Hi @zaatar - jumping in here, although Nelson and Jack may wish to supplement my answers / give their own take:

Neither me or Jack have been appointed to PNF yet, so this item is a first-order priority once onboarded. We shared our initial thinking on the problems we see with the DAO and how PNF can help solve some of these coordination problems in our presentation in Tampa . See slides 102-112 here

And Jack also summarised the planned approach in his OP.

To answer you directly though, PNF’s operating systems ultimately refer to how we plan to embed PNF’s values and operating principles into its working practices; how we communicate, how we facilitate feedback, how we listen, how we act transparently, how we collaborate, and so on.

One fundamental way the community can keep PNF accountable is by referencing PNF’s public roadmap and KPIs. We want to ensure this is a two-way process, as PNF aims to partner with community stakeholders, not act as the parent. And to amplify the impact that all stakeholders in the ecosystem can make.

Updating the DAO constitution refers to the updates in Jack’s OP, ie:

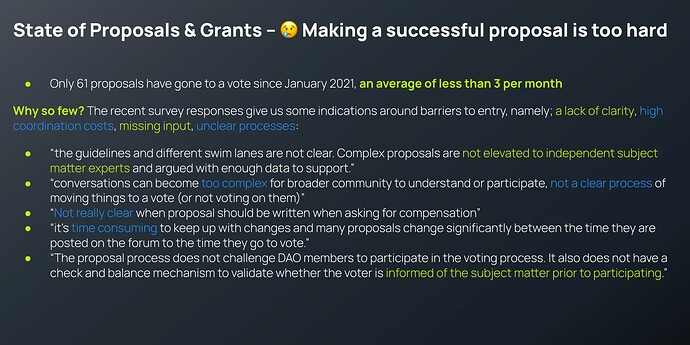

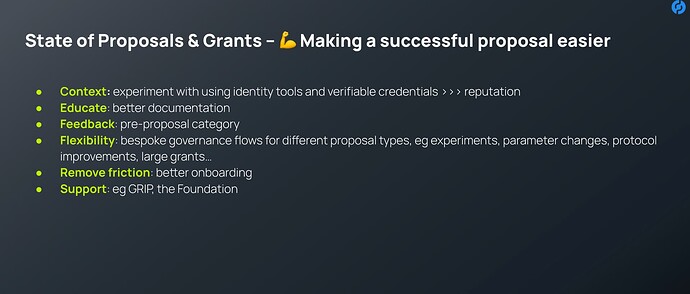

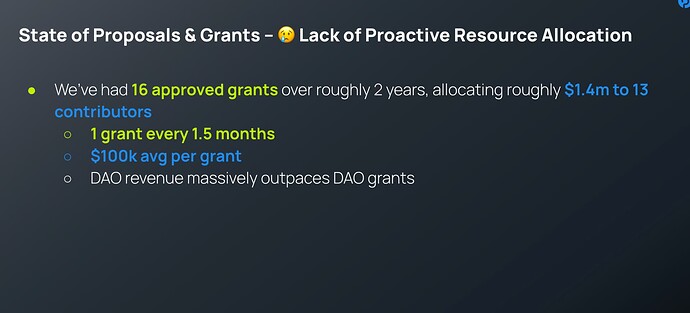

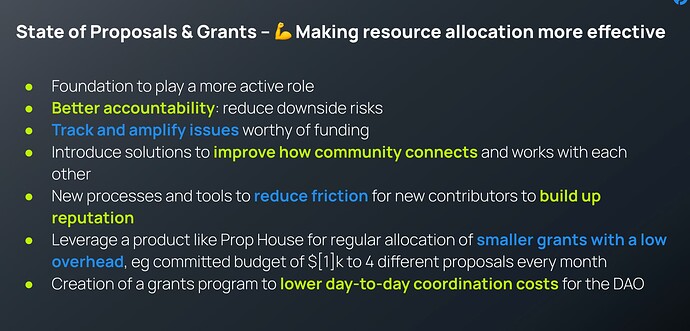

This was covered in the SOTU update in Tampa, and relates to some ideas on removing more friction from the proposal process while also increasing contributor accountability. See slides 102-112 here

All changes that affect the proposal process will be subject to a DAO vote.

