Are you saying that once the DAO approves a PEP submitted by the Foundation, the Foundation can do whatever it wants with the money - in your words: “subsequently have discretion to allocate said funds”? Or would the Foundation’s use of any DAO Treasury money not have to adhere strictly to the terms for use of the funds as set out in the PEP?

It would of course be subject to the terms of the PEP. Though the PEP might request a lump sum for use in the Foundation’s own discretionary grant program. As another example, the PEP might request a reimbursement for an expense the Foundation already elected to incur at their discretion, such as the Copper custody integration or an exchange listing fee, the latter being something the Foundation can’t publicly ask permission for and thus a good example of why we need the Foundation to be able to have discretion.

And, of course, the Foundation’s current funds do not have any terms attached.

What do you mean “publicly ask permission for”? If you mean ask the DAO, why can’t the Foundation ask the DAO to cover listing fees, even if it’s for reimbursement of money dispensed from the PNF treasury?

And somewhat related, is the Foundation including its treasury part of Pocket Network?

Because the Foundation can’t communicate about prospective exchange listings before they’re official.

Reimbursement is another thing but you seem to be implying in your line of questioning that the Foundation should not have any discretion to spend funds without first asking the DAO for permission.

I don’t understand your last question.

The foundation has discretion to spend funds only based upon decisions made in keeping with the Constitution and the lawful exercise of authority by the Foundation - IE, acting in accordance with the Constitution. If the Foundation has lawful authority, of course it can spend money without asking for DAO permission.

That is the case as I outlined above. It would be different if the DAO negotiated for the POKT granted to the Foundation in a specific PEP to be used for a specific purpose. In this case, the duty to carry out DAO Resolutions would override the lawful discretionary spending authority that the directors have, unless the specific use of funds directed by the DAO was itself in violation of director’s duties.

To bring it back to the big picture, the DAO controls the appointment/removal of directors, which means the DAO ultimately has the levers to control the direction of the Foundation. The DAO cannot, and does not need to, micro-manage the directors’ spending decisions made in the course of carrying out their duties.

Where does the Constitution authorize the Foundation to make spending decisions using the Foundation’s money without DAO approval?

Paragraph 4.10 of the Constitution provides:

“The Foundation shall serve as a custodial entity for Pocket Network, deferring decision-making to the Council in all cases except Material Adverse Exception Events (MAEEs), i.e. crises resulting from incomplete contracts and unforeseen events.”

If the Foundation and its treasury are part of Pocket Network, the Constitution appears to give the DAO decision-making power over routine Foundation spending.

You have referred to certain Articles of the Foundation:

Article 23.2 purports to give the Foundation authority to make decisions on spending without DAO approval. If the Foundation is part of Pocket Network, this Article would appear to be unconstitutional.

Note: I see you’ve edited your original comment but I’ve already drafted my response so I’m posting anyway.

The Constitution defines the DAO’s treasury quite specifically, as I quoted above. It’s quite a leap to say that the DAO controls Pocket Network and thus the Foundation’s own accounts. I suppose the DAO should also have the power to control the spending of every other POKT holder? No, the DAO’s power is not limitless - the DAO controls:

- On-chain powers as defined by the ACL and the gov module

- The Foundation as outlined above, not directly but through the checks and balances in the Foundation’s Articles

The clause you have quoted describes that the directors defer to the DAO in decisions over which the DAO has authority, in “all cases” except MAEEs. I can understand that “all cases” is ambiguous.

You have rightly highlighted that the constitution is an imperfect and outdated document; see also reference to Aragon Court, a product which has not lived up to the expectations I had at the time of writing the document and is thus highly unlikely to be used by us in the way the constitution describes.

This is why we have already identified the need to update the constitution on our roadmap.

Ambiguities in the wording of the Constitution do not make the Foundation’s Articles unconstitutional. The Constitution itself was published and ratified after the Foundation’s Articles, and directly reference the Foundation’s Articles, which at the time already had the provisions granting discretion to the directors.

Concerns about the removal of critical talent by DAO voters

You make a valid point. Under my proposed concept, the Directors that value their job more than the Executive Director would remove the Executive Director. Alternatively, they would sacrifice their roles for the greater good protecting the Executive Director until the DAO could appoint Directors that would remove the Executive Director. The hope would be that Directors would act in the interest of the project. The chaos caused by the latter scenario may be considered an extra protection mechanism as the chaos caused by the removal of the majority of the Directors increases the cost of the attack. The following proposals should lead to increased engagement from other DAO voters, giving the disengaged community time to react.

Simple additions to solve this case

In light of this response, I would consider a similar model with minor checks, such as proper performance evaluation with evaluation periods and protections against arbitrary dismissal by Directors. The Civil Reform Act of 1978 may provide a blueprint for this:

A similar model would balance the needs of the employees of the Foundation and provide for effective oversight and performance evaluation by the Directors. The key would be right-sizing this for where the Foundation is today. While there will be concerns about administering something like this we only get one bite at this apple and it is worth doing right from the get-go using an MVP-like implementation of the idea.

Transparency & Funding

I urge the Foundation Directors to release a historical record of expenditures and a current balance sheet before any changes. It is difficult for voters to make decisions about such structural change without specifics. Other than the loose definition of assets provided, there is very little to go off. Only the proposers of PIP-26 know the actual numbers.

Worst case, adding the requirement to be transparent before the proposal goes to a vote is a good forcing function for the Foundation to reconcile its accounts and present the first transparency report.

It would be wise to present a plan created by the to-be Directors to address the long-term viability of the Foundation. One year of runway is not an overwhelmingly inspiring number for an entity designed to steward the ecosystem for decades.

We can debate the role and the timeline of the new Foundation, but the reality is that the Foundation will need to be fully funded for multiple years. Continued funding should be a key issue that DAO voters should think about as we go to a vote.

We should expect an in-depth execution and financial plan before taking this to a vote.

Remuneration

The incentives in this proposal put all compensation in the hands of Directors, i.e. remuneration (token grants) are decided by Directors for the Directors out of the Foundation Treasury.

