The Inner structure of inflation and token price

Part 1. Structure of inflation

The state of static inflation (100%, 50%, 20% or 5%) depicts the beginning of many projects based on their needs with initial inputs but as a project grows, it needs to get rid of spontaneous approach and move to more proficient vision of inflation with a structured framework.

In order to set inflation in a more accomplished way (indirectly influencing a token price) there need to be figured out in the very nature of inflation. Inflation in the decentralized systems is intended to launch a project and secure the viability of the network. A decentralized concept of the protocol vitality in terms of token emissions can be ensured if the interests of all parties which are involved in a project are met and satisfied. In this case, inflation serves as an incentive for all parties to get in.

What parties are represented in this network on the level of the token distribution during protocol maintenance? This protocol has 2 interacting parties: stakers and node runners. In the examples below the Dao share is omitted for now and isn’t considered in the overall inflation to simplify the notions with calculations and grab the whole idea.

Stakers have stimulus to delegate tokens to node runners and stake on the reason they get additional tokens as a reward. This reward can be compared to dividends in the traditional finances (let’s call it «Stakers’ rewards»). In addition, stakers have expectations that a token price will increase.

Node runners have more complicated structure of received tokens because node runners have to pay for servers rental (let’s call it Server rental cost - «Server rentals») and have profits for their work (let’s call it Node Runners’ Profits - «NR’ profits»).

So, inflation contains some percent of tokens which go to satisfy expectations of stakers and another percent of tokens which go to provide needs of node runners. Then inflation consists of the following components:

Inflation = Server rentals + NR’ profits + Stakers’ rewards

It is worth to consider this equation in more details and gauge the percentage of all components in the overall inflation in this equation in order to understand which components can become automatically variable depending on the price of token and the network metrics under certain conditions.

Now the inflation stands at 5%. The overall monetary base is about 1,65 bln. So, the average daily inflation in tokens equals to 1,65 bln tokens * 5% / (100 * 365 days) = about 220k

- Server rentals part in the overall inflation

Server rental costs can be calculated as Number of bare metal servers in the network multiplied by rental cost for one server (an average price is 250 USD monthly).

Server rentals = Number of servers * One server rental cost

Then all that remains to answer the question about the number of servers in the network. Let’s assume that there are 48 000 nodes (15k nodes) in the network. The technical requirement for one node is not so high therefore, one powerful bare metal server can contain a large number of nodes which (as I know if I’m right) can reach up to limit of 400-500 nodes. I suspect that the max number of nodes per one server is not spread largely because of a high workload. On the other hand, a node runner has to employ a rationally maximum number of nodes per one server to have a revenue. In this regard, the average number of nodes per one server may be equal to 300 what which it follows that the number of servers in the network is 48 000 nodes in the network / 300 nodes per one server = 160 servers.

Then to summarize the monthly and daily server rental costs are:

Server rentals = 160 servers * 250 USD = 40 000 USD (monthly)

Server rentals = 40 000 USD / 30 days = 1 333 USD (daily)

It should be noted that server rentals component is fixed in USD (dependent on number of servers) but when measured in tokens, the server rentals component is changeable and depends on a token price.

-

In case when the price per a token is 0,025 USD monthly server rental costs in tokens are 40 000 USD / 0,025 USD = 1 600 000 tokens and daily server rental costs are 1 600 000 tokens / 30 days = 53 320 tokens. This makes up 24% from the present daily inflation of 220 000 tokens.

-

In case when the price per a token is 0,25 USD monthly server rental costs in tokens are 40 000 USD / 0,25 USD = 160 000 tokens and daily server rental costs are 160 000 tokens / 30 days = 5 332 tokens. This represents 2,4% from the present daily inflation of 220 000 tokens.

-

In case when the price per a token is 2,5 USD monthly server rental costs in tokens are 40 000 usd / 2,5 usd = 16 000 tokens and daily server rental costs are 15 500 tokens / 30 days = 533 tokens. This represents 0,24% from the present daily inflation of 220 000 tokens.