See the following screenshots from the presentation by way of example:

Socialware refers to mechanisms that create assurances through human relationships, eg cultural practices and processes like AMAs, debates, as well as recommendations on how we communicate and give feedback to each other. Well-developed mission, vision, values, and practices on transparency would fall into this bucket. It’s basically the social layer of the DAO. And we want to work hard to improve that. As I think we all agree that it could be a lot better.

Socialware is opt-in, and could be as simple as a new channel in discord, or some simple recommendations on what we - on behalf of the community - believe to be best practice. Or even simply a new website that collates certain key community resources. As a result, most new social ware initiatives will not be subject to a DAO vote. On the other hand, any thing that gives special permissions to any particular group, or has additional funding implications from the DAO - such as a proposal like GRIP - will require DAO approval.

The Secretary is Silverside Management , the Cayman Islands organisation paid to carry out company secretarial functions for PNF, such as filings etc

The Secretary is referred to in PNF’s articles, which are stored publicly on Github - see here

There are no “members” in the context of PNF as an “ownerless organisation”. If PNF were to change its legal structure to have shareholders or other beneficiaries, it would then have a set of “members”. However, such a change is not envisaged or planned, so you can ignore all references to members

Jack listed the types of resolutions that require an ordinary/special resolution in his original post, namely:

- Director appointments (except where the appointment is temporary to fill a vacancy)

- Director removals

- Admission of new members (a legal term for Foundation members, of which we have none)

- Restricting the subsequent admission of new members

- Validating prior/future acts of directors which would otherwise be in breach of their duties

- Designating and revoking the designation of beneficiaries

- Amending previous Ordinary/Special Resolutions

- Fixing a quorum for the transaction of business at a meeting of directors

- Releasing directors from liability in connection with the discharge of their duties (except in cases of their own dishonesty)

- Transferring the jurisdiction of the Foundation

- Winding up the Foundation and determining the distribution of Foundation assets

- Changing the Foundation’s name

- Changing the provisions of the Foundation’s Memorandum

- Altering the Articles of the Foundation

The legal definition of ordinary and special resolutions is referred to in the articles linked above

The Foundation is legally based in the Cayman Islands; if it were to change jurisdiction it would require a special resolution.

Sharing these here for posterity:

We are currently reconciling all finances, including all immediate outgoings, such as paying for the Copper custody arrangements on behalf of the whole ecosystem and putting together a budget for 2023.

Once the new Foundation team is appointed, we will get to work quickly on providing more transparency into Foundation financials, including sharing annual accounts and quarterly transparency reports (the latter being enforced by clause 4.42, as introduced by this proposal).

The foundation received a gensis grant of POKT as per the token distribution chart on the website

The Foundation has approx 23m POKT in its treasury as of today.

POKT was sold to investors as part of previous financing rounds, which has resulted in PNF having some stablecoins on its balance sheet.

PNF’s major outgoings over the last couple of years have been funding PNI’s development work on behalf of the ecosystem, payments to Copper (for custody), market makers and exchange listing fees.

This proposal does not affect the DAO’s treasury or how the DAO allocates such treasury.

As per Jack’s comment in the original post:

The articles refer to the foundation as the “Company”

PNF directors will have no affiliation or duty towards PNI

Similar to most board positions, there is no specific end date for these appointments. For now, the key priority is getting the foundation up and running and delivering value to the ecosystem. We expect the board to expand in the latter half of next year once certain critical operational and strategic items on the roadmap have been delivered. At that point, the hope is that the PNF board can be more focused on governance than operations, and it would likely make sense to have fixed term limits, or to explore other ideas around voting via the DAO, and so on. This will be a collaborative process, and we want to seek community feedback and input throughout.

Looking forward to your further questions and input. However, to respond to your last point, we are delivering more DAO oversight over PNF spending through quarterly transparency reports, which goes much further than any other foundation in the ecosystem. DAO control over appointment/removal of directors is another key aspect of “DAO-based control and transparency”. Ultimately, we expect to be removed if we aren’t doing our job. Furthermore, PNF will need financial support from the DAO in the future to continue its mandate, so it will be a crucial priority for those leading PNF to showcase to the community exactly how we are deserving of current funding and what we plan to do in the future to deserve any more.

FWIW, I’m very excited to work on unlocking Pocket’s DAO and its wider community. It’s a mission very close to my heart. And I like to think that we can do a decent job of leading by example and showcasing PNF’s operating philosophy, which we all put a lot of work into defining and aligning around. S/o to @b3n in this regard too!