Further, this proposal would eliminate the $50,000 salary cap - the only proactive check provided to prevent overly generous remuneration (edited for clarity). Possibly more concerning, the Directors could set terms for grants that the DAO cannot control. Theoretically, Directors could decide that they all deserve 2M POKT guaranteed no matter the level of contribution or the status of their service to the Foundation.

Established precedent

This proposal seems to go against the established precedent for compensation. In this case, remuneration is determined before the work is performed. This practice goes against the precedent set by the authors for remuneration after work is performed as demonstrated by PEP-35:

While the nature of the proposal is different the idea is the same: the compensation for work should be determined after the value of the work can be assessed. This standard should be applied in this case as it is much easier to assess the success of the Foundation leadership after their work product is delivered - not before.

If we go down this path of compensation before the work is performed we create a clear delineation for contributors to Pocket Network: insiders and outsiders. Insiders who are not subject to the DAO’s oversight and outsiders who must create proposals and convince others for compensation for work.

If we are to go against the established precedent of retroactive compensation in favor of prospective compensation, I propose an alternative solution. To ensure transparency and fairness the Directors should be required to ask for a token grant from the DAO. The ask would come in the form of a proposal that would delineate the amount and specific terms of the grant.

I would take this a step further and disallow Foundation Treasury funds to be spent on Directors and employees/contractors to avoid this issue. Any employee grant pool should be established and approved by the DAO and should be administered by the Foundation Directors per the proposal.

Alternatively, we could stick to the precedent and pursue retroactive grant compensation based on the performance of the Directors/Executive Directors, creating a level playing field for all contributors.

I am suggesting these changes to create a level playing field where contributors of all types are being compensated in the same manner and to avoid any appearance of preferential treatment of, or foul play, perceived or actual, by Directors.

Foundation Treasury

I would raise concerns about using this part of the constitution to justify its control over the remaining Treasury Foundation:

The line provided above from the Pocket Constitution clearly outlines that the DAO allocates funds via PEPs and that the Foundation intended to allocate those funds per the PEP. It makes no mention of the Foundation Treasury or the allocation of that in that quote.

Further, I do not believe there is a reference to the Foundation Treasury in the constitution. With this stated, we must rely on what is in the constitution to understand the role of the Foundation. It would appear that the proposed discretion is unconstitutional:

As the Foundation Treasury decision does not qualify as a Material Adverse Exception Events (MAEEs), I would be curious how to justify the Foundation Treasury discretionary spending. The proposal as it stands could be in jeopardy of being unconstitutional.

The challenge then is how to interpret the ambiguity, which is addressed in the Constitution:

The question raised above by @JackALaing and @zaatar should be resolved. The resolution could come from an understanding of which document takes precedence. I would argue that the Constitution is the end-all-be all governing document in the Pocket Network ecosystem, despite how flawed it may be. Rather than dismissing it as antiquated we should seek to fix it through amendments.

My understanding of the Foundation Treasury is that it enabled a legal wrapper for the DAO. It could be used to sell tokens that would fund DAO initiatives. The DAO, possessing no means of storing stables nor executing real-world agreements, would be reliant on the Foundation to execute. Logic would follow that it makes sense to have both a DAO and Foundation Treasury that provide funding for different cases (fiat and POKT). In a scenario where there is no Foundation, the DAO would have no mechanism to convert POKT to fiat and pay employees/contractors for services.

Operationalizing the Foundation Treasury

I would suggest that some discretion could be built into the system, but with proper checks and balances. At a minimum, the DAO should have adequate boundaries for Foundation Treasury spending (e.g. a budget) that provides some oversight for DAO voters. A budget would be a way to operationalize the intent of the proposal. There would need to be an update to the Pocket Constitution to make this work - as it stands, the Directors appear to be unable to use any discretion.

Summary

There are issues with the proposal as it stands that should be resolved before contemplating a vote:

1.The DAO should expect to receive some sort of detailed balance sheet to understand what we can reasonably expect out of the Foundation.

2. I would urge the would-be Foundation directors to release an in-depth execution and financial plan before taking this to a vote.

3. Lack of oversight on remuneration. Directors should have reasonable oversight and restrictions on token grants.

4. Potential constitutional questions around Foundation autonomy and the Foundation Treasury

To be clear about my position, I believe in the essence of what is being suggested, but I believe some of the details are rushed. I believe the Foundation should be separated from PNI in all haste, it should be given reasonable control over a budget so that it can play this role, and the Constitution should be updated to clarify its role in the ecosystem.

I want to avoid a situation where we rush through this process for the sake of expediency without putting the proper structure in place to see it through. I understand that this will be an ongoing and evolving process, but we risk tainting this administration if we rush through this process.

I do not support this proposal in its current form.

While no one disputes the need to separate Pocket Network Foundation (PNF) from Pocket Network, Inc. (PNI), sooner rather than later, the proposal contains features that augur ill for the future of the DAO. Among these are lack of DAO control over spending by the foundation and the way it defines “supermajority” for votes on key issues. There are other concerns. I address all of these below.

DAO Control of Foundation Spending

Some background first.

As the linked article explains, a DAO is a decentralized organization governed by a community. But it lacks legal “personality” and is therefore unable to:

(a) interact with third parties outside the DAO; (b) enter into contracts (particularly with digital asset exchanges); (c) hold assets; (d) protect valuable intellectual property that may be imitated by other projects or DAOs, and, (e) carry out the wishes of the DAO where the community has voted for the DAO to undertake an action vis a vis third parties.

To overcome these legal limitations and perform these functions, the foundation was created. Think of it as the DAO’s legal wrapper.

The foundation was created to advance the interests of Pocket Network and serves at the DAO’s pleasure. Let’s not forget this overarching principle.

Effective Oversight

Oversight of the foundation by the DAO is essential. For such oversight to be effective, it must be exercised “before the fact.”

