Attributes

- Author(s): @JackALaing @o_rourke @nelson @Dermot

- Implementer(s): Pocket Network Foundation (PNF)

- Category: Governance Upgrade

Summary

At the time the Pocket Network Foundation (PNF) was incorporated, in April 2020, Pocket Network Inc (PNI) was the only contributing entity to Pocket Network.

As the ecosystem has evolved into a pluralistic era, with multiple builders such as Node Pilot, POKTscan, Thunderhead, SendNodes, Poktfund, and DNA Labs, not to mention the dozens of staking providers/pools and individual contributors, the need has arisen for a more active credibly neutral entity who can support all of these stakeholders and level the playing field.

This proposal recommends transitioning Jack Laing’s governance team from PNI to PNF – along with some additional restructuring and amendments to the Foundation’s Articles – to evolve the Foundation into a more active entity that will support and coordinate a fair ecosystem for all Pocket stakeholders, with the ultimate aim to provide the DAO with the resources it needs to unlock its true potential.

Background / Motivation

Growing Pocket Network into a Hyperstructure

PNF’s mission is to grow Pocket Network into a Hyperstructure.

Hyperstructures are a new category of public good infrastructure that are non-extractive, unstoppable, permissionless, and thus create positive-sum value for all participants.

Certain coordination activities within the Pocket ecosystem are vulnerable to incentive failure, but are nevertheless critical for the growth of Pocket Network as a hyperstructure. These activities ultimately relate to good governance that is representative of all of Pocket’s stakeholders and a healthy and vibrant community of contributors.

In order to slay Moloch, the “God of coordination failure”, Pocket needs a credibly neutral entity who can support its stakeholders and bolster the efforts of the DAO.

A Credibly Neutral Steward

PNF is a credibly neutral entity with a duty to serve Pocket Network’s DAO.

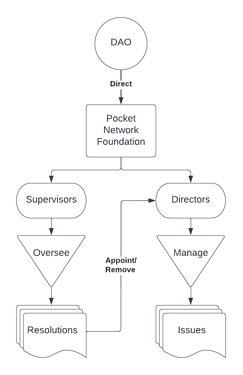

How? It is a non-profit Ownerless Foundation that was incorporated with the express purpose of serving the Pocket DAO. Checks and balances have been designed to empower the DAO to control the Foundation. PNF’s directors/supervisors can be appointed/removed by the DAO, certain decisions are not valid without DAO approval, and the supervisor’s sole responsibility is to ensure the directors honor the rights of the DAO. By design, the Foundation has no incentive or power to unilaterally treat any Pocket Network stakeholder unfairly, which means it is by definition credibly neutral.

PNF was designed this way so that the Pocket DAO could have an entity trusted to carry out the DAO’s wishes through governance transactions (outlined here), contract with third parties, hold assets for the DAO, and custody the protocol’s open-source IP on behalf of the DAO.

Specification

PNF’s Role

The responsibilities detailed below are a preliminary outline and may evolve as the Foundation’s operators learn more about what works best in pursuit of PNF’s mission.

- Nurture Pocket’s values: assist stakeholders with continued refinement and reinforcement of Pocket’s values

- Advocate for Pocket’s stakeholders: be available to listen to all Pocket stakeholders, track and amplify their issues, and provide them with a platform to be heard by others

- Empower Pocket’s contributors: support the personal development of Pocket contributors and unblock them from creating value

- Facilitate Pocket’s governance: help Pocket stakeholders make more informed decisions and build the mechanisms required to make Pocket a true hyperstructure

- Preserve Pocket’s public goods: help the DAO to protect the integrity of Pocket’s open-source IP

- Connect Pocket’s community: facilitate meaningful connections and reduce coordination costs between Pocket stakeholders

- Represent Pocket’s DAO: carry out the DAO’s wishes through governance transactions, contracting with third parties, monitoring counterparty compliance with contracts, and enforcing accountability standards

- Invest in Pocket’s opportunities: maintain a thesis for Pocket’s success, support strategic initiatives that further the thesis, and channel contributions towards opportunities

- Defend against Pocket’s attack vectors: proactively identify and neutralize attack vectors, protect the DAO’s checks and balances, and eliminate central points of failure

PNF’s Operating Philosophy

The Foundation will uphold its mission by acting as a role model and steward for the culture, values and behaviors of the whole network. The main philosophies we will operate with and promote are:

- Gardening, not Gatekeeping: We will focus on helping a rich and diverse Pocket ecosystem to bloom, not on growing the size of (or reliance on) the Foundation.

