I think having a roadmap here would help folks appreciate what the potential uses caes for DAO funds looks like a few quarters out.

That proposal would be a hard yes from me if it weren’t for the following reasons:

-

A change of this magnitude amidst a potential systemic crash in cryptocurrencies and uncertainty in the traditional markets can have a lot of unintended and severe side-effects.

-

I am still unconvinced that we will get a significant increase of the demand from the retail token holders in exchange for the significant decrease of the demand from the node runners. Especially, amidst the current sentiment. Also, please, note that we just had a run up from $0.5 to $3 during this red hot inflation. Which makes me question the thesis that the inflation really affects the demand of the holders.

-

As @ArtSabintsev mentioned, I’d love to see the roadmap for the intended DAO spending first.

-

These two months lots of people committed their capital to fund more that 10,000 nodes. Any drastic not communicated way ahead change in the rewards schedule will have terrible optics and some degree of reputational damage. Further exacerbated by the fact that - correct me if I am wrong here - currently it is not possible to become a DAO voter by the sole virtue of committing significant capital to run nodes. Which lead to the underrepresentation of the node owners in DAO. Specifically, the ones that joined the last month.

tl;rd: let’s wait for a month for the dust to settle and then start to gradually decrease the rewards having communicated the schedule ahead of the action to avoid any shocks - it is hard to interpret the almost 70% reduction of a parameter in other way - to the network.

Although not opposed to the direction, seems the throttle could be backed off gradually rather than all at once to avoid node runners community dissatisfaction. Another lever that could be leveraged is to revisit relay growth targets as a trigger to control inflation. The growth has slowed since harmony(defi kingdom) got going…which is a short term view at this point. Just thinking that until there is more widespread growth, the node runners have more risk so the reward should reflect that until economies of scale are more achieved. Tough decision and inflation does need to be addressed, however there will be node runners churn if it is too aggressive and in turn, that will damage token price, which in turn could cause more churn. We need to avoid the death spiral.

Priority #1 should be to lock in more relay sources. Quite frankly, if the DAO wants to get paid more, it needs to do deliver on this first - or at least tell us how they plan to.

I’m generally in support of this in the future, but this feels like a reactionary response to a bear market panic.

I also fully agree with Lex’s observation of the recent run-up in price amidst the inflationary environment. The relatively nimble nature of DAO governance (in relation to actual governance) means we aren’t required to take stabs in the dark and attempt to have a predictive approach to monetary policy. We can afford to be a bit reactionary if it gives us the benefit of some hindsight and the ability to base decisions off of empirical evidence. I don’t particularly like getting stabbed in the dark, that’s just not my thing.

Over the last three months, as network relays increased significantly, the token price continued to rise in OTC, and node count growth was nearly vertical in demand. While inflationary controls were being actively discussed, the inflation was having zero impact on any of the the metrics by which the project value was measured.

Now, the entire global macroeconomic system is experiencing a major correction, and Pokt, being listed on a number of exchanges, is being affected by that. Perhaps if were still OTC only the impact would be less, and the timing of the market listings ahead of the major downturn seems unfortunate. That is neither here nor there.

What is relevant is this:

-

Pokt, a newly listed exchange token, will not be able to recover in price while major tokens such as BTC or ETH are still significantly down. For better or worse, the token is now paired with the crypto market at large, and no economic adjustment internally will overcome automated trading which uses BTC and ETH indices to trigger buy and sell activity.

-

What a reduction in rewards WILL accomplish is increasing the impact of the token value downturn on the very people supporting the network by running nodes. If the goal is to get noderunners to unstake and leave the network, passing this proposal will accomplish that. The only solace that noderunners have right now in a down market is that they are still stacking Pokt at a good rate, and that as the greater markets recover, they will be in a strong position to profit from continuing to provide relays while the market was tough.

-

Retail sentiment has gotten very dark, with some service providers receiving an onslaught of messaging accusing them of dumping on the marketplace, running a Ponzi scheme, etc. Given that most of the exchange listings currently do not even support US customers, few of us in the core support groups are even present in the exchanges (I have not even attempted to create an account with any of them), and yet are shouldering the load of of the negative sentiment. A radical reduction in noderunning rewards during the midst of all this is likely to negatively impact core support further.

I absolutely support an increase in the allocation for the DAO. However, attempts to improve token pricing by reducing token minting are misguided when the major cause of the price reduction (a global macroeconomic downturn) is misguided; this proposal is unlikely to have any effect on the price at all, while it will have a decided effect on market sentiment.

This comment demonstrates that the core driver of this proposal is not sustainability per se, but as a response to the current market conditions, and thus my concern.