In each case, node runners have to sell these tokens on the market to cover server rental costs. Node runners may sell these tokens on a daily basis or once a month after accumulating them.

- NR’ Profits in the overall inflation

Node runner daily profits (which include salaries etc) in USD can be expressed as tokens which node runners get during their operating activities excluding server rental costs and be calculated as follows:

NR’ Profits = (Monetary base * Inflation / 365) * Rewards share * Token price – Rental costs =

= Daily rewards * Rewards share * Token price – Rental costs = (Daily rewards / Number of nodes) * Number of nodes * Rewards share * Token price – Rental costs = Daily rewards per node * Number of nodes * Rewards share * Token price – Rental costs

In the current situation with 48 000 nodes and with the daily inflation of 220 000 tokens the approximate daily rewards per node are 220 000 tokens / 48 000 nodes = 4,58 tokens.

Rewards share is individually specified by a node runner. Rewards share can have different weights, for instance, 80/20 (80% goes to a node runner, 20% goes to a staker), 50/50, 25/75 etc. depending on the size of stake and a particular node runner. What an equitable allocation of tokens between a node runner and a staker is the controversial question because a node runner will be interested in more distribution of tokens as well as a staker. In this example there will be applied an allocation of 25/75 (25% directs to a node runner, 75% directs to a staker). This specific number of distribution is taken on the reason it can be reckoned as fair number because a staker risks his personal savings in terms of negative price fluctuations and a node runner responsibility. In this relation, a node runner invests his knowledge and time within the operational activity. However, this rewards share distribution (25/75) can be considered fair, for instance, in case of staking above 1mln tokens form a staker.

- Then in case when the price per a token is 0,025 USD the daily NR Profits in USD are:

NR’ Profits = 4,58 tokens * 48 000 nodes * 0,25 rewards share * 0,025 USD – 1333 USD = 41 USD

Profit per one server would be:

NR’ Profits per server = 41 USD / 160 servers = 0,25 USD (daily)

NR’ Profits per server = 0,25 USD * 30 days = 7,5 USD (monthly)

- In case of 0,25 USD price per a token the daily NR Profits in USD are:

NR’ Profits = 4,58 tokens * 48 000 nodes * 0,25 rewards share * 0,25 USD – 1333 USD = 12 407 USD

Profit per server would be:

NR’ Profits per server = 12407 USD / 160 servers = 78 USD (daily)

NR’ Profits per server = 78 USD * 30 days = 2340 USD (monthly)

- In case of 2,5 USD price per a token the daily NR Profits in USD are:

NR’ Profits = 4,58 tokens * 48 000 nodes * 0,25 rewards share * 2,5 USD – 1333 USD = 136 067 USD

Profit per one server would be:

NR’ Profits per server = 136 067 USD / 160 servers = 850 USD (daily)

NR’ Profits per server = 850 USD * 30 days = 25 500 USD (monthly)

It is clear that NR’ profits component in USD is dependent on a token price (and number of nodes). According to a token price a node runner can bear a loss or have profit which starts above 0,02 price per a token.

NR’ Profits expressed in tokens can be obtained the same way excluding price of a token, then NR Profits in tokens are as follows:

NR’ Profits = Daily rewards per node * Number of nodes * Rewards share – Rental costs (in tokens)

- In case of a token price 0,025 daily and monthly NR Profits are:

NR’ Profits = 4,58 tokens * 48 000 nodes * 0,25 rewards share – 53 320 tokens = 1 640 tokens (daily)

NR’ Profits = 1 640 tokens * 30 days = 49 200 tokens (monthly)

These 1 640 tokens make up 0,75% from the present daily inflation of 220 000 tokens.

