The Pocket Network Economics Committee, composed of @RawthiL , @TracieCMyers , and with input from PNF, has created the following guidance for Shannon tokenomics. Please review and add your comments where necessary.

Main Mechanisms

With the Shannon update, the protocol leaves the open-beta phase and enters the initial stages of its maturity. In line with this natural growth, the relative prices of the Pocket Network economy (tokenomics) need to be adjusted and set to a level which positions the protocol as a real competitor in the market.

While the protocol aims to serve several protocols and data sources, there is currently a single type of traffic being transacted in the network: the blockchain traffic. In this context the analysis of the market that drives this document is focused only on that data type, and seeks to position the Pocket Network as a realistic alternative to the existing offers.

Minting Strategy

Starting with Shannon, the network supports on-chain and automatic burning of tokens to pay for relaying services. Also, it permits the staking of permissionless demand, and to enable this there is no other mechanism than to set the total minting equal to the application burning.

Initially, the Shannon upgrade will have no supply growth. However, if the DAO decides it is necessary, it can increase the total supply by using the reimbursement event in the Shannon protocol. This mechanism should only be used to mint in favor of the DAO treasury, as any other recipient of the burn-mint asymmetry can result in self-dealing. Implementing this strategy and accounting for the DAO share in all minting transactions will result in a liquidity reduction since:

Liquid POKT burned > Liquid POKT Minted

The Price of a Pocket Compute Unit

Many offerings center their price models on a so-called “Compute Unit” (CU), which is loosely defined as the cost of processing and transmitting a unit of information. This conception is highly arbitrary, but is useful to denominate the prices of the different services that can be offered, and isolate the cost of a relay from the price of the POKT token.

Starting with Shannon, we will set the price of a CU in the Pocket Network to:

1 COMPUTE UNIT = 1 x10^-9 USD

or

1 USD per billion CUs

PNF will ensure the USD-denominated price by periodically controlling the Compute Unit To Token Multiplier (CUTTM) parameter of the Shannon upgrade. Initially, this parameter will be set to:

CUTTM = 66667 pPOKT

It is important to note that the denomination of the CUTTM is in pico POKT (1x10^-12), while its Morse corresponding parameter Relay To Token Multiplier (RTTM) was in micro POKT (1x10^-6). This is necessary to allow for cheap services and token price growth.

Currently the base RTTM is 190 uPOKT per relay, which means that the cheapest relaying service in Morse would consume ~2850 CUs in Shannon. This definition will be useful during the comparison and later definition of the average cost of a service in the Shannon update.

The next thing we need is to define the number of CUs for an average relay in the Pocket Network. For this, we need to compare our current price scheme with those of our main competitors. The full analysis of the competition can be seen at the end of this document in section “Blockchain Relays Competitor”. The main takeaways from that analysis are:

- Average Relay Price for Competitors : 6.58 USD/M Relays

- Average Relay Price for Pocket Network Service: 14.3 USD/M Relays

- Cheapest Competition Offer : 2.5 USD/M Relays

In this context, we see that the Pocket Network is currently ~2x above the competitors (on average and in the comparable services). To remain competitive, the prices must match those of the competitors. Taking into account that the cheapest competitor offers a price of 2.5 USD/M Relays, in a plan that is pay-up-front (as opposed to Pocket Network that can be seen as a Pay-As-You-Go service) and that the service offering of the Pocket Network is in general much larger than the competitors, we propose to set the new average price of the Pocket network to:

Shannon Price per Million Relays (Average) : 2.50 USD

The execution of this will be done by setting the new base CUTTM to 495 pPOKT, translating into a reduction of all RTTMs by 5.76x and rounding down in the current network. This new price scheme will make most Pocket Services much cheaper than the competitors (from 30% to 75% reductions).

Others will remain higher (like: Harmony, Solana, opBNB and Kaia), which will need further adjustments, but the service-specific tuning of prices is out of the scope of this proposal. While the new per-services changes can change the target of the 2.5 USD/M relays, they will probably respond to negotiations between supply and demand, and the DAO should not interfere with this.

The general rule is that the DAO won’t be enforcing prices on services after this initial correction. The DAO will limit it to act on the market with the strength of its treasury and nothing else. The end-game for the Pocket network is to provide a free market for data sources, not to set prices.

Volume Rebates Schemes

The launch of the Shannon update means the final transition to maturity of the network, however this transition cannot be done in an open-loop fashion. The DAO is aware of the bootstrapping needs of the supply side and will make its best effort to keep the main traffic generators on track to meet their goals.