- Availability, not Access: We will engage with and listen to all stakeholders, not create an ecosystem governed by proximity and connections.

- Empowering, not Entitling: We will level the playing field for everyone to contribute, not grant exclusive rights to the few.

- Clarifying, not Controlling: We will eliminate asymmetries of context, so that stakeholders can understand, align, and participate consensually, not force them to trust us and fall in line.

- Partnering, not Parenting: We will work side-by-side with the community as peers, maintaining a feedback loop built on conversation rather than curation, being constructive about our disagreements, thoughtful about our communication, and authentic about our blind spots.

- Continuity, not Conviction: We will provide a stable presence by anchoring around our values and our mission, not by subscribing stubbornly to specific solutions, to create a directionally consistent opportunity space for innovation and evolution.

PNF’s Roadmap

The below is a preliminary outline of the new PNF team’s priorities. These will be developed over time and a public roadmap will be maintained on the Foundation’s website.

Edited 12/30/22.

Q1 23

- Launch the new PNF

- Execute the changes in this proposal, including onboarding the new PNF team

- Finalize and publish PNF’s new operating systems and KPIs

- Publish PNF’s website

- Clarify governance structure, process & vision

- Update the DAO’s trophies

- Update the DAO Constitution

- Improve the proposal process

- Publish better governance documentation

- Publish PNF’s DAO Vision & Roadmap

- Launch socialware to support contributors

- Organization design for scaling the DAO through contribution groups

- Builder Brand Guidelines

- Contributor onboarding processes

- Implement trustware to remove human bottlenecks on governance process

- Automatic verification of trophies using APIs

- Self-service claiming of trophies & votes

- Enhance the ecosystem’s communications architecture

- Upgrade the forums to be a place for productive communication and collaboration

- Begin investing in the ecosystem’s opportunities

- Publish PNF’s working thesis for the ecosystem

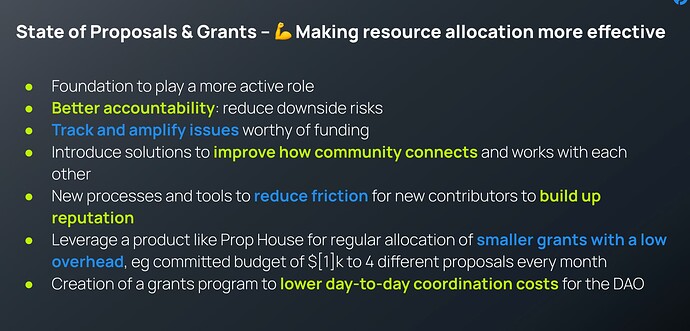

- Launch PNF’s grants program

Q4 23

- Work with the DAO to design and propose a process for the nomination/consideration of new/existing directors

Post-v1

- Enable unstoppable on-chain governance by upgrading the protocol’s ACL system to incorporate a governance transaction staking/veto mechanism, validator delegation, and any other mechanisms that will enable the Foundation to be disintermediated from its role as the DAO’s on-chain representative

- Adopt protocol R&D from PNI into the Foundation/DAO’s stewardship

Article Amendments

Edited 12/30/22.

A few amendments need to be made to the Foundation Articles in light of the evolution to a more active Foundation, to empower the directors/officers to carry out their duties.

These amendments amount to unblocking standard compensation for Foundation directors and contractors…

- Empower the directors to make remuneration decisions without DAO approval, subject to annual budget approval and consent-based approval of special transactions

- For accountability on the above, require the directors to publish quarterly remuneration figures on a per-director basis

- Allow directors/officers to receive POKT token grants as part of their remuneration, subject to the remuneration cap and a minimum of 3 years vesting

- Raise the cap on director/officer remuneration (previously $50k/annum)

…and preserving the operational continuity of the Foundation

- Empower the directors to fill director vacancies temporarily until the DAO chooses a permanent replacement

- Increase the approval threshold for changes to the legal structure of the Foundation to require a 75% supermajority and a quorum of 25% of active voters from the last 12 months

Note: where Foundation spending is referenced, i.e. remuneration, this involves use of the Foundation’s treasury only, not the DAO’s treasury. None of the clauses detailed herein empower the directors to transfer funds from the DAO treasury. Only approved PEPs have the power to action DAO treasury transfers.

