I’m so happy that you all are driving forward an outside contribution to Pocket Core v0. I think more community members ought to be adding value like this group is.

I’ve got some thoughts (and charts) to dissuade us that this is the silver bullet that solves all of our issues. No matter how low-cost light clients are, nodes always have a non-zero cost. Leading me to my main point, there is a dangerous assumption in the models presented: node count remains the same with lower costs. This omission paints a prettier picture and ignores one of the key issues at hand: overprovisioning.

A stable node count seems like a reasonable assumption, but let me demonstrate why it isn’t:

The justification for the value provided to the network has to be in question. It must account for the long-term future AND adoption to be valid.

I’ve done some modeling based on the numbers above that paint a more accurate picture of a just light client future. First, some assumptions:

- Growth % = Percent of node count growth monthly (we’ve been growing at a minimum of about 7% - 13% monthly and higher than that previously)

- Cost Growth % = Percent of node running costs increasing per month (node running costs rarely decrease). 4% growth monthly over 18 months = $77.92 to give you a scale.

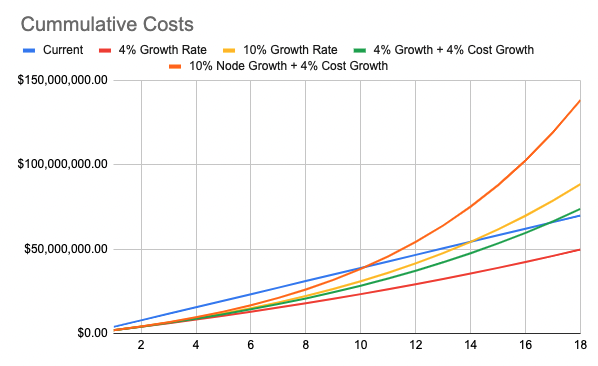

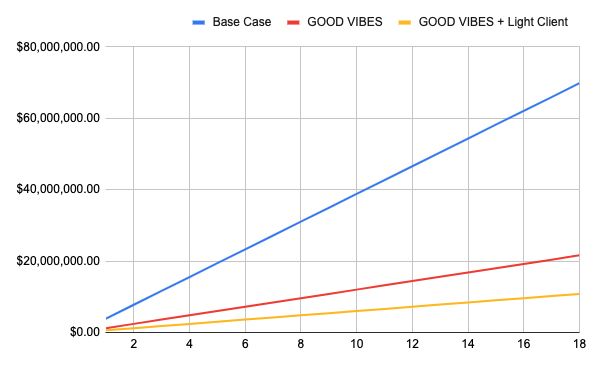

This chart lays out multiple scenarios versus the base case given different growth and cost growth assumption.

The base case is blue (nothing changes on Pocket Network). The rest are various scenarios based on growth and cost increases assuming a 50% drop in network costs (using @addison’s numbers). As we can tell, cost can meet or exceed the network that would be stable at 48.5K nodes.

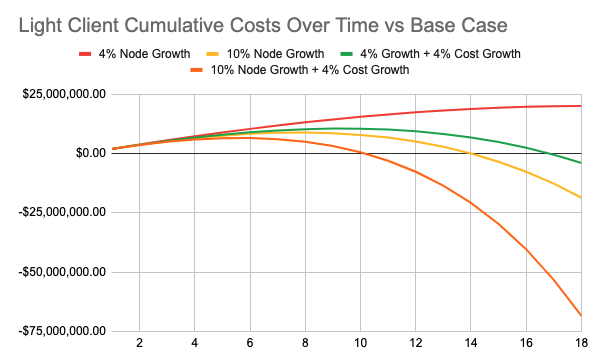

Here is the effect of that over time to network payback:

As you can tell, not addressing the core issue of over-provisioning costs the network over time. This proposal in isolation could lead to -ev and much higher actual network costs in the medium-to-long term.

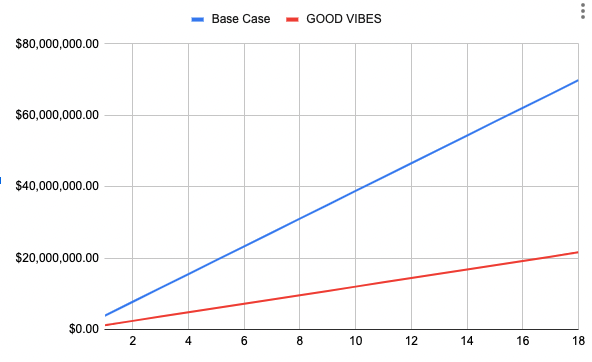

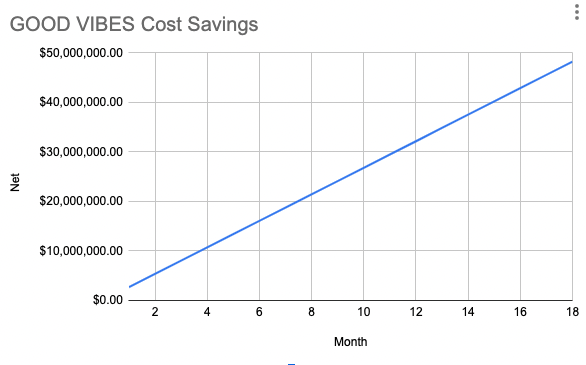

That said, it’s not all doom and gloom. GOOD VIBES has the desired effect on cost savings that @addison was describing in his post, without the risk of spiraling network costs OR betting $2M on the light client:

BUT WAIT, there’s more: What if you combine them?

The combination has the optimal effect on network costs leading to the best possible short-to-medium term answer.

Now to the question of value of this proposal: while there is certainly merit to the client as whole, its value may not be as high as initially requested given the math laid out above. It’s my personal opinion that $2M feels extreme and I’d advise the creators of the proposal to consider something more reasonable for the benefit of the DAO and the future project as a whole.