The main difference from the Morse approach to bootstrapping is that the supply won’t be increased in order to bootstrap actors. This strategy can only get us so far, and has been abused in the past to bootstrap the supply side. And, endless inflation only reduces the total value of the network, resulting in a net loss (see current market activity). Starting with Shannon, the bootstrapping of the demand will take the form of volume rebates.

The proposed rebate strategy is:

- Average less than 250 B CUs/day (approx. 105 M Relays/day) : Full price (no rebate)

- Average more than 1250 B CUs/day (approx 525 M Relays/day) : 40 % Percent rebate, resulting in burn cost of 1.5 USD / M Relays.

- Between these traffic levels, the rebate will be a linear function between 10% and 40%. The more relays you do, the higher the rebate you receive.

- The total rebatable CUs to be paid by the DAO will be capped at 128 Trillion CUs per quarter.

The rebate will be paid every quarter on the trailing averages for each of the gateways that request a rebate. Gateways requesting a rebate will need to register with the Foundation and agree to an established set of standards and practices.

Here is a quick reference for the rebate scheme; please refer to the analysis section for more details:

| Average Traffic on the last 90 days | Rebate |

|---|---|

| B CUs / Day | M Relays / Day |

| Lower than 250 | Lower than ~105 |

| More than 250, less than 1250 | More than 105, less than 525 |

| More than 1250 | More than ~525 |

On each pay date, the total traffic for the last quarter is analyzed, and the gateways that requested rebates are ordered by the amount of traffic they received. The average CUs per day they processed is calculated from the total traffic in the observed quarter. The budget of 128 T CUs is then assigned to the requesting gateways in this order until all requests are fulfilled or the rebate budget is exhausted. All traffic that falls outside of the budget will be paid in full by the gateways.

The strategy of using a linear growth of the rebate level and a cap on the total rebateable claims aim to minimize unnecessary traffic on the network and maximize the runway of the DAO treasury.

Morse to Shannon Reference

Brief description of each parameter change, as seen from the Morse network:

- Base RTTM : from 190uPOKT per relay to 495 pPOKT per CU (change in unit). This is (approximatelly) equivalent to a reduction of the RTTM to 33uPOKT.

- Any other (non-base RTTM) : Morse RTTM divided by 5.7575 and rounded down.

- Base Gateway Fee Per Relay: from 0 uPOKT to 495 pPOKT per CU or ~33uPOKT per relay.

- Any other (non-base GFPR) : Follows the same rule, RTTM = GFPR.

New Rebate Mechanism:

- A traffic of less than ~105M Relay/day (in the current network) will mean no rebate.

- Starting at 105M Relays/day the rebate will be 10% and grow linearly until 40% when passing the 525 M Relay/day.

Supply will be stable at the level it reaches when the Shannon migration is finished.

Relay minting share:

- Servicer: 78 % (no change)

- Validator: 14 % (no change)

- DAO : From 8 % to 5 %

- Owners : From 0% to 3 % (DAO will be the initial recipient of all owner rewards)

A proposed change of minting shares to increase validator incentive is being researched, but will not be in effect at Shannon go-live.

The Minimum Stake per Servicer will be increased from 15,000 POKT to 60,000 POKT, since more than 80% of the nodes are already staked at this level and Shannon does not have a stake multiplier system (aka PIP-22).

Analysis and Projections

In this section we will present the details behind the proposal, including data sources and calculation of the different parameters. Some basic projections of the DAO treasury evolution are also presented.

Blockchain Relays Competitors

The analysis of the Pocket Network competitors was centered on 4 operators: Alchemy, Infura, QuickNode and Chainstack. While these are not full competitors, they provide reference for the market price of several services available in the Pocket Network. The analysis was performed on 25 blockchain RPC services, and for each of them we tracked the lowest price given by all competitors.

As a general rule, we found that pay-as-you-go services are around 12 USD per million relays, and that the cheapest way to access these services is by paying upfront, where the price can drop to 2.5 USD per million relays.

Also, for each of these services, we calculated the price of the Pocket Network in the current price and RTTM conditions. Then we obtained the difference in price of the current status of the network and the market:

| USD for 1M Relays | DIFFERENCE | USD for 1M Relays | ||

|---|---|---|---|---|

| Chain | POKT Network CUs | POKT Network Price | (lower better) | Cheapest Competitor |