Empower the directors to make remuneration decisions without DAO approval, subject to the annual budget approval process (4.43)

Modify 4.37 to empower the directors to determine directors/officers remuneration without the requirement for an Ordinary (and thus DAO) Resolution

4.37 Subject to Article 4.38, directors’ and officers’ remuneration shall be at such rates and on such terms as may be agreed in writing by an Ordinary Resolution of the Company. Unless that agreement provides otherwise, the remuneration shall be deemed to accrue from day to day.

becomes

4.37 Subject to Article 4.38 and 4.43, directors’ and officers’ remuneration shall be at such rates and on such terms as may be agreed in writing by the directors. Unless that agreement provides otherwise, the remuneration shall be deemed to accrue from day to day.

Require the directors to publish quarterly remuneration figures

Add via 4.42 an accountability mechanism that total remuneration must be published quarterly.

4.42 Financial transparency reports should be published quarterly by way of DAO Notice within the first 4 weeks following the end of the previous quarter. These should include management accounts showing actual spending vs the budget, an updated balance sheet, and cash flow forecast.

Add an annual budget approval process

4.43 Annual budgets should be published by way of DAO Notice at least 4 weeks prior to the start of the 12 month period to which they relate. The budget should include director remuneration reported on a per-director basis, total contractor remuneration, and any other material expenses categorized as the directors reasonably see fit. The budget shall be automatically approved in full unless there is a DAO Resolution contesting any line item, subject to the vote starting within 2 weeks immediately following the date of the DAO Notice, the vote lasting no fewer than 14 days and no more than 15 days, with a quorum of at least 25% of DAO participants who have cast a vote within the 12 months immediately prior to the date that voting commences on such DAO Resolution. DAO Resolutions may only contest existing line items (not propose new line items), may only contest 1 line item each, may only reduce (not increase) the value of a line item, and shall not call for the transfer of resources from one line item to another. In the event that any line item is contested, the remainder of the budget shall proceed. The directors must amend any successfully contested line item(s) by way of DAO Resolution (no quorum required), subject to any limitation imposed on them by existing contracts or obligations. If a line-item amendment is rejected by the DAO, votes on further amendments to the same line-item shall continue until DAO approval or until the directors abandon the line-item.

Note that for the first annual budget and quarterly transparency report, due to the timing of this proposal, we should not be bound by the same timing requirements defined above. We will aim for the annual budget and transparency report to be published ASAP if/once this proposal passes and we are appointed to the Foundation.

Allow directors/officers to receive POKT token grants as part of their remuneration, subject to a minimum vesting of 3 years

4.38. A director or officer shall only be remunerated for services rendered. Any agreement between the Company and a director or officer concerning the remuneration of such director or officer shall be null and void where such agreement:

(a) entitles such director or officer to participate in any distribution, dividend or transfer of assets of the Company or awards or entitles such director or officer to any profits or any assets of the Company; or

becomes

4.38. A director or officer shall only be remunerated for services rendered. Any agreement between the Company and a director or officer concerning the remuneration of such director or officer shall be null and void where such agreement:

(a) entitles such director or officer to participate in any distribution, dividend or transfer of assets of the Company or awards or entitles such director or officer to any profits or any assets of the Company, except where the transfer or entitlement of assets is in the form of a POKT token grant subject to at least 3 years vesting; or

This sets a constraint on the permission to remunerate directors in POKT, by requiring that such grants should be subject to at least 3 years vesting.

Raise the cap on director/officer remuneration

Raise the remuneration limit specified in 4.38 c).

4.38 A director or officer shall only be remunerated for services rendered. Any agreement between the Company and a director or officer concerning the remuneration of such director or officer shall be null and void where such agreement:

…

c) agrees to remunerate the director or officer for an aggregate sum exceeding US$50,000 per annum

becomes

4.38 A director or officer shall only be remunerated for services rendered. Any agreement between the Company and a director or officer concerning the remuneration of such director or officer shall be null and void where such agreement:

…

c) agrees to remunerate the director or officer for an aggregate sum exceeding US$300,000 per annum (as of January 2023), adjusted annually for inflation by reference to the Consumer Price Index as measured by The Bureau of Labor Statistics, where such aggregate sum includes the annual vesting amount of any POKT token grant, and the value of the per annum vesting of such POKT grant will be determined by the prevailing market price as at the time of the grant and shall not exceed 50% of the director’s US$ salary.

