Clearly inflation needs to be addressed, this path is unsustainable. Whether it’s done now, or when there’s 2 billion tokens, or when there’s 5 billion tokens, the arguments will be the same, the apprehension from node runners will be the same. I think it’s better that it gets addressed sooner rather than later. I like PUP11, but I think a reduction over the course of a few months to 0.003162 as a stopgap would be welcome.

Burning the DAO’s tokens is a red herring that does not solve the issue at hand. These tokens are locked up in the DAO treasury, not included in the circulating supply, and do not have any impact on sell pressure in the market. All you would achieve is crippling the DAO’s ability to fund projects that benefit the ecosystem, without actually changing anything about the inflation problem.

I think that’s a fair stance for now and I wish that the proposal had not included changes to the DAOAllocation as a secondary action. People are getting hung up on this but the main purpose of this proposal was to reduce inflation, not to increase the DAO’s revenue.

I have taken the time to review both PUP-11 and PUP-12 again in succession. Here are the key themes that spring to mind while reading both debates, followed by some monetary policy recommendations. Note that these views are my own and not the views of Pocket Network, Inc., the Pocket Network Foundation, or the DAO.

This proposal isn’t reactionary; it doesn’t contradict WAGMI (at the current relay count)

PUP-11 was designed to target a fixed APY (WAGMI) that persists at different relay counts. The intention was that the WAGMI curve framework would be approved first, followed by a separate proposal that would set the target APY. Adam is now workshopping a refined inflation framework based on the feedback in that proposal, yet inflation continues and relays are expected to continue growing, so he suggested PUP-12 as a stopgap while he works on this.

The example WAGMI curve provided in PUP-11 was such that, at the current relay count of 260M, the inflation rate would be less than 0.005. This is approximately the rate that Adam is proposing here in PUP-12. I see no inconsistencies.

With these facts about Adam’s consistency in mind, I would suggest that it is not Adam who is being emotional or reactionary to market conditions, but rather those who are accusing him of such. However, I do not think that emotional reactions should be dismissed, they perhaps reveal factors that haven’t been reflected yet in any of the inflation proposals…

Price is a factor in inflation

While we might like to treat POKT as an isolated system, infrastructure costs are paid in $USD, which means the price of POKT is a factor in inflation.

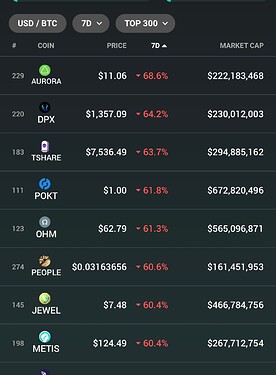

POKT’s price dropped significantly in the last couple of weeks, more so than the wider market even though some have pointed to a correlation with BTC. In fact, from looking at CoinGecko a few days ago, POKT was the 4th largest dip among the top-300 coins.

I personally attributed this to high inflation, with a hypothesis that in bull markets high inflation will accelerate buy pressure, while in bear markets it will do the opposite (accelerate sell pressure), since those who chased POKT’s APY now have a glut of liquid tokens, not yet staked, that they can sell to hedge the market by reducing the size of the bags that they’re holding. A cycle of “feast and famine” as @miner so aptly put it in the other proposal thread.

On reflection, this may not be entirely the case, though I do believe it is one of the factors. Unfortunately, due to the timing of this wider market crash, we have a counterfactual to contend with. It is possible that POKT sold faster than most other top-300 coins simply because it had just had a significant run-up in the month prior, or because the listings generated their own mini hype-correction cycle, and then these factors combined with the wider market crash to generate a correction of greater magnitude. It’s also possible that my original hypothesis was correct, that our current inflation dynamics lead to accelerated sell-offs during market downturns, but we won’t know this until another one happens without the prior conditions I mentioned.

Another cause that I hadn’t considered, but I have noticed as a theme in people’s responses to this proposal, is the fact that infrastructure costs are paid in $USD and Pocket nodes don’t get cheaper when POKT gets cheaper. In fact, they’re more expensive now than they’ve ever been, with 4-8 vCPUs now being the recommended minimum adopted by most large providers. Now that POKT is almost half the price that it was last week, node runners, who are paying $USD to bare-metal/cloud providers, and stakers, many of whom are paying the node runners $USD to cover these infra costs, are now seeing less return on their investment in $USD terms.

This may be another factor in the hedging behavior that I hypothesized; rather than hedging the crypto market, they’re hedging the fixed monthly costs of their infra. Selling more POKT while it’s high can lower the average cost of infra relative to selling on a just-in-time basis. This is rational behavior.

If this is the case, then perhaps our inflation framework should account for the price of POKT too. Rather than targeting an APY (e.g. 100%) relative to the 15k POKT stake, perhaps it should target the APY based on the effective $USD cost of the 15k POKT stake PLUS one year of estimated infra costs.