I would support an increase to the DAO allocation in pairing with a substantial burn to the existing DAO supply. This has the effect of the DAO putting its money where its mouth is. If the concern currently is an overabundance of supply, and this proposal is a stop gap method to reduce inflation, a more concrete and immediate solution would be to immediately burn a significant portion of the DAO holdings, which currently stands at 69,611,227 POKT. This has the additional benefit of a real world test of the theory being proposed here around supply impact on price.

Seems the DAO burning tokens is a great way to address situations that are more extreme and get the tokenomics out of balance while continuing to grow the node runners, which I believe is a primary goal of the growth phase. Lowering the reward will slow node growth, which is against the phase goal.

I agree with everything in this post excepting this final suggestion.

This idea feels similarly reactionary - in that it is both punitive and speculative - doubling down on the experimental approach to governance that I find not only unnecessary but overtly risky. Do we need a “real world test” of anything right now? Can’t we just spend money on getting more business like a regular company? Call me oldschool, but the product works, now let’s sell the fuck out of it.

You’re telling me that the DAO has $70M and is asking for more money?

DAO Spending Roadmap

A roadmap implies centralized treasury management, which misses the point of a DAO. All that a larger DAO treasury means is more funds which the community can allocate through proposals like this.

Becoming a DAO Voter

Indeed it is not. From the beginning, we have deliberately avoided token voting and instead we grant 1 vote to anyone who meets the qualification criteria of experience & contribution. In the case of node runners, this means experience running nodes well, helping other node runners get set up, contributing to documentation, building tooling, etc. If you would prefer us to enable people to buy votes, I’m happy to debate in another forum why I think that’s not wise.

“The DAO underrepresents nodes”

This is just false. 2/3rds of DAO voters are node runners.

“The DAO wants more money?!”

The DAO is not a monolith. This is not the DAO asking for money. This is one member of the community proposing that we collectively allocate more funds to the common resource that we collectively govern.

Burning DAO Tokens

The DAO’s tokens are not included in the circulating supply because they are locked up and can only be paid out subject to approved proposals. Burning DAO tokens is irrelevant to sell pressure, which this proposal seeks to address.

Given that the sell pressures are generally a function of the greater marketplace pullback, why do the poposers think that this measure would address the price of the token at all?

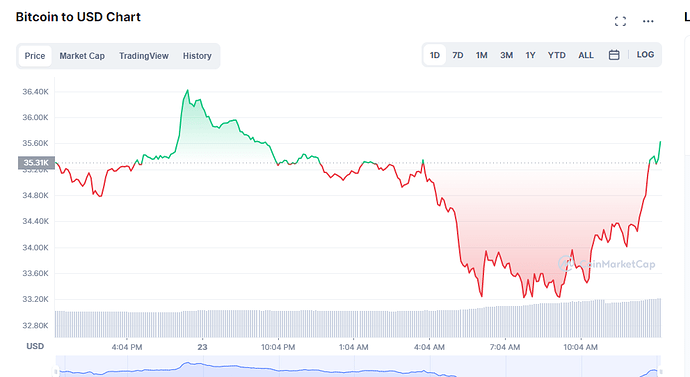

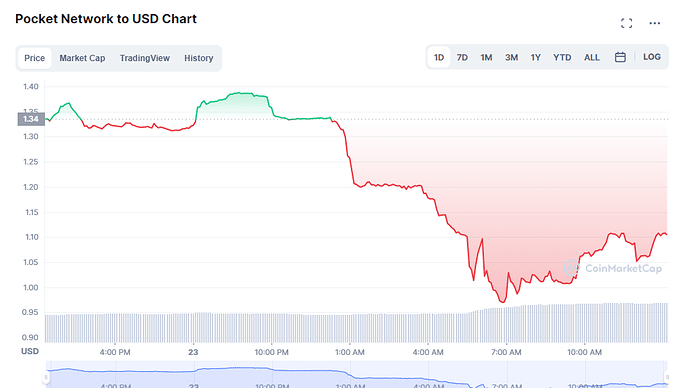

Bitcoin, the single largest driver of the crypto market, is down at almost perfect parity with the price of pokt. In fact, the correlation is astoundingly close.

The 24 hour chart paints a clear picture, and the last 4 days could practically be the same track:

Why is this being treated as though it’s a Pokt emergency instead of recognizing the macroeconomic conditions which are truly driving the token pricing?

Let me clarify my ask. I think have ing an idea for the types of proposals you (or others) may have in mind and how much capital they might need is what I (and others) are asking for.

Does that help?

I’m at odds with this. Does inflation needs to be addressed eventually? Absolutely, but does it needs to be addressed in this fashion? I don’t believe so.