As an example of how this would be applied in practice, if a director is being paid $250k per annum in salary, at a price of $0.1/POKT, this would allow them to receive a token grant of up to a maximum of 1.5M POKT vested over a 3 year period. For directors being paid smaller salaries, their token grant would be limited such that the value of their per-annum vesting cannot exceed 50% of their salary.

Add consent-based approval for special transactions

4.44 Subject to any limitation imposed on the directors by any confidentiality agreement, financial regulation, or related laws, the following special transactions shall be published by way of DAO Notice no fewer than 4 weeks prior to the transaction date and shall be automatically approved unless there is a DAO Resolution rejecting them, subject to the vote starting within 2 weeks immediately following the date of the DAO Notice, the vote lasting no fewer than 14 days and no more than 15 days, with a quorum of at least 25% of DAO participants who have cast a vote within the 12 months immediately prior to the date that voting commences on such DAO Resolution:

(a) Incur any capital expenditure (including obligations under hire-purchase and leasing arrangements) which exceeds the amount for capital expenditure in the relevant capital expenditure of the Budget by more than 25% or (where no items were specified but a general provision made) in relation to any item exceeding US$300,000 (as of January 2023), adjusted annually for inflation by reference to the Consumer Price Index as measured by The Bureau of Labor Statistics,.

(b) Engage any employee or consultant on a salary at a rate of US$300,000 per annum or more, or increase the salary of any employee or consultant to more than US$300,000 per annum or vary the terms of employment of any employee earning (or so that after such variation he will, or is likely to earn) more than US$300,000 per annum, where US$300,000 is the limit defined as of January 2023 and will be adjusted annually for inflation by reference to the Consumer Price Index as measured by The Bureau of Labor Statistics,

c) Enter into or vary either any unusual or onerous contract or any other material or major or long term contract.

(d) Enter into any transaction or make any payment other than on an arm’s length basis for the benefit of the Company.

(e) Make any loan or advance or give any credit to any person or acquire any loan capital of any corporate body (wherever incorporated).

(f) Do any act or thing outside the ordinary course of the business carried on by it.

These clauses grant the DAO a check on special transactions, in addition to the previous annual check on the forecasted budget, in a consent-based manner that minimizes obstruction of the Foundation’s operations. The 2 week time limit on the rejection proposal, coupled with the 2 week length of the vote, ensures that the transaction date (at least 4 weeks out from DAO Notice) is not delayed in normal circumstances. Note that these clauses restrict - not expand - the powers of the PNF directors and are taken from some boilerplate commercial “protective provisions”. They are designed to make explicit that anything unusual will not happen without DAO notice and consent.

Empower the directors to fill director vacancies temporarily until the DAO chooses a permanent replacement

Subject to Article 4.6, a director may be appointed by Ordinary Resolution. Any appointment may be to fill a vacancy or as an additional director.

becomes

Subject to Article 4.6, a director may be appointed by Ordinary Resolution. Where a director has for any reason either been removed or has resigned, the directors of the Company may appoint a temporary director to fill such vacancy until such time as the DAO shall direct the appointment of a new director by DAO Resolution.

Clarify the definition of DAO Resolution

Clarify that a default DAO Resolution requires a simple 50% majority and no quorum unless otherwise specified.

DAO Resolution shall mean a resolution validly passed on the DAO in accordance with the governance protocols of the DAO by the participants of the DAO.

becomes

DAO Resolution shall mean a resolution validly passed on the DAO in accordance with the governance protocols of the DAO with at least 50% approval by DAO participants who voted on the resolution. There will be no quorum requirement unless otherwise specified in these Articles.

Add a definition for Supermajority DAO Resolution

Supermajority DAO Resolution shall mean a resolution validly passed on the DAO in accordance with the governance protocols of the DAO with at least 75% approval by DAO participants who voted on the resolution, subject to the vote lasting no fewer than 14 days and a quorum of at least 25% of DAO participants who have cast a vote within the 12 months immediately prior to the date that voting commences on such Supermajority DAO Resolution.

These clauses provide security against minority governance attacks, while minimizing the risk of stalling governance due to inactive voters. Note that while this excludes inactive voters (defined as those with at least 1 year of absence) from the quorum count, it does not preclude those voters from casting their vote.

