- Nucypher

- Covalent

- Hopr

In comparison to the other projects in this category, Pocket saw the typical steep increase of emitted rewards when the network scales up. Despite having the steepest increase in monthly rewards relative to token supply after ~1 year, the cumulative sum of those rewards is still below 20% today, which is less than e.g. Livepeer at that stage and also at the lower end of the spectrum compared to all the web3 infrastructure networks we analyzed.

Below chart shows the average (blue line) and the interquartile range (blue shaded) of the monthly token rewards of all Web3 infrastructure networks together with the projects of the KPI-driven and constant emissions category highlighted:

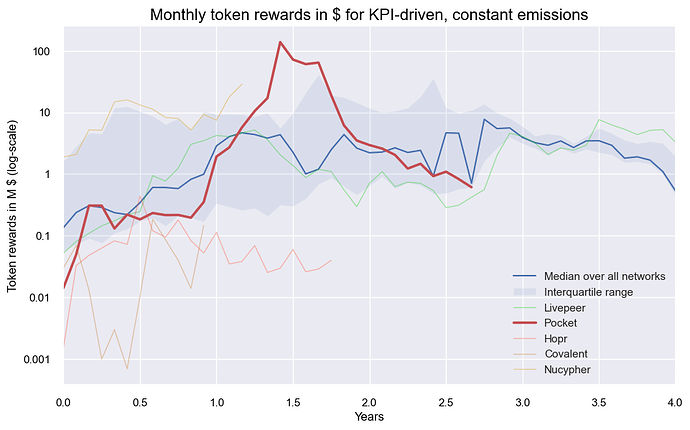

Next we looked into the dollar value of those emissions, to compare how nodes are actually getting compensated:

Pockets reward emissions in dollar-terms are most elevated in the time of early 2022 in line with the POKT price and declined afterwards when market conditions no longer provided tailwinds. Despite the high peak of POKT emissions, the KPI driven schedule reduced the emissions eventually to the point where we are now, much further in line with other protocols.

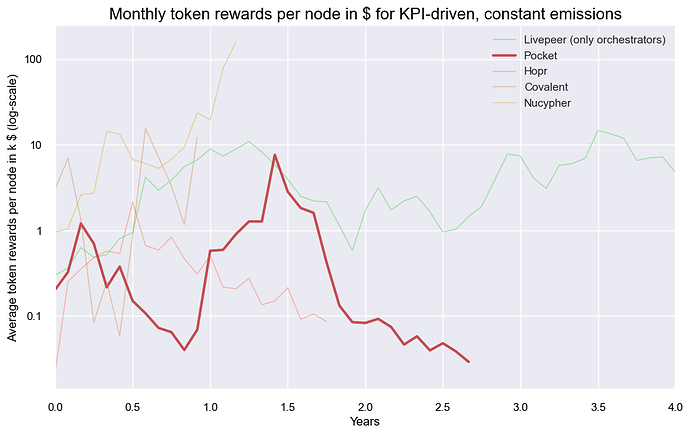

More information is available in this repo that also contains the paper with further details on the published report and caveats. One example of those: below chart with rewards per-node needs to exclude rewards for delegators for a somewhat fair compariso, which we couldn’t get for Nucypher and Covalent (yet).

Those (avg.) rewards in dollar-terms per node decreased in line with the total rewards in dollar-terms below 100$ over the past six month (given node count stayed above 20k since the start of 2022):

We hope this information yields some insightful information for the pocket community and are open to your feedback. What would be some additional data you would want to see?