We should avoid a supply shock

Due to app purchasing of POKT not being activated yet through the Portal, all of our buy pressure right now is coming from nodes and, whether we like it or not, many of these probably fall under the category of speculative investors chasing high APY, “mercenary capital” who are not in it for the long-term vision of POKT but instead for the short-term incentives brought on by our high APY. I don’t think it’s a coincidence that POKT’s repricing occurred around the time of our relay growth; more relays = more APY = more stakers.

Given this, I agree that any changes made to inflation should be gradual and predictable. Mercenary capital is likely to cause a supply shock if a drastic change is implemented. We already have reports of Poktpool participants asking to withdraw their funds and this proposal hasn’t even been put to a vote. If we rock the boat too much, we may simultaneously amplify sell pressure while diminishing buy pressure.

To address this in the long run, I think we should aim to close the supply-demand loop in our economy, activating the natural source of buy pressure from apps using the Portal to coincide with any inflation reductions on the horizon so that any drop-off in mercenary buy pressure can be replaced by app buy pressure, and apps can, in turn, swallow up mercenary sell pressure. This means ending the current free-for-all model in the Portal, activating payments above a free tier which can be set at a slight discount to centralized alternatives, and using the Portal revenue to buy back POKT from the markets. This, in my view, would be an effective substitute for app stake burns.

Recommendations

- Rescind PUP-12. It was intended as a simple stop-gap but it seems to introduce more uncertainty to market participants than a predictable WAGMI schedule.

- Revisit PUP-11 (WAGMI) and edit with the following refinements:

- Inflation to reduce to the target level over the next 4 months, with the first reduction in 30 days (as suggested by Adam)

- Adam’s refinements from the other model he was working on, where relevant,

- An adjustment to factor in the price of POKT, i.e. APR should be relative to node stake PLUS annual node operational costs

- If WAGMI passes, submit a separate proposal to agree upon a fixed WAGMI rate that the Foundation would target by adjusting the RelaysToTokensMultiplier. 100% APY was Lex’s suggestion. I would suggest we calibrate it with reference to substitute APY sources in crypto, excluding those that are clearly outliers on the upper end of the spectrum.

- The core team maintaining the Portal should work to activate monetization (above a free tier threshold) then close the loop through a buyback program. This would be a temporary measure to replicate app stake burns until we activate them (most likely in v1).

I apologize in advance for the English not so good.

I believe that a way to avoid a mass evasion of nodes and at the same time attract new investors, who at this moment are afraid to run nodes for fear of reduction in rewards, would be to stipulate some kind of counterpart for the reductions to start. For example, for the first reduction in APY to occur, the number of relays has increased above 10% in the average of the last 5 days, taking into account the ATH of relays.

Those who follow POKT the longest have more confidence, but those who have not yet started to invest wonder if the project will continue to grow to the point of sustaining the rewards.

I wholeheartedly support this well thought out set of suggestions.

Love love this, and fully support this approach. Inflation must be adjusted, but gradually and within set data triggers so to not shock the ecosystem. Start ramping up ARB as per outlined in the Maturity Phase in order to have a more sustainable economy and able to better scale for growth.

Hi all,

I want to start off by saying that I love this project and am very happy to have found it when I did and to be a node runner. Huge props to Michael and the entire team.

I’ve read a lot of the comments and think there have been many good points made both for and against, both taking price into consideration and ignoring price. So much well-trod territory there that I won’t bother rehashing.

TLDR: There is a greater risk to the health of the network in attempting to control inflation prior to projected increases in daily relay count than there is in managing it after the fact.

The thing that I haven’t seen mentioned (and apologies if it was and I missed it) is how this will affect the growth of the network and Pocket’s ability to scale large enough to take significant market share from competitors Infura and Alchemy.

To that end, I’ve put together a spreadsheet based on the best of my knowledge that models out how a reduction in inflation will affect the ability of the network to satisfy future demand. Please feel free to challenge my math/assumptions, as they form the basis of this argument.

Here is a link to the spreadsheet, and below are my assumptions:

Link: POKT Inflation Scenarios - Google Sheets

Assumptions:

-

Pocket Network’s eventual TAM is approximately 10x current volume or 3 bn relays/day (consistent with Infura)

-

To service this the network must grow to at least 4x current node count or approximately 100k nodes.

-

Approximately 60% of the token supply will be used to run nodes, with the other 40% held by DApps, market makers, liquidity providers, the DAO, exchanges, and speculators.

(Note: Currently 57% of supply is used to run validator nodes, I expect that number to go down as wPOKT comes online, this makes the projection more conservative than the likely outcome.)

Based on these assumptions, which I believe to be somewhat conservative, we will need 2.7 bn POKT tokens as total supply to support a robust relay network able to onboard significant market share from current competitors.