As an example of how the quorum would work in practice, only 3 of the current 56 voters have not voted in the last 12 months, which would result in a quorum of 14 of the remaining 53 active voters. If we were to make the quorum 50% instead, the quorum would be 27, a vote count that is surpassed only by 3 proposals: PIP-22 (33 votes), PEP-32 (28 votes), PEP-31 (28 votes).

Increase the approval threshold for changes to the legal structure of the Foundation

Use the new definition of Supermajority DAO Resolution to increase the approval threshold for changes to the legal structure of the Foundation.

1.5 Unless otherwise specified herein, no Ordinary Resolution or Special Resolution passed by persons entitled to attend and vote at a general meeting shall be valid or take effect until such Ordinary Resolution or Special Resolution has been approved by Supermajority DAO Resolution.

6.3 With the exception of the first supervisor, the DAO may direct by way of Supermajority DAO Resolution that the directors appoint a person named in such Supermajority DAO Resolution as a supervisor of the Company either as an additional supervisor or to replace a supervisor. For the avoidance of doubt, the directors cannot appoint any supervisor unless upon the instruction of a Supermajority DAO Resolution.

6.4 Where the DAO has directed the directors by way of Supermajority DAO Resolution to appoint an additional supervisor, the directors and the Secretary shall undertake all action required to ensure that the additional supervisor named by such Supermajority DAO Resolution is properly appointed and registered in the register of supervisors of the Company.

6.5 Where the DAO has directed the directors by way of Supermajority DAO Resolution to replace an existing supervisor, the directors shall:

(a) appoint the new supervisor named in the Supermajority DAO Resolution and, together with the Secretary, shall ensure that the new supervisor named by such Supermajority DAO Resolution is registered in the register of supervisors of the Company; and

6.6 Where no supervisor has been appointed or where all supervisors have for any reason either been removed or have resigned, the directors of the Company must appoint a temporary supervisor to fill such vacancy until such time as the DAO shall direct the appointment of a new supervisor by Supermajority DAO Resolution. The temporary supervisor may be a director of the Company.

6.8 The DAO may direct by way of Supermajority DAO Resolution that the directors remove a person named in such Supermajority DAO Resolution as a supervisor of the Company. For the avoidance of doubt, the directors cannot remove any supervisor unless upon the instruction of a Supermajority DAO Resolution.

Director Appointments/Removals

- Remove Stephane Gosselin as director of PNF

- Appoint Dermot O’Riordan (or a corporation owned solely by him) as director of PNF

- Appoint Jack Laing (or a corporation owned solely by him) as director of PNF

Supervisor Appointment/Removal

- Remove Pocket Network Inc (Michael O’Rouke) as supervisor of PNF

- Appoint Campbell Law as supervisor of PNF

Rationale

Foundation Articles/Amendments

Empower the directors to make remuneration decisions without DAO approval, subject to annual budget approval and consent-based approval of special transactions

Currently, 4.37 requires that remuneration of directors/officers be determined by an Ordinary Resolution of the Foundation.

This is problematic for two reasons:

- because PNF is an Ownerless Foundation, per 9.6 below, the only actor who can vote on Ordinary Resolutions is the supervisor, an actor whose role is not to manage the business of the Foundation (the directors’ role) but rather to enforce the Articles and ensure that DAO Resolutions are carried out,

- per 1.5 below, Ordinary Resolutions are not valid unless paired with a DAO Resolution (i.e. an approved proposal), which implies that the DAO would need to vote to approve the remuneration of every operator the Foundation hires.

Ordinary Resolution means a resolution of a duly constituted general meeting of the Company passed by a simple majority of the votes cast by, or on behalf of, the persons entitled to attend and vote at a general meeting. The expression also includes a unanimous written resolution under Article 9.28.

9.6 The persons who have the right to receive notice of, and to attend and vote at, general meetings (hereafter called persons entitled to attend or persons entitled to attend and vote at a general meeting) are:

(a) any Members; [we have none as the Foundation is Ownerless]

(b) the supervisors; and

c) any beneficiary to whom the right has been granted by an unrevoked declaration under Article 7.1 c). [we have none as the Foundation is Ownerless]

1.5 Unless otherwise specified herein, no Ordinary Resolution or Special Resolution passed by persons entitled to attend and vote at a general meeting shall be valid or take effect until such Ordinary Resolution or Special Resolution has been approved by DAO Resolution.

