This proposal is now up for voting Snapshot

I realize I am not an amazing economist nor will I pretend to be one, but I would say I do have a good gut feeling when it comes to incentives. I’ve outlined my pros and cons:

Pros:

- Decreases inflation slightly to attract more investors who believe we are hyperinflationary (speculative)

Cons:

- Force small node providers slowly to look into chain sharing or quit node running (which is still not mature at the moment as CC is not available and we need more than 1 provider to offer this service imo).

Note: I have also received word from multiple small node runners that this is detrimental to them, and this also limits the potential and motivation of becoming a large node provider in the future. I would love to see more diversity in the node-staked set. - We reach inflation rates closer to other more “mature” tokens such as AVAX and ATOM.

- There are fishermen and portal actors in V1 who should be incentivized from the get-go. We aren’t including them in the inflation measures, and we will need to pay them. THis becomes increasingly difficult if we are decreasing rates now.

I am concerned about the small to medium short impacts this proposal has, and I don’t believe we are being future forward enough to leave room for V1 incentives. In my anecdotal experience, small runners’ skills, input, and experience are extremely valuable to this ecosystem, and I don’t believe we are in a mature place enough to be forcing them to consolidate due to the lack of software available. While I realize that we can also revert course on these changes, it may come with certain pushbacks that will be hard to reverse. There are a lot of unknowns that we haven’t figured out yet, and sometimes the best thing to do during a time like this is nothing.

Thank you @poktblade for some very well thought out feedback. For context, I will paste below the discussion points I made in our dm outlining from my perspective, “why SER”.

I note that the cons you list are very node-runner centric. We have tried to do node runners justice in this proposal as a counter to the more drastic cuts Art and Michael were suggesting, and shifting to a reduction rate that is much slower than that of the last year (4% per month vs 12%). On the other hand, we must collectively remember that the project does not exist in order to prop up node runners. If that becomes the goal sans commensurate demand, it becomes a ponzi scheme, which eventually collapses with token price driving to zero. In which case node runners are in much worse shape than any hit resulting from this proposal.

I am mindful of upcoming v1 shakeup of the emissions pie. I do not know if portal actors need to get a piece of the emissions pie, as they should be capturing value by the differential between fees collected from their clients and the expenses incurred. They do not need pay from the protocol in order to capture that value . But fishermen… yes they will squeeze into the pie, and yes servicer rewards will likely have to be reduced to make a carve-out for fishermen.

The end goal is emissions produced in balance to app burn (“burn and mint”). As app burn increase, emissions for node runners will increase, not decrease, even as the inflationary boost-strap portion of emissions diminishes and eventually gets phased out altogether. If some node runners decide to call it quits in the current environment, I think that will be temporary only. Once demand is there to warrant growing the network, emission growth via burn-and-mint will naturally lure back those that were sidelined.

Hey, thanks for your feedback.

Heard you are an amazing coder though- respect! ![]() I have a huge inferiority complex there.

I have a huge inferiority complex there.

I generally do ok with markets and economics.

“Gut feel” is something we all believe we are good at (including me) but Daniel Kahneman debunks that very well.

Allow me to address your post a bit differently and nothing is for universal acceptance, just my personal views.

A famous and soon to be a living centenarian once said: “Show me the incentives and I will show you the outcome.”

Are you a node runner as well? I am relatively new, please forgive my ignorance.

The length of the cons list above VS pros hints me so.

I don’t consider such probable behaviours good, bad or evil btw.

I consider those very humanly and therefore discuss them very openly.

Behaviours and aspects such as- humans being interest and incentive driven, forming interest groups, tragedy of the commons, etc etc

Just as in one of my recent tweets I said- incentives may not be aligned for PNI (as a for-profit entity) to de-monopolise themselves. I don’t consider that evil, thats just capitalism. And PNI can be replaced with any 3 letter company in the current situation, and my comments will not change.

Why is this important?

Because if PNF (@JackALaing , @Dermot , @nelson , @b3n , @Ming ) has to do good and smart governance in this DAO, it’s important to discuss those probable behaviours and consequences openly, and factor those in the governance processes.

I have called out a few more things here and here.

Going back to supply and inflation-

I would encourage you to check this sheet and you may change your mind if you want to compare and contrast (which we should).

I think the conclusions are self-explanatory of where POKT stands VS the rest on the list.

I mean most actually have a definitive supply, which is even more radical if we were to take that route but we didn’t.

Btw Solana and Pocket mainnets happened around the same time.

Comments I keep hearing- we are over provisioned, we don’t need ~25k nodes, we need more validators, etc

I don’t know the precise answers because that’s not my area of expertise yet.

But I do wonder how other POS chains are decentralising, securing, validating, transacting with less staked, fewer validators, etc.