Based on our current emission/relay rate, it will take us 678 days or 1 year and 10 months to get to this level of supply on the network. So think October of 2024.

As the total number of daily relays scales, this supply target gets closer and closer. Based on this model there’s no question that inflation has to be addressed- are we going to have demand from Dapps to satisfy 100k nodes in Jan 2023? Maybe, but likely not.

But in addressing how we handle reducing emissions the question that I believe we need to be asking is wen? Wen do we want to have capacity to offer Pocket network at Infura scale? According to the current proposal and daily relay count that answer seems to be September 2027, by which time I fear we will have missed the boat.

In my mind, there is more risk to the health of the network in having too little supply than too much. If we print too much POKT then the price goes down, speculative node runners will drop off as rewards become less and less profitable, true. But their tokens will be absorbed by others and the network will grow capacity regardless, and when inflation does finally go down the network will have the necessary resources to support relays at scale across the globe. As demand surges, prices will inevitably go up.

On the flipside, if we constrain supply then the network can’t possibly scale to meet a surge in demand. This will in turn create choke points and a bad experience for DApps, who will be reluctant to switch to a netwok that can’t possibly give them the capacity they need to be performant. Sure, price will go up in the near term, but the network will essentially cut itself off at the knees without enough tokens for future growth.

This will open the door to fast followers who will take the lessons of Pocket, tweak the model, and be able to offer a superior product, eventually leading to the demise of Pocket network.

We’ve seen this in other projects and should learn their lesson well. Typically those with their hands on the levers tightened too early, causing both a flight of existing capital and discouraging new capital from coming in. Klondike BTC reduced the return rate, causing a flight of capital from the project, which took the token ten percent off of its peg and discouraged new investors from getting in. The project couldn’t recover and went to zero.

In my mind, the only real factor that needs to be considered is total token supply against an eventual steady state of relay demand. If we try to manage the growth curve too tightly we risk choking it to death.

Key metrics to use when considering how we balance these are:

Target dates for achieving scale: Based on a target for steady-state of relays, we can start to figure out how many nodes are needed to support them, and in turn back out to a total supply needed to support the network. We can use this same thinking to set target dates for onboarding new projects/chains and a projection of how many relays they will bring to the network. Once we see the actuals come in we can adjust the emissions rate to stay on target with our date for steady-state.

Total projected demand for nodes: We need an accurate baseline of just how many nodes are needed to run an X-bn relay/day network. A good comp is to get an understanding of just how many nodes Infura is running. They are scaling their nodes to run as efficiently at capacity to meet demand. If we know how many nodes they’re running on average, we have a target for how many we’ll eventually need and in turn a total token supply target.

In the meantime, the price will do what it does, for reasons both well and poorly understood. While I don’t believe that this proposal is in response to a price drop, I do believe it attempts to control an outcome before that outcome arrives, and I would argue that there is more risk in attempting to manage a prospective surge in relays than there is in seeing what comes and managing it after the fact.

At the end of the day, demand has the ability to scale exponentially, while supply can only scale linearly. The Pocket network is still taking its first steps in getting off the ground, and knowing that we will eventually need over 2 billion tokens to meet demand that could come in massive spikes in the next 24 to 36 months should give us comfort that we can afford to be a little loose with the emissions rate for now. In the meantime, price and relay count will do what they do.

If instead we try to engineer supply so tightly that number go up only we guarantee that at some point we’ll have to again raise the emission rate (likely by a lot and quickly) to balance token supply, which will cause a flight of capital from the project in anticipation of a crashing price, compounding the economic damage to long term investors in the project in a way that will be irrecoverable.

In pretty much all things, if you try to too tightly control short-term volatility, you only end up pushing that volatility further out the curve where it compounds in magnitude to the point where it can’t be contained and must be reconciled, wreaking unimaginable havoc compared to the inconvenience it would have caused if otherwise left alone.

While I agree we cannot ignore inflation, I cannot support the proposal as it stands until such a time as the network demonstrates the need for these controls or until supporting material is provided with respect to the key metrics outlined above. Until emissions rise significantly or evidence is provided that the network will suffer from an oversupply of nodes I believe it’s in all of our best interest, long-term, to let it ride, even if number go down for a bit.

Had many thoughts on this proposal and the one before this.

I thought of the whole from team’s, dao’s and investors perspective.

Honestly, DAO’s funding being diluted is not the issue here. DAO will always have more funding no matter what.

Node runners are getting rewards so investments grows with inflation.

However, team’s locked coins are probably being diluted faster than what the team anticipated.

If we as community do not want any major disruption on inflation, then we also need to find a solution for team’s coin that is being diluted.