| Solana (F025) | 1932 | $28.98 | 1059.20% | $2.50 |

| Fraxtal (F011) | 694 | $10.41 | -16.72% | $12.50 |

| opBNB (F01F) | 2375 | $35.63 | 1325.00% | $2.50 |

| Harmony-0 (F014) | 1932 | $28.98 | 1059.20% | $2.50 |

| Sui (F026) | 1049 | $15.74 | -37.06% | $25.00 |

| Ethereum (F00C) | 606 | $9.09 | 263.60% | $2.50 |

| BNB Smart Chain (F009) | 606 | $9.09 | 263.60% | $2.50 |

| Polygon zkEVM (F029) | 606 | $9.09 | 263.60% | $2.50 |

| Kaia (F016) | 1932 | $28.98 | 1059.20% | $2.50 |

| Fantom (F010) | 960 | $14.40 | 476.00% | $2.50 |

| Polygon (F021) | 429 | $6.44 | 157.40% | $2.50 |

| Arbitrum One (F001) | 1049 | $15.74 | 529.40% | $2.50 |

| Avalanche (F003) | 1049 | $15.74 | 529.40% | $2.50 |

| Base (F005) | 473 | $7.10 | 183.80% | $2.50 |

| zkSync (F02B) | 694 | $10.41 | 316.40% | $2.50 |

| Near (F01B) | 1932 | $28.98 | -7.26% | $31.25 |

| Blast (F008) | 872 | $13.08 | 423.20% | $2.50 |

| Optimism (F01D) | 694 | $10.41 | 316.40% | $2.50 |

| Oasys (F01C) | 517 | $7.76 | 210.20% | $2.50 |

| Gnosis (F013) | 429 | $6.44 | 157.40% | $2.50 |

| Celo (F00B) | 340 | $5.10 | 104.00% | $2.50 |

| Scroll (F024) | 473 | $7.10 | 183.80% | $2.50 |

| Moonbeam (F019) | 340 | $5.10 | 104.00% | $2.50 |

| Celestia Archival (A0CA) | 190 | $2.85 | -88.60% | $25.00 |

| Bitcoin (F007) | 253 | $3.80 | 51.80% | $2.50 |

| Osmosis (F020) | 2375 | $35.63 | 42.50% | $25.00 |

| Averge Relay CUs | Average Relay Price | Average Relay Price | ||

| 914.76 | $14.31 | $6.59 |

It can be seen that the average price of the network is around 14.3 USD per million relays, making Pocket an average player for a pay-as-you-go business, however the limitations of the network (namely ease of access and QoS triage) make this price too high for the actual service.

In this context it is proposed to reduce the price of the network aiming for a 2.5 USD per million relays, a very competitive price for a pay-as-you-go service. With this change, the network prices are seen in the following table:

| USD for 1M Relays | DIFFERENCE | USD for 1M Relays | ||

|---|---|---|---|---|

| Chain | POKT Network CUs | POKT Network Price | (lower better) | Cheapest Competitor |

| Solana (F025) | 5033 | $5.03 | 101.32% | $2.50 |

| Fraxtal (F011) | 1808 | $1.81 | -85.54% | $12.50 |

| opBNB (F01F) | 6188 | $6.19 | 147.52% | $2.50 |

| Harmony-0 (F014) | 5033 | $5.03 | 101.32% | $2.50 |

| Sui (F026) | 2733 | $2.73 | -89.07% | $25.00 |

| Ethereum (F00C) | 1579 | $1.58 | -36.84% | $2.50 |

| BNB Smart Chain (F009) | 1579 | $1.58 | -36.84% | $2.50 |

| Polygon zkEVM (F029) | 1579 | $1.58 | -36.84% | $2.50 |

| Kaia (F016) | 5033 | $5.03 | 101.32% | $2.50 |

| Fantom (F010) | 2501 | $2.50 | 0.04% | $2.50 |

| Polygon (F021) | 1118 | $1.12 | -55.28% | $2.50 |

| Arbitrum One (F001) | 2733 | $2.73 | 9.32% | $2.50 |

| Avalanche (F003) | 2733 | $2.73 | 9.32% | $2.50 |

| Base (F005) | 1232 | $1.23 | -50.72% | $2.50 |

| zkSync (F02B) | 1808 | $1.81 | -27.68% | $2.50 |

| Near (F01B) | 5033 | $5.03 | -83.89% | $31.25 |

| Blast (F008) | 2272 | $2.27 | -9.12% | $2.50 |

| Optimism (F01D) | 1808 | $1.81 | -27.68% | $2.50 |

| Oasys (F01C) | 1347 | $1.35 | -46.12% | $2.50 |

| Gnosis (F013) | 1118 | $1.12 | -55.28% | $2.50 |

| Celo (F00B) | 886 | $0.89 | -64.56% | $2.50 |

| Scroll (F024) | 1232 | $1.23 | -50.72% | $2.50 |

| Moonbeam (F019) | 886 | $0.89 | -64.56% | $2.50 |

| Celestia Archival (A0CA) | 495 | $0.50 | -98.02% | $25.00 |

| Bitcoin (F007) | 659 | $0.66 | -73.64% | $2.50 |

| Osmosis (F020) | 6188 | $6.19 | -75.25% | $25.00 |

| Average Relay CUs | Average Relay Price | Average Relay Price | ||

| 2383.24 | $2.49 | $6.59 |

In this new scenario the network is very competitive and leaves margin to create business on top of the base price.