PEP-26 would have the DAO exercise this oversight after the fact. Directors would set their own salaries (at the same time as the current $50,000 salary cap is lifted), and, to attract “world-class talent,” would award themselves token grants as they see fit from its treasury.

According to the authors of this proposal, the DAO would have “unparalleled” oversight by virtue of quarterly spending reports, its ability to remove directors by vote and even sue them in the Cayman Islands.

But all this – as noted - is after the fact. (And, realistically, who would sue in the Caymans?)

The current Articles include a requirement that the DAO vote on appropriate remuneration of DAO directors. For good reason: PNF is answerable to the DAO, not to itself.

How does PEP-26 justify removing the DAO from any role in approving the remuneration of the foundation’s officers and allowing the directors to set it themselves?

Simple Solution, But Not the Best

This may be the simplest way to resolve the “tension,” but as far as the DAO’s interests and best-practice governance are concerned, it is not the best.

The DAO should have the power to approve in advance the salaries set for PNF directors and other PNF spending. To carry out its functions, however, the foundation must have some spending discretion.

There has been some discussion in this thread about whether the Constitution allows the foundation to set directors’ salaries and make spending decisions without DAO input. If the Constitution is capable of such interpretation, it ought to be amended to clarify that the DAO has the final say on spending and to set guidelines for discretionary spending by the foundation.

Oversight and control should be “before the fact,” not “after the fact.” There can be no backing down on this fundamental principle.

The advance oversight of the DAO should be as non-intrusive as possible. Not a committee. Not a mandatory DAO vote on every funding or payment decision. We do not want to unnecessarily burden or distract the foundation.

The least intrusive solution would be for PNF to publish its planned budgets with directors’ salaries, proposed token grants (more on these below), and totals/global amounts (not line items) for each department/division. A DAO meeting (gov call) would be held where PNF would present its quarterly budget and where community members could ask questions and provide feedback. (At a separate meeting, the foundation should discuss its actual spend for the prior quarter as disclosed in its quarterly reports, providing greater detail as requested: See section on “Transparency” below.)

After the meeting on the new budget, 7-14 days would be allocated for discussion in the forum. If concerns were not allayed by persuasion or budget tweaks, a minimum number of voting members - say, 3 voters (or some other reasonable number) - could force a snap DAO vote on the disputed part of the budget. The budget would be deemed approved if no vote was triggered.

Alternatively, budgets, annual or quarterly, could be put to a mandatory DAO vote.

Integrity not at Issue

I wish to make clear that I am not impugning the integrity of the prospective PNF directors. My position has absolutely nothing to do with whether this person or that person can be trusted. This is solely about good governance design and establishing checks and balances that will serve the DAO long into the future.

(I agree that the role of the supervisor in approving remuneration should be eliminated. And the amendment on publication of quarterly remuneration figures and all other spending is, of course, welcome.)

Solidifying the DAO’s oversight role will increase its governance experience. This will be a benefit as the Pocket Network grows. Before it can run, the DAO must learn to walk.

The proposed amendment to the foundation Articles to allow for token grants to PNF officers deserves a closer look. For outsiders new to Pocket, token grants make sense. They can lure talent and incentivize alignment with the project. But for Pocket veterans who already received token grants, are new grants going to boost alignment? DAO oversight of token grants should therefore require disclosure of prior token grants by would-be recipients. (A nod to Adam for calling this to my attention.)

Supermajority Definition

PIP-26 would require a supermajority of 2/3 of participating voters for vital decisions. This purports to prevent a handful of voters from making or blocking important changes. Practically, however, the protection of this supermajority definition is illusory.

Under this definition, three voters can introduce significant changes including alterations to the Foundation Articles. If only three people show up for a vote and two support the change, it will carry. This is untenable, bad for democracy and unnecessary.

Some background first:

Supermajorities are common among democratically elected legislatures and other governance bodies. For example, the U.S. Senate and House of Representatives require majorities of 2/3 to amend the U.S. Constitution, expel a member of Congress or remove the president from office under the 25th Amendment.

The two-thirds requirement can be qualified to include the entire membership of a body instead of only those present and voting, where abstentions and absences count as votes against the proposal. Alternatively, the voting requirement can be specified as “two-thirds of those present”, which has the effect of counting abstentions but not absences as votes against the proposal (see Wikipedia entry.)

At first blush, the supermajority definition put forward by PIP-26 appears to fit the “two-thirds of those present” formula. In truth, it is far from it.

The difference between a supermajority in the legislative or corporate board context on the one hand and our context on the other is that a supermajority in the former context relates to a body of individuals who are elected or appointed for the purpose of voting on behalf of the constituents or shareholders who put them in office.

The supermajority definition of PIP-26 is not that of a body of elected or appointed representatives. As a vote by the entire electorate it is akin to a referendum or plebiscite.

Referendum with Turnout Threshold

The supermajority vote requirement of this proposal resembles a referendum with no participation quorum or threshold requirement (see Wikipedia entry). Where a participation quorum or threshold requirement exists, a majority of those voting must approve of the referendum, and a certain percentage of the population must have voted in order for the results to be approved.

Quorums or turnout thresholds prevent referendum results from being skewed by low turnout or decided by a motivated minority of voters. In a participation quorum, the turnout threshold can be a percentage or an absolute number.

For it to be effective, the supermajority definition of PIP-26 (2/3 of participating DAO voters) must also contain a turnout threshold. This could be set at 25 members (if there are 50 eligible voters), or 50% of the electorate, or any other numbers that are deemed reasonable. (edited on December 11 for clarity).

Terms of Tenure

To facilitate proper oversight, the foundation’s actions must be transparent and its officers accountable. This section addresses accountability; I address transparency afterward.

These positions should begin with a fixed term, say two years. Having to seek DAO re-election will ensure accountability from the outset – rather than tacking it on “after the fact.”

Transparency

(The comments below supplement Adam’s in his post immediately above.)

We are currently reconciling all finances, including all immediate outgoings, such as paying for the Copper custody arrangements on behalf of the whole ecosystem and putting together a budget for 2023.