This says it all right here. I cannot possibly understand what would cause anyone to be concerned about inflation whilst all that emission AND THEN SOME is being staked on a daily basis. BEWARE of the negative feedback loop that will cause the destruction of any first mover advantage that is currently enjoyed. There are many thousands of people who are counting on the current terms to get where they need to be. I feel like it’s horrendous to speak about those running pokt nodes as if they are undesirable. You all coded the rewards this way!

I have brought dozens of node runners here, and in turn I have been thanked very profusely. Any change at this point to the extent of a 70% reduction whether over 3 months or 12 months will serve to blow one of the feet off of the growth phase currently being enjoyed by by pokt Network. If this happens PN will begin to hobble and limp.

A reduction on a monthly basis of 1% per month I would support. If it would make the core team feel better about their locked tokens. I will not support anything over that.

I am absolutely stunned to hear anyone speaking about making these type of changes to a structure that is currently deflationary because they are worried about token price in an illiquid market. BTW take a look at what happens to anyone that trys to sell POKT while it’s bedtime in the USA. Every single day, BTC down or not. The price drops. There is little international interest currently. Hopefully that will change and the overnight window doesn’t become a haven for speculative predatory day traders. There just isn’t much demand overnight like EVER.

I AGREE WHOLEHEARTEDLY WITH @TimeTravelerBowie

This is a very expensive infrastructure to build.

To have a chance to walk back such drastic measures as a 70% reduction is not going to happen. Once the number of nodes is where it needs to be, then roll back rewards. It is my strong feeling that @TimeTravelerBowie s summary needs to be respected as the law. Everything stated is exactly what I was thinking yet would have never been able to articulate so clearly.

Unless I see some indication that this tenthening proposal as well as wagmi proposal is being put on ice

I am going to put my people on notice that I may have been wrong. That PN doesn’t want to be the unstoppable, blockchain agnostic infrastructure for web3.

THOUSANDS OF STAKES. These people, many of them are very proud to be part of what looks to be the backbone of the future infrastructure of everything.

Many of these node runners bought in near $3.00.

Not only would a proposal to reduce rewards 70% cause them to unstake. The 60 days it takes all of them to unstake would create a mass panic.

So now you go ahead and reduce the rewards. If this happens it my strong feeling that pokt is going to zero.

Many people have invested their life savings into this because they were able to see light at the end of the tunnel.

This proposal needs to be tabled until the MaxNodeCount can be determined and then reached.

The fact many have invested their life savings just a few weeks ago in order to stake nodes, and already have a paper loss of over half of it due to the market downturn, that’s fine. That’s crypto.

To have a rug pool done right afterwards. That’s not a scar that will ever heal.

For the sake of pokt network having a fighting chance to be the dominant web3 infra.

For the sake of the little guy.

WAGMI IS A HUGE MISNOMER.

MORE THAN HALF OF THE NODES WONT MAKE IT THRU Q122 IF THIS PASSES

THATS OVER 160 MILLION TOKENS SPILLING AT ONCE

ps. Incase you all don’t know. There is at least one network that burns your stake as soon as it’s vested and pays 1% daily on that stake every day. It can be compounded daily and the token price has gone UP 30% in the last 2 weeks. It’s the only green listing on my radar in a sea of red. I will not post the ticker here. It has however been up and running, doing what it said it would do for nearly a year now.

I would much rather keep promoting a project I absolutely love that has utility. Then again whose to say making free money isn’t a utility? It is kind of a pain in the ass to run nodes after all. Maybe there is a better way.

Pocket network is not the only play around for this APY.

It IS the only one with a utility and a way forward towards unstoppable blockchain optics. It’s the only one that pays well and doesn’t feel like a ponzi. But trust me, it’s not the only reliable APY in town. Reduce the rewards, go ahead. Don’t worry about me I’ll be fine. It will take some time to recover. I really believed I had found the best investment ever. I had planned to hold $pokt even without running nodes. But now that I see the DAO may vote to disable the networks ability to scale to compete, I dread saying this. But if this happens I’m going to have to keep looking.

I pray that this project doesn’t bite off it’s nose to spite it’s face.

THIS IS A REVISION OF THE CURRENT PROPOSAL

As I was working through responses on both the WAGMI and Stopgap proposal, I’ve effectively ended up writing several blog posts. With that, I’m just going to lay out my thoughts here with some recommendations of a plan of action, because there are some real concerns that haven’t been brought up within the conversation happening here. I’ll start with the benefits of the current inflation:

The biggest benefit to not lowering revenue is twofold:

- We attract more node runners to participate in the network

- High revenue keeps the price point for node runners down before a large inflection point

By attracting more node runners to purchase POKT, this helps the Pocket economy by taking more POKT out of circulation with the promise of future revenue. The question is, how big is the market for people willing to earn passive income?

This is potentially everyone in the world. This is a pretty massive node market given the ability to allow professional node runners run infrastructure for you. Given the growth of the infrastructure market in blockchain, in some ways, this could be seen as a UBI for contributing to the network.