It must be noted that all the price analysis had to be done as a function of the publicized prices from centralized services, since we were not able to obtain cost metrics and prices from the majority of the Pocket Network players.

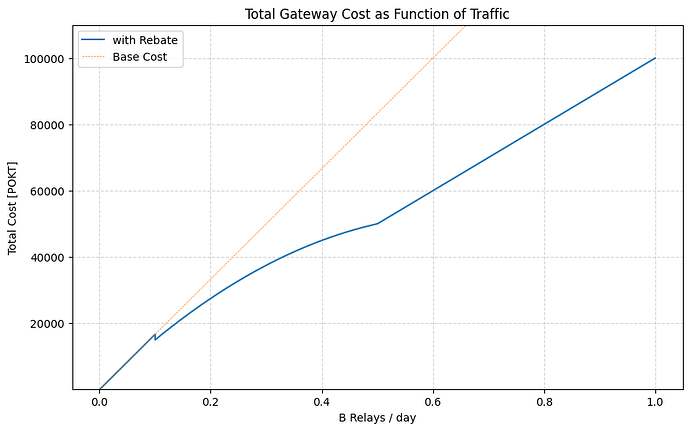

Rebates Scenarios Analysis

In order to promote bulk traffic on the network during bootstrap of the demand side, the DAO agrees to provide rebates on large amounts of traffic. However, in a fixed-supply scenario, these rebates must come from the DAO treasury. Since the DAO treasury is finite, a strategy must be reached that maximizes the DAO treasury longevity and minimizes the risk of premature draining. To do this we analyzed how much time it will take to drain the DAO treasury by 50% under different rebate levels and total traffic.

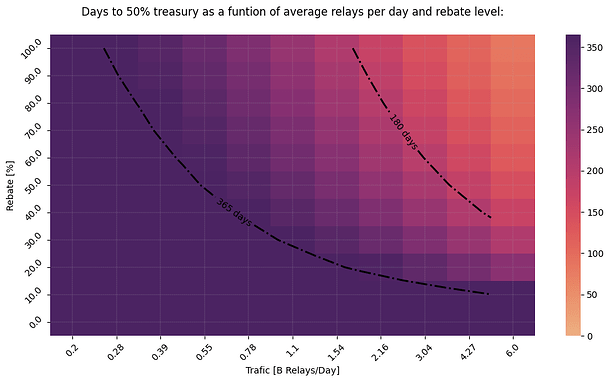

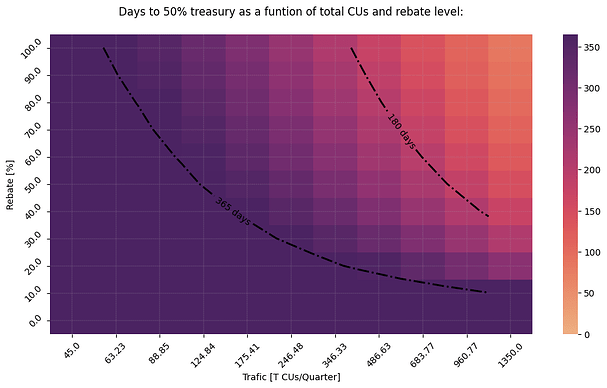

The following graphics are heatmaps, where the Y axis represents the rebate levels, the X axis the total traffic that can be rebated the DAO and the color of each pixel represents the amount of days until the treasury is drained by half. The graphs also have two isolines, one in the contour of 360 days and the other on the contour of 180 days.

A valid rebate strategy is that in which the coordinate pair (rebate, traffic) remains below the 360 days isoline. Values above this line jeopardize the health of the DAO treasury.

The first figure shows this information as a function of the traffic in units of relays by day, a commonly used feature for traffic.

However the most important one is the second graph which tells us not only the rebate, but the total amount of CUs that can be rebated in a quarter. This limitation is key, since the treasury cannot support an arbitrary amount of gateways pushing a given rate of relays by date, it can only rebate up to a total amount of units per quarter.