Once the new Foundation team is appointed, we will get to work quickly on providing more transparency into Foundation financials, including sharing annual accounts and quarterly transparency reports (the latter being enforced by clause 4.42, as introduced by this proposal).

Transparency is essential to accountability.

The Foundation Articles recognize this: Article 4.35 states:

“The Directors shall give to the DAO …such reports, accounts, information, and explanations concerning (a) the Company’s business and affairs, and (b) the discharge of the directors’ duties and the exercise of their powers, as may be required by a DAO Resolution of the Company.”

Full transparency must be the default, with any exceptions narrowly defined in the foundation Articles. (this sentence was added on December 11)

Quarterly reports on foundation spending are a good start but they fall short. What if we have questions about these reports? A category should be created in the Forum where DAO voters can make reasonable requests for any information about the foundation including its spending and activities - and get prompt answers. (Another nod to Adam for this suggestion.) The foundation should pledge to provide a full accounting of its assets including stables, not merely “more transparency,” which could be a lot or next to nothing.

CONCLUSION

PIP-26 represents an important and necessary step forward: disengaging PNF from PNI. However, it raises serious concerns that need proper consideration before it can be voted on:

- Advance DAO oversight regarding PNF directors’ salaries, token grants and PNF spending including use of the foundation’s treasury

- Clarify the relationship between the DAO and PNF

- Definition of supermajority

- Limitation of directors’ terms

- Transparency of PNF activity and spending

- Add to these, the concerns that Adam has raised in the post above mine.

Voting on PIP-26 should be postponed so that these issues can be fully debated and to allow for needed changes to this proposal. The future of our governance hangs in the balance. Let’s get the foundation right (no pun intended) and not rush this through.

Postscript: I can only imagine how much time the core governance team spent on developing this proposal. It is well thought-out, well researched and well written. It reflects the level of preparation and quality of work we need to best develop the Pocket ecosystem.

At the same time, given the importance of this proposal to the ecosystem’s future, it is vital that the DAO community carefully scrutinize it. To this end, a properly resourced and organized mechanism to perform that scrutiny (EG, a governance committee?) would have been very useful. Instead the critique of this proposal has been scant and sporadic. Better scrutiny will produce better debate, which in turn will lead to better proposals and better governance changes.

This is a good debate and the feedback is making a better and stronger proposal. That said, we must understand that governance and operations have different needs. More governance does not necessarily equal good governance.

Governance defines permissioned authorities and scope boundaries to secure the organisation from governance capture and catastrophic failures. Permission however is a terrible way to run an organisation. You cannot build a culture of dynamism, innovation and speed using permissions. Permission is “do-not-act-until-approved" which is organisational stasis and death.

I think some of the feedback and proposed solutions, particularly as it relates to budgeting and remuneration, lead to outcomes that are operationally unwieldy and suboptimal. Powers should be permissioned with clear constraints but provided those constraints are not breached then people should be empowered to get on with using their own autonomy and creativity to deliver results, which ultimately is the most important thing for anyone to be held accountable to.

What might this approach of permission and constraint look like re budgeting and remuneration? Define whether PNF directors can hire people and what they can spend on, set reasonable limits on budgets and remuneration, and then let them do it. It’s incumbent on the Directors to demonstrate ROI (via transparency and reporting) but requiring reasonable acts to be debated and permissioned before the fact is not necessarily good governance, it can easily become bad org design.

You make good points @b3n. The Foundation does need to be dynamic and make optimal decisions to grow Pocket Network. I’d steer the conversation toward a governance structure that enables rather than restricts.

Generally Proposed Structure

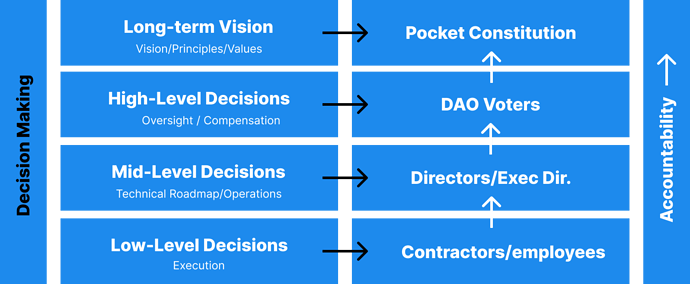

As I believe there to be some misunderstandings, I’ll break things down further. I would like the DAO and the authors to consider the merit of multiple layers of oversight:

- DAO: A DAO-based governance “board” that includes compensation, budgeting, potential term lengths, etc.

- Foundation: Directors and the Executive Directors determine the specifics of the who, what, where, when, and how.

- Execution layer: The individuals executing the Foundation level plan

DAO

The DAO-based governance protects the project and the Foundation resources from abuse.

At the DAO level, there are a few asks:

- Have a documented plan

- Create a “not to exceed” budget based on that plan

- Have reasonable compensation that attracts best-in-class talent

I don’t believe these requests to be onerous. Any capable businessperson should produce these materials, even in absence of third-party oversight.

Some of your feedback points to the larger struggle of DAOs - every act requires significant preparation, discussion, and resolution. The idea is that the tension created by that process produces an acceptable outcome for all stakeholders. This model is non-optimal for a dynamic business, which is why it won’t be required for every decision - just the ones that could cause major interruptions and project setbacks.

Foundation/Execution

The Foundation layer provides for effective oversight on execution. Therefore, once the budget allocation occurs, the Foundation will have free reign within the company to make decisions and execute, pivoting as needed. This includes, changing strategy, hiring new contractors/employees, etc. Further, those executing would have the autonomy to perform the task with reasonable oversight from the Foundation leadership.

Other Thoughts

There’s no real reason you can’t have a dynamic Foundation while providing the right-sized levels of oversight. We can point back to Amazon for an example of this. Amazon created a well-developed governance structure that enables them to be dynamic and stay relevant in the market while protecting investors. They have 11 Directors on the board and three different committees - no small amount of governance. They view governance as a part of doing business rather than a hindrance. So should we.