Regarding revenue and price, I think there’s something very powerful about giving the world the opportunity to accumulate POKT. In time, more people will move towards bare metal servers, and as tooling improves, potentially even having Pocket Node boxes in their homes. While the economics of 1.0 will change some of the dynamics of node running, at its core the model is the same.

There’s something to be said about allowing as many people to come into a protocol before a massive inflection point in price. What do I mean by this? For 19+ months now, we’ve effectively had a perpetual fair launch. We’re around $1.00 today. We sold our first POKT at $0.01 in 2018. We had our second sale at $0.04 in 2019, and sold between $0.06 - $0.15 when we launched mainnet. The fact that so many people have been able to come in and participate before a massive inflection point is remarkable.

During the ~10 months of the protocol launching, there was ample opportunity for anyone to come in and buy POKT at slightly higher prices than our sale when we launched. Everyone had the same opportunity. I think this is something that has been massively impactful to our community and should be acknowledged. Current revenue will continue to affect price while incentivizing people to stake POKT and run more nodes given the rewards, which I would argue is a good thing.

There is so much more Pocket Network can do outside of just providing RPC service on a 3 - 10 year time horizon. With this in mind, giving as many people an opportunity to participate can provide the foundation for the protocol in the future, where there may be many more reasons to stake and burn POKT outside of the current use case.

What are the downsides to the current rate of revenue?

My major concerns are two-fold:

- The network is massively over provisioned and is increasingly expensive to operate

- We are attracting more “mercenary capital”, diluting the culture of what we’ve spent building the last few years

Using some ballpark math here (every node runner has a different cost basis); At 25k nodes and an average monthly maintenance price of $150 per node, we’re looking at an annual network cost of $45m in just server costs that must go into the market to support the network.

Pocket nodes didn’t used to be this expensive. There is an arms race amongst node runners to ensure they have the capacity to serve relays quickly. Our recommended CPU count has gone up from 2 to 8, causing a real bottleneck in availability and cost. The Portal filters out slow nodes, and if you don’t have the CPU horsepower, you will lose out on rewards. Due to our increase in traction, relay proofs are taking longer to produce. Due to legacy tendermint, Session rollover causes spikes in CPU usage. While the change from 15k to 1k validators helped on the p2p side, we’re still treading water.

This is extremely problematic if left unchecked. At current relay throughput, this less than 1% of the available capacity of the Pocket nodes themselves. Node runners will scale their own blockchain full nodes as average traffic increases.

The protocol team is hard at work at optimizing storage and CPU usage - outside of 1.0 this is the highest priority. 0.8 and 0.8.1 are expected to provide some relief here, though it is still unknown to what extent.

We should not strive to be in a position where the network is costing over $100M/year while relays are in the low billions. This is not efficient nor sustainable over the long run.

The definition of mercenary capital:

Mercenary capital refers to the opportunistic capital provided by investors seeking to take advantage of the short-term incentive programs conducted by a platform for individual gain.

Mercenary capital is something we should be familiar with across all industries. Startups, established businesses, ICO’s, it doesn’t matter. Too much money attracts the wrong kind of people. Too much money kills culture, causes organizations to fail. DAOs, protocols and blockchains are not immune to this.

I see new people posting considerate thoughts for the first time on this thread, and that is fantastic. After perusing the poktpool and node pilot discords, it’s crystal clear from the conversations happening there that not every new participant is mercenary capital given the care and sophistication of how people are thinking about the protocol.

That said, my biggest concern with the rewards today is that while yes, we are attracting many new users, each marginal new POKT node runner at current rates is more likely to be “mercenary capital” than a long term participant in the network.

Since we’ve launched Pocket, all of us node runners have been content with sub 50 POKT/day rewards. For many months, we were lucky to be earning 20 POKT a day, and the economy was sustainable. Today, the network is the most stable it has ever been, relay latency continues to drop, there are more relays, and we have more prospects for growth than we’ve ever had.

We attracted more people to Pocket because of relay growth, not node returns.

I would argue that the primary reason we have such a strong community is because many of us went through extended times of lower rewards. You believed in the potential of Pocket and what we can collectively achieve. You stuck through hard times and now deservedly so, are being rewarded for it. A drop in rewards is an opportunity to find out who’s going to stick around through the bad times.

That said, from speaking to people in the community it’s clear that it is shifting. With growth comes noise and that is natural, yet I can’t help but think from my vantage point we’re seeing more mercenary capital join. I think the community is doing a fantastic job policing much of this, but we are seeing the fraying edges of this type of person participating in the network.

We should not be optimizing for node runners who just care about the rewards. We want to attract node runners and applications who believe in Pocket for the long term. Who believe all of us can execute on driving more applications to the network and improving node runner UX. We want people focused on what matters.

