Fool Me Once, Shame on You; Fool me Twice, Shame on Me

Although there is a clear consensus in the community regarding the need for a reduction in inflation, my team and I are shocked at the lack of urgency that is being put forward. We would like to begin our proposal by giving some background and adding a new perspective to the conversations we have seen thus far.

Let’s step back for a second and consider the reasons for the hyperinflation in the bootstrapping phase to begin with. The building up of enthusiasm around the project, getting the word out there for incredible “50-100% Node APRs”. The morality of this strategy is questionable to begin with, but the community galvanized around its initial effectiveness. For over a year, the network has achieved all of its performance targets, beaten the all-important Infura benchmarks, and has developed an ability to serve far more relays than it currently does (in fact, by a magnitude of times).

The Illusion of Revenue - Minting of Air

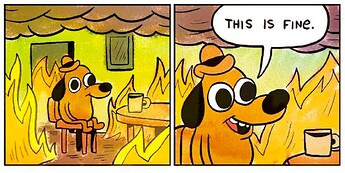

Whenever we mint a token that is not related to the newly introduced burn mechanism, we are adding additional momentum to the downward price movement. In our opinion, the performance of the POKT token has become a barrier to the goals of marketing, sales and implementation of V1. Setting the inflation rate equal to the burn rate will have an extreme impact on the short-run. However, it represents the reality of the project and where we are at. The longer we keep up with this illusion of revenue the more that the token price will depreciate and ultimately damage the prospect of success and implementation. Node runners, of which we are a part of, should only earn the REAL intrinsic value of burned tokens. This creates a healthy economic system.

The Argument of Node Runner Going Out of Business - Further Delusion

Nobody is profitable running nodes, both directly and indirectly, no matter the scale at these prices. The costs of electricity, internet and wages remain fixed in fiat for most operations. The only profitable node runners right now would be groups that started their nodes within the last month. A huge part of this that is left unanswered is the CAPEX investment of buying the machinery and components needed to run a node + the minimum balance of POKT at 15,000 tokens. Many of us bought our first POKT nodes for a price of USD 30,000 or USD15,000; just to put things into perspective. Is the leadership and community telling us that those previous investments of stakeholders are less significant than the prospect of future investors? If you are using part of your token rewards to cover certain costs, don’t be fooled, you’re essentially financing your operational costs by diluting the CAPEX of the investors before you. And soon, the same thing will happen to you as it did to the others beforehand. We suggest this immediate alignment of burn rate to mint rate in order to stop the bleeding and ensure the long-term tokenomics are linked to real relay-growth income and not the continuation of illusions.

Misalignment of Incentives in the Community

One of Pocket Network’s ultimate goals lies in creating a cost efficient market place between supply and demand, where POKT is the native currency of exchange. The reality today is much different; a predominant amount of trade/payment is settled in USD. POKT’s underlying value will derive from its utility and while most crypto projects and their tokens are simply the object of speculation/narrative, Pocket Network is different.

POKT’s inflationary death spiral has had a detrimental effect on the margins of node runners. To the employees of PNI/PNF, how would you feel if your salary was entirely paid in POKT? Well you now understand what it feels like to be a Pocket node runner. There seems to be no sense of urgency in fixing inflation because, in reality, the token price makes no immediate difference to the decision makers. How would you feel if your salary decreased by 50% every second month?