- In case of a token price 0,25 daily and monthly NR Profits are:

NR’ Profits = 4,58 tokens * 48 000 nodes * 0,25 rewards share – 5 332 tokens = 49 628 tokens (daily)

NR’ Profits = 49 628 tokens * 30 days = 1 488 840 tokens (monthly)

These 49 628 tokens make up 22,6% from the present daily inflation of 220 000 tokens.

- In case of a token price 2,5 daily and monthly NR Profits are:

NR’ Profits = 4,58 tokens * 48 000 nodes * 0,25 rewards share – 533 tokens = 54 427 tokens (daily)

NR’ Profits = 54 427 tokens * 30 days = 1 632 810 tokens (monthly)

These 54 427 tokens make up 24,7% from the present daily inflation of 220 000 tokens.

This approach to calculation of NR Profits describes the state of affairs as it is going now.

It is evident that depending on a token price node runners can suffer losses, operate at breakeven or have profits. During losses node runners can increase their part of rewards share but this measure may scare away stakers. At a high token price node runners can have unreasonably huge profits (at the price of 2,5 USD per a token the profit per server is 25 500 USD) what is unhealthy for the network because in that case it happens an emission of big number of unnecessary tokens which aren’t supported by customer demand for relays. As the result, the dilution of ecosystem can take place on account of surplus emission of tokens going to NR Profits.

With regard to NR’ Profits can be applied another approach when the network (represented by Foundation, Managing Entity, CEO, Founders or DAO, etc) as a pioneer in the decentralized RPC infrastructure sets the Destandards of the whole tokens allocation structure. One of the angles of this framework includes NR’ Profits allocation in tokens.

Another point of view on NR’ Profits, which differs from the current one, is to set standard NR Profits fixed in USD per one server. Which NR’ Profits in USD per one server can be? Let’s say at 3x the costs (expenses) presented by one server rental payment. A node runner during an operational activity has expenses in the form of rental payment for one server 250 USD. In this sense NR Profits per one server can exceed costs of server rental in 3 times and equal to 750 USD. Why 3x? On the reason this number can often be met in real businesses and secondly, this only is an assumption, this number can be corrected after an elaboration and a clarification of the standard of income for node runners per server which can be amended in discussions between network representatives and node runners. I wouldn’t post the calculations but according to my estimates with 3x approach per server a node runner to whom stakers delegated 50 mln tokens can have 8300 USD profit monthly (if I’m right in my guessing because I’m not in the DAO or the team to have all detailed information).

Additionally, if this 3x parameter is reckoned to be low by a node runner then a node runner can buy and stake his own tokens to increase profits. This is a quite normal situation, for instance, in Bitcoin network and miners have to make additional buys of ASICs by their own in order to have additional profits, especially during halving.

This fixed 3x (or other) way in USD has its own advantages and disadvantages. A node runner may not like this approach because this will limit his potential profits at a high token price. But in this sense a node runner provides a service, for instance, like cloud services from Amazon, Microsoft, Alibaba, Saleforce, Snowflake which have more or less fixed unit profits and earn depending on the volume of service. On the other hand at a low token price a node runner is secured by the protocol that he would have more or less a stable fixed profit.

These USD fixed NR’ Profits per one server are dependent on a token price. With a token price increase, a number of tokens that a node runner has to sell to get his 3x profit are decreasing and vice versa. A node runner will have to sell his tokens every day in order to secure himself from price fluctuations.

- In case when the price per a token is 0,025 USD, monthly NR Profits in tokens are:

NR’ Profits = Number of servers * Server rental * 3x rate / Token price =

160 * 250 * 3 / 0,025 = 4 800 000 tokens (monthly)

Then daily NR’ Profits in tokens can be calculated as:

NR’ Profits = 4 800 000 tokens / 30 days = 160 000 tokens (daily)

This makes up 72% from the present daily inflation of 220 000 tokens.