This series of clauses (4.37, 9.6, 1.5) therefore creates unnecessary friction on the directors’ ability to carry out their duties, by hiring operators who can execute, because it defers the power to two parties (the supervisor and the DAO) who aren’t managing the Foundation’s day-to-day operations. This also conflicts with 4.28 and 4.32 below, which both empower the directors to appoint directors/officers to positions with remuneration “as they think fit”.

4.28 Subject to Article 4.38, the directors may appoint a director:

(a) as chairman of the board of directors;

(b) as managing director;

c) to any other executive office

for such period and on such terms, including as to remuneration, as they think fit.

4.32 Subject to Article 8 (dealing with the office of Secretary), Article 4.38 and the provisions of the Laws, the directors may also appoint any person, who need not be a director, to any office that may be required for such period and on such terms, including as to remuneration, as they think fit; and that Officer may be given any title the directors decide.

The simplest way to resolve this tension is to modify 4.37 in line with 4.28 and 4.32, to empower the directors to determine remuneration of directors/officers without the need for approval from the supervisor or DAO. However, this should also be subject to some checks, which we retain with the director remuneration cap and we have introduced with the annual budget approval process and the consent-based approval of special transactions.

Require the directors to publish quarterly remuneration figures

We understand that there will be accountability concerns with the previous amendment, so we are also adding a clause that total remuneration should be published quarterly, which is information that the DAO can use to determine the ROI of PNF’s operations and keep the directors accountable to PNF’s mission.

Quarterly publication of spending is in line with how the most transparent Foundations operate in the industry, with many Foundations opting instead for biannual or annual reports, and who don’t have the same DAO controls that we do.

Allow directors/officers to receive POKT token grants as part of their remuneration, subject to 3 years vesting

4.38 (a) is intended to ensure that the Foundation operates as a non-profit focused on growing the Pocket Network ecosystem, with no perverse incentives for directors/officers to seek profit for the Foundation at the expense of the ecosystem.

However, POKT token grants, allocated from the Foundation treasury to directors/officers on a vesting schedule, are a vital mechanism for PNF attracting and aligning the incentives of world-class talent.

We therefore want to clarify that 4.38 (a) excludes POKT token grants, subject to a minimum of 3 years vesting.

Raise the cap on director/officer remuneration

4.38 c) is a clause that was included by default in the context of a less active minimal Foundation, where directors/officers were assumed to be operating in a part-time capacity, and is therefore incompatible with the new era of the Foundation that we are proposing.

The operators who will be transitioning over from Pocket Network Inc are already paid more than $50k per annum. Limiting their pay to $50k is therefore untenable.

If we wish the Foundation to be able to hire and retain world-class talent as our ecosystem scales, including directors/officers who can help our ecosystem deliver on exponential outcomes, we think it imprudent to set a conservative cap on compensation. We are therefore proposing to raise the cap to $300k.

Empower the directors to fill director vacancies temporarily until the DAO chooses a permanent replacement

In the event that a director is removed or resigns, to ensure operational continuity, the directors should be able to fill the vacancy until the DAO has voted for a replacement.

Increase the approval threshold and quorum for changes to the legal structure of the Foundation

The Foundation is designed to provide reliable support to the ecosystem and a long-term mission-driven view of Pocket’s strategy. This is undermined the easier it is for a smaller set of DAO voters to disrupt the legal structure of the Foundation, though it should not be impossible for the DAO to achieve consensus on making changes.

By adding the definition of a Supermajority DAO Resolution and referencing this in amendments to the Foundation itself, we ensure that the threshold to approve changes to the Foundation’s legal structure is higher, while maintaining (per 4.17 and 6.17) that directors and supervisors will (subject to the Articles of the Foundation, their duties to the Foundation, and applicable law) continue to carry out any DAO proposal that passes with a simple 50% majority.

4.17 Subject to any limitation imposed on any director pursuant to each director’s fiduciary duties to the Company and all applicable law and these Articles, the directors shall observe, implement, carry out, action and execute with best efforts any and all DAO Resolutions.

6.17 Subject to any limitation imposed on any supervisor pursuant to each supervisor’s fiduciary duties to the Company and all applicable law and these Articles, the supervisors shall observe, implement, carry out, action and execute with best efforts any and all DAO Resolutions.