ETH staked is ~13% of the supply (although will increase after Shanghai)

Solana has ~3000 validators

Forgive me if I overstep because I am not an expert here; maybe I am missing critical details & nuances of the argument.

I understand the supply side going little ahead, the need for subsidies etc in a startup.

But Pocket is not a node running company, that’s not its core offering. And it’s not “THAT NEW” anymore.

It’s high time that we start paying attention to other space and market realities:

-Demand/end users

-Investors/Token Value

-Dev/mind share

-Market share

-Protocol financials

-DAO governance

-Marketing

to name a few, also overlapping ones.

And there will be tradeoffs and compromises to be made.

I will continue to be vocal on this front.

At this moment, SER appeared “net-positive” & “the best alternative” to align with market and space realities and to get the ball rolling. We decided against “do nothing”.

Next step of tokenomics will hopefully be more dynamic and robust- factor in demand, burn etc. At least that is the attempt and discussions have already started. We are all excited!

To end this- “speculation” has a bad reputation but we forget that we all indulge in it knowingly or unknowingly. Several comments above are speculative in nature.

Starting a company (entrepreneurship), marriage and many more critical decisions are the biggest speculations ever!

Thanks for reading.

Just to bring a little clarity:

The above numbers are benchmarks against we can compare POKT number of validators and POKT staked to validators. Currently POKT has 1000 validators with 6% of the supply staked to validators. I think those numbers speak for themselves as being low compared to other projects in the space. Hence my separate proposal to at least double the number of validators (which will also almost double the POKT staked to validators. 6% is simply too low to secure the network (IMO)

Number of servicers ( and everything in that black box such as number of chain nodes etc), on the other hand, is a very different beast, and it is difficult to form comparisons between projects. POKT servicers are a distributed set of service providers earning pay via emissions. for servicing client’s’ RPC requests on various supported chains. The number of servicers needed has nothing to do with the Pocket chain itself but everything to do with level of demand generated by clients’ PRC requests. It is by comparing the client demand as measured in the RPC requests per region and per chain and the supply to service that demand in which judgments of “under-provisioned” or “over-provisioned” can be made.

The “top-50 by market cap less stables” is a good first stab at comparitive analysis. A next step, if you are game to do more research, is to form a list limited to just other “work” tokens like POKT, whether for distributed computing, storage, rendering, or whatever.

[Note: As to POKT staked to servicers, vitaly makes a compelling case that it should be zero. Staking to nodes (almost always validators in other projects) is for the purpose of being able to enforce a punitive bite for bad or negligent behavior via slashing. This helps secure the network. With no slashing defined for bad or negligent servicer behavior (in v0), what is the point of requiring them to be staked (in vitaly’s argumet)? This is not to say that we should get rid of POKT stake for servicers. That ship has sailed. And I do believe that v1 will bring concept of slashing to servicers. Just wanted to bring some clarity.]

I agree with @poktblade view, but I think that this comment is the reason why I tend to lean towards accepting SER.

We need to keep on track and focus on long term goals and models. This is why I created the radCAD model topic. We need some clarity on how the different actors will affect the economy, starting from app burn and adding fishermen and tokenized portals to the mix later. The faster we get some consensus on how the token will work in the future, the faster that we can correct or replace SER with a better approach.

Small node operators are screwed either way unless they think price will miraculously hold up while tokens are printed like crazy.

A year ago, we were at 100x the current emissions while the price was going all time high. “Printed like crazy” is kind of hyperbolic given that, no?

I would agree with that if the price stayed there atleast for some time, but it shot down quickly indicating an abnormal event. I don’t wanna go into what those factors were, its another discussion.

Sustainable rise in price has not happened yet and I believe SER has the potential to get us there.

I have to read that thread. But I am not sure if staked to validators or validator to staked is the right metric to use for benchmarking to arrive at an optimal number of validators needed. That might be misleading. Tokens with ponzinomics can have very high percentages of tokens locked up or staked for earning “rewards”. But that doesn’t mandate a need for more security or more validators.

I am tempted to write more but the agenda will get derailed. I am already seeing so much dispersion of discourse- more about that later.

Has anyone come up with an objective way to arrive at the “optimal number of servicer nodes” Pocket needs or will need? Is that kind of logical pathway and conclusion or a formula even possible?

I have been reading a lot of opinions on this but I haven’t come across a solution yet. Please correct me if I missed it.

All this might feed into the evolution of SER into the next stage of POKT tokenomics.

ANKR is the only one closest to what Pocket does and has a token. The tokenomics is very low quality. But hey, what do I know. They just announced MSFT as a partner. Anyone interested can check here.

Yes I want to do the Web3 infra , middleware, web3 stack type tokens but first want to understand where we are heading and what role such a research will play in our future course.

