Intro

Hey there! I’m Denis aka contentropy - I’m on the team of MYSO, a peer-to-peer lending protocol built on the EVM.

I would like to present an innovative treasury strategy to allow the DAO to generate stablecoin revenues by using part of its idle $POKT holdings for covered call lending - this strategy would employ idle tokens to be lent out with custom terms (duration and upside cap) to generate upfront revenue for the treasury which can be subsequently used to fund new and ongoing initiatives.

I am sharing this RFC proposal to gauge interest prior to making a full proposal for employing these on-chain covered call strategies through MYSO (https://myso.finance/ | https://app.myso.finance/)

Idea

The idea is to leverage a portion of Pocket’s treasury through on-chain covered call lending. This approach involves lending out a smaller part of currently idle $POKT tokens. By doing so, the DAO can generate significant upfront revenue in USDC. The earned USDC can be immediately utilized for community needs. And unlike a simple token sale, covered call lending enables the treasury to diversify its holdings into stable assets without an immediate market impact. All loan execution happens through MYSO’s 3x audited smart contracts and is trustless and fully transparent with full on-chain traceability

Benefits

• Idle $POKT tokens can be used to generate upfront USDC revenue

• Immediate revenue and liquidity for operational and developmental activities

• Diversification of the treasury into stables

• Tokens don’t need to be sold, thus there’s no immediate market impact

Example Scenario

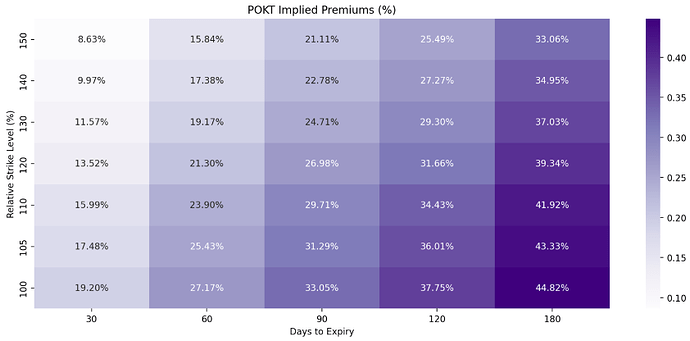

The diagram below shows indicative upfront premiums (as of Jan. 24, 2024) that the DAO treasury could earn across various loan duration (Days to Expiry) and upside cap (Relative Strike Level) combinations

For instance, let’s say the Pocket treasury lends $100k worth of $POKT for 60 days at a 120% upside cap. In turn, the DAO treasury gets approx. $21.3k USDC upfront - the treasury keeps this no matter what happens at loan expiry.

Now, at the end of the loan period, two outcomes are possible:

i) If the $POKT price remains below 120% after the 60 days, the originally loaned $POKT is returned.

ii) If the price of $POKT exceeds the 120% cap, the DAO treasury receives $120k USDC

As mentioned earlier, the upfront premium ($21.3k) is paid out upfront and is retained no matter the outcome of the loan

Conclusion

This proposal outlines how the Pocket treasury can generate USDC stablecoin revenue by using idle $POKT treasury for covered call lending. This approach not only diversifies the treasury but also avoids market impacts that could arise from outright selling $POKT tokens.

Would love to hear feedback and comments from the DAO and community and would be happy to answer any questions. Looking forward to putting together a full proposal outlining each of the above points, the process for facilitating this trustless, on-chain covered call, and describing MYSO, the proposer, in more detail.