To summarize, Ordinary/Special Resolutions (which would now require a corresponding 75% Supermajority DAO Resolution, not just a simple 50% majority, and a special quorum of 25% of active voters from the last 12 months), govern:

- Director appointments (except where the appointment is temporary to fill a vacancy)

- Director removals

- Admission of new members (a legal term for Foundation members, of which we have none)

- Restricting the subsequent admission of new members

- Validating prior/future acts of directors which would otherwise be in breach of their duties

- Designating and revoking the designation of beneficiaries

- Amending previous Ordinary/Special Resolutions

- Fixing a quorum for the transaction of business at a meeting of directors

- Releasing directors from liability in connection with the discharge of their duties (except in cases of their own dishonesty)

- Transferring the jurisdiction of the Foundation

- Winding up the Foundation and determining the distribution of Foundation assets

- Changing the Foundation’s name

- Changing the provisions of the Foundation’s Memorandum

- Altering the Articles of the Foundation

We are also referencing the Supermajority DAO Resolution in the following actions, which do not reference Ordinary/Special Resolutions but instead directly reference Supermajority DAO Resolutions:

- Supervisor appointments (except where the appointment is temporary to fill a vacancy)

- Supervisor removals

The remainder of actions that the DAO may instruct the directors to execute, such as contracting with third parties, would be subject to a simple 50% majority.

Appointments/Removals of Directors/Supervisors

Appoint Jack Laing as (Executive) Director

No-one on the core team has lived and breathed the Pocket Network ecosystem more than Jack. Few – save perhaps Michael O’Rourke (Mike) and the Poktopus himself – have been in front of the community as much as Jack has, or have a broader network of Pocket stakeholders in their DMs, from anons of Discord/Telegram, to builders, to VCs. Mike is also on record saying that no-one has a broader knowledge of Pocket (except Mike himself), spanning governance, community, protocol, economics, and the wider industry.

Jack began his DAO journey while studying Economics & Management at the University of Oxford, when he did a thesis on DAOs and the theory of the firm under the guidance of the business school and the Oxford Internet Institute. From there he immediately jumped into working on Colony, one of the first DAO platforms, where he learned more about governance mechanism design and the wider DAO space, then ran the first DAO-focused newsletter (OrgTech Review / DAObase).

Jack first crossed paths with Pocket when he met Mike at a decentralized governance conference in Berlin almost 4 years ago. A few months later, he joined Pocket as a part-time governance researcher, during which he participated in early Network Design Syncs with Mike, Luis, and Andrew, co-authored the first economics paper, and helped design our early visions for the DAO. A year later, he was converted to a full-time position, during which he wrote the DAO Constitution, modified the Foundation’s Articles to include the accountability mechanisms we’re relying upon in this proposal, and designed and launched the Pocket Arcade qualified voting system. This pioneering work preceded DAO design patterns that now, 2 years later, are proliferating in the most exciting areas of governance such as Soulbound Tokens and Verified Credentials, and being adopted by other governance pioneers such as Gitcoin and Optimism.

The scope of Jack’s role expanded in recent years as Pocket’s ecosystem grew, which often led to governance R&D workstreams falling to the wayside as he worked to establish PNI’s community management and developer relations functions, all while coordinating the DAO’s governance and playing a key role in PNI’s executive leadership. This year, starting in January, Jack hired a team of ecosystem-facing employees to help scale these efforts, including Joe Habel (blockjoe), Jessica Daugherty (jalde), Mike Pumphrey (bmmpxf), Ben Perez (b3n), Ming-Chun Lee (Mingtopus), Moez Dhahri (MoezD), and Dan Farahani (profish). A few of these team members have transitioned to other teams inside PNI, where they are imbuing our ecosystem-centric values into everything from the protocol development cycle, to the maintenance of open-source tooling, to PNI’s engagement with the community.

The evolution of the Foundation also constitutes a refocusing of Jack’s time, with his scope narrowing to those synergistic responsibilities outlined in this proposal, and a remit to dedicate all efforts to building a stronger foundation for the future of Pocket’s ecosystem and DAO. He is excited to push forward his vision for the DAO, to nurture relationships with all of Pocket’s stakeholders, and through these efforts to grow Pocket Network into a true hyperstructure.

Appoint Dermot O’Riordan as Director

Dermot first became enamored with the mission of Pocket in early 2019 after an introduction to Mike through a friend of a friend. He then began to support Pocket as a strategic adviser; his contributions included co-authoring the first economics paper and providing feedback on Jack’s work on the DAO. Dermot then led Eden Block’s first investment into Pocket Network in the summer of 2020. Eden Block followed on in two subsequent investment rounds, with Dermot becoming a valuable resource for the Pocket leadership team and an active community member. In addition, Dermot has attended three Pocket summits to date; the Dominican Republic in March 2020, Mexico in October 2021, as well as the most recent Infracon in Bogota in October 2022.

