Our initial vision for the foundation was that it should be run as a lean entity with no one on the payroll (not even directors). It was just Stephane and I as directors. In line with this thinking, we agreed at the time that the foundation would keep its operations to a highly narrow operational focus, meaning that we would not run nodes and focussed only on negotiating and funding ecosystem costs - such as exchange listings, custody integrations, and market maker fees - and core protocol development.

When the need for a lean client was first identified in March last year, PNF should have been in a position to immediately bounty this work rather than requiring a PEP via DAO. And the R&D budget from that point forward could have included payments to Poktfund et al. for delivering LeanPocket.

But hindsight is 20/20. At the time, PNF wasn’t an active entity, didn’t have the needed systems in place, and PNI (until 2022) was the only contributor to core products like the protocol and the Portal. LeanPocket was truly a first for our ecosystem (the first major protocol contribution from someone other than PNI). It’s these lessons from the last year that are informing the work we’re doing now to establish the systems that we were missing.

This leads to the relevant line items in the budget for this year:

Contractors & Bounties: $150k USD + 2M POKT

Grants: 4M POKT

From the establishment of the foundation, it was expected that initiatives would be funded by the DAO, not the foundation. And to help nudge things along in this direction, I made a proposal - PEP-15 - recommending that the DAO sell some POKT for stables so as to have funds set aside for ongoing community grants funding, which the community was ultimately strongly opposed to.

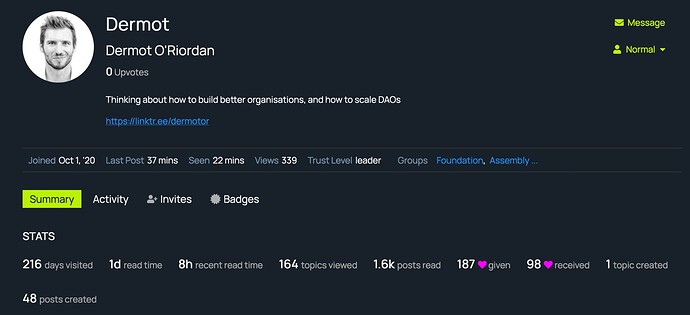

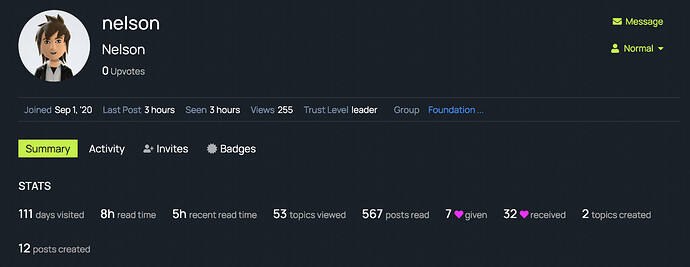

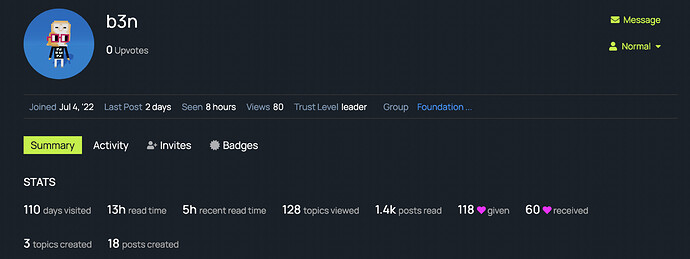

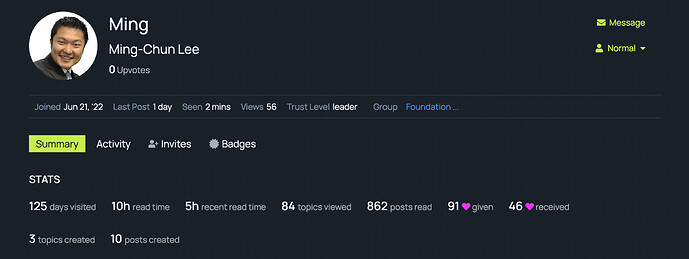

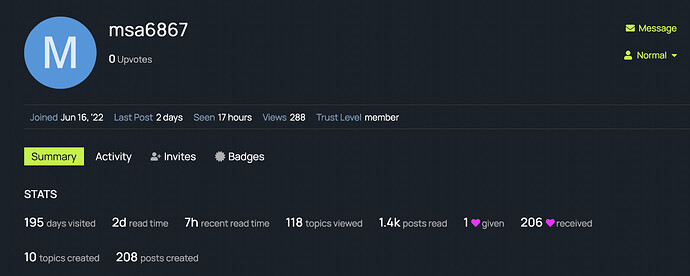

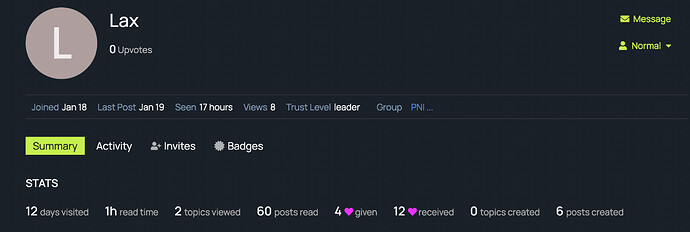

To remain neutral as an organisation, we largely tried not to weigh in on public discussions, claim a vote in the DAO or be seen steering things in one direction or another. Over time we began to see the DAO becoming quite risk-averse, limiting this source of community funding, which was why we felt there was a need for the foundation to expand beyond core protocol funding. This led to PIP-26 and the new vision for the foundation, including bringing on Jack, Dermot, Ben and Ming to allow us to take a more hands-on role and ultimately be facilitators to the community.

You are right to say that PNF overspent in 2022, and in hindsight, we should have raised more capital when prices were higher. However, our goal was to remain aligned with the community and only sell the minimal amount of POKT necessary to provide ongoing funding for core protocol development. Unfortunately, the market for POKT dried up in the second half of last year, and the foundation hasn’t received any additional stablecoins since the token sale to investors in January 2022. The foundation still has a substantial budget to make a significant impact on the community this year. Given PNF’s much smaller treasury of POKT holdings when compared to the DAO, the DAO will always be the natural funder of choice for any large POKT grant. And it is a key priority for us in the coming year to make it faster and easier to fund contributors, whether or not that funding comes from PNF or the DAO.