- In case when the price per a token is 0,25 USD, monthly NR Profits in tokens are:

NR’ Profits = Number of servers * Server rental * 3x rate / Token price =

160 * 250 * 3 / 0,25 = 480 000 tokens (monthly)

Then daily NR’ Profits in tokens can be calculated as:

NR’ Profits = 480 000 tokens / 30 days = 16 000 tokens (daily)

This makes up 7,2% from the present daily inflation of 220 000 tokens.

- In case when the price per a token is 2,5 USD, monthly NR’ Profits in tokens are:

NR’ Profits = Number of servers * Server rental * 3x rate / Token price =

160 * 250 * 3 / 2,5 = 48 000 tokens (monthly)

Then daily NR’ Profits in tokens can be calculated as:

NR’ Profits = 48 000 tokens / 30 days = 1 600 tokens (daily)

This makes up 0,72% from the present daily inflation of 220 000 tokens.

- Stakers’ rewards

Stakers have their stumulus to delegate tokens to node runners in the form of token rewards. These rewards can be considered as dividends in the traditional finances when shareholders get dividends.

Number of daily tokens that all stakers receive in total can be calculated as follows:

Number of stakers’ tokens = (Daily rewards in tokens / Number of nodes) * Staker rewards share * Number of nodes = (220 000 tokens / 48 000 nodes) * 0,75 staker rewards share * 48 000 nodes = 165 000 tokens (daily)

Then monthly number of all stakers’ tokens is:

Number of stakers’ tokens = Number of daily staker tokens * 30 days = 165 000 tokens * 30 days = 4 950 000 tokens (monthly)

This value of 165 000 tokens represents 75% of 220 000 daily inflation tokens. It should be noted that at fixed inflation the number of all stakers’ tokens in total remains unchanged independently on the number of nodes and a token price, so this is a constant component. This can be shown in this calculation:

Number of stakers’ tokens = (Daily rewards in tokens / Number of nodes) * Staker rewards share * Number of nodes = (220 000 tokens / 55 000 nodes) * 0,75 staker rewards share * 55 000 nodes = 165 000 tokens (daily)

Number of stakers’ tokens = (Daily rewards in tokens / Number of nodes) * Staker rewards share * Number of nodes = (220 000 tokens / 100 000 nodes) * 0,75 staker rewards share * 100 000 nodes = 165 000 tokens (daily)

But it is different when it comes to APY for an individual staker. APY of an individual staker can be calculated as follows taking into account number of nodes and number of tokens required for one node:

Staker APY (in tokens) = ((Daily rewards in tokens / Number of nodes) * Staker rewards share * 365 days / Number of tokens per one node) * 100% =

= ((220 000 tokens / 48 000 nodes) * 0,75 staker rewards share * 365 days / 15100 tokens per one node)* 100% = 8,3%

It should be noted that Staker APY at fixed inflation is measured in the number of tokens, not in USD because a staker can buy tokens at one price but then a token price can change and a staker may lose or win in relation to the initial cost of a node. Additionally, Staker APY depends on the number of nodes, as the number of nodes increases, APY for each individual staker decreases and vice versa. Now the number of nodes is constantly changing from 47 000 nodes to 49 000 nodes and in my opinion has reached the average balance of 48 000 nodes.

8,3% APY for an individual staker - this is a lot or a little? Moreover, can APY be decreased or increased in order to seem attractive for investors to buy tokens and stake? How to choose right APY to respond investors’ rational expectations? In this relation APY should be justified and substantiated in order to become clear for an investor. The network as a pioneer in the decentralized RPC field in the face of Foundation, Managing Entity, CEO, Founders or DAO, etc can (should, has) set the standard (benchmark) APY for an investor. Because now APY can be calculated on one’s own but not every single investor would want to make any calculations depending on the network metrics (number of nodes etc) what can be regarded as an obstacle for some potential stakers to enter this project.