I’m hopeful we can get away from an all-or-nothing approach to oversight and governance. The current stance appears to be, “we want funding when we need it, we’ll pay ourselves what we want, and you can remove us if it doesn’t work - after the fact.” This attitude has the potential to taint the goodwill of the community if things go wrong. Instead of a binary approach, we should be working together to craft reasonable oversight for the good of the Foundation and Pocket Network.

Hey @adam

@JackALaing will respond at some point today with a more comprehensive response to the comments from you and @zaatar - many of which I hope you’ll both be pleased to see have been taken into consideration.

In the meantime, I wanted to respond directly to your points above about changing the governance structure of the DAO and the Foundation. Namely, to establish a “DAO Board”.

Regarding establishing a “DAO Board”, it’s not clear to me what benefits would accrue from creating a centralising force within the DAO, particularly when:

- Such a board would not be subject to any legal fiduciary duties to its stakeholders, ie the DAO members, or be in a contractual relationship to enforce its mandate with any entity within the ecosystem; and

- it’s unclear what distinct value-add such a board would bring to the community, beyond what PNF plans to provide in the short to medium term.

Unpacking the roles of the DAO and the Foundation

The DAO and the Foundation are extremely synergistic institutions. The phrase “highly aligned, loosely coupled” comes to mind as the DAO and the Foundation share a similar vision but focus on distinct missions to get there.

As a result, I believe that each institution would be best placed to lean into its unique attributes to achieve its goals.

The DAO

In the case of the DAO, it is the key vehicle for driving Pocket towards becoming unstoppable, i.e. as resistant as possible to capture. And to eventually become a hyperstructure. The DAO achieves this mission by representing the broadest possible set of interests of the Pocket ecosystem. In doing so, the DAO also maximises the quality of its decision-making in concave environments “where pluralism and even naive forms of compromise are on average likely to outperform the kinds of coherency and focus that come from centralization”. Further, by investing its treasury, the DAO maximises the impact its contributors can make on behalf of the broader community. Becoming more representative while continuing to learn and evolve is what makes the DAO so valuable.

The Foundation

The Foundation is ultimately all about enabling the DAO on its mission. It can represent the DAO in the real world and enter into contracts on its behalf. However, more than that, with its own separate genesis allocation, a credibly natural mandate, and a small but focused group of paid staff, the Foundation can focus on longer-term goals that members of the DAO may not have the time to think about or care about as it doesn’t impact their stakeholder group directly. The more that the Foundation’s autonomy is reduced, the less its impact will become. And while there is undoubtedly a balance to be struck, highly centralised direct control of the Foundation by the DAO is not it. Being as credibly neutral as possible while maintaining sufficient autonomy to represent Pocket’s values and think longer-term makes the Foundation valuable.

The Future roles of the DAO and the Foundation

The DAO is just not ready yet to fulfil the Foundation’s role as well as its own. Putting a “Board” on top of the DAO wouldn’t change anything for the better. I think it’s clear that the Pocket ecosystem has been missing an entity like a more active Foundation in the last year or two, a credibly neutral entity with the mandate, resources and reputation within the community necessary to facilitate better governance, connect Pocket’s community, empower contributors and stand up for the interests of the DAO in front of other ecosystem institutions and players.

As the DAO’s socialware and trustware develop, I hope that the DAO can make PNF redundant. However, we can all agree that we’re at least a couple of years away from that point. And hopefully, most of the community can see the benefit of having paid, highly aligned directors and staff working for the Foundation focused on unlocking the DAO to deliver the most value to the rest of the ecosystem in the meantime.

Thank you @adam and @zaatar for your feedback. Below I have outlined some suggested amendments which we believe address the concerns we found to be valid, I have explained which concerns we have chosen not to address and why, I have outlined which suggestions we have added to our roadmap, and I have taken the time to clear up some misunderstandings.

Suggested Amendments to the Proposal

Update the definition of Supermajority DAO Resolution to add a Quorum requirement

Supermajority DAO Resolution shall mean a resolution validly passed on the DAO in accordance with the governance protocols of the DAO with at least 75% approval by DAO participants who voted on the resolution, subject to the vote lasting no fewer than 14 days and a quorum of at least 25% of DAO participants who have cast a vote within the 12 months immediately prior to the date that voting commences on such Supermajority DAO Resolution.

This clause provides security against minority governance attacks, while minimizing the risk of stalling governance due to inactive voters. Note that while this excludes inactive voters (defined as those with at least 1 year of absence) from the quorum count, it does not preclude those voters from casting their vote.

As an example of how this would work in practice, only 3 of the current 56 voters have not voted in the last 12 months, which would result in a quorum of 14 of the remaining 53 active voters. If we were to make the quorum 50% instead, the quorum would be 27, a vote count that is surpassed only by 3 proposals: PIP-22 (33 votes), PEP-32 (28 votes), PEP-31 (28 votes).

Add a “DAO Oversight” section

Clarify the nature of transparency reports

4.42 Financial transparency reports should be published quarterly by way of DAO Notice within the first 4 weeks of the end of the previous quarter. These should include management accounts showing actual vs forecasted spending, an updated balance sheet, and cash flow forecast. The budget should include total director remuneration as determined by 4.37, total contractor remuneration, and any other material expenses categorized as the directors reasonably see fit.

This clause is pretty self-explanatory. This level of detail in transparency reports was always the plan, this just makes it explicit.

Note that, given the timing of this proposal, the first financial transparency report for Q1 2023 would have a deadline of 8 weeks, not 4 weeks, from the beginning of the year. This does not prevent the Foundation from publishing the report as soon as it is ready.

Add consent-based approval of a forecasted annual budget

4.43 Financial transparency reports in the first quarter of the year should include a forecasted annual budget. The annual budget shall be automatically approved unless there is a Supermajority DAO Resolution rejecting the budget, subject to the vote starting within 2 weeks immediately following the date of the DAO Notice. If the budget is rejected, the directors must amend the budget using their own reasonable judgment, subject to any limitation imposed on them by existing contracts, but shall not be compelled to go through any further rounds of approval.