If decreasing rewards incentivizes people to unstake and sell their POKT, then those are exactly the sort of participants in the network we do not want, and I would much rather ride that out.

What role does 1.0 play in all of this?

If this wasn’t enough, we have a curveball in Pocket 1.0 that will impact every decision we make for 0.8x. Like the transition from Ethereum to Ethereum 2.0, we’re looking to keep 0.x alive and improve everything while we scale usage and build 1.0.

Without giving away too much, one of the most important impacts 1.0 will have on the economics of Pocket is massively decreasing the cost of operating the network itself. It’s difficult to give hard numbers, but suffice to say, we’re looking at a 10x decrease in network costs at a minimum.

What happens when we have all this excess capacity in compute that is no longer needed? What contracts will node runners have in place, where they must cover costs of 1 year+ infrastructure to save money? What impact will this have on the market? There may be a need for some buffer to recover from something like this, given the rate at which we’re expanding the node network.

Given this context, how do we move forward with something that makes sense?

To recap:

I am concerned about the long term ramifications of POKT minting and revenue on a hard numbers and community basis. Network cost issues aside, I would be amenable to keeping rewards as is - but I do not view this as tenable in the medium to long term before 1.0. We have a careful balancing act that needs to be managed on a network cost side and with our own community.

I believe we will hit 1B relays per day sooner rather than later. Our growth will continue to exacerbate the existing problem. Macro events aside, I do believe that current revenue needs to be reigned in.

I do not think lowering rewards will meaningfully impact demand due to our relay growth pipeline.

Regarding the DAO allocation increase - I would much prefer seeing our protocol have much more purchasing power moving forward in “dormant capital” than needlessly burning what could be used for growth across many areas in the future. This creates the same effect as fully burning the allocation by removing POKT out of circulating supply, but with optionality for the future.

Due to the nature of infrastructure (there are less web3 users in down markets), markets , and our own growth, I propose a gradual decrease in rewards to something that amounts to 100% (~41 POKT per day) APY over the course of 6 months. As of posting, current network average is 111 POKT per day. Something as simple as this would work:

- Month 1 - 90 POKT/day

- Month 2 - 80 POKT/day

- Month 3 - 70 POKT/day

- Month 4 - 60 POKT/day

- Month 5 - 50 POKT/day

- Month 6 - 41 POKT/day

This should include an increase to 20% of the DAO allocation by month 6. Having a clear plan of action for at least the next 6 months will allow us to continue working through the WAGMI proposal without remaining in stasis.

Thank you for clarifying this, Your Excellency!

I absolutely love the way you explained everything so eloquently. It’s perfection! I actually had to read it twice.

I feel that I can speak for all those staking around me when I say THANK YOU for giving us the short term stability.

The gradual decrease after that will be well handled!

The way I am reading this, In the mid term the reductions will begin and complete reductions in autumn!?

I must say, I am very happy to support the pocket network again and am very pleased to meet you!

Well sort of meet you. Hopefully one day!

Ps- I really would love to do trade shows and conventions in order to recruiter App developers in a meaningful way. Maybe I can have a few moments of your time to discuss?

Pss- Thank you so much for giving the little guys a way to stay here and help build this wonderful community!

@o_rourke You are absolutely a genius’s genius!

I wanted to add that I was just over the moon when you mentioned pokt node running as UBI.

This is exactly what I have been telling everyone. The Golden goose will grow, and when it starts laying eggs, your all set! Just don’t ever kill that Goose because you’re hungry. If you do then no more eggs for you!

The view is different from the top down, and your eloquent outline of the problems as you see them is very enlightening for those of us who are in the trenches, and don’t always have the benefit of the network wide view.

It seems that there are two issues at play:

-

Sustainability in the long term

-

Stability in the short term

Both of the revisions I’ve seen proposed do a good job of stepping down in a predictable fashion which allows for a measured response to the changes, versus reactionary panic. The thoughtful calculations I’ve seen from many about immediate impact are worth noting, as is your concern about mercenary capital, and long term sustainability.

Were the original tenthening proposal hard coded into the protocol, we’d be approaching that event this year, rapidly, and none of these conversations would be occurring. I think that not hard coding it was the right choice, despite the seemingly contentious debate around inflation controls. And lord knows, the market crash has intensified some positions on the topic as people figure out where they’re at for the long term.

The fact is, some are more capable of sustaining through diminished rewards than others are. This is especially true of those who financed hardware to build nodes expecting a certain term of ROI, who may now be on the hook to make payments that have exceeded the current return of nodes given the market price we’re seeing now. Anyone who’s engaged in term financing of any kind around Pocket will be impacted by this change, and that’s likely unavoidable, but a staged drawdown helps minimize that impact. And I expect a number of folks who have built out bare metal likely did so on credit cards, so their concern is of personal sustainability, not that of mercenary capital. I greatly appreciate that you’ve noted that in your response.