As present inflation is fixed at nearly 220 000 tokens per day so APY is variable and dependent on a number of nodes. In this case at 30 000 (15k) nodes APY for a staker would be 13.3%, at 40 000 (15k) nodes APY for a staker would be 9,9%, at 60 000 nodes APY for a staker would be 6,6%, at 65 000 nodes APY would be 6,1%, at 70 000 nodes APY would be 5,7%.

So the present APY of 8,3% is high or low? This number can be considered as high.

-

The reward rate of the most famous token Ethereum, the reward rate value equals to 3,86%. This is significantly less but Ethereum is in demand.

-

Let’s look at service Stakingrewards.com which aggregates staking information about the most prominent tokens. This service highlights such a metric as Benchmark Reward Rate which “provides an average reward rate across all staking opportunities tracked by Staking Rewards, balanced by the amount staked. It’s determined by calculating the balance weighted average reward rate across all opportunities. It’s worth noting that this average rate may be affected by assets offering high APRs through high inflation rates or by assets with low APRs but deflationary tokenomics.” As of now this figure is 6,32%.

-

Then next most representative indicator is the Federal Reserve Rate kept the Fed funds rate unchanged at a 23-year high of 5,25%-5,5% for a fourth consecutive meeting in January, in line with expectations. This rate can be regarded as safe so it is reasonable if staking rewards should have some risk premium on the reason all blockchain projects can be attributed as risky for investments considering that tokens (regarded as commodities) can increase in price value.

This average risk premium is well reflected in the Benchmark Reward Rate at Stakingrewards.com equaled to 6,32% which is more on 1% in relation to the Federal Reserve Rate.

This project being a pioneer and a leader in the Decentralized RPC field can be classified as a Benchmark RPC Project which should set metric standards in this industry, so that one additional percent 1% over the safe Federal Reserve Rate of 5,5% can be regarded as acceptable APY of 6,5% for a staker. In order to make project’s inflation algorithmically variable APY can be automatically tied to the Federal Reserve Rate + 1%. It is expected that the Federal Reserve Rate will be reduced and thereby staker APY can be consequently reduced as well.

The present Staker floating APY is 8,3%, this parameter can be reduced and made fixed at the level of 6,5%. This percentage at 48 000 nodes accounts for 0,065 * 15100 tokens per node / 365 days * 48 000 nodes = nearly 130 000 tokens emitted on the daily basis what is less than the present number of 165 000 tokens.

This approach has the disadvantage that when a number of nodes increases, a number of stakers’ emitted tokens also increases. But at fixed APY of 6,5% the number of daily tokens issued at the current level of 165 000 will be only with the number of 15k nodes equaled to 61 500 nodes. In addition, the investment attractiveness of the project consists in a number of relays which continue to be at the same level, so a large increase in nodes cannot be expected. And the second more important factor is that this fixed APY of 6,5% will be tied and follow the Federal Reserve Rate with premium of 1% and as it is known that with a high degree of probability the Federal Reserve Rate will be reduced and there may be a situation when the Federal Reserve Rate will be 3% and sliding Staker APY will be 4% accordingly.

From a new staker point of view the project state of affairs can be improved to give a potential staker convenient information to assess the project and expedience to stake. What steps can be made in this direction?

-

on the webpage to make calculator of APY for a staker or to show APY based on the current network metrics; sometimes it seems a little bit ridiculous that the technical part of the project gets better and better but an attitude to a potential staker remains the same, so far a staker has to calculate by his own APY based on a number of nodes, inflation, share rewards etc but a staker doesn’t do this;

-

to simplify for a staking process for a staker as much as possible as it is done in other staking projects, to have a webpage which aggregates all node runners with all info: rewards share, free capacity to stake etc, and stake with pressing one button.