Giving the DAO the power to micro-manage the budget is entirely impractical. The directors need autonomy to effectively manage the Foundation’s affairs and we should generally lean towards trusting the directors to act in good faith to exercise reasonable judgment, given:

- their incentives to retain their position,

- their legal duties to the company,

- their relative closeness to, and expertise of, the affairs.

Budget debates can easily become proxies for strategy debates, which may often lead to impassable conflict between the directors and certain subsets of the DAO, though this does not mean that the DAO as a whole disagrees with the directors. Therefore, in these conflict scenarios, following the principles above, the DAO should only be able to override the directors judgment with a supermajority.

The DAO is given 2 weeks to digest the DAO Notice, prepare a rejection proposal if they wish, and begin voting. This timeline is chosen because 1) we should not risk stalling the directors from entering into important contracts 2) if the DAO takes longer than 2 weeks to build consensus on rejecting the proposal, it is unlikely to achieve a supermajority anyway. Coupled with the 4 week DAO Notice limit and the 2 week supermajority voting requirement, this means that in a worst case scenario the Foundation can achieve budgetary certainty by the end of February.

In the scenario where the DAO does obtain a supermajority to reject the budget, the directors should be compelled to amend the budget, but should not be compelled to go through further rounds of approval. Further, there should be no strict rules about the nature of the amendments, since there may be a multitude of reasons for a diverse group of DAO participants to reject the budget and there may be items that are subject to contracts and which therefore cannot legally be amended. Per the first paragraph above, the directors should be trusted to act in good faith to exercise reasonable judgment in addressing what they understand to be the most substantive reasons for the budget’s rejection, then explaining to the DAO which steps were taken and why. If the directors exercise poor judgment, the DAO’s recourse is to replace the directors. When considering such extreme steps, however, the DAO should focus on how the directors manage the budget over time to account for feedback, rather than potentially unrealistic expectations about how quickly the directors amend certain line items.

Add consent-based approval for special transactions

4.44 Subject to any limitation imposed on the directors by any confidentiality agreement, financial regulation, or related laws, the following special transactions shall be published by way of DAO Notice no fewer than 4 weeks prior to the transaction date and shall be automatically approved unless there is a Supermajority DAO Resolution rejecting them, subject to the vote starting within 2 weeks immediately following the date of the DAO Notice:

(a) Incur any capital expenditure (including obligations under hire-purchase and leasing arrangements) which exceeds the amount for capital expenditure in the relevant capital expenditure of the Budget by more than 25% or (where no items were specified but a general provision made) in relation to any item exceeding $300,000.

(b) Engage any employee or consultant on a salary at a rate of $300,000 per annum or more, or increase the salary of any employee or consultant to more than $300,000 per annum or vary the terms of employment of any employee earning (or so that after such variation he will, or is likely to earn) more than $300,000 per annum.

c) Enter into or vary either any unusual or onerous contract or any other material or major or long term contract.

(d) Enter into any transaction or make any payment other than on an arm’s length basis for the benefit of the Company.

(e) Make any loan or advance or give any credit to any person or acquire any loan capital of any corporate body (wherever incorporated).

(f) Do any act or thing outside the ordinary course of the business carried on by it.

This clause grants the DAO a check on special transactions, in addition to the previous annual check on the forecasted budget, in a consent-based manner that minimizes obstruction of the Foundation’s operations. The 2 week time limit on the rejection proposal, coupled with the 2 week length of a supermajority vote, ensures that the transaction date (at least 4 weeks out from DAO Notice) is not delayed in normal circumstances.

Rejected Amendments to the Proposal

Fixed terms/renewals

Forcing a renewal vote to take place after a certain period of time does not introduce any more accountability than we already have; “accountability from the outset” is provided by the ability for the DAO to remove the directors at any time. Fixed terms would threaten the operational continuity of the Foundation by enabling a scenario in which an inability to meet quorum could leave the Foundation without any directors.

Limits on POKT grants based on prior POKT holdings

POKT grants with vesting restrictions are not just about alignment with the project as a whole, but an incentive to continue working on the Foundation. Any existing POKT holder who enters one of these positions is taking on a lot of extra responsibility and risk, so to be refused any extra upside is a raw deal, which undermines the incentives for POKT veterans to volunteer for the role, and is therefore untenable.

The transparency and controls that the DAO will have are more than sufficient to prevent undue POKT allocations. Not to mention, Directors duties ensure that the directors will act in good faith in the best interests of the company and not for any personal or improper purpose.

Publishing accounts and budgetary plans before taking this to a vote

We don’t want this vote to become a vote on the budget itself. There are important governance upgrades here and it would be a huge loss to the ecosystem if this proposal gets rejected because of a disagreement over budget.

Since we are introducing annual approval of budget forecasts, the DAO will have the opportunity to discuss these things with us in Q1 23.

Updated Roadmap Items

Introduce a standard DAO Notice channel

We will create a new category in the forum dedicated to DAO Notices, to which everyone would have the permission to respond. However, the definition of a DAO Notice already requires that the DAO participants should have access to such notice, so we feel it is unnecessarily prescriptive to make an amendment to the Articles specifying the use of a forum category in which people can ask questions. We also plan to hold regular AMAs with the community and continuously maintain a transparent feedback loop, though it would be similarly prescriptive to include this in the Articles.

Protections Against Unfair Dismissal

The Cayman Labour Act already defines unfair dismissal, and the Foundation operates under Cayman Companies Law, so the Foundation is already bound to these rules. The directors and supervisors (per 4.17 and 6.17) are not compelled to follow DAO Resolutions that would break the law, which should protect against unfair dismissals actioned by the DAO. It may be worth checking this with the Foundation’s Cayman lawyers but not so urgent to delay this proposal.