In terms of Dermot’s background, he revels in being a generalist, having worn many hats in his career over the past ten years; as a startup operator, a lawyer, an investor, a board member, and as an active Web3 community member.

His first (serious) job was as an early employee at the Websummit in Dublin - now the world’s largest technology conference and very much a technology company - where he focused on startup research and investor relations. He subsequently worked as a corporate lawyer in the London offices of two major international law firms, Hogan Lovells and Orrick, specialising in venture capital, private equity and M&A, advising some of Europe’s leading VC and PE firms, as well as the founders of high-growth technology companies. Through his support for various startups within his network and his professional work at Orrick, he became a board member of The ICE List, one of Europe’s leading communities for technology entrepreneurs. He held this role until the summer of 2021.

Dermot fell down the Web3 rabbit hole in 2016 with the rise of the DAO - "what do you mean there is a decentralised venture capital firm?!” - and has been immersed ever since. He helped Orrick build out its European blockchain practice in early 2017, working with startups and investors as well as educating regulators and other market participants. Following his work at Orrick, Dermot became COO of a Web3 venture builder. He subsequently joined Eden Block, the Web3 VC, where he was a partner for two and a half years, leading most of the team’s investments while he was there and building out the fund’s platform for supporting its portfolio.

Dermot left Eden Block in June 2022 to focus full-time on working in the DAO space - both as a contributor to DAOs like Public Nouns and as a researcher collaborating with people looking to advance the mission of DAOs further.

Replace PNI as Supervisor with Campbell Law

PNF is supposed to be a credibly neutral entity, which means treating all stakeholders fairly. PNF’s neutrality is less credible if PNI is a supervisor, the actor that is supposed to enforce the rules and keep the directors in check. Campbell Law, on the other hand, is a truly neutral actor who is familiar with the local Cayman laws, which means he is perfect for the role.

FAQs / Dissenting Opinions

Why not appoint more directors? / Why not run an open nomination process for directors?

The DAO will be able to appoint/remove directors at any time through PIPs. This “founding team” is designed to kickstart the new era for PNF. We have also added to our roadmap that by Q4 of 2023 we will work with the DAO to design and propose a process for the nomination/consideration of new/existing directors.

When choosing whether to appoint new directors, the DAO should keep in mind that the Foundation board is not intended to be a governing body for the ecosystem, or for that matter to be a representative sample of the ecosystem. Foundation directors should be appointed to the extent that they are fit to carry out the duties of the Foundation (as has been described above).

How will you ensure that PNF has no bias towards PNI?

We will take steps to ensure that PNF has the same relationship with PNI that it does with other stakeholders. For example:

- Jack will step down from PNI once he is legally appointed to PNF.

- PNF operators won’t be in PNI’s internal channels. We will create new external channels with PNI, as we will with other stakeholders.

Why is there a need for a new “Supermajority DAO Resolution”?

As per the Rationale section, the Foundation is designed to provide reliable support to the ecosystem via a long-term mission-driven view of Pocket’s strategy. The easier it is for a smaller subset of DAO voters to disrupt the legal structure of the Foundation, the more this objective is undermined.

Saying this, it should not be too difficult for the DAO to achieve consensus on making changes, which is why we should not implement a quorum as this can result in an inability to pass anything if the DAO gets too large - with a growing proportion of inactive voters - therefore, a supermajority of 66% of participating voters strikes the right balance between resilience and flexibility.

Implementation

- Due to Stephane’s inability to carry out the operational duties that are required of a director, Dermot has been appointed as Stephane’s alternate director. This simply means that he carries out Stephane’s duties in Stephane’s absence, with no right to remuneration, and his appointment as alternate is therefore not subject to DAO approval. This proposal serves as DAO Notice that Dermot has been appointed as Stephane’s alternate until the DAO approves the removal of Stephane and a permanent replacement.

- If this proposal is approved, the directors and supervisors will execute all aspects of this DAO Resolution.

- Once the new directors are appointed, the protocol’s ACL permissions will be transferred to a new multi-sig with the new directors as signers.

- Once Jack Laing is legally appointed as director, he will step down from his employment at PNI.

Copyright

Copyright and related rights waived via CC0.