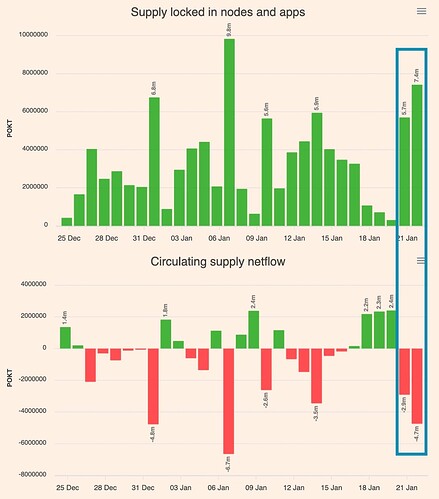

The current price decrease is not caused by inflation, all indicators on the network stats are still showing a trending demand for POKT, where there are consistently more tokens being staked than minted. The current price decrease is caused by the overall market condition, which is in a correction for both equity and crypto, especially after getting listed on the CEX which makes it subject to BTC and ETH conditions further like all other listed tokens.

It feels like this is a rushed proposal that is based more on the emotions caused by current market turmoil than the actual impacts of inflation.

some are obviously trying to put blame of the price decrease on something or someone to make themselves feel better as to place their responsibilities on others instead of themselves, and we’ve seen fingers being pointed at OG node runners, service providers, even Founders (which is impossible as it is locked), and of course, on inflation, but all of it were pointed 100% without any solid bases.

Inflation should be addressed, but let’s address it with a more clear headedness, and not during a market turmoil where judgements can be more easily clouded and misguided.

On one hand, I strongly agree with some of the sentiments expressed here, such as (1) this proposal feels overly-reactionary to the broad market downturn recently; (2) the DAO’s need for additional funding does not seem like a high priority right now; and (3) a rapid change to the downside in node running rewards risks creating discontent in the people providing the backbone to the network right now.

I’m also uncomfortable anecdotally relying on a statement like this. There are plenty of serious investors that are taking a long-term approach to this project, and are viewing lower prices as an opportunity to DCA, build a position, etc. I’m sure there are many that are overly focused on price, but to suggest that lower prices (during a broadly bearish market) would “forever put a stain on the token itself” feels hyperbolic.

On the other hand…I do understand that we need to keep in mind that this proposal’s 80% annual return for node runners in one year is an estimate that is based on CURRENT relay/node levels. There have been prominent voices in this community that have suggested that 1 billion relays per day is a reachable target in the not-so-distant future. If we were to 3x or 4x our daily relays by onboarding new sources of relays, the 41 POKT per day estimate in this proposal suddenly changes pretty drastically, does it not? (Assuming number of nodes also increases, but perhaps not as drastically/not in step with relays).

Overall, I think my position on the inflation debate is relatively unchanged from how I felt after reading through the WAGMI discussion. We watched the price rise to $3 during an equally inflationary environment, and we’re watching it come back down during a bloodbath for the broader crypto market. I would support a careful, deliberative, gradual approach to implementing inflationary controls; one which gives node runners plenty of advance notice and is based on real metrics rather than anecdotal beliefs on market sentiment.

And, even with implementing a reduction in rewards, node runners and fractional stakers could see this balanced out when we bring in large additional sources of relays, and become less than 70 to 80 percent reliant on DFK as a source of relays. I believe that is where DAOllocation efforts should be focused (i.e. diversifying sources of relays), but I fully understand that is top of mind for Pocket Network, is actively being worked on, and is a discussion for another day.

100%! And furthermore, I think any proposal that advances inflationary policy needs to put forth relay targets at which time a phased policy kicks in. That way everyone knows what will happen when. No systemic shocks - it’s all “priced in”.

I also meant to mention this point from the Pocket Network Docs:

“The Maturity Phase is defined as the point in which Pocket Network has crossed equilibrium and the growth in inflation begins outpacing growth in the total staked supply of POKT.”

This proposal would seem to suggest to me that we believe we are reaching the Maturity Phase. If so, have we changed the above definition? The numbers that I’ve seen recently seem to show that the total staked supply of POKT is rising, rather than being outpaced by inflation.

Its important to note that WAGMI was not introduced in the macro-market down turn, although I do see some reactionary language going around.

I think inflation does need to scale back, I have not seen any node runners onboard an application of substantial relays that are not also on the pocket team, I have seen most flocking to staking pools or larger node providers.

If new nodes correlated to more relays directly, i’d see that argument more powerful.

You could argue indirectly, but ehh.

