That is a illusion if you aren’t also taking COST into account. Validator APY means nothing if the servicer APY is not enough to cover costs on it’s own. Even if a validator decides to unstake to become run servicers because the POKT APY is better, they are at a loss at the end month when comes to the amount of USD that they put into infrastructure vs the amount of POKT that was generated.

This is why I asked:

EXAMPLE:

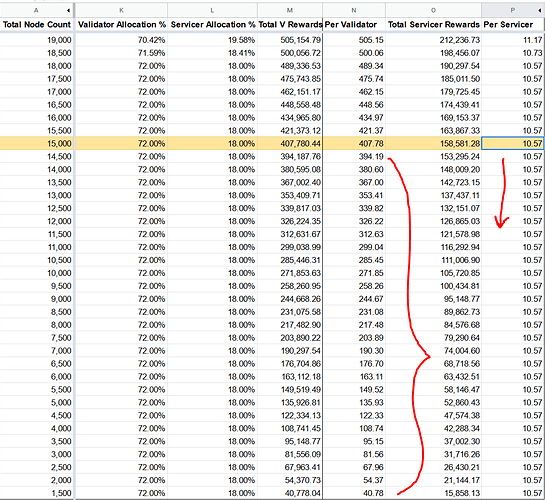

If I were to run 15k servicers on OVH, a bare-metal rental service, I can get the most bang for my buck. Running bare-metal is the most efficient way to cut node costs… though it takes much more work because you aren’t in a dynamic cloud.

So with the most efficient servicer network possible with 15k servicers, this is what it could require if entirely on OVH.

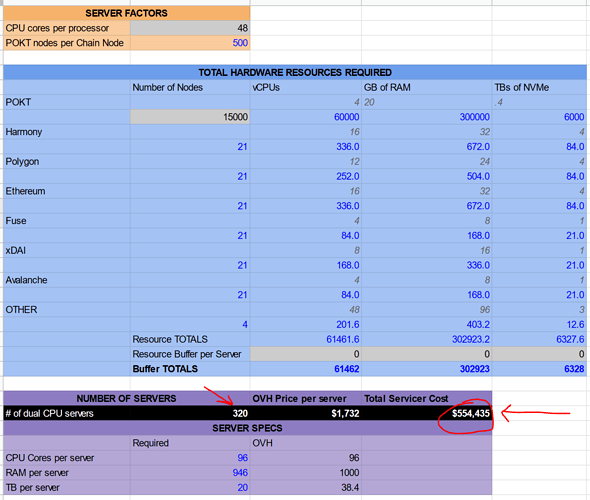

With the most efficient servicer infrastructure possible with 15k nodes, you are looking at $554,435 of monthly costs.

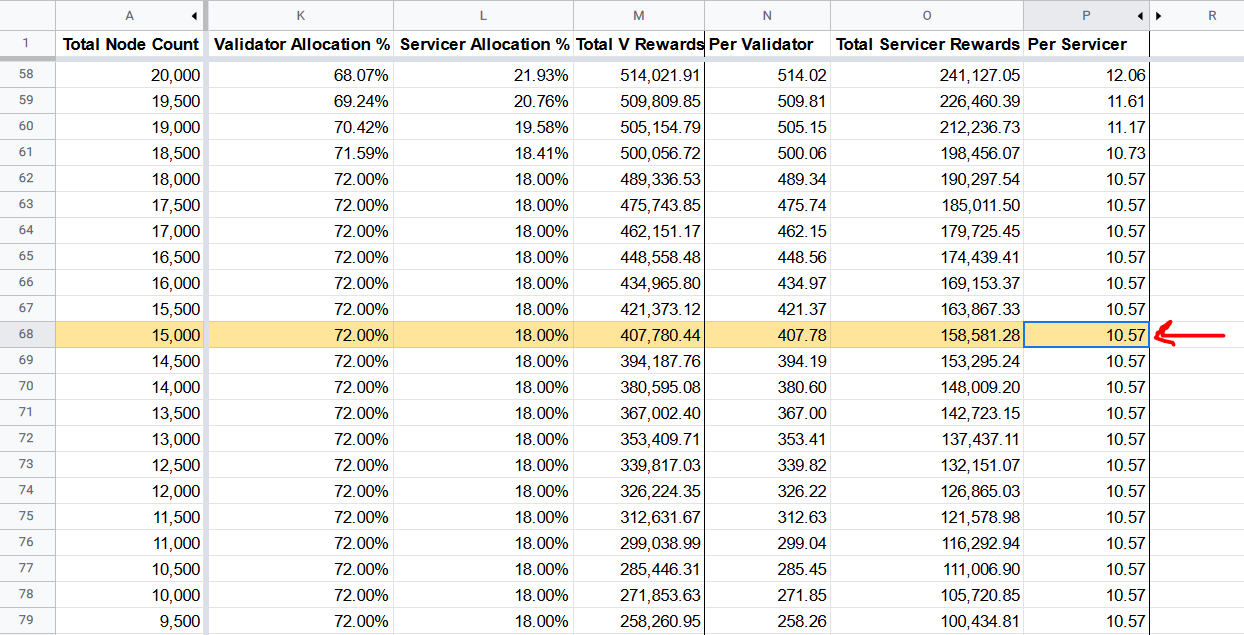

Now the question is, how much rewards would those servicers produce? 4,757,438.4 POKT with a price of 12c bring a value of $570,892.61.

If one individual, in the most efficient way possible, ran the ENTIRE servicer economy, they would only generate $16,457.61 in PROFIT a month. That is an APY of .61% when taking COST into account with the most efficient servicer network possible.

What will the quality of our RPC service be if the entire profit of running servicers is has an APY of .61%? What single individual will run the entire servicer network for a monthly salary of $16,457.61?

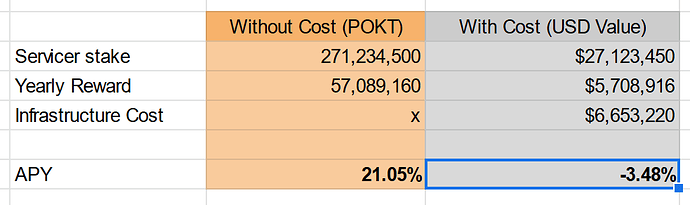

That is of course if the price doesn’t dip beyond 12c. At 10c your APY is -3.48%.

This is why only whales, who can take the losses, will be willing to run servicers. They will run them at a loss, but it keeps their validators generating rewards.

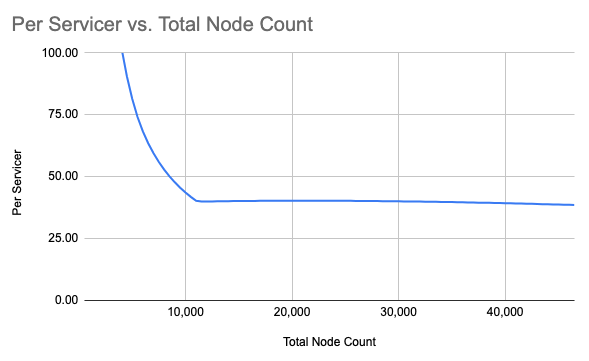

With this scenario… how are whales going to decide how many servicers each of them should run to keep the rewards coming? Some whales may not pay to run any servicers, which is a burden to the network.

Is this where we trust that everyone will do their fair share and run robust servicers, at a loss, and add up to 100 new chains by the end of the year?