It’s also clear that the upcoming versions themselves will help mitigate that, and I’m excited to hear the v1.0 spec reveal tomorrow. I expect that this conversation may flow a little differently after a number of us in the community have a clear picture of what the path forward looks like.

Thank you for your time in constructing such a thoughtful response to all of us. You continue to inspire faith.

This proposal is so badly timed it is hard for me to take at face value as anything but reaction to price action and an attempt to support price. I don’t know I’ll ever think anything but that about it. Especially given how… weak the last post by o_rourke was.

There’s a lot of hemming and hawing about “mercenary capital” and a lot of “YOU know who those (bad) people are”. Lots of it. Most of the post was moralizing about mercenary capital is bad and a lot of reminiscing about the “good old days”. Lots of insider/outsider division being sowed. Ultimately it amounts to a desire to flex governance muscles, punish the new people and unbelievers, and a grab to enrich the DAO (aka insiders). All because pokt price went to $3 and is now maybe half that?

I’d like some concrete things about the specific ways in which “mercenary capital” is bad. There just wasn’t anything except for a “ruins the community” - again in some non specific way. Hire better community moderation?

In the end, all capital is mercenary. The entire premise of the pocket network is for capital to come in, stake, and operate nodes. Why are mercenary capital node runners specifically worse?

Finally, the original plan surely charted this out, why did we so significantly slip of the plan that we need this drastic move? What’s so wrong right now - except price action of pokt?

Great content - straight to the point!!! Thanks!

Thanks so much for the long and thoughtful passage. It sparked a few questions for me that I’d love to get more information on.

Firstly, you mentioned a move from 0.8 to 1.0, and seemed to indicate that this move would further overprovision the network. I’d love to get some more insight on that because I believe it could be material for modeling out the right solution. Likely the majority of the people on this thread have no idea about what that change would mean (raises hand) so further context is definitely needed.

Secondly, questions around mercenary capital aside (which, isn’t all capital at the end of the day just rationally following incentive structures?), it’s very likely that the selling pressure is coming from incumbents who are overweight POKT and underweight dollars/stablecoins. As nickquick points out, it’s difficult to set up nodes, and smaller owners of POKT must work with a service that takes a cut of their tokens rather than a flat fee denominated in fiat. This ties revenue to the market for POKT instead of a fiat vig on their bare metal cost basis, which inevitably creates price distortions as they sell to mitigate risk.

In short, “the kidnapper is calling from inside the house!”

Additionally, I recognize and appreciate your concern for the community. Bootstrapping a community is no small feat, and it feels absolutely amazing in the beginning. It’s only natural to want to preserve that feeling for as long as possible. I was part of the early VR community and still miss the camaraderie and the feeling of knowing everyone who was doing anything in the space. The hard truth is that for anything to scale, the community must change and adapt, and usually that means the early community goes away. It’s a loss, no doubt, and there are always people and practices who have made valuable contributions in early days that unfortunately must get left behind, usually because they can’t adapt to the changing needs of the project as it scales into an empire.

Arguments around mercenary capital and community preservation aside, I’m very interested in learning more about how the network is currently overprovisioned, and how plans for onboarding new projects and chains are going. What are your projections for when POKT will be servicing 1bn+ relays/day? How many nodes will be needed to service that volume of throughput?

At the end of the day, we agree that we absolutely must reduce inflation, and I hope we agree that it must be a one-way street. Once reduced, inflation can’t go back up again as this would signal to the market that we’re headed for the bigger disaster of not having enough supply to stake the nodes required to scale the network. Better to have an oversupply now than run out of tokens later.

My understanding is that, currently, we have a single large project on Harmony that’s pushing about 3-5 percent of their overall traffic our way. It seems to me that if new projects are onboarded, or even if this large current project pushes the rest of their remaining traffic our way, we’ll have a network that’s working at capacity and all the new tokens will be a godsend as it will allow us to scale to meet this demand. Given this context, I wonder how to arrive at a conclusion that we should instead reduce emissions to preserve the existing population of node runners?

I’ll admit that I know nothing of the change from .8 to 1.0, so allow that there may be a technical change coming that would impact the project in ways I’m not currently factoring into my analysis. I’d love to learn more on this subject.

Finally, regarding the balance between the cost to run infrastructure and token price- I firmly believe that this will work itself out. Token will price higher and it will price lower, but at the end of the day node runners will simply not sell for lower than the cost to run their monthly infra. They’ll either lower their costs or hold out for a higher price. Some won’t make it.

Trying to engineer the relationship between buyers and sellers of the token based on price rather than total tokens needed to run the network at scale seems like the wrong place to putfocus. Better to put focus on finding the right dynamic model for balancing emissions with growth, and in the meantime allow the network to keep building token supply and the room to grow exponentially when needed.