But, Node profitability amongst the intrinsic motivators that we have as a battle hardened community has been a great factor to “getting past the tough times” and helping build this community in ways we could not have imagined. That’s important to note. We’re literally promoting ourselves as “One of the highest revenue generating networks in all of blockchain land”

The difficulty with the maturity phase definition is interesting because a massive increase in price might change the optimal strategy to dump instead of stack/compound. You could see this with OTC volume increasing at these prices.

What I hope people really latch unto:

I’d like to see an increased transparent/coordination efforts around layer 2 utilities that will expand the optimal strategies/utility for using POKT.

wPOKT as an example.

Tokenized Nodes into a rebasing asset wrapped into an NFT or single token.

Auto-compounding staking pools and other DeFi mechanisms that make staking continue to be the optimal strategy for most.

These things done well will increase staked supply, and open up way more liquidity channels that have greater depth then what we see today while other exchanges come online.

Summary

Dial back inflation some to start - according to relay growth, not “What we think node runners should earn max.” We have to be aligned around growing and quality of service.

If DAO takes more funds (or even not), immediately allocate more resources & promotion of L2 mechanisms such as wPOKT, Tokenized Nodes, Staking Pools, Lending, etc that have a direct impact on this as well.

Establish Working Group & Cadence to discuss this topic and alternative mechanisms that contribute.

A number of us are independently working on additional options for collective noderunning and other liquidity sources, and I think a working group to help focus those efforts would be a great thing.

Yeah and it solves (or helps a lot) for the attempt to balance both long-term nodling and speculating

Makes staking POKT still super attractive,

And even if/when inflation dies back, still healthy enough speculation around the tokenized assets compensates without negatively effecting pockets fundamentals.

I don’t want to make this proposal discussion about that exclusively, but Its important for people to be aware that if that comes out soon, and we rally around it, then we can dial back inflation some/ a lot without as much of the perceived blowback (theoretically lol)

Hello all. I’d like to offer my two cents in here, for whatever that may be worth.

In my view it is absolutely perilous to consider changing the reward structure at this juncture. (If it works don’t fix it)

I do not believe that the current structure is flawed. I must say that it is the most beautifully designed system / protocol I have ever found.

I firmly believe that pocket network has the capacity to have a million nodes running along with 100,000 validators. I project the API calls created by web3 to double every 4 to 6 months from here. As long as balance is maintained between the node side and the dApp side we need to keep the pedal to the metal!

Even in a market downturn, perhaps especially now, app development will continue to double on a yearly basis for the foreseeable future. It seems to me that the current 300 million per day can very easily 10x over the next year. If scalability is not an issue we should stand pat.

As long as supply is constrained by the staking of new nodes as well as dApps being staked; the current rate of minting new tokens will at some point create a scarcity, hence making the current mechanism deflationary.

The DAO treasury has 70 million tokens locked up? Let’s get those tokens out there to developers in the form dApp staking grants on a 30 day trial basis. Once we bring them on board and show them what we have to offer they will never go back to Infura. We can easily do 1,000 grants per month right now and only use 10% of the treasury in doing so. I Believe by making this available to developers at no initial cost to them we, will grow relay numbers exponentially.

This simple practice of 1,000 rolling grants of 30 day duration, even at a 67% retention rate, should double the amount of active dApps from here in the next 90 days.

Pocket network might currently be handling one tenth of one percent of the actual traffic happening. That’s just a guess. I’m an eternal optimist when it comes to crypto in general. Web3 makes me exponentially so. With that said I not only feel that we want to continue the current rate of growth but that we need to. It’s better to have the extra ammo if we need it than to need it and not have it.

Has anyone yet proposed a system of extending grants to developers? Is the any implementation of an EVM at this point?

I’m class of 2017. My first BTC was purchased 5 years ago this month, as soon as the BTC price passed the price of gold.

I feel very strongly about this Pocket network being the absolute best protocol launch ever.

Not even the sky is the limit.

I have read literally hundreds of white papers and looked at hundreds of roadmaps. Not a single one ever came close to generating this much of a feeling of gnosis.

Gnosis that this is the one. One protocol to run them all.

I firmly believe that if we stay the course during this downturn that before 2025 $pokt will be listed #10 by market cap. Maybe higher, definitely #1 by revenue.

Sometimes it’s hard to see the forest for the trees.

For me personally, it’s as clear as day.

Cheers. And thank you. I have finally found my home in this community!

I believe the DAO should represent the contributors in their entirety, including those whose contribution and commitment is monetary. However, I understand the risk of centralization that plagues most PoS networks, so their influence should be moderated. Let’s discuss it somewhere else, yes.

Now That’s What I Call Optimism.

I’m intrigued by the dApp Staking Grants idea. It sounds like a concrete way to leverage DAO funds into more relays.

Does anyone have details on if and how this has been done in the past with other protocols?