I agree that a longer ramp down to the agreed level will help alleviate any negative effects from supply shock.

Thanks Adam. The notion of diminishing returns gradually so that we approach 100% APR (~42.42 POKT/Day per node) makes logical sense on a certain level; I certainly agree inflation must be curbed. But how can we be sure / assume that this is the optimal level for rewards as it relates to attracting node runners and optimizing the health of the ecosystem?

This suggestion has been mostly ignored. Not rejected on reasoned grounds. Just ignored. An assessment by a disinterested, respected outside expert is arguably vital. It may bolster support for what appears to be the gelling consensus, or it may point to some tweaks that should be made to the imminent PUP proposal. No doubt it will take a few weeks to complete an evaluation, but with the health and longevity of the project at stake, a short delay is justified.

I am in favor of commissioning economic reports and I’m already looking into some Web3 specialists. However, I don’t think it should delay this decision. Given that we’re talking about a gradual 5-month drawdown, there is time to reverse the decision if new findings come to light.

With this in mind, could we target an economist commissioning a report by the time the first drop in rewards occurs (30 days from vote approval), and build into the proposal that the drop in rewards would be contingent on this economic assessment agreeing with the efficiency and structure of the updated rewards framework? This would not delay the vote and would keep to the teams timing, but also make sure that it has been looked over by an economist?

The proposal can’t be edited once it enters voting. If voters feel strongly about that, they can reject the proposal in its current format.

Personally, I think since the first drop in rewards is only 10% from current levels, and then the next one a further 10%, and so on, this is minimal enough to proceed without the contingency you suggest.

Keep in mind that at any time a new proposal can be approved and overwrite previous proposals.

Ok that makes sense. When would you be targetting to have a report commissioned by?

It’s too early to say but I do think the sooner the better. Note that this is my opinion, I’m not communicating an official position/promise.

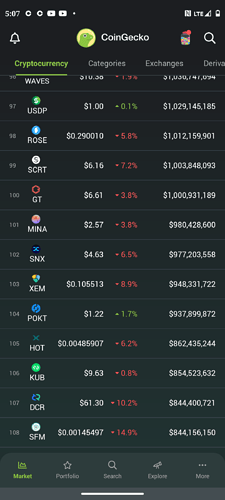

$pokt is outperforming everything in the top 100 and beyond.

Pokt is becoming a safe haven!

It’s the day of Canadian Bank runs, we are outperforming stable coins!

Let’s hope the outside expert report agrees with this proposal 100%. Nothing says “we don’t know what we’re doing” like making a structural change on economics on a project with a billion dollar market cap (undervalued), then getting an outside expert report (which you acknowledged you needed before that change) and then having to change the economics again because of what that report said.

Not a great look guys. Kind of amateur hour. Take the time to do this right. I can’t vote because I’m not smart enough to jump through all the hoops, but I’ve got a 7 figure investment in this project. Hope it gets voted down and you get someone to weigh in on this.

I would appreciate if you didn’t misquote or misattribute what I said. Firstly, as I said in my previous comment, commissioning a report isn’t an official position. Secondly, my position is not that we need a report; my position is that it would be a nice thing to have for the long-term to instill more confidence in community members such as yourself, who want the certainty that comes with an “expert opinion”, but I don’t need an “expert opinion” for my own confidence in this decision. I won’t go into how economics isn’t an exact science and economists often make mistakes. Just as there are many schools of economists who disagree on how to manage the economy, there will be people who disagree on how to manage Pocket’s economics.

Let me expand on the things I didn’t say in my comment. If we commission a report, in my opinion it should be a broad forward-looking analysis, simulating our economics in different scenarios, and for the benefit of designing v1’s economic landscape (app stake burning included) not limited just to this minor, temporary, and reversible inflation decision. Minor because it’s a gradual decrease that settles rewards still higher than they were a few months ago. Temporary because it will be obsolete when we launch v1 of the protocol. Reversible because every decision the DAO makes can be updated and calibrating parameters is not a sign of incompetence (economists do it all the time). If such a report suggested that WAGMI isn’t the best approach to inflation, I expect that it would be a matter of minor efficiency tweaks not major structural changes.

WAGMI is not a significant departure from our existing economics, so we are not “changing our economics”. We originally planned to tenthen the metric, now we’re taking a slightly different approach that still generally lowers the metric based on growth. Note: you’re talking to the “amateurs” who have spent years designing and calibrating the economics that got us where we are today.

Okay now THIS is the information that I was talking about. However again the issue isn’t about how much utilization the network is getting now, it’s about how much we’ll need in the future.

So now I understand the following:

-

The network utilization is variable according to metrics such as session node count, providing scaling and capacity controls not directly tied to token quantity.

-

Apps can share a single stake, again providing another scaling mechanism that isn’t reliant on token supply.

This is great! This means we can tune these metrics to help manage surges in demand. Very smart.