Updating the Constitution

The Constitution needs updating but there is no reasonable argument that the Foundation (or this proposal) is unconstitutional (see “Claims of Unconstitutionality” below). Therefore, this is a Q1 workstream that shouldn’t block this proposal.

Rearranging Existing Items

I am going to move the “Clarify governance structure, process & vision” item to Q1 23. I remain hopeful that we’ll be able to execute on the “Launch the new PNF” item in Q4 22.

Clearing Up Misunderstandings

Retroactive Reimbursements & Claims of Author Inconsistency

This proposal… goes against the precedent set by the authors for remuneration after work is performed

The topic of retroactive reimbursements is not relevant to this proposal, for a few reasons:

- This is a PIP to appoint new Foundation directors/supervisors and unblock full-time operations, not a PEP to request funds

- The Foundation’s directors/officers will be full-time operators who are doxxed and have a fiduciary duty to the Foundation, not anonymous one-time DAO contributors

- The claimed precedent about retroactive reimbursements doesn’t exist

I am addressing this topic mainly to clarify a misunderstanding stemming from Adam quoting me out of context. Let’s look at the full context:

If we’re calling this a retroactive funding proposal, this shouldn’t go to a vote until the work is complete and the DAO can assess the real impact. Publishing a retroactive funding proposal in advance of completing the work is bad practice because it just leads to speculation and disagreement about the fair value of a contribution, as we’ve seen here.

The bad practice I was referring to was calling it a retroactive funding proposal when in reality the DAO was being asked to proactively make an assessment about the value of the contribution. I posted my message on the back of a heated debate that centered around this.

To test the claim about any precedent of retroactive reimbursement, see PEPs 27, 31, 33, 34, 41, 42, 43, and 45.

Claims of Unconstitutionality

Edited this section 12/14/22.

@adam and @zaatar have both raised concerns about the constitutionality of the Foundation using discretion. They have pointed to 4.10 in the Constitution as the violated clause, specifically, “deferring decision-making to the Council in all cases”:

Qualified Code Deference and the Foundation’s Custodial Rights & Responsibilities

4.10. The Foundation shall serve as a custodial entity for Pocket Network, deferring decision-making to the Council in all cases except Material Adverse Exception Events (MAEEs), i.e. crises resulting from incomplete contracts and unforeseen events.

However, the Foundation’s role and its relationship with the DAO are already well established in the Constitution itself, in the Foundation’s Articles, and through precedent. This is clear if one looks comprehensively (not selectively) at the Constitution and considers the history of the DAO.

My explanation is comprehensive and therefore long. If you want to read more, open this toggle.

So what is the Foundation’s role, according to the Constitution?

The Role of the Foundation

4.5. The Foundation’s objectives are to:

- Steward Pocket Network

- Hold legal custodianship of Pocket Core

- Request funds from the Council for specific projects that have strategic value to the Pocket Network ecosystem, by submitting PEPs.

How does the DAO control the Foundation?

The Council’s Control of the Foundation

4.6. The Council’s control of the Foundation is hard-coded into the Articles of Association of the Foundation, which separates the powers of all Foundation agents and defers those powers to the Council:

- Directors/Supervisors are appointed/removed by each other on behalf of the Council

- Directors must resign from other positions of authority in the Council (except Voter)

- Supervisors ensure that Directors comply with the articles

- No Supervisor decision is valid without Council approval.

4.7. New Directors/Supervisors will be appointed/removed according to PIPs approved by the Council.

Note that, where the DAO’s control of the Foundation is concerned, the Constitution defers to the Foundation’s Articles. Indeed, the Constitution is not the only document that the DAO relies on. The Foundation’s Articles are currently the only formally enforceable document and it is the Articles that provide the DAO with explicit checks and balances over the directors. We should therefore not so easily dismiss the relevant clauses in the Articles when seeking to understand the relationship between the DAO and the Foundation.

So we’ve established the Foundation’s role and the DAO’s controls over the Foundation, as defined by the Constitution and the Foundation’s Articles. Where does 4.10 fit in? To understand the spirit and limits of this clause, we need to understand the concept of Qualified Code Deference (QCD) as well as what we mean by the Foundation being a “custodial entity”.

QCD is designed to structure exception handling in crisis events for automatically governed (smart contract) systems, i.e. times where “code is law” may not always be desirable. In other words, it is all about emergency powers. For example, if a smart contract is compromised, a multi-sig authorized by a QCD agreement would be able to rescue vulnerable funds without the delay of DAO voting.

Pocket doesn’t have smart contracts and the DAO’s decisions aren’t capable of being automatically executed, so why did we bother to include QCD in our Constitution? Two reasons:

- At the time, I anticipated that we might figure out automatic cross-chain execution of governance transactions. “4.20. The Foundation multi-sig will hold all ACL permissions at launch, but the Council may work to automate (and thus disintermediate) the Executive function by building a cross-chain integration between Pocket Network and the Council’s Aragon Agent (or a similar smart contract representative).”

- Until we have full on-chain governance, or an ability to automatically resolve off-chain votes into on-chain governance transactions, the Foundation custodies the DAO’s governance of the Pocket Network blockchain, i.e. the Foundation holds all of the ACL permissions. QCD seemed like an elegant way to restrict the Foundation to only submitting Governance Transactions that correspond with approved DAO proposals, while having an exception handling path for crisis events.

For full clarity, the ACL is defined as “a permission framework used by Pocket Core to control which accounts can submit Governance Transactions, such as transferring funds from the Pocket Core DAO Treasury, burning funds in the Pocket Core DAO Treasury, updating On-Chain parameters, and activating Protocol Upgrades”, and Governance Transactions are defined as “transactions executing the results of Council decisions On-Chain”.

A more likely need for QCD in Pocket’s case might be a poorly configured parameter value that leads to a network emergency which can only be solved by quickly adjusting the parameter value. The Foundation has not had to use this exception handling path so far. The closest the network came was with with PUP-8, which fortunately was able to be resolved through a quick DAO vote.