Which takes me to-

I think we might need some prioritisation or even elimination for efficiency purpose, at least for the working group (WG). Here is where related/overlapping discourse is happening today-

a) Thunderhead Telegram

b) SER (Forum)

c) Fixed Supply (Forum)

d) radCAD (Forum)

e) WG Discord

While a) will do what it’s suppose to do and that’s fine. How do we streamline b-e? Maybe you guys don’t feel the need and want to approach this differently but I see some chaos and repetitions

SER Question-

Given that SER will get approved- do you think we should ask for a marketing budget to spread the word? @msa6867 @Cryptocorn @RawthiL

I am convinced that SER needs marketing “if” we want to push the narrative. Pocket doesn’t have the organic strength yet.

Messari seems to be an option.

Messari’s 1st report will be released end of Q2, am guessing will be big research report, and we don’t know what they will precisely cover.

I am talking about Coin Desk type articles/content and Coin Desk promoting those for us through their social media channels, which is very focussed and different from a quarterly report.

I will refrain to answer some stuff here to avoid de-railing. I will give some quick answers.

I’ve been thinking on this for a while now, and there is no “objective” way to do this IMO. The fact that Pocket should be “decentralized” adds a lot of discretionary and opinions on what is “decentralized enough”.

Impopular opinion here, but stuff in TG only deserves a quick read. I try not to enter large discussions there as the information goes away quickly and it always end in chaos and ponzinomics.

Dont we already have people on this? like @TheDoc on reddit and @PoktNews ?

I Messary proposal is approved I think that they might talk about this. But we have no saying on what they will write about.

I am not inclined to get involved in that question right now. There is nothing newsworthy about the reduction schedule per se. The only thing that may have an impact is getting the word out about POKT having “single-digit inflation”. Reporting that "in the near future POKT will have single-digit inflation is near meaningless. Once we cross that bridge in August/September, a good case could be made to get the word out that POKT has single-digit inflation to help combat the very persistent misperceptions out there. I’d be inclined to punt the whole discussion until then. In the meantime, yes TheDoc and PoktNews ought to incorporate SER passing in whatever language and spin they think best in doing what they do.

I feel you pain, but some of this can’t be helped… The different media serve different purposes. On the forum, there are proposals and research area… sometimes stuff gets posted in comments section of proposals that ought to be preserved in a different thread, either a new or existing research thread. Research thread owners may need to copy over relevant content so that it doesn’t get buried in the comments of the proposal.

The research threads are there to mature a topic in public view to the point of taking next action - usually a proposal. Care should be taken to keep them single-topic.

TG groups meander all over the place and are useful for gauging community sentiment and collecting outside pov. For example I use it extensively to learn as much as a I can of Vitaly’s pov. But these are not areas where any work gets done.

working groups (whether hosted on discord or TG) are for completely different purpose. Usually a small handful of action-focused individuals hashing out ideas, opposing povs, etc with actionable results - usually a proposed protocol change - either directly or via a research topic on the forum as an intermediary next step. For example in August, when several ppl put forward different ideas on next steps for emissions reduction, the players with different povs got together in a wg to work through a consensus proposal to bring to the wider audience.

I agree that we should have some marketing around SER.

-PR Newswire press release

-Messari including/focusing in their next review of us.

-Coin Telegraph article.

This could be something that Daniel, the new CMO of PNI could potentially help/lead?

I am going to make one last attempt and check if there is any interest in publicising the positive inflation story (contrary to what it has been)-

-

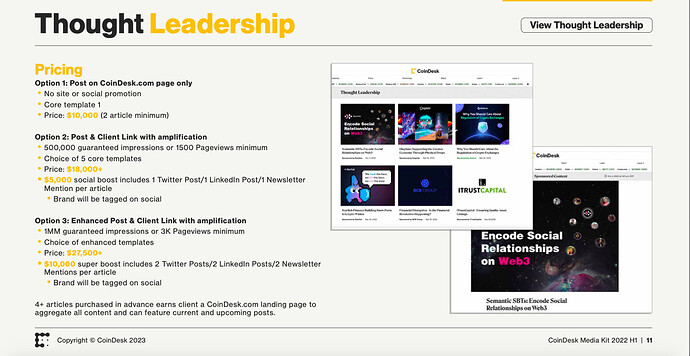

This is different from the Messari type of deal- its publicity/promotion/advertisement, very targeted and one-time. All media outlets have very clear offerings and price listings on their media kits; crypto native media outlets have those too.

-

We shouldn’t conflate this with Messari’s quarterly reports. I have read their reports and those are different from what we are trying to achieve here.

Although I want to check with Messari if we can at least make suggestions, just out of curiosity. There is no harm in checking.

- Have a pretty good sense of narratives. We are underestimating the newsworthiness of inflation in this space. A sustained reduction in emissions (starting from March onwards) to single digit annual in 2024, etc are sellable stories if done properly and through right channels.