DAO Treasury Evolution Under POKT Price Variations

The selected rebate levels:

- Starting at 10% for 250 B CUs per day

- Ending at 40% for 1250 B CUs per day

- A total rebate of 128 T CUs per Quarter

Will work in the following ways:

| Gateway Traffic | Average Traffic | Expected Rebate | Remaining Budget | Rebatable | Effective Rebate | |

|---|---|---|---|---|---|---|

| T CU / Quarter | B CUs / Day | M Relays / Day | T CUs | T CUs | ||

| Gateway A | 78 | 866.67 | 363.65 | 28.50% | 50 | 78 |

| Gateway B | 30 | 333.33 | 139.87 | 12.50% | 20 | 30 |

| Gateway C | 25 | 277.78 | 116.55 | 10.83% | -5 | 20 |

| Gateway D | 23 | 255.56 | 107.23 | 10.17% | -28 | 0 |

| Gateway E | 15 | 166.67 | 69.93 | 0.00% | -43 | 0 |

In this example we see 5 Gateways (from A to E) that requested rebates. They are ordered by the total number of CUs they received in the last 90 days. We see that the first two, Gateway A and B will receive a rebate of 28.5% and 12.5% according to the linear interpolation (see last column).

Gateway C, while still meeting the lower threshold of 250 B CUs/day, will not receive the expected rebate of 10.38% (see column “Expected Rebate”). This is because the budget was exhausted by 5 T CUs (see column “Remaining Budget”). In this case the rebate applies only to 20 T CUs (see column “Rebatable”) from the total 25 T CUs processed, resulting in an effective rebate of 8.67% (lower than expected).

Gateway D has no rebatable CUs left in the budget, and as a result its effective rebate goes from 10.17% to 0%.

Finally, Gateway E has not even reached the minimum of 250 B CUs/day, and consequently receives zero rebates.

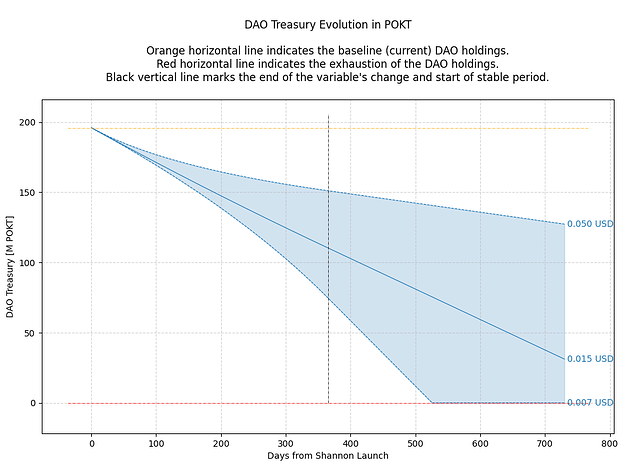

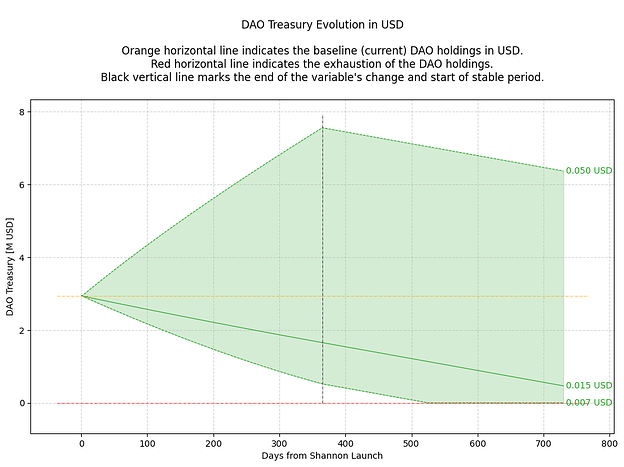

With the selected rebates mechanism we can estimate how the DAO will evolve in dynamic scenarios. To do so we created a mildly positive scenario, where, within a year, the total amount of relays increases from 0.8 B/day to 5 B/day, and the amount of organic traffic (not requesting rebates) increases from 5% to 10% of the total. For these estimations we test 3 different price levels, one where the price declines to 0.007 USD, one where it remains stable at 0.015 USD and a third one where it increases to 0.05 USD.

After reaching these end values within a year (365 days) we keep them stable for another year (until day 730) to observe the evolution in the absence of changes.

The first graph shows how the DAO treasury sees a constant reduction, that is highly non-linear. The price going down can accelerate the exhaustion of the treasury but a growing price keeps it in a very healthy position.

The second graph shows the same information but now projected to USD, we can see now that a growing token price will increase the net DAO holdings in USD, greatly increasing the longevity of the treasury. In this case the lines are more linear, since the majority of the DAO expenses is denominated in USD.