The key takeaway to note here is that this exception handling path specifically concerns code. QCD is only necessary where code is concerned because the code powers an automated system that may spiral out of control before the DAO’s normal governing authority has the chance to react. By granting exception authority to the Foundation, there is a quicker path to crisis resolution. Consequently, the limits of these QCD clauses are defined by the DAO’s governance of code, which are defined by the ACL of the Pocket Network blockchain. If the DAO were to expand its boundaries into other blockchains, e.g. by launching a wPOKT smart contract, then it could indeed be argued that QCD also applies to the governance of the wPOKT smart contract as code.

So let’s revisit 4.10 with this context in mind:

Qualified Code Deference and the Foundation’s Custodial Rights & Responsibilities

4.10. The Foundation shall serve as a custodial entity for Pocket Network, deferring decision-making to the Council in all cases except Material Adverse Exception Events (MAEEs), i.e. crises resulting from incomplete contracts and unforeseen events.

In other words, the Foundation is “deferring decision-making” to the DAO in its capacity “as a custodial entity for Pocket Network”, i.e. the holder of ACL permissions, meaning it will not submit Governance Transactions without the DAO’s authorization unless in a crisis (or unless the authority has been delegated to the Foundation as in 6.5, 6.6, and 6.7, or as part of a PUP that requires continuous adjustments as in PUP-11 and PUP-22). This clause is not designed to grant the DAO authority over all of the Foundation’s other affairs.

To validate this interpretation, we can look at precedent, where the Foundation has already exercised discretion and the DAO has continued to consent:

11,000,000 POKT will be placed back into the Foundation Treasury for deployment into similar, high-leverage transactions, where using the Foundation entity is ideal or discretion is a must, as in the case of these listings.

it makes sense to free up as much Foundation treasury POKT as possible for other purposes

Knowing the full context, I feel confident in saying that this proposal does not fundamentally alter the role of the Foundation or its relationship with the DAO. This proposal does not change the Foundation’s role as custodian of the blockchain’s ACL permissions. Rather, it focuses on the Foundation’s other equally important role as steward, adjusting some of the clauses in the Foundation’s Articles in order to empower it to become a more active steward. This proposal is not unconstitutional.

Reminder of the Purpose of this Proposal

I’ll wrap up by asking us all to take a step back and remind ourselves of the purpose of this proposal, which is to empower the Foundation to be a more active and credibly neutral steward of the ecosystem, who can advocate for and empower all stakeholders and contributors.

Anything else in this proposal – appointing the new directors/supervisors, amending the Articles to provide the Foundation with more operational autonomy – is in service of that vision. Some of the feedback here views the Foundation through the original lens as a lean legal wrapper, which misses the forest for the trees. This feedback not only pushes back on extra autonomy, but would have us take the Foundation in the opposite direction by robbing it of the little autonomy it has already established and turning it into a pure passthrough entity for the DAO. To do so would render this entire proposal pointless.

I hope the DAO will keep these thoughts in mind when deciding whether to proceed with this opportunity that the authors (and Ben) have worked so hard to provide the ecosystem.

This is a thought subject to follow and the discussion has raised some interesting points. I must admit that before this PIP I had no idea of how the PNF worked, now who was the director. I’m inline some of the critics laid out by @zaatar and @Dermot and I also think that the latest response from @JackALaing brought some clarity to my concerns.

Just for the record, my main concerns/comments are:

-

The DAO should have some control over the spending of the PNF. While I do not advocate for a micro-management of the PNF I think that an approved budget is required. I think that this is somewhat addressed by the

consent-based approval of a forecasted annual budgetand theconsent-based approval for special transactions. -

The absolute majority was not properly defined, now it seems more solid.

-

The transparency was lacking, thanks for adding the

DAO Oversightsection. -

The problems with arbitrary assignment of funds will always be there. Any further control by the DAO (besides fixed budget approval) will hinder the PNF working. Also any action that the DAO can do after the fact will not be effective… I will have to trust you in this one…

As I said before, I had no idea of what the PNF was before this post, and I hope that it will result in a more active part of the Pocket Network ecosystem. Given the degree of autonomy that is being requested, the transparency must prime to keep the DAO confidence.

This post might not bring much value to the topic, but I think it reflects the basic understanding that some members of the community have on this subject…

Note to anyone who already read my reply: I have just edited the Claims of Unconstitutionality section to add more detail.

I am preparing a response to the suggested amendments; it will be ready by the weekend. In the meantime, I have a few questions:

4.42 Financial transparency reports should be published quarterly by way of DAO Notice within the first 4 weeks of the end of the previous quarter. These should include management accounts showing actual vs forecasted spending, an updated balance sheet, and cash flow forecast. The budget should include total director remuneration as determined by 4.37, total contractor remuneration, and any other material expenses categorized as the directors reasonably see fit.

“The budget should include” – By “budget” do you mean only the spending that will take place in the coming quarter (including the first 4 weeks during which the report is published)?

“total director remuneration as determined by 4.37…” – does this mean the aggregate spending on directors’ remuneration for the coming quarter, with no breakdown as to what each director will receive? (same question applies to “contractors”) If so, will individual directors’ salaries be disclosed - and when and as part of which report?

On a related note, when and where will POKT token grants be disclosed?

(PS: For clarity “within the first 4 weeks of the end of the previous quarter” should read “within the first 4 weeks following the end of…”)

Why was the supermajority number increased from 66% to 75%?

A further question : regarding DAO input leading to budget changes.

Introduce a standard DAO Notice channel

We will create a new category in the forum dedicated to DAO Notices, to which everyone would have the permission to respond. … We also plan to hold regular AMAs with the community and continuously maintain a transparent feedback loop…”

This appears to recognize that concerns of DAO voters on budgets (published as DAO notices in the new DAO Notices category of the Forum) could be allayed through discussion in the new Forum category and at AMAs. However, does it also contemplate the possibility that as a result of these discussions, the directors could be persuaded to implement budget changes even without being compelled to do so by a DAO resolution vote rejecting the budget?