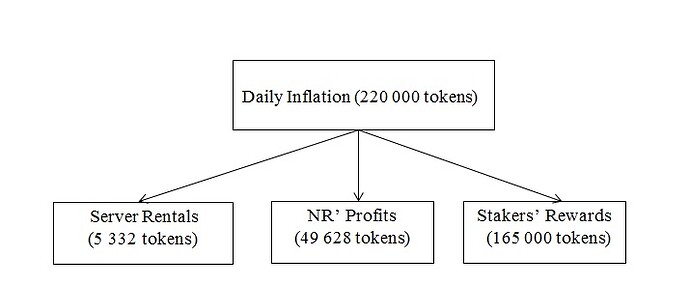

To summarize, what is going on currently with the distribution structure of daily inflation and inflation per se:

Fixed 5% inflation from the Monetary Base of 1,65 bln tokens what means 220 000 tokens of daily token emission. Provided from this example that the number of 15k nodes is 48 000 nodes, the number of tokens per one node is 15 100 tokens, the rewards share is 25/75 (25% goes to a node runner, 75% goes to a staker), APY is 8,3%, a token price is 0,25 USD, the daily token distribution is as follows:

5% yearly inflation

220 000 tokens daily

- 5 332 tokens (2,4%) go to Server Rentals;

- 49 628 tokens (22,6%) go to NR’ Profits;

- 165 000 tokens (75%) go to Stakers’ Rewards

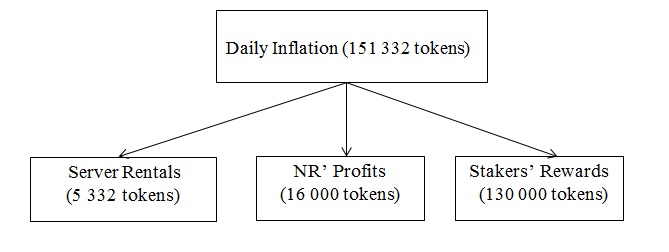

What is going on with the distribution structure of daily inflation and inflation per se with another approach:

Floating inflation or conditionally sliding inflation from the Monetary Base of 1,65 bln tokens based on 3x node runner profit (750 USD per one server) over server rental cost (250 USD per one server) and staker APY of 6,5% with a premium of 1% over the Federal Reserve Rate (5,5%) what under the current network metrics means 151 332 tokens of daily token emission or 3,3% on a yearly basis. Under the example conditions that the number of 15k nodes is 48 000 nodes, the number of tokens per one node is 15 100 tokens, the rewards share is 25/75 (25% goes to a node runner, 75% goes to a staker), APY is 6,5%, a token price is 0,25 USD, the daily token distribution is as follows:

3,3% yearly inflation

151 332 tokens daily

- 5 332 tokens (2,4%) go to Server Rentals;

- 16 000 tokens (22,6%) go to NR’ Profits;

- 130 000 tokens (75%) go to Stakers’ Rewards

This approach to inflation has its traits:

-

inflation is structured and so that intuitively clear for a person;

-

an ability to regulate particular components of inflations;

-

has an inner logics of setting inflation because, for instance, it is still not clear why the current inflation is 5% but not 4,99 or 3,67% or maybe 2,35%;

-

the most important point is that inflation can be made automatically and algorithmically changeable what eliminates the need in every vote conducted by DAO because in recent cases of voting on inflation the decisions were very long drawn out, the high inflation which diluted and depreciated the project has been remaining for a long time that almost ruined the project.

As stated in the beginning of this essay the DAO share (10%) wasn’t included into calculations in order to simplify explanations, to take the essence of idea and on the other hand to involve the responsible people from the team to make calculations with the DAO share to get interested in making changes in the inflation approach which is being long overdue because of maturity of the project and a stable price growth.

This approach in case of support from the team and community can be laid into pre-proposal, proposal or become a concept to move further in this direction of setting algorithmically automated inflation.

Excel file with these calculations depending on price and other metrics can be attached in TG (Jinx’ or Price group) if anyone would be interested, here I couldn’t find how to attach an Excel file. All changeable parameters in the Excel file are highlighted in color.

Thanks!