Attributes

- Author(s): @adam

- Parameter: RelaysToTokensMultiplier

- Current Value: .01 POKT per relay

- New Value: Variable

Summary/Abstract

I’d like to encourage sustainable inflation that protects rewards against a decrease in relays and sensibly reduces rewards as Pocket Network grows. The proposal would implement an annual inflation target set by a DAO proposal, which would provide a predictable amount of inflation for users of Pocket Network. The first inflation target will be set by a different proposal. I have provided some suggestions below for numbers, but I would encourage you to debate what the numbers should be if you support the proposed scheme.

Note: I am a Pocket Core team member and Partner at NachoNodes (with Nymd on Discord). I run nodes and stand to benefit from extremely high inflation. The ideas in this proposal are my own and don’t necessarily reflect the views of others on the core team or Pocket Network, Inc.

Motivation

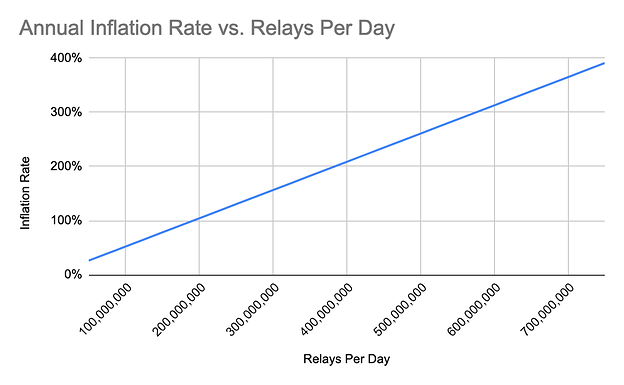

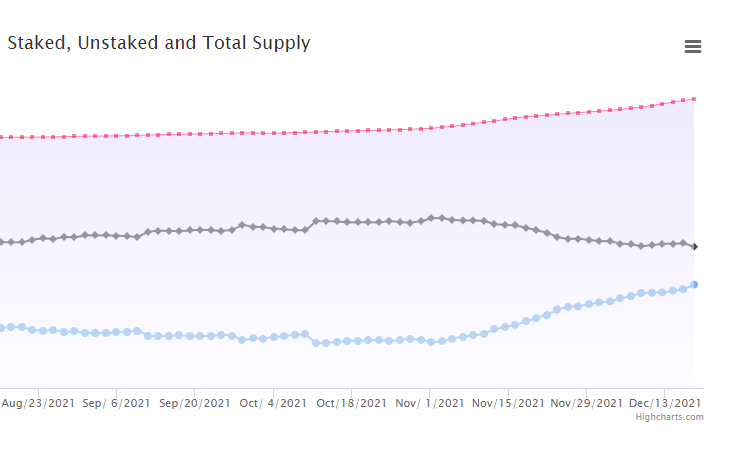

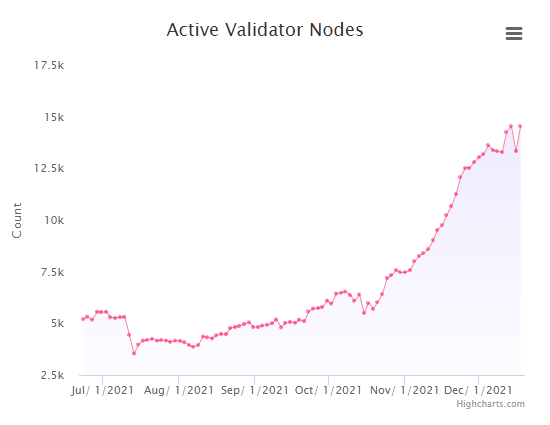

At present, we are experiencing high levels of inflation with no end in sight caused by the current RelaysToTokensMultiplier (I refer to this interchangeably as the mint rate). The graph below shows the relationship between the Relays per Day on the network and the annual inflation rate. There is a simple linear relationship between the two variables. The more relays, the more inflation grows on the network. This model has done a good job to get us where we needed to be.

First, I’d like to address the advantages of high inflation as there are certainly pros to keeping rewards at the same mint rate:

-

Very attractive rewards for new and existing participants

-

High revenue stats attracts more attention via leaderboards like the Web3Index

-

Excitement in the marketplace driven by attractive node rewards

-

Near term buying pressure from new node runners

-

Ability to bootstrap new chains more easily

The inflation level was great for bootstrapping to this point. Continuing to rely upon inflation instead of growing the value of the overall network is counterproductive.

I would argue that the cons of excessive inflation outweigh the pros at this point in our lifecycle. Here are a few that move the needle from my perspective:

-

Grow my slice mentality where users don’t necessarily care about token price, instead they care about selling immediately as to not be holding the bag. To explain further, if the inflation rate exceeds the increase in the rate at which the market price increases, POKT tokens will decrease in value. Taking this a step further, because node runners will realize that token prices won’t increase, sell pressure from wanting to exit the position immediately to get the best possible price will create a negative feedback loop on token price.

-

Constant sell pressure from fiat-based hardware costs (15K nodes * $75/node = $1.125M/month)

-

Major network underutilization leading to unnecessary hardware costs (i.e. we only need a certain amount of nodes to serve a certain amount of relays)

-

Perception of long-term unsustainability (hype around high rewards will eventually get outweighed by FUD of unsustainability)

-

Exponential growth in the number of nodes (if scalability ever becomes an issue with RC - 0.7)

While this level of inflation has pros and cons, we should consider the long-term impacts and perceptions from new participants to the network. I would posit that it’s more valuable to grow the value of the whole network rather than my slice of the pie. If we frame value generation from a network-wide perspective, then we should be doing everything we can to grow the value of the network rather than a few individuals.

