(by Pablo | POKTscan)

The increase in traded volumes within the Pocket ecosystem is a desirable and the community as a whole pushes towards this objective by the creation of a wrapped token (wPOKT, proposal from 2020) or directing resources to open more CEXs (as stated in the ERA budget).

However its difficult to imagine that new capital will flow into the ecosystem after the initial high APY phase of node running is over and given the unattractive token performance in the last year. New incentives should be created to provide support for the token exchange rate, one of such could be the futures market, which will arise with the wPOKT and if the ecosystem trade volumes increases. But the futures market can be a double edge blade that we need to wield carefully, as we will present in this thread.

Abstract

This thread tries to make explicit some consequences of not having a monetary policy holistically thought and implemented from the Pocket ecosystem. Although the thread carefully

observes the development of futures markets, where it is expected that Pocket will start to play if the ecosystem grows, it is not the intention to describe the virtues or successful strategies of futures markets, but rather to observe their relationship with the risk-free interest rate.

The analysis highlights that the lack of a risk-free interest rate in the ecosystem puts the economics of Pocket at risk of being carried away by other ecosystems rates, and can create situations where the price action of POKT declines out of lack of a proper interest rate to settle expectations. On the other hand, developing a risk-free interest rate can help the inflow of capital into the ecosystem.

What is a futures contract?

It is a contract whereby two parties, buyer and seller, agree to trade a certain underlying asset within a previously fixed term and at a price established at the time of entering into the contract.

It is expected that if the Pocket ecosystem grows, the exchanges where the POKT token is traded will offer the option of trading POKT contracts in different positions in the future, as is the case with the tokens of the large ecosystems, such as Bitcoin, Ethereum, Solana and others. This thread deals with the consequences of this, some of which might be unexpected to community members not versed in the subject.

What is the purpose of a futures contract on POKT tokens?

The answer of this question depends on the point of view of each ecosystem participant (or the ecosystem itself):

For Applications / Gateways

It reduces uncertainty, because, given that they will permanently need POKT as an input to be able to request work (relays), it is logical to think that they will commit themselves in the present to buy POKT in the future, at a price agreed today, which reduces the risk of an abrupt price increase.

For Servicers (node runners)

Uncertainty is reduced, because, since they will permanently collect POKT as payment for the services rendered, it is logical to think that they will commit themselves in the present to sell POKT in the future, at a price agreed today, which reduces the risk of an abrupt fall of the price.

For speculators

It gives them the option of investing by betting on the volatility of an asset, without holding the asset itself, with all that this implies, especially in terms of stacking (unstacking a position in the future takes a matter of seconds, while unstacking takes 21 days).

Note: Perhaps the word speculator may carry a negative charge, but in this context, nothing is further from the truth, in fact, extensive speculative activity is necessary for the smooth flow of commodity futures transactions. Without speculative participation, it would be virtually impossible for Servicers and Applications to follow a consistent hedging policy and for futures exchanges to perform their basic economic functions.

Speculators serve to improve the efficiency of the futures markets by providing the liquidity necessary for the markets to function smoothly, increase trade volume to allow each market participant to enter and exit without significant cost, and keep the various markets aligned through arbitrage trading. Speculators provide the risk capital needed to offset hedging operations. By increasing the volume of futures trading, speculators reduce the cost of hedging. This means that when a hedger wants to trade, some speculators will be willing to take the opposite side of the transaction

For the ecosystem as a whole

It is clear that the development of these markets is a sign of confidence (or of the distrust it possesses) in itself, since the mere future transaction of the token, induces to think about how much of the token will be consumed (now or in the future) and what quantities are convenient to produce, giving stability not only to the parties transacting the future contract, but also to the

ecosystem as a whole.

How to establish the theoretical value of a future contract on POKT tokens

For those who deal with USD as their daily currency, the POKT token should be considered simply a foreign currency that they can buy and sell, and as such it is expected that the POKT should have a risk-free interest rate in the same currency.

Under these conditions, if we will consider the situation where the investment in POKT provides a known, risk-free return under a continuously compounded interest rate rp. This means that the income is known when it is expressed as a percentage of the asset price at the time of payment.

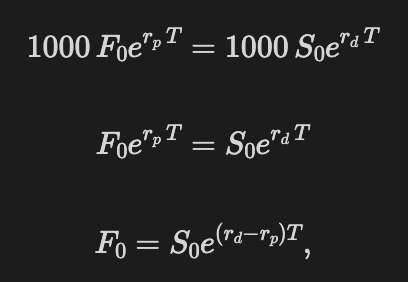

Then the price of the futures contract should be as follows [1]:

where:

F0is the theoretical price (fair price) that future contracts should be signed at. It is the price that each parties should agree to buy/sell the POKT tokens in the future, any other price would permit any of the parties to obtain benefits without risk.S0is the price of the underlying today, this is the current price of the POKT token in USD.rdis the risk-free interest rate in USD.rpis the risk-free interest rate in POKT.Tis the time until the POKT tokens should be delivered.