And specially given how negative the sentiments continue to be about POKT and inflation.

Even in the recent podcast with Mike, inflation issue came up.

- As much as I love Pokt news and I roll with them almost daily on twitter, they are still very small.

Coin Desk seems to be the right fit for this job.

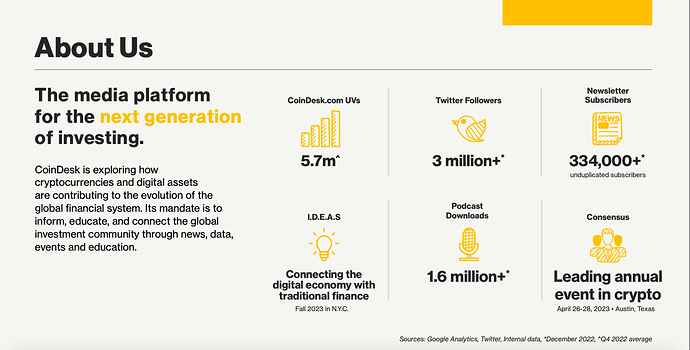

Here is a sneak peak to the kind of stats and reach we need if we want an impact-

- My only hesitation is this information; content and ad space in crypto media are not cheap. Coin Desk has a big menu and here is the “type of content and promotion” I think will be appropriate for telling the inflation story.

Not going to die on the hill for this if the community is not interested.

Personally I would prefer to “do something” than “do nothing” as I see this as an opportunity to shift the narrative and sentiments around POKT inflation.

Alternative suggestions are welcome.

In general, Messari approval was a great demonstration and a good start for the DAO valuing marketing and branding.

I’m certainly interested in positive marketing. Where are you thinking of publishing?

Edit: My mistake, I missed that the graphics were specifically CoinDesk. Rereading.

-

Instead of developing/maturing the case for this $$ in the comments section of an already-closed proposal, might you consider posting up a new pre-proposal with TBD funding amount?

-

In the meantime, we should make sure TheDoc is on top of this narrative in his tweets which the DAO already funds.

-

if the advertising works and new people want to start engaging POKT, whether as investors/speculators, dAPPs or whatever, the UX is not the greatest atm. I would recommend concurrent or prerequisite spending to raise the bar on this in order to maximize engagement and capture once advertising accomplishes a “first look”

-

In thinking about an advertising campaign, we need to really hone in first on who is the target audience. I’d love to see that fleshed out a bit

TheDoc posts to Reddit, but needs content to do so.

Agreed on the new proposal, but this suggestion would work with TheDoc, not in place of him.

Thanks @msa6867 & @Jinx for replying.

I want to clarify/cover a few things-

a) Not trying to get an approval for a few thousand dollars with my post. It was just to re-trigger the conversation and get a sense of the community sentiments. In my first attempt of proposing publicity for SER, 2/3 feedback from the core team members were negative and therefore I want to make this one last attempt.

I will take the formal route if and when the time comes.

b) I intentionally posted on this thread because I wanted to get a feeler first. All the information gathering needed (in this situation) to type a pre-proposal before I see some engagement maybe a waste of time and effort. And processes should be enablers not detractors.

I don’t see a more efficient way in this particular situation. What am I missing?

The scope of this question maybe broader- “how to do forum” moving forward.

c) The Coin Desk screenshots were teasers and samples. If there’s some interest, ideally I would like to collect the offerings, price chart (other details) from all the top crypto media outlets, and then come to a consensus.

d) We should not treat this as a straight NGU (number go up) move. And therefore nowhere I mention token price, that surely could be impacted eventually. Narratives and sentiments do not shift overnight. This is an attempt to counter the negative publicity about POKT inflation and give the community ambassadors ready ammo to use the Coin Desk (or XYZ) content beyond the duration of the campaign itself.

Such campaigns have not been tried by the DAO in the past as far as I know.

In the meanwhile, let me try to find out if Messari could cover inflation in their 1st report that I believe will be released at the end of Q2. That should also tick the “do something” checkbox, if the DAO doesn’t have an appetite for budgets for such campaigns at this moment.

Hey @Caesar , by all means carry on in this thread to develop the idea “out of the limelight” so to speak.

Only guidance I would offer is that greater perseverance may by needed than connoted by “therefore I want to make this one last attempt” Sometimes is takes several touches and time for a good idea to marinate before it gathers sufficient steam to move forward.

To summarize my earlier thoughts: who is the target audience, what is the desired action fro the target audience to take and what needs to first get done on UX so that the marketing is not wasted by people having negative experience when trying to find out more about POKT - crude landing page, out-of-date documents, etc.

We are in the exhaustion phase of a bear market. A tough time to try to attract new attention to a project. So maybe more focused on retention / re-engagement of those already familiar with / engaged with the project.