Thank you for sharing these feelings @Emil_K99. We know that node runners are hurting and it is important to hear more perspectives on this. You are also setting an example – it is important that more Pocket stakeholders voice their perspectives, coordinate together, and, most importantly, recognize their own agency to enact positive changes to solve the problems they face.

Overcoming the Bystander Effect

The beauty of DAOs is the equal agency they grant contributors to enact positive change. The combination of permissionless contribution and democratic governance structure in our DAO means that every Pocket stakeholder is equally capable of pioneering decisive actions. However, realizing the full potential of this requires full buy-in from everybody.

There is a very real bystander problem in our community - not enough agency, action, or follow-through.

If you’re living in a house and there’s a fire, do you complain at your housemates for not putting it out quickly enough or do you pick up a bucket and throw some water on?

“oh wow, glad that fire is in your bedroom and not mine”

a few moments later

“what?? the fire’s in my bedroom! how did you let this happen?!”

We’re all Pocket stakeholders living in the Pocket house. If we feel there is a fire, we should help put it out. However, when the house is virtual and contains thousands of residents, it’s easier to be passive due to the diffusion of responsibility. This is the bystander effect. It is natural but we should be mindful of it and hold ourselves accountable as DAO stakeholders (not point fingers at each other).

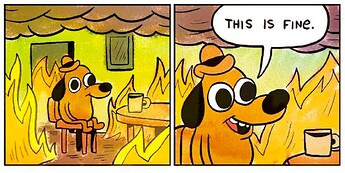

Pictured: “the DAO is too slow”, DAO stakeholders

We think Pocket’s community is made up of some of the brightest minds in the entire industry, something that every single person in this community should take some comfort in. Some of our best contributions have come from stakeholders with no affiliation to the (temporarily) core PNI & PNF teams.

But it’s also not uncommon to see these bright ideas manifest into Twitter threads and Telegram debates about the issues faced, rather than directing that mental energy towards the harder but more effectual work of rolling up our sleeves, coordinating people, building consensus, and following through on proposals that bring the change we want to see.

Our DAO has vast potential to be a more effective organization and PNF is working tirelessly to facilitate this. If you are reading this and you want to see Pocket achieve its full potential, I urge you to realize your agency, plug in to our DAO’s OS, and help us make it happen.

Using Data to Preserve Our Two-sided Market

While we need more decisive action, it is important that such actions are well-informed. To that end, I want to address the proposed actions and set them in context. In this case, setting mint equal to burn means minting ~$30k per month to nodes. In other words:

- ~800k POKT per month (vs ~610k POKT per day currently)

- ~$1.50 per month per node (vs $32.50 per month per node)

- ~0.5% inflation at current prices, less if the price goes up (vs ~12% inflation)

Adopting this strategy amounts to cutting off node revenue streams and telling everyone to sit tight and hold. That might make sense in a network where no work is being done but our entire ecosystem relies on nodes providing RPC service to DApps. I’ve seen community members scapegoat node runners and characterize them as a cabal with no incentive to do “the right thing”. This is unfair. The node runners are our supply-side. They’re the stakeholders who serve the RPC calls the DApps come to us for and providing this service incurs costs that must be covered somehow. How many node runners will be left to serve these RPC calls if we cut off their revenue? How many DApps will be left if the quality of RPC calls plummets due to an exodus of our supply-side? Such drastic measures flirt with the unwinding of the two-sided market we have worked for 3 years to bootstrap.

In light of these possibilities, we must be certain that such measures would not irreversibly shock the system. Have any of the proponents of a 1:1 mint:burn collected any data to prove that these actions would benefit our ecosystem? What about proof that there is a “clear consensus” these changes need to be made? This is the kind of follow-through I’m talking about above.

Pre-proposal & Survey

PNF can’t make the DAO drink but we can lead it to water. We recently published a roadmap to becoming a net-revenue-positive (aka deflationary) protocol. We have since helped coordinate decisive action to activate demand-side fees almost a year ahead of schedule (it was previously assumed that we would have to wait until v1). We also outlined a vision for how emission policies could be adapted to shorten the road to becoming deflationary. You will see in the post that we designated “economists” as the stakeholders to enact policy changes, however we have not been able to achieve the buy-in we anticipated from the usual economists who would iron out the details. As I said above, we haven’t reached our full agentic potential as a collective of contributors.

As a result, PNF is working on a pre-proposal to implement some of the ideas outlined in The Road to Revenue. We are conscious of the desire to act quickly so will likely break this up into steps, with easier steps first, to enable quicker actions while the details of more complex changes are worked out. The general idea is bringing inflation down further using the existing SER mechanism (e.g. to ~4%) and targeting an attainable deflationary threshold (e.g. 10B daily relays) that we can rally around as a compelling north star.

We also have a node economics survey coming soon, which seeks to gather the data we need to properly calibrate the inflation rate we can set to sustain a supply-side and avoid the unwinding of our two-sided market.

If you read The Road to Revenue and it resonated with you, if you want to help us with our pre-proposal and survey, please reach out. Conversely, if you disagreed with the vision in The Road to Revenue, and oppose any of the actions we propose, I hope you now realize you have the agency to propose an alternative.