Thanks for the answer, I will respect the topics:

Relay Pricing

Thanks for the clarification, now the price makes much more sense.

I suggest that you change the initial post to reflect the value of the relay to the correct one. The notion of price per “daily relay” is confusing and should not have the units [u$d/relay].

The actual value of the relay in u$d for the Pocket network client will ultimately be selected by the portal runners (currently only PNI), the price in POKT of the relay is what the DAO should control. Anyway this discussion is not really central to this topic and I think that the price that you chose is a good starting point. Lets assume it is fair and correct.

Bounding Minting with Relay Volume

Its fair to think that growth was from free relays, however I’m a little more optimistic on the sales team. I will explore what happens if we reach 3B relays in a year.

As I understand you are bounding emissions to relays AND the ecosystems revenue which you obtain from PNI sales (I disagree with this, but lets move forward). If sales go up, the minting should go up. You mention that minting 240K u$d worth of $POKT per month will put us in balance. So, if PNI doubles its sales we should mint more? (I’m not clear on this). This seems to unbound the minting from the relays again, as revenue is proportional to relays, you cant have both… I will explore both scenarios (bounding minting to relays and to revenue)…

Now, here are the results from my “unhappy paths” for this proposal. You will find the calculations here, please let me know if you find any errors/miss-interpretations.

All scenarios share:

- Time frame: 2023-04-01 to 2024-02-01

- Initial $POKT price: 0.04 u$d

- Initial relays per day : 1.2 B

- Initial $POKT supply : 1.58 B

- Linear interpolations between initial and end values.

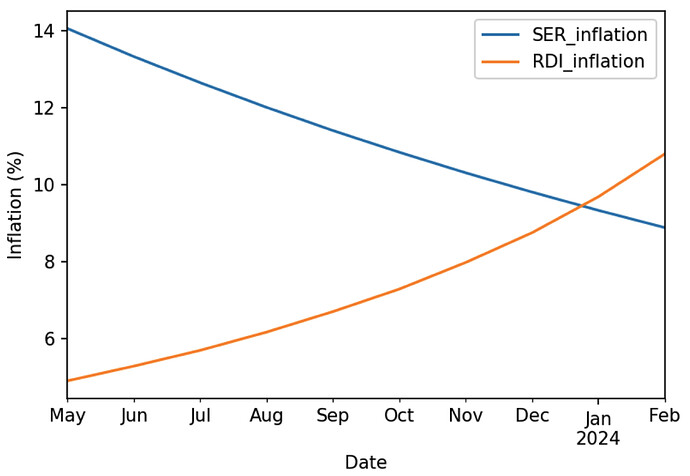

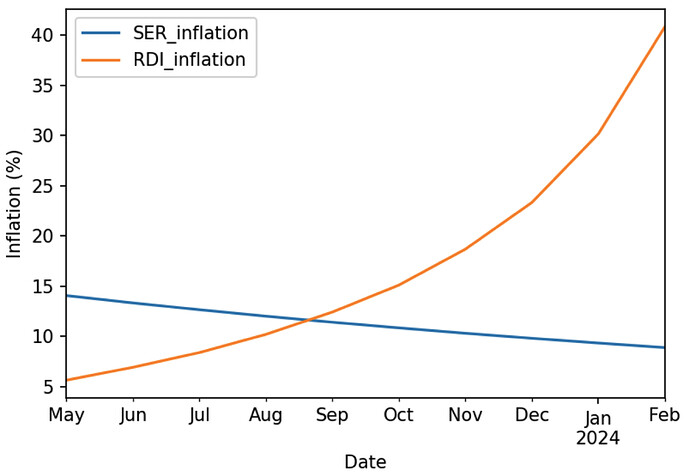

Price Down, Relays Up (current scenario, bounded to your projections)

- Final $POKT price: 0.02 u$d

- Final relays per day : 1.5 B

- Bounding minting to relays

Result: RDI produces more inflation than SER after January.

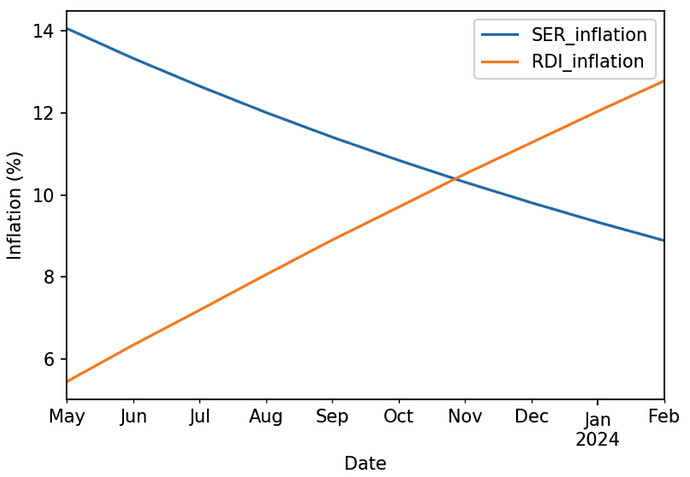

Price Constant, Sales Up (probable scenario)

- Final $POKT price: 0.04 u$d

- Final PNI revenue: 720 K u$d/month (3 times higher).