Regarding your proposal, I plugged those numbers into my spreadsheet available as “Sheet 2” at the following link: POKT Inflation Scenarios - Google Sheets

Please have a look and let me know your thoughts. You’ve built an incredible network and I want to see to it that Pocket is around and generating profits for everyone for a very very long time.

Kind regards,

TTB

It seems that from reading the above posts, a lot will be revealed during the v1 spec release. This is a good thing as it seems like there may be a bit of a disconnect and misunderstanding between those people who are familiar with it and those who are not. It may shed some more light on why controlling inflation sooner rather than later is better, and perhaps introduce new use cases. Overall, a controlled reduction in inflation seems like a good path ahead, given that the network is over-provisioned, but one that must be treaded carefully.

As a newcomer, and also someone who is not at all familiar with the inner workings of blockchains, I was excited to invest in this project as it was one of the first crypto projects I could understand. It is clear what the value is and where the token value comes from. But as great as the technology is, I care mostly about my bottom line, and I see nothing wrong with this. People will believe in Pocket if Pocket is profitable and gives them a return on investment, that is what matters to a lot of us.

With this said, I don’t think “mercenary capital” is a problem, capital will flow in and out , making profits or losses as it goes along. Some may try to flip the token, some may not have a long term horizon, some may have a lower risk tolerance than they thought. It’s not something the project can be shielded from entirely, and I think it’s a bit unfair to make it sounds like every new(er) participant is somehow less valuable. Many of us only found out about this about a month ago, are staking through the pool as we do not have the knowledge or capital to run a node, and have a naturally high entry price point.

We do not have the same tolerance as some of the older members who have had the opportunity to accumulate Pocket at lower prices (which is not to downplay the great risk they took), so naturally some of the new capital will be a bit skittish, and it may get scared off if too drastic measures are applied. I understand that this is precisely the purpose, but in a way it feels punitive, for no reason other than not joining sooner. This in consequence would discourage decentralization, as those who have accumulated Pocket will continue to do so, as their tolerance is much higher, and limit any new entrants.

Pocket also needs more use cases, as the only reason to get it is to stake it, so the overbuilding in the network is a reaction to this. It seems like with wPOKT (and maybe v1), POKT will have more diverse uses which will alleviate the high network costs. I am also hopeful that with v1 it becomes increasingly easier and cheaper to run one’s own node, as currently we do have nodes concentrated with few major providers, as someone pointed out.

All in all, I think it is a good idea to discuss and reduce inflation gradually, but not so much that new entrants are discouraged entirely, as that would damage the decentralization mission of Pocket.

Awesome discussion we’re having here, which points to the quality of this community.

I’d first like to point out that I’m a newcomer to the community and layman with regards to technical aspects of the Pocket Network, so I will refrain getting into that part of the discussion.

I understand that this proposal wasn’t meant to be reactive to the price action, but we all know any changes to the network’s inflation can directly influence, as well as be influenced by, the price. We simply cannot isolate one from another and look at each of them in a vaccum, as they are connected intrinsically.

With that being said, I don’t know if you guys have been closely following the price action, but it has been stabilizing at aroung the $ 1.20 to 1.30 range. There has been roughly a 60% price drop from the ATH, which was at around $ 3.00, since POKT got listed on exchanges.

In comparison, BTC dropped to roughly 50% from its ATH and many other other high market cap altcoins have fallen by as much as 70% from their respective ATHs, some even more.

As has been echoed by others, mainly @Jinx , if you look at the whole crypto market, we are in a downtrend, and the price of POKT is falling with it.

I firmly believe that the current price action has little, if anything, to do with inflation, and probably due to the current downtrend as well as due to pent up supply caused by OTC market’s illiquidity that artificially drove the price up which then ‘broke the dam’ after sudden increase in liquidity from exchange listings.

I also believe that if we do change the current rewards system we will not see a significant change in price, at least not until the crypto market bounces back.

Basically what I’m trying to say is that if there are changes to the rewards system, there should be a very strong reason which is not fundamented on price action, because I think it likely will not stop the downtrend, and can possibily exarcebate it.

I guess we’ll see what 1.0 is all about and what it means for the network.

I am not as eloquent as many of the posters on here so I will keep my opinions short and sweet.

I joined the community in late November and truly grateful that I did. I bought into the idea.

I suppose I could be considered Mercenary Capital but my main goal with this project is to grow my node count over time and learn how to set up my own nodes and get away from the 3rd party provider I use now and pass it on to my kids.

In regards to the inflation stop gap I will leave that up to the DOA they are the ones who truly have the best intrest of the protocol at heart.

Who knows one day I might open up a Pocket Hub 10 years down the road. Would be cool seeing that on the side of the road.

I would agree. We should be careful about sowing divisiveness, perhaps the biggest trap of our times.