Any other price would allow an arbitrage to be exercised that generates profits without risk, it will then be the task of speculators to act and regulate the market until it balances at that price.

This expression can be derived by means of a simple example:

Suppose someone starts with 1000 POKT, there are two ways to convert the POKT to USD at time T. One is by investing the POKT for T years at rate rp and participating in a forward contract to sell the proceeds for USD at time T. This generates the following amount of USD:

The other is by exchanging foreign currency for USD in the spot market and investing the proceeds for T years at the rate rd. This, in turn, generates this other amount of USD:

In the absence of arbitrage opportunities, both strategies should yield the same result. Therefore:

It is clear that a very high rp will generate a very low F0 value, and that no investor will want to bet on an asset whose price has such a low expected value, which in turn generates devaluative expectations and acts on the spot price of the POKT, pushing it downwards.

That is to say, if somehow the Pocket ecosystem manages to grow enough for its own token to be traded in futures markets (all the so-called large ecosystems have futures markets for their own tokens), the lack of a clear reference interest rate in POKT that is accessible to all the players in the ecosystem can generate a fall in the price of the token itself.

But if the ecosystem does not grow, and no forward markets are generated on the POKT price, then we are safe from a price drop due to lack of a clear definition of the interest rate on POKT tokens?

The answer is definitely NO. Let’s study why is that…

The absence of futures markets on a certain underlying, in this case the POKT, will not prevent the search for a hedge against the risk of price variation of the asset, it will only generate that whoever has the need to hedge will do so imperfectly, that is, looking for an asset with a high positive correlation with the POKT, this asset could be any other cryptocurrency, let’s call it BTC or ETH or let’s call it whatever name it is.

The chart above[2] shows the POKT price in USD (blue), BTC (yellow) and ETH (red). Obviously the POKT price in the other cryptocurrencies (yellow and red lines) is more stable, more horizontal, this tells us about the correlation between POKT and the other cryptocurrencies.

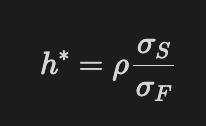

When using cross hedging, setting a hedge ratio equal to 1 is not always the best. The hedger must choose a value for the hedge ratio that minimizes the variance of the value of the hedged position. Now let’s see how the hedger can do this:

Calculation of the minimum variance hedge ratio [1]

We will use the following notation:

∆S: Change in the spot priceS. In our case the exchange price of POKT in USD over a period equal to the life of the hedge.∆F: Change of the futures price,Fduring a period equal to the life of the hedge, in this case could be, for example futures on ETH.σs: Standard deviation of∆S.σF: Standard deviation of∆F.ρ: Correlation coefficient between∆Sand∆F.h*: Hedge ratio that minimizes the variance of the hedger’s position.

This tells us that if the hedger (a Servicer or an Application) wants to hedge an exposure of E POKTs, then he will take a hedge of E.h* futures on ETH.

The consequence of this is that the price of the POKT is going to be influenced by the price of the ETH future, which in turn is going to be influenced by the risk-free rate that is determined in the ETH ecosystem, and that rate does not have to be aligned with either the interests or the needs of the Pocket ecosystem.

Conclusions

This leads us to think that trying to influence the price of POKT without having a risk-free interest rate in POKT can be extremely exhausting, and even frustrating. The POKT’s interest rate is just one more parameter to establish a macroeconomic balance for the Pocket ecosystem, and perhaps not more important than deciding how many POKT’s to burn in each block or how many to issue or what minimum number of days is needed for unstaking, or how many POKTs are necessary to keep in staking to be able to run a node.

The risk-free interest rate in POKTs is just one more parameter to take into account, but ignoring it will generate that the efforts that the ecosystem makes in other areas will not have the full effect that they could have.

Not having a risk-free interest rate in POKT is simply going to make us get carried away by the rates of other more developed ecosystems, and it would be good to emphasize the phrase more developed ecosystems and not larger ecosystems (large in the sense of market capitalization).

But a two-edged knife cuts in two directions, and it could also happen that if POKT becomes a more developed ecosystem in this sense, it ends up attracting capital that otherwise would not be able to take hedge positions in their ecosystems of origin, either for a question of volume or for a question of development itself. The arrival of these capitals, in turn, could increase the volume and size of our market capitalization if behind these capitals come speculative capitals, as a counterpart of Applications or Servicers. These capitals enter the ecosystem, because they trade POKT but do not produce them, that is, they would not modify neither the production nor the consumption of POKT tokens.

In any case, the only player able to establish a risk-free interest rate is the DAO, and considering the possible consequences of not doing so, it should be part of the DAO’s concerns for the long term economic plamning.

References

[1] - Hull, J.C., 1995. Introduction to futures & options markets.

[2] - https://www.coingecko.com/en/coins/pocket-network