- Bounding minting to revenue (with more revenue we can mint more)

Result: RDI produces more inflation than SER after November.

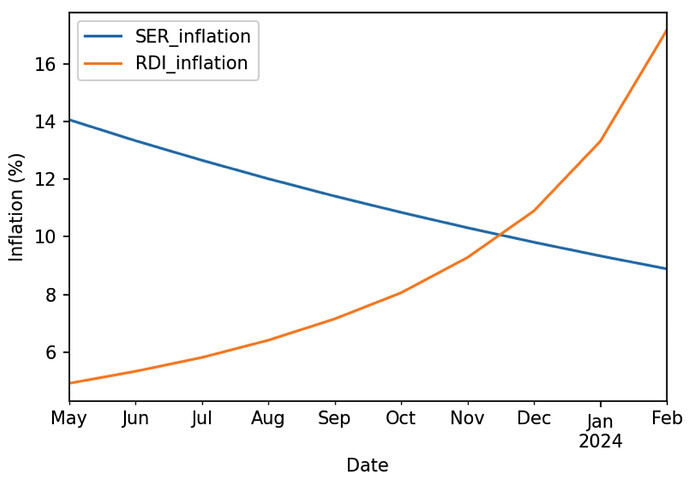

Price Down only

- Final $POKT price: 0.01 u$d

- Relays and PNI revenue constant

Result: RDI produces more inflation than SER after November.

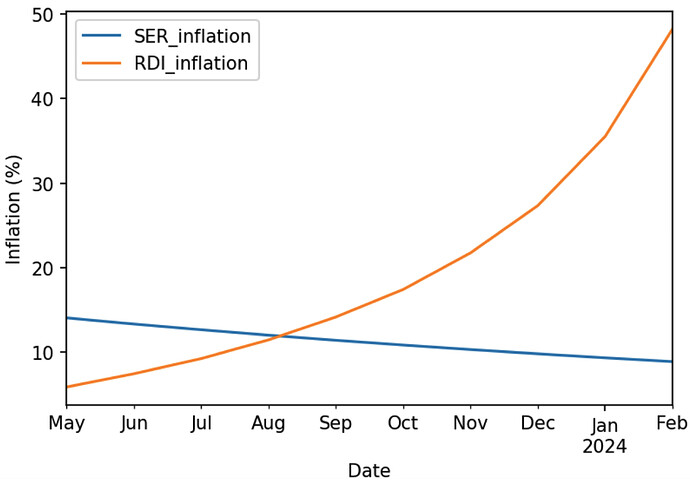

Price Down, Sales Up

- Final $POKT price: 0.01 u$d

- Final PNI revenue: 720 K u$d/month (3 times higher).

- Bounding minting to revenue (with more revenue we can mint more)

Result: RDI produces more inflation than SER after August and clearly exponential, pre-WAGMI again…

Price Down, Relays Up (limit case)

- Final $POKT price: 0.01 u$d

- Final relays per day : 3 B

- Bounding minting to relays

Result: RDI produces more inflation than SER after August and also clearly exponential, pre-WAGMI again…

Inflation Balancing

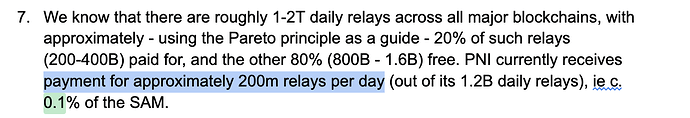

According to PNF post (more precisely the document they attach in the post), the current PNI revenue is:

So, from the 1.2 B they only get paid for 200 M and they are committed to buyback only 60% of their revenue [citation needed]. Their revenue that can actually act as buy pressure for $POKT is actually 27.2 K u$d/month according to my calculations (see gist). If we modify your proposal to match this revenue level and keep everything else constant, we would only mint ~22 K $POKT, this is unbearable (IMHO)…

Network Cost and Node Running

We all agree that using hardware that has no cost, like blockchain nodes primary used for other stuff or independent node runners is the ideal situation, however the Pocket Network current incentives are not aligned with this and this proposal will not help that.

I fear that small node operators who do not care about the scaling or the price of POKT probably do not care also for the QoS or data integrity of their operations. But I fear this is a subject on its own and has little to do with this proposal.

Or they can choose to chew more from their clients and use their size to leverage the reduction in incomes from this proposal. They will feed on the smaller ones that capitulate. This has happened before with some node runners charging up to 99% rev share…

I disagree with this, we should be able to survive while keep the decentralization alive. Otherwise lets just pay CC for all the relays, they can handle them.

Over-provision

Its not the same to count Pocket Nodes than counting Blockchain nodes. If you agree with this (as I seem to understand from what you write), you should make this clear in the proposal and remove all mentions to Pocket Nodes in regard to over-provision to avoid confusion.

Yes, we are over-provisioned and we should try to reduce that, but again this proposal is not the right way to do it for other reasons that I mentioned earlier in this post.