At the present, users are motivated to keep up with or exceed inflation rates on the network which are leading to an arms race in the number of nodes. While this is the intended outcome of the economics in the early days, one could argue that we have accomplished our mission of providing a base-layer of infrastructure for Pocket Network. Hyper-inflation is no longer required.

In this regard, peaking at the right time matters. As we close in on critical (Copper Launch, wPOKT, etc.) events we don’t want the best times behind us. If we have inflated too much too soon, the market may not look so kindly upon the token. Instead, if we peak at the right time, it will add extra fuel to the fire and invite the market to enjoy the rewards of Pocket Network. We, as an ecosystem, don’t want to inflate ourselves to the point where there is no token price growth left to achieve because of inflation.

Rationale

I propose that there is a better way to manage inflation. My suggestion revolves around the idea of creating a targeted annual inflation rate or what I’m calling the Weighted Annual Gross Max Inflation (WAGMI) rate. The WAGMI rate would set an annual inflation figure, in POKT, from which the RelaysToTokensMultiplier would be adjusted dynamically. In practice, the WAGMI would be a figure set at the beginning of the period, from which we would set the initial RelaysToTokensMultiplier based on a given WAGMI target. In subsequent periods, the RelaysToTokensMultiplier would be adjusted per the curve established by the WAGMI.

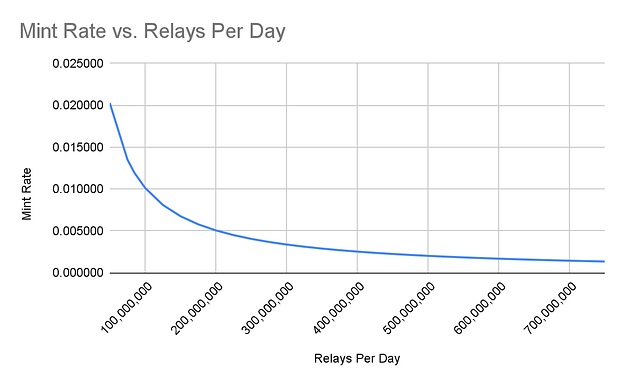

An example WAGMI Mint Rate curve is provided below.

Source: Node Rewards Modeling. WAGMI = 50%

It becomes quite clear that as relays increase, the Mint Rate exponentially decays. What’s interesting is that from a total perspective the inflation remains constant. The WAGMI could be adjusted to ensure healthy, stable rewards are present. Further, this protects against a downside scenario where rewards decrease below [100M] relays/day. If relays/day decreases beyond that point, the mint rate increases to compensate for the decrease in relays, ensuring that there is a stable form of income for node runners on RelayChainIDs where relays do exist. Note that in the chart above we’ve set the mint rate for 100M relays to be 0.01, which is the current value. This means in practice that node runners should continue to earn what they’re currently earning as a baseline; this proposal just prevents hyperinflation beyond this point.

The execution of this activity would be delegated to the Foundation Directors. I suggest a semi-random schedule based on the trailing 30-day average relay/day so that the system is less likely to be gamed. Foundation Directors would adjust the RelaysToTokensMultiplier according to the trailing 30-day average to meet the WAGMI target as set by a separate proposal.

Dissenting Opinions

Perpetual fair launch - We should punish those that don’t participate. High inflation is a great way to do that.

This is true, but low to medium inflation also continues to punish people that don’t participate.

Give it to the DAO - We should not decrease inflation, but instead give it to the DAO. Hyper-inflation designed to maximize the DAO treasury helps all the holders of POKT.

While I’d be in favor of increasing the DAO allocation parameter as they are diluted as they don’t run nodes, we shouldn’t rely upon the DAO allocation parameter as a primary economic strategy whenever we want to solve economic issues. Even by increasing the treasury, we still end up with the problem of diluting all holders of POKT. To maximize the per token value of POKT, we need to avoid dilution in the first place. Simply moving the tokens around doesn’t eliminate the presence of the tokens and the pricing impact of those tokens. Further, the DAO allocation parameter isn’t a fix for larger economic problems because it merely hides the symptoms, rather than being the cure.

Targeting a fixed inflation rate, regardless of relay count, decouples the incentive for people to grow the relay count.

This is true. Instead, we’d be incentivized to grow the value of the network as a whole. Also, if we introduce the app stake burn, growing the relay count means growing the buying pressure from apps, which reintroduces the direct incentive to grow the relay count.

We can counter the selling pressure from fiat-based hardware costs by introducing the app stake burn so that the mint rate is directly matched by relay buy pressure.

While this is true, there are other trade-offs to introducing app stake burn at this time, and it shouldn’t be relied upon as the only strategy for countering sell pressure. It could be paired with this WAGMI proposal for a double-whammy - lowering the selling pressure while increasing the buying pressure.

Analyst(s)

@adam, Core Team Member, NachoNodes Partner, man with cats, pikpokt on discord

Copyright

Copyright and related rights waived via CC0.

for all the contributions in the thread too. Sadly, it seems there is no collective noun for octopuses, as this is an impressive insert collective noun here of Poktopuses.

for all the contributions in the thread too. Sadly, it seems there is no collective noun for octopuses, as this is an impressive insert collective noun here of Poktopuses.