I would still like to see data on network capacity expressed as some multiple of node count as there is still a question of what the actual physical limit of the network will be, but the above points are well taken.

Imo we need to maintain 2 things to keep the line going up and to the right:

1- Consistent requirements around POKT needed/node (i.e. we lock it in at 15k)

2- Inflation only ever goes down.

The point is well taken that with QoS-based rewards this per-relay metric will become obsolete, however, the larger point about POKT being a commodity necessary to fuel the network rather than an asset generated by the network is worth understanding.

Thanks, @JackALaing for being the first person to directly address these concerns. I hope that someone can derive a metric that represents relay capacity as a multiple of nodes so that we can have a clearer view of the long-term consequences of reductions to new supply.

Burn is a bad idea. We need POKT to run the network. Reduction in rewards is a much more sustainable way to achieve the same results.

I’m supportive of an economic report. Just that third-party validation, regardless of outcome, will go a long way toward either informing an adjustment to our trajectory or building confidence in the current strategy.

@JackALaing you asked how long I think it should take and I think a year with a more gradual stepdown every 2 weeks. So that would be a 1.9% reduction every two weeks for 52 weeks. We could even do it 0.9% every week. I think from a market behavioral standpoint you would get a lot of buying the dip and most would hodl knowing that every week they’d be getting just a little less token than last week. This would be the smoothest way to reduce rewards, drive the behavior that the project is looking to encourage (and sustain it for longer), and do minimal damage to those that are financially reliant on the current reward structure.

PUP-13 passed with 67% quorum and 100% support. Snapshot

This means the RelaysToTokensMultiplier parameter will now be adjusted in order to target a 100% network-wide inflation rate. The parameter change hasn’t gone into effect yet, I will update here when it has.

The parameter will also be adjusted again every 30 days from now on the following dates:

- Mar 26th: 90%

- Apr 25th: 80%

- May 25th: 70%

- Jun 24th: 60%

- Jul 24th: 50%

I will update on these dates when the parameter change happens again.

To avoid confusion, could you please confirm that adjustments to RelaysToTokensMultiplier will continue to be made after July 24th on a semi-random schedule using a trailing 30 day average per PUP-11 in order to maintain network-wide inflation of 50% going forward. Also, could you please confirm we will be targeting a percentage the POKT supply at the time each adjustment is made, as opposed to a percentage of whatever the POKT supply was when PUP-11 passed - since POKT supply will increase significantly between adjustments.

For the avoidance of doubt, the WAGMI parameter changes will be calculated using:

- a 30-day trailing average of daily relays at the time of each adjustment

- the total supply at the time of the proposal passing (Feb 24, 2022, 6:37 GMT), which corresponds to block height 51909, which is 945,014,988.719332 POKT. We’ll call this the Total Supply Baseline.

If we were to use the total supply at the time of each adjustment, as opposed to the Total Supply Baseline, we would not actually be hitting the annual inflation targets. In a period of sideways relays, the total supply at the time of each adjustment will be continuously growing, which would mean the inflation target essentially compounding on itself. In this proposal’s spirit of stabilizing inflation, we will be using the Total Supply Baseline for all future adjustments until another proposal is passed or 1 year has elapsed.

The parameter is going to be adjusted now to target a 100% annual network-wide inflation rate based on a 30-day trailing average of 306M daily relays and the Total Supply Baseline. This means a RelaysToTokensMultiplier value of 0.008461, reduced from 0.01. I will update here when the parameter change has been executed.

The parameter will be adjusted again every 30 days from now on the following dates, to target the following inflation rates:

• Mar 26th: 90%

• Apr 25th: 80%

• May 25th: 70%

• Jun 24th: 60%

• Jul 24th: 50%

The calculation will be performed on these dates using a 30-day trailing average of daily relays and the Total Supply Baseline. If daily relays changes significantly in between these dates, we will make discretionary adjustments to smooth out the reduction of the parameter.

Once we have hit the 50% target, the parameter will continue to be adjusted according to this method to maintain 50% regardless of the relay count, until a new proposal is passed.

Thank you for the clarification.

After following this for quite a while and seeing how this has played out I have to agree with some of the dissenters here. This feels a bit forced and rushed and poorly timed much like the exchange listings just over a month ago. As a comparison, wPOKT has been under development for over 3 months and outside third parties/experts were hired to assist with its development and implementation. While I understand that is substantially different from implementing an inflation adjustment curve I believe this comparison is worth noting. When others here expressed the need for a third party/expert/economist to weigh in on a drastic reduction in rewards affecting the entire community their suggestion was largely ignored and the proposal moved forward without consideration. The optics of this are unsavory at best. Without a neutral third party weighing in on these inflation adjustment parameters and their corresponding timeline they appear arbitrary. Dealing in abstracts with something as impactful as this is ill-advised. I believe this implementation should be halted until a study is performed by an outside third party with suggestions based on metrics and projections that can be shared with the